Are you in need of a reliable letter template for insurance certificate verification? Whether you're managing your own insurance or facilitating a client's verification process, having the right wording can make all the difference. This straightforward template ensures all necessary details are covered while maintaining a professional tone. Ready to dive deeper and explore how you can customize it for your specific needs?

Policyholder Information

Insurance certificate verification requires accurate information regarding the policyholder. Essential details include the policyholder's full name (matching identification documents), date of birth (for age verification purposes), address (including street, city, state, and zip code), policy number (unique identifier for the insurance policy), and the issuance date of the insurance certificate. Additionally, contact details such as phone number and email address facilitate easy communication. The coverage type, such as life, auto, or health insurance, should also be clearly stated alongside the effective date and expiration date of the policy. This thorough compilation ensures that the verification process is efficient and precise.

Policy Details and Coverage

Insurance certificates provide crucial information regarding policy details and coverage limits for various types of insurance, such as auto, home, and health insurance. Each certificate includes essential data like the policyholder's name, policy number, effective date, and expiration date, ensuring clarity on the duration of coverage. Coverage limits, specifying the maximum amount an insurer will pay for a covered loss, are also detailed, often listing sub-limits for specific circumstances like natural disasters or personal liability claims. Furthermore, the certificate may outline the types of coverage included, such as liability, collision, comprehensive, and additional riders, showing the extent of protection provided. In cases of verification, these certificates must be validated with the issuing insurance company, usually based in specific locations, ensuring all information aligns with their official records.

Insurer Contact Information

An insurance certificate verification process requires complete and accurate details for effective communication. Essential components include the insurer's name, such as XYZ Insurance Company, and its official address, which could be 1234 Insure Avenue, Los Angeles, CA, 90001. Additionally, it is important to provide a direct contact number, typically formatted as (555) 123-4567, and an email address, such as support@xyzinsurance.com, for swift electronic correspondence. Lastly, inclusion of the insurer's website, www.xyzinsurance.com, can facilitate access to online resources and contribute to an efficient verification process.

Verification Request Instructions

Verification requests for insurance certificates require meticulous attention to detail to ensure accuracy and legitimacy of the documentation. Key elements include a comprehensive list of required documents, such as a copy of the certificate, identification of the certificate holder, and specific details regarding policy numbers or insured entities. Timelines for submission are critical, typically within 5-10 business days, and must adhere to the guidelines established by the insurance provider. Furthermore, verification may involve a comparison against official records maintained by regulatory bodies, such as the Insurance Regulatory Authority, ensuring compliance with local laws and regulations. Providing accurate contact information for follow-up inquiries enhances the efficiency of the verification process.

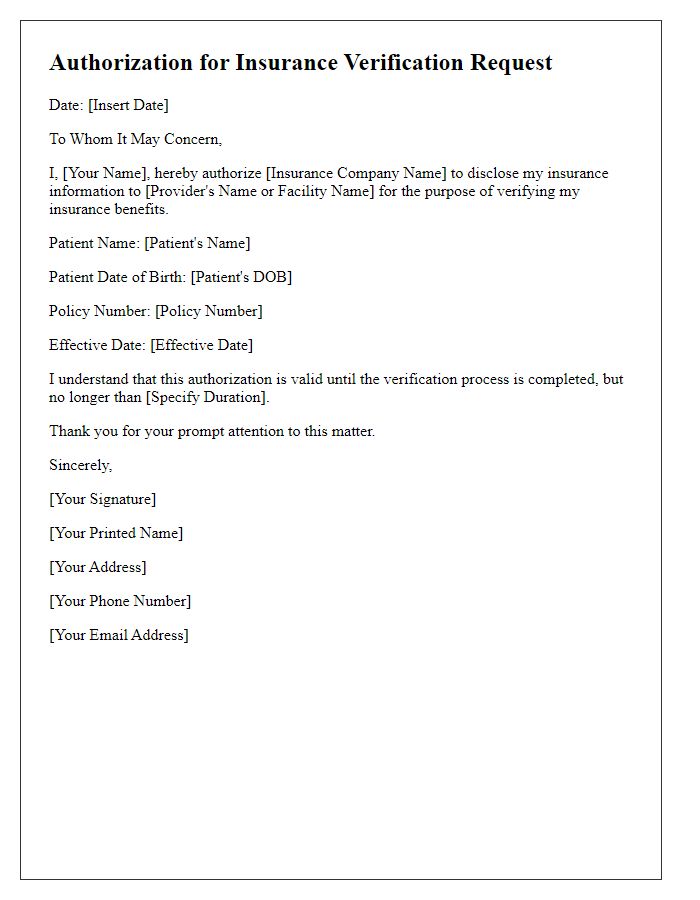

Signature and Authorization

Insurance certificate verification requires a formal acknowledgment from the policyholder, ensuring that all provided documentation matches the records held by the insurance provider. The verification process typically includes essential components such as policy number, insured individual's name, coverage dates, and specific coverage details. Authorization must be signed by the policyholder or an authorized representative, confirming their consent for the insurance company to disclose pertinent information. This signature acts as a legal agreement, establishing trust between the policyholder and the verification entity. Proper handling of these documents is crucial to maintain confidentiality and comply with regulations, ensuring that sensitive information is only shared with authorized parties.

Letter Template For Insurance Certificate Verification Samples

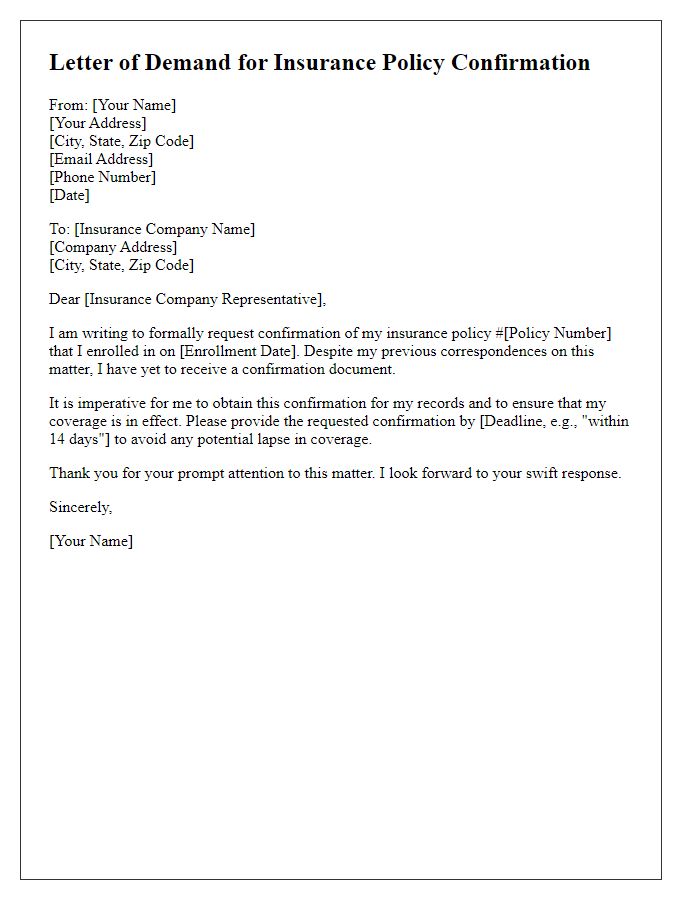

Letter template of confirmation needed for insurance policy verification

Comments