Are you curious about how your health insurance premium is calculated? Understanding the various factors that contribute to your monthly premium can help you make informed decisions about your coverage. From your age and location to your health history, many elements play a role in determining what you pay. Join us as we dive deeper into the intricacies of health insurance premium calculations and how they affect your overall coverageâread on for more insights!

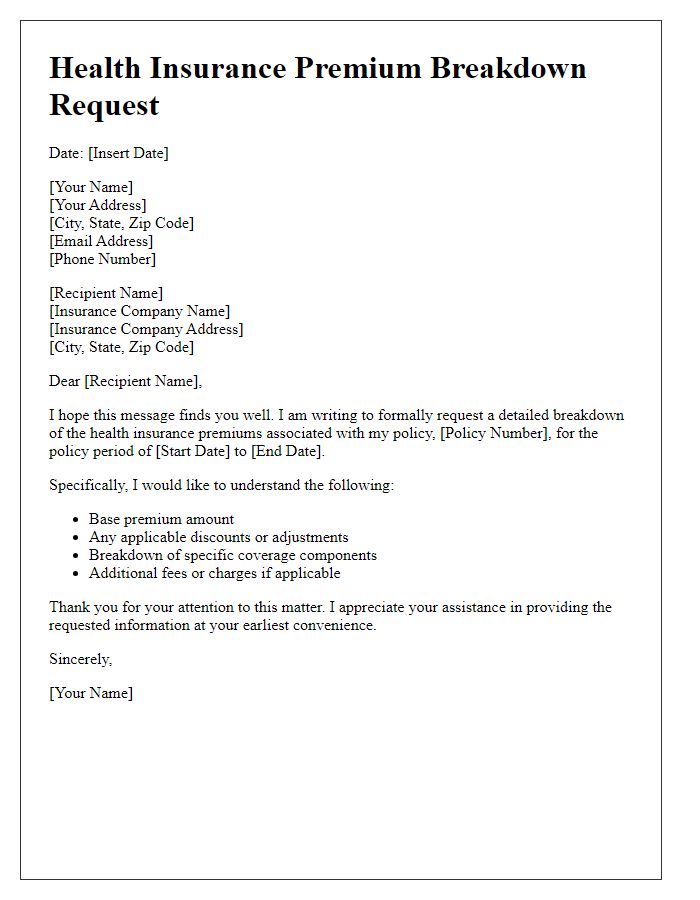

Personal Information Details

Accurate health insurance premium calculations require detailed personal information such as age, which directly influences risk assessment. Next, gender plays a significant role, with many providers adjusting premiums based on statistical health data. Pre-existing medical conditions must be disclosed, including chronic illnesses like diabetes or hypertension, as they can considerably raise premiums. Lifestyle factors such as smoking status or physical activities like regular exercise can also impact the final cost. Geographical location, specifically the ZIP code or region, influences healthcare costs and the risk pool, while family size and the number of dependents seeking coverage are key components determining the premium structure.

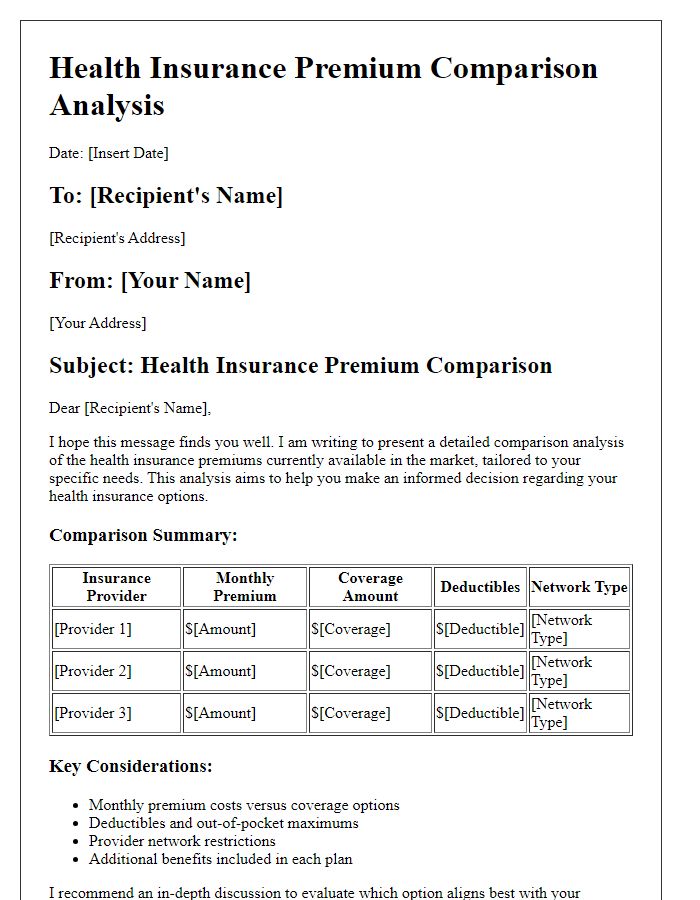

Coverage Plan Options

Health insurance coverage plans like Comprehensive Health Plan and High Deductible Health Plan offer varying premiums based on factors such as age, location, and chosen benefits. For instance, an individual aged 30 in New York may pay approximately $350 monthly for a Comprehensive Health Plan. In contrast, a family plan for a couple aged 35 in California could cost around $800 monthly. Additionally, specific coverage options including maternity care, mental health services, and emergency room access can significantly impact premium rates. Deductibles ranging from $1,000 to $5,000 influence overall costs, as plans with higher deductibles typically reduce monthly premiums but increase out-of-pocket expenses. Understanding these variables ensures informed decisions regarding appropriate health coverage.

Premium Calculation Breakdown

Health insurance premium calculation involves various factors that contribute to the total cost of coverage. Key elements include the insured individual's age, which significantly impacts risk assessment, and geographical location, where different states or regions may have varying healthcare costs (e.g., New York and California often face higher premiums). Coverage levels offered by insurance plans, such as bronze, silver, gold, or platinum tiers, directly determine the premium amount. The inclusion of additional benefits, such as dental and vision coverage, also plays a vital role in overall premium costs. Lastly, lifestyle factors like tobacco use can lead to increased premiums, reflecting the higher risk associated with certain health behaviors. Understanding these components helps individuals make informed decisions regarding their health insurance options.

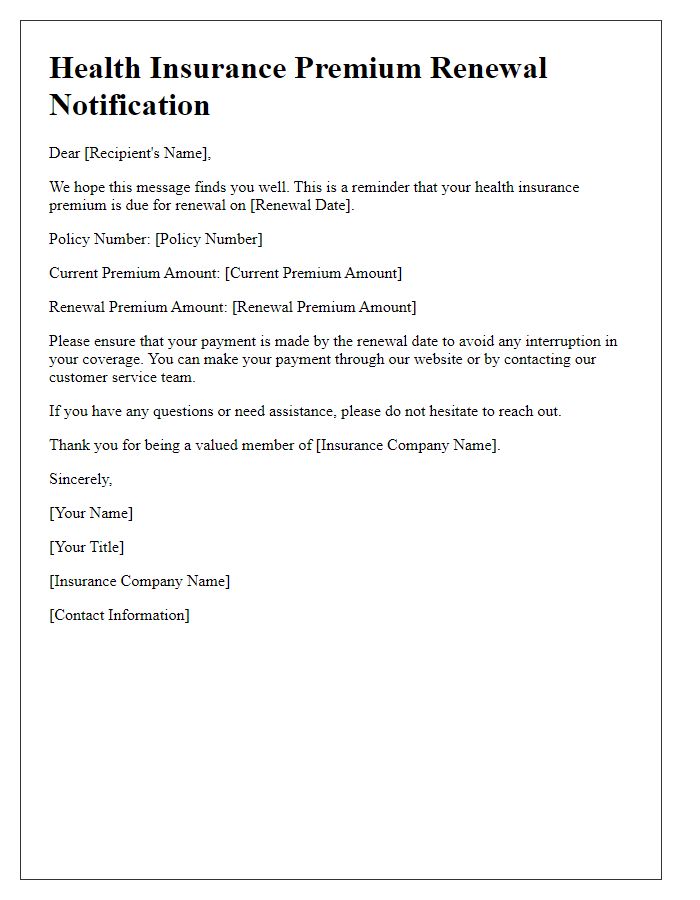

Payment Terms and Methods

Health insurance premium calculation involves multiple factors such as age, medical history, location, and chosen coverage level. Premiums may vary significantly based on geographic regions, with policies from providers like Blue Shield and Aetna offering different rates in urban centers like New York City versus rural areas in Montana. Payment terms often include monthly, quarterly, or annual options, with discounts for upfront annual payments. Payment methods can range from direct bank transfers to the use of credit cards, promoting convenience for policyholders. Late payments may result in penalties or lapse in coverage, impacting access to essential healthcare services.

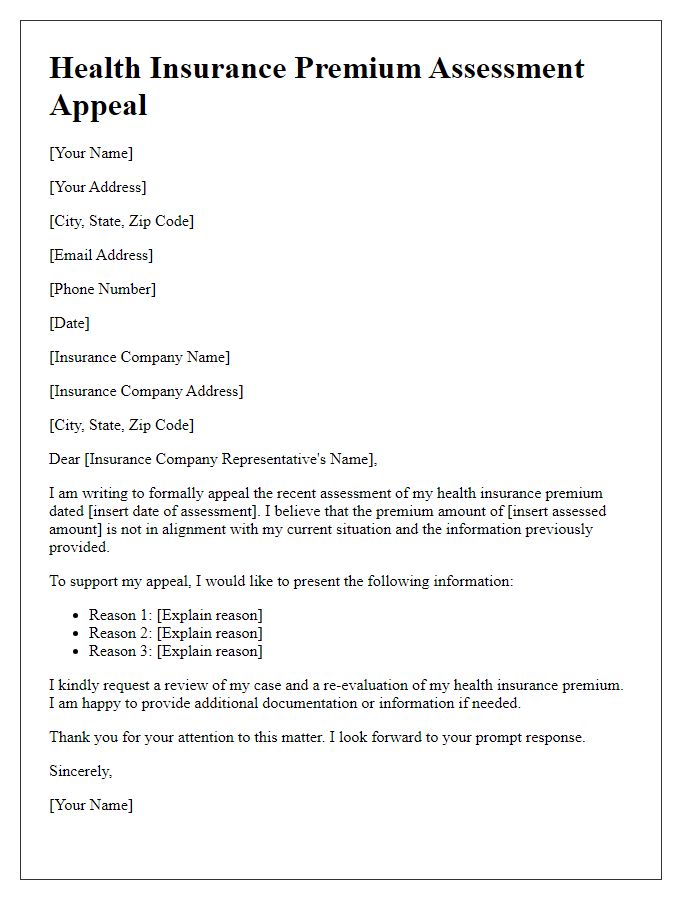

Contact and Support Information

Health insurance premium calculations require precise data analysis regarding individual health profiles, age demographics, and chosen coverage plans. Important variables include age (with increased premiums typically for individuals over 50 years), pre-existing conditions (which may incur additional costs), and family size (with multi-person plans offering different rate structures). Locations (like urban areas often having higher costs than rural settings due to healthcare access and demand) play a crucial role in determining regional pricing. Furthermore, the specific insurance plan (such as PPO or HMO) influences premiums, with HMO generally being more cost-effective but offering less flexibility in provider choice. Contact points for inquiries typically include dedicated customer service hotlines, email addresses, or online support chat services.

Comments