Navigating an insurance dispute can be a daunting experience, but having a clear and well-structured letter can make all the difference. In this article, we'll explore the essential components of an effective dispute resolution letter, ensuring that your case is presented in the best possible light. From outlining your concerns to providing supporting documentation, every detail matters. So, if you're ready to tackle your insurance issue head-on, let's dive in and discover how to craft a compelling message that resonates with your insurer!

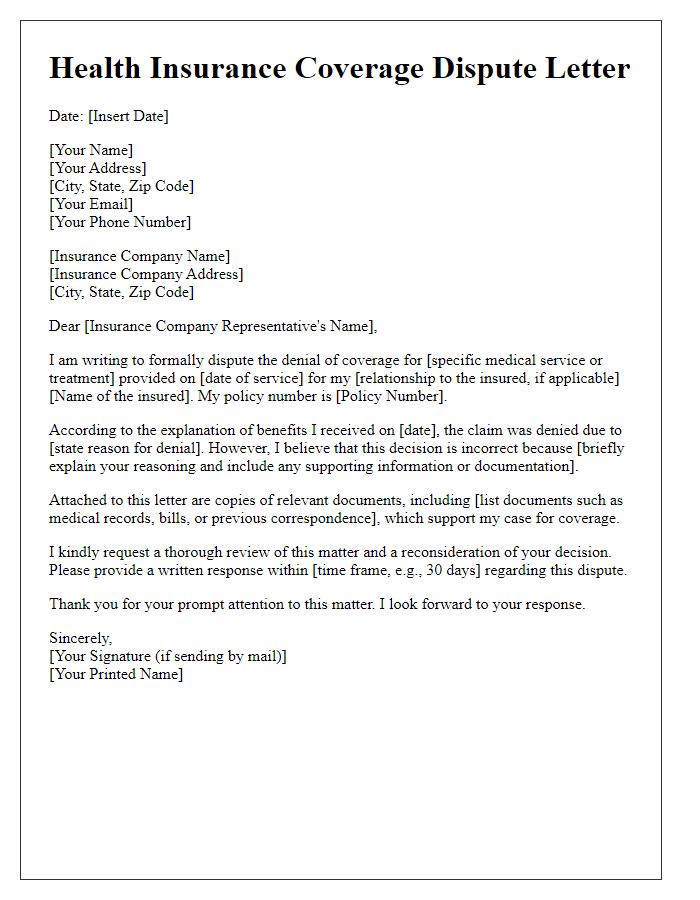

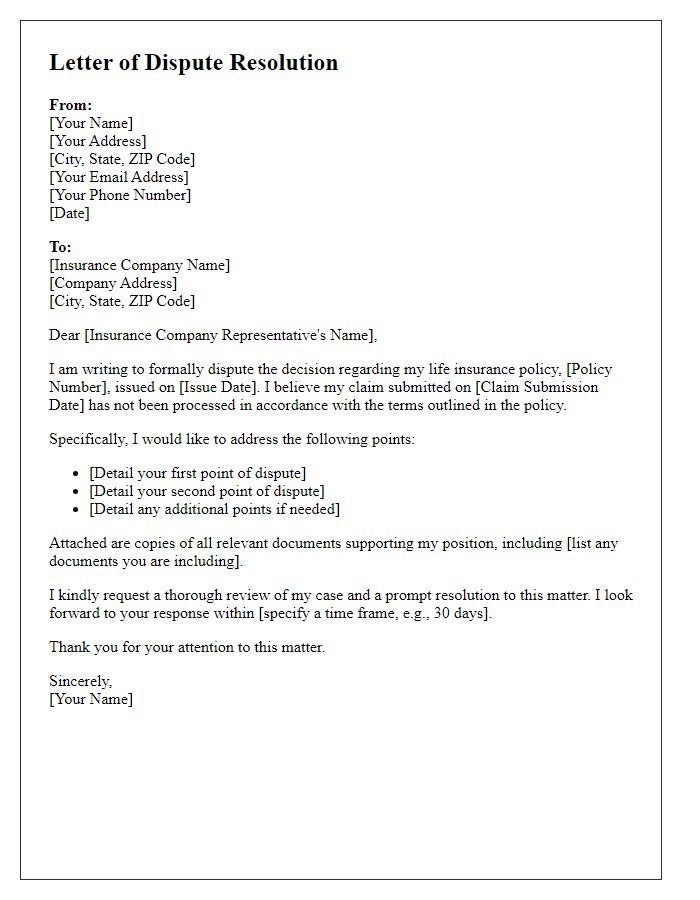

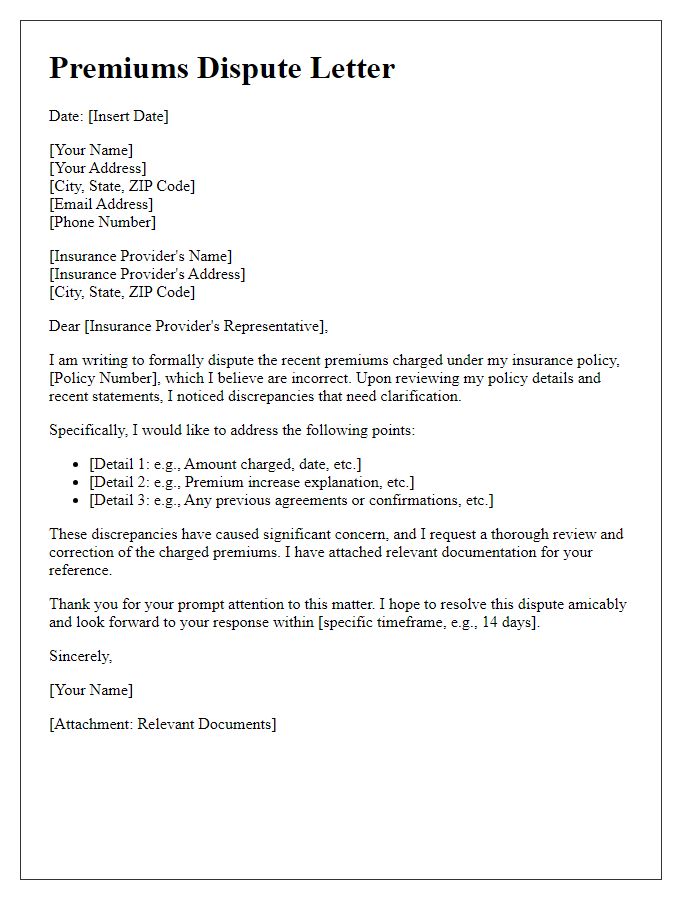

Clear Policy Reference

When addressing an insurance dispute, it is crucial to reference the specific policy number (e.g., Policy No. 1234567) related to the case. Discrepancies can arise concerning claims processing or coverage eligibility, with dates (e.g., Claim Date: January 15, 2023) and referenced exclusions or conditions (e.g., Section 3.5: Natural Disasters) often being focal points of contention. Noting the exact coverage limits (e.g., $100,000 for property damage) helps clarify the financial implications of the dispute. Additionally, citing any communication with the insurer (e.g., Emails dated March 1 and March 15) strengthens the case, establishing a timeline for unresolved issues or misinterpretations. This detailed approach ensures transparency and promotes a fair resolution process.

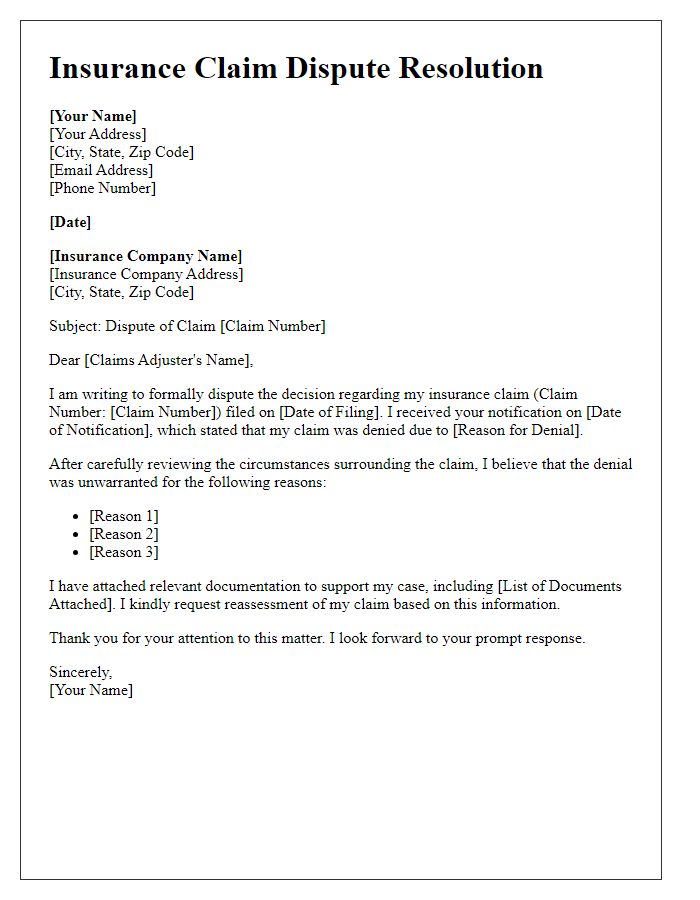

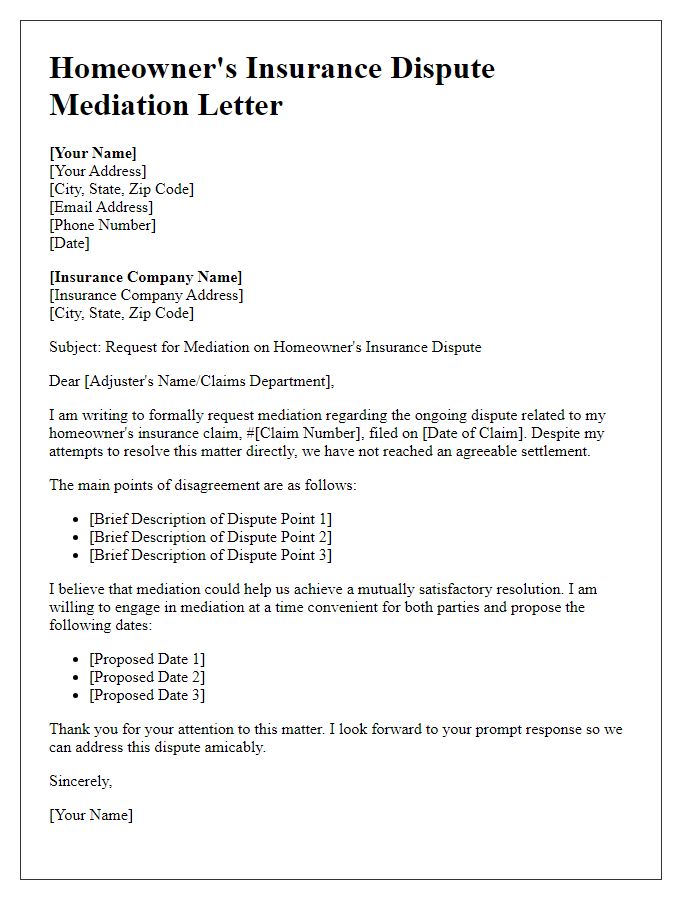

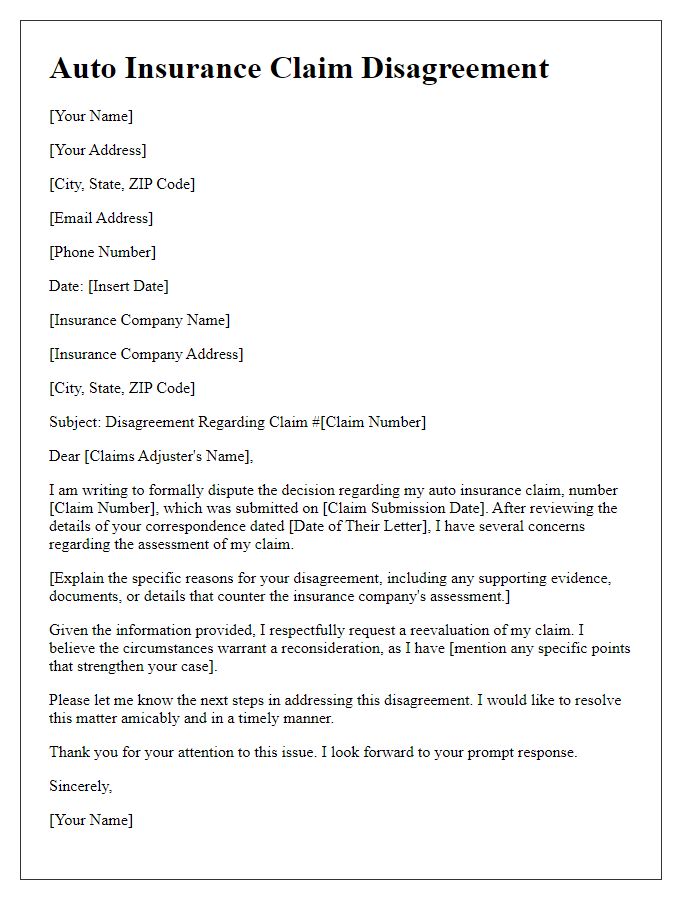

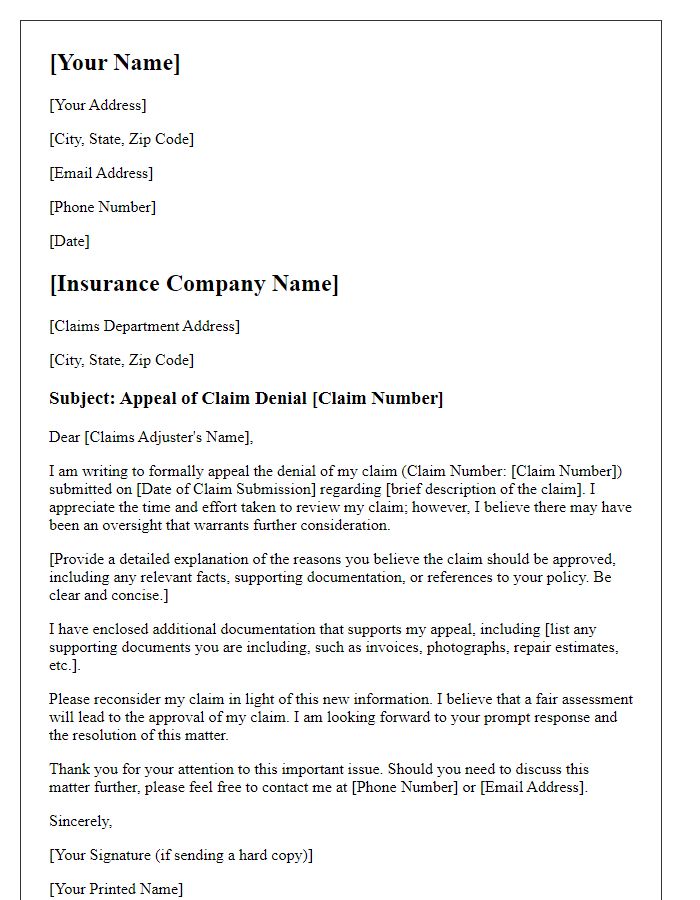

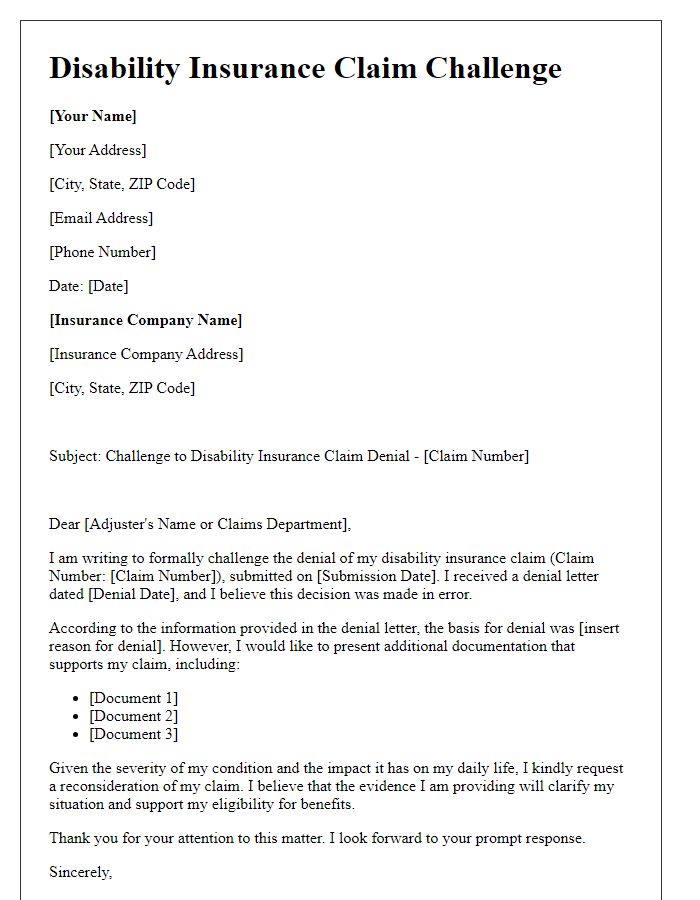

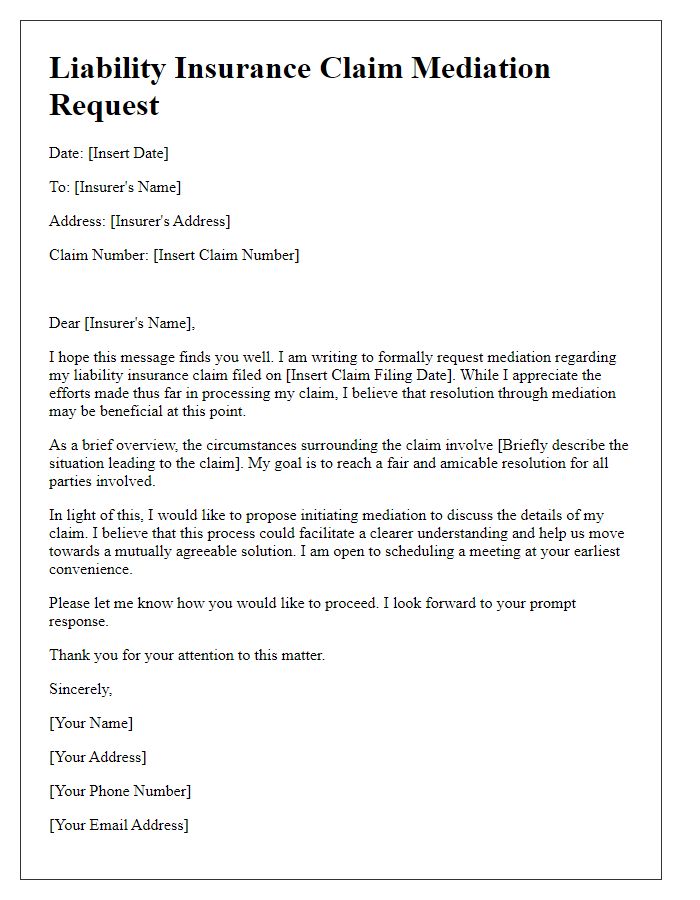

Specific Dispute Details

The insurance dispute regarding the claim submitted, number 123456789, highlights the challenges faced while navigating the complex processes established by the insurance provider, XYZ Insurance Company, headquartered in Springfield. This claim, filed on January 15, 2023, involves property damage resulting from water infiltration due to a burst pipe in a residential building located at 123 Maple Street, resulting in an estimated repair cost of $20,000. Despite providing necessary documentation, including photographs, repair estimates, and previous communication logs, the insurer denied the claim on grounds cited in policy document section 4.2, stating it was not covered under the terms of the policy. Seeking clarity on this resolution, further examination of policy language and applicable clauses regarding water damage should be conducted. Prompt action from the customer service department is required to facilitate a fair and timely dispute resolution process.

Supporting Documentation

During an insurance dispute resolution process, providing comprehensive supporting documentation is crucial to strengthen your case. Key documents may include the original insurance policy (which outlines coverage limits and exclusions), communication records (such as emails or letters exchanged with the insurance company regarding claims), and photographs (visual evidence of damages or incidents). Additionally, include estimates or invoices from repair services that substantiate your claim amount. Medical records (in cases of personal injury) and police reports (for incidents involving law enforcement) provide essential context. Timely submission (often within a specified timeframe, such as 30 days from initial dispute notice) of these documents can significantly impact the outcome of the resolution process.

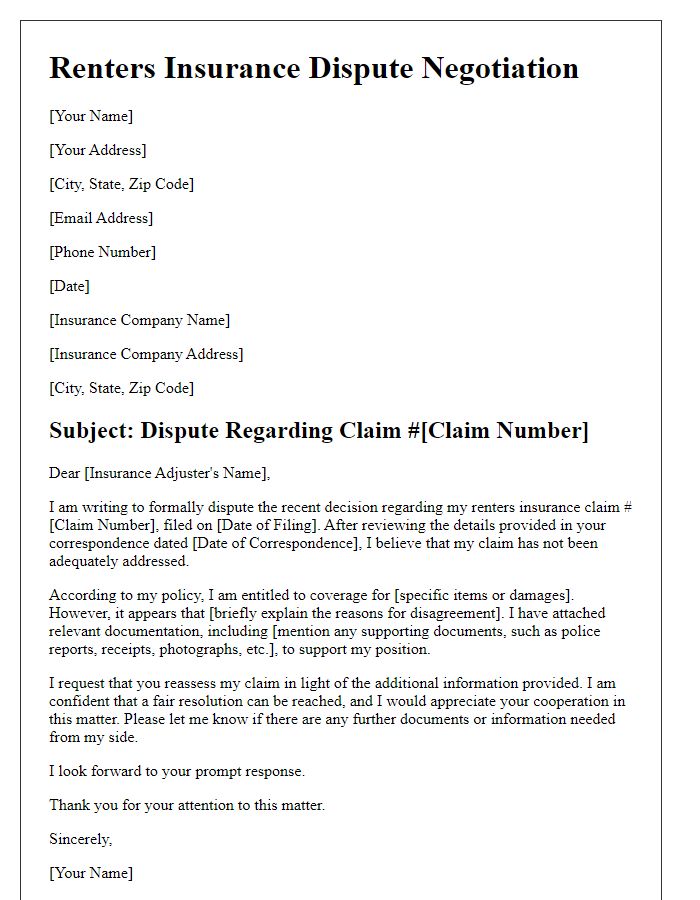

Resolution Request

In insurance dispute resolution, a formal resolution request serves as an essential document to address grievances regarding claims processing, policy interpretations, or coverage denials. This request typically includes key details such as the policy number, claim number, and the specific incident date, providing a clear context for the dispute. Notably, documenting any previous communications with the insurer, including dates and representatives spoken to at the company, can strengthen the case. Additionally, submitting supporting documents like photos, repair estimates, and medical records plays a vital role in substantiating claims. The resolution request should articulate the desired outcome, whether it involves a claims payment, coverage clarification, or policy amendment, contributing to a clear and concise resolution pathway.

Professional Tone

Insurance disputes often arise from misinterpretations of policy details or disagreements over claim settlements. A well-documented letter can serve as an essential tool in addressing these conflicts. In an insurance dispute resolution letter, elements such as the policy number, claim number, and specific dates of events must be clearly outlined. This allows for a precise reference during the review process. Additionally, the inclusion of relevant documents like claim forms, photographs, or other supporting evidence enhances the argument. Emphasizing the specific terms of the insurance policy, such as coverage limits or exclusions, can clarify positions. Professional language should maintain a respectful tone while firmly stating the facts and requested resolutions, ensuring a constructive dialogue aimed at achieving a satisfactory outcome.

Comments