When unexpected events occur, filing a home insurance claim can often feel overwhelming, but it doesn't have to be. This letter template is designed to simplify the process, guiding you through the essential details you need to include to ensure a smooth submission. By staying organized and providing clear information, you'll increase your chances of a timely response from your insurer. So, if you're ready to learn more about how to effectively communicate your claim, keep reading!

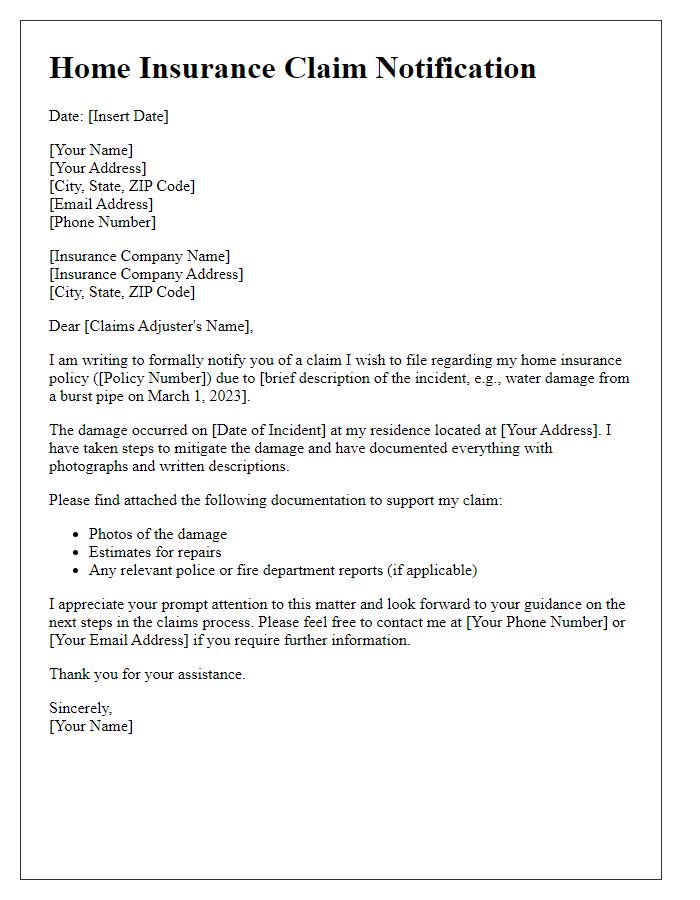

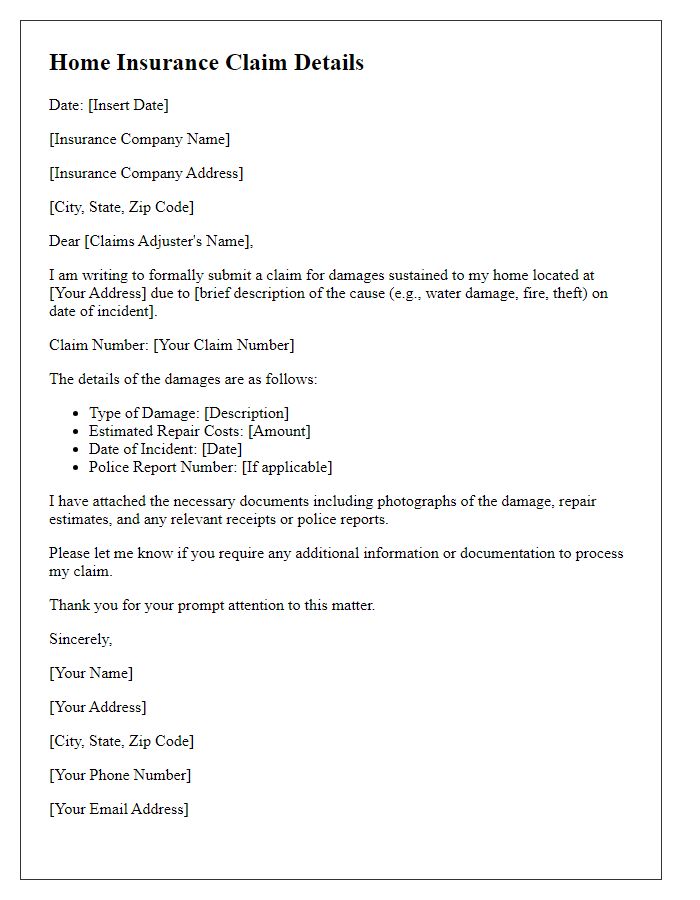

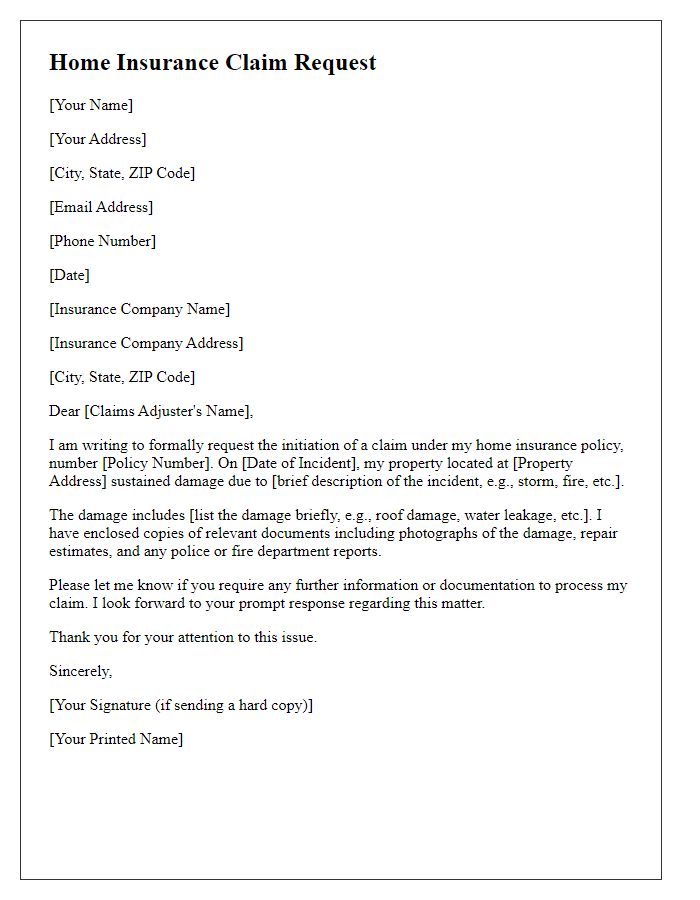

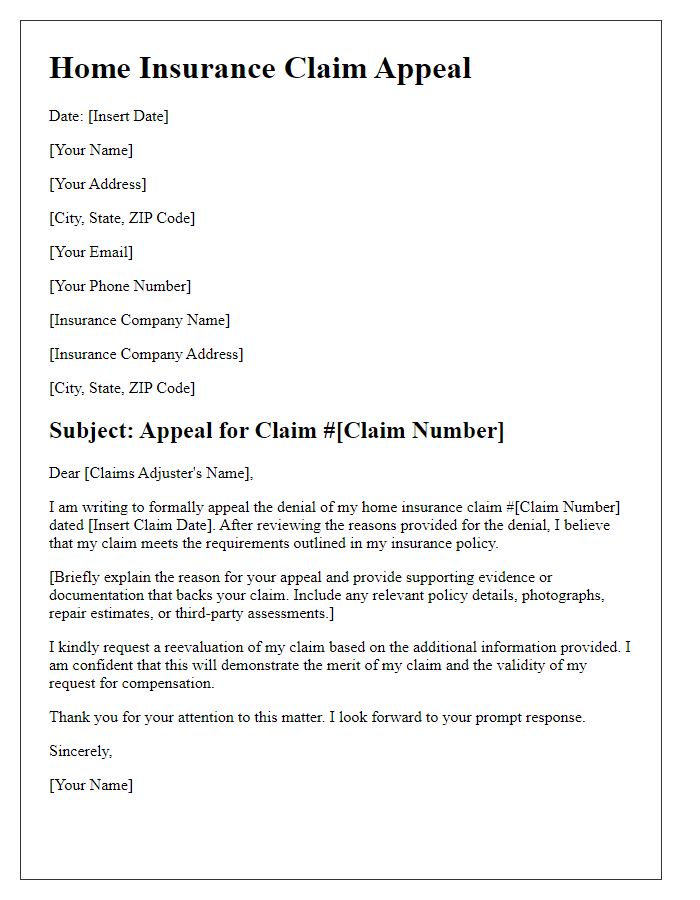

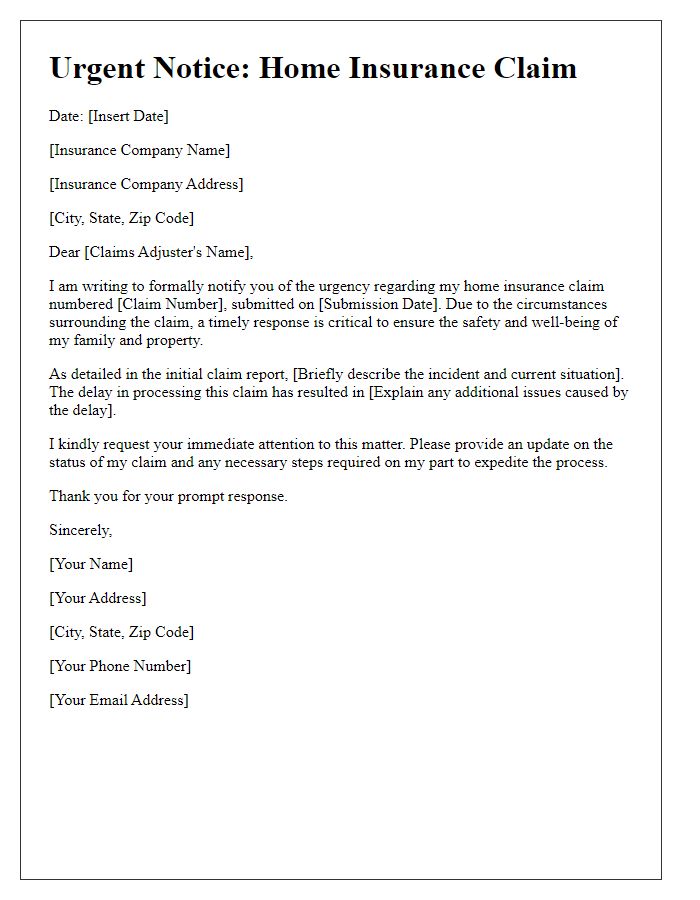

Policyholder's Information

Home insurance claims often require detailed documentation to ensure a smooth processing experience. Policyholder information typically includes the full name of the insured individual, policy number associated with the specific home insurance plan, and contact details such as phone number and email address for efficient communication. Address of the insured property should be clearly specified, including street address, city, state, and ZIP code, ensuring that the claim is linked to the correct location. Additionally, it may be beneficial to provide the date of the insurance policy's inception to clarify the coverage timeline. Clear and accurate policyholder information is crucial in facilitating prompt assessment and resolution of the insurance claim.

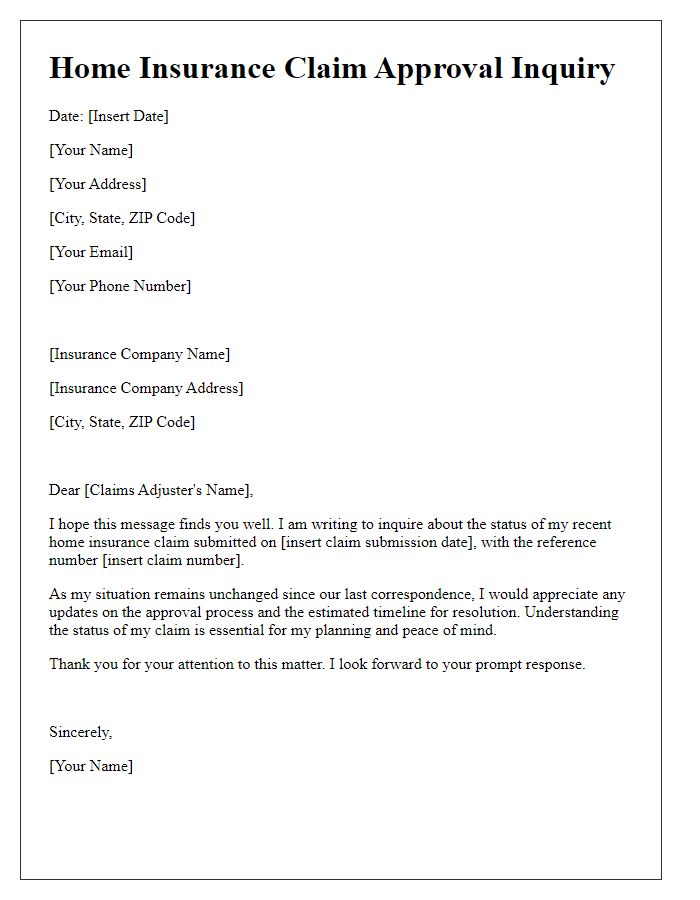

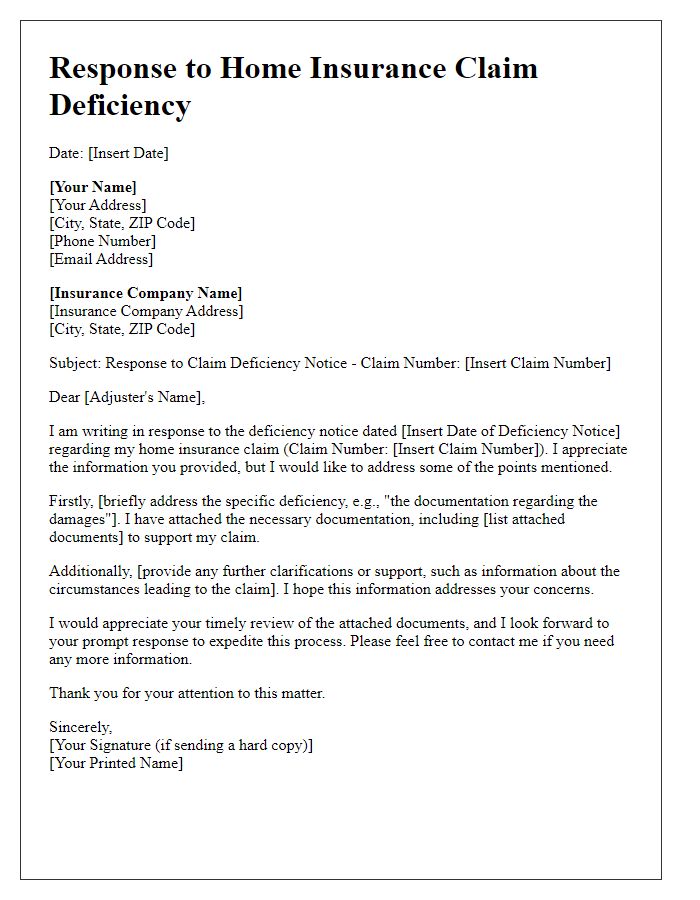

Claim Details and Incident Description

Home insurance claims can often involve complex details surrounding specific events, such as fire damage or flooding. For instance, a claim submitted for a fire incident caused by faulty wiring could detail the date (e.g., March 15, 2023) and location (e.g., 123 Maple Street, Springfield), along with an explanation of the damages incurred, including the destruction of personal property valued at approximately $50,000. Similarly, water damage claims might specify the event's trigger, like a burst pipe, and an estimated cost of repairs totaling $10,000. Additional documentation, such as photographs of the damages and repair estimates from licensed contractors, can enhance a claim's legitimacy, ensuring a more efficient claims process with the insurance company. Prompt submission of all necessary details can significantly expedite the resolution process.

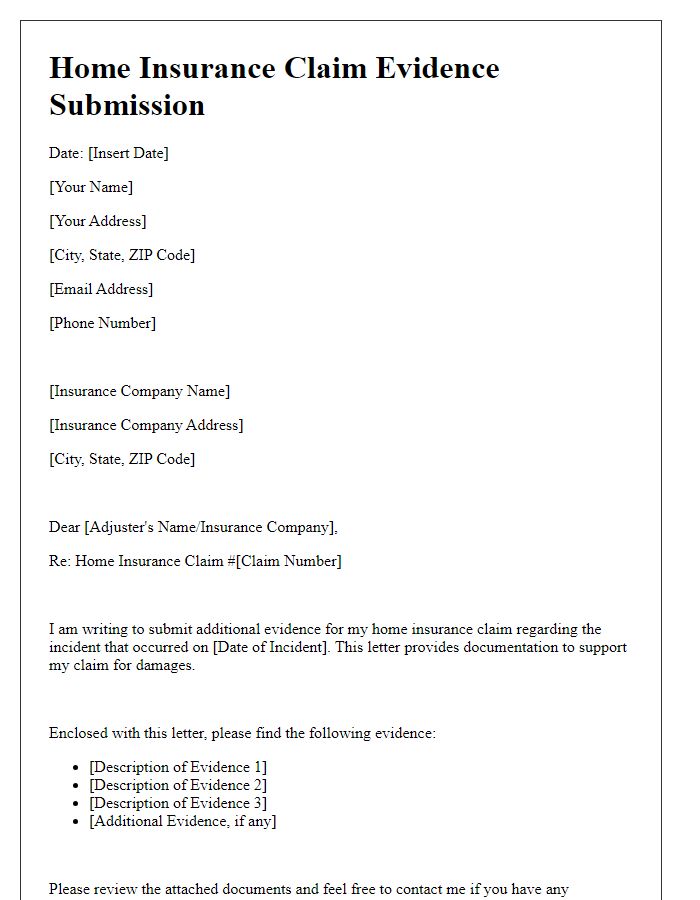

Supporting Documentation

When submitting a home insurance claim, it is crucial to include supporting documentation to substantiate the claim. Items such as photographs of the damaged property, receipts for repairs or replacement, and police reports (in cases of theft or vandalism) provide essential evidence. Detailed lists of affected items, along with their purchase dates and values, further enhance the claim's credibility. Additionally, obtaining estimates from licensed contractors for repairs helps insurance adjusters assess the damage accurately. Policy numbers and correspondence with the insurance company should also be included, as they streamline the claims process and clarify coverage details. The total cost of repairs can significantly influence the settlement amount, making thorough documentation essential for a successful claim submission.

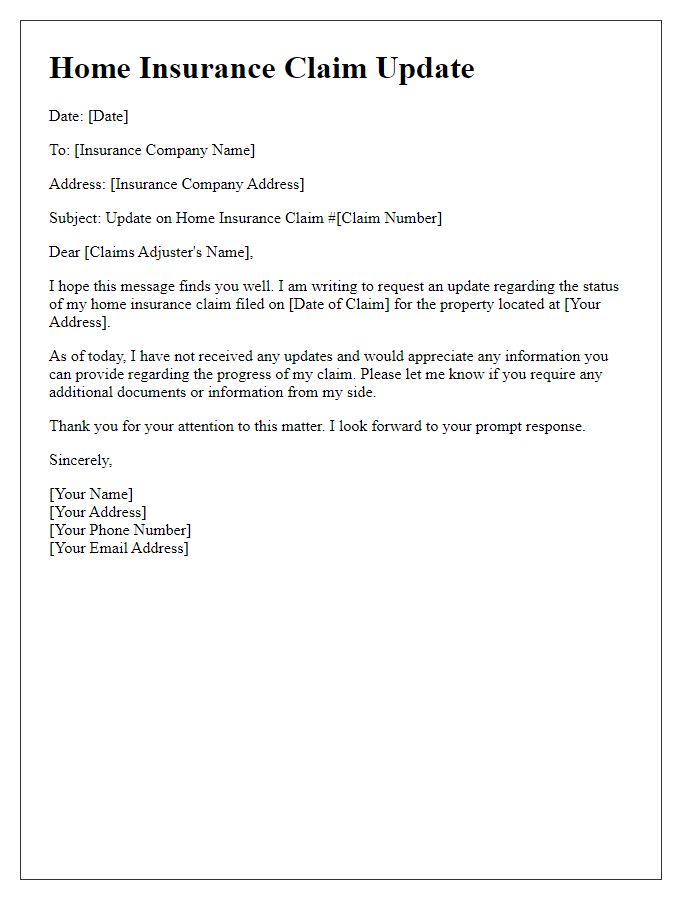

Contact Information for Follow-Up

Providing accurate contact information for follow-up is crucial in the home insurance claim process. Claimants should include a clear and updated phone number, such as a mobile phone number (for instance, +1-555-123-4567) ensuring immediate communication availability. Additionally, an email address (like name@example.com) can facilitate the exchange of documents or updates. Including a physical mailing address (for example, 123 Main Street, Anytown, State, ZIP code 12345) may also be necessary for official correspondence. Timely and accurate contact details can expedite the claims review process and ensure efficient handling of the claim by insurance adjusters.

Formal Closing and Signature

When wrapping up a home insurance claim submission, a formal closing serves to provide a courteous conclusion to your correspondence. Utilize a respectful closing statement such as "Sincerely" or "Best regards" to indicate professionalism and appreciation. Following this, include your full name, which is essential for identification purposes, along with your policy number to facilitate swift processing by the insurance company. Additionally, it is prudent to provide your contact information, including a phone number and email address, to ensure the insurance adjuster can reach you easily for any follow-up inquiries related to your claim.

Comments