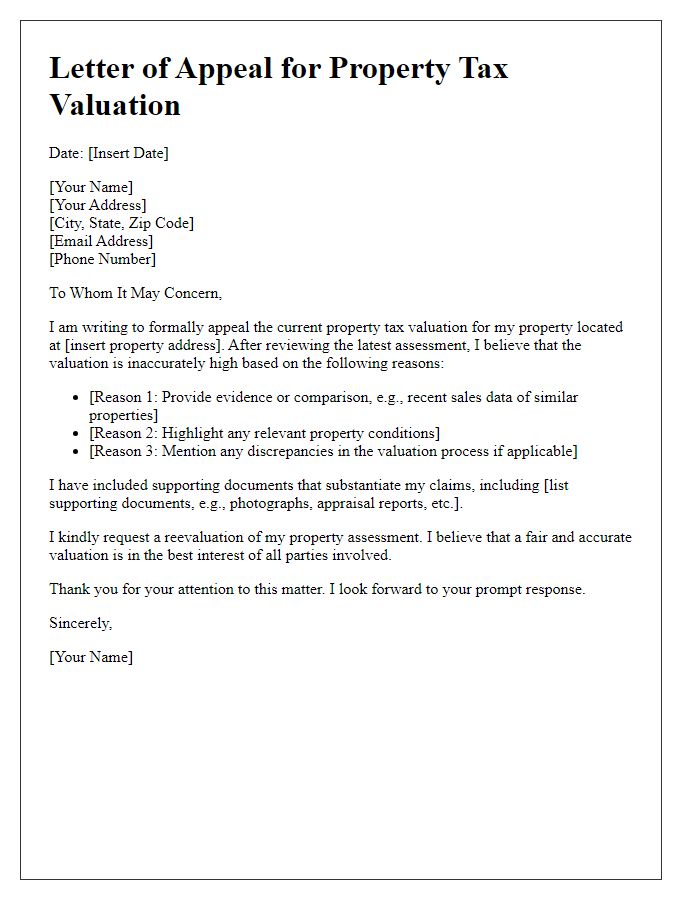

Are you feeling overwhelmed by property tax inquiries and unsure where to begin? It's completely normal, and you're not alone! Understanding property taxes can be complicated, but having the right information can make all the difference. In this article, we'll guide you through a sample letter template for property tax information inquiries, ensuring you're equipped to communicate effectively with your local tax authority. Keep reading to discover how to streamline your inquiry process!

Property details: Address and parcel number

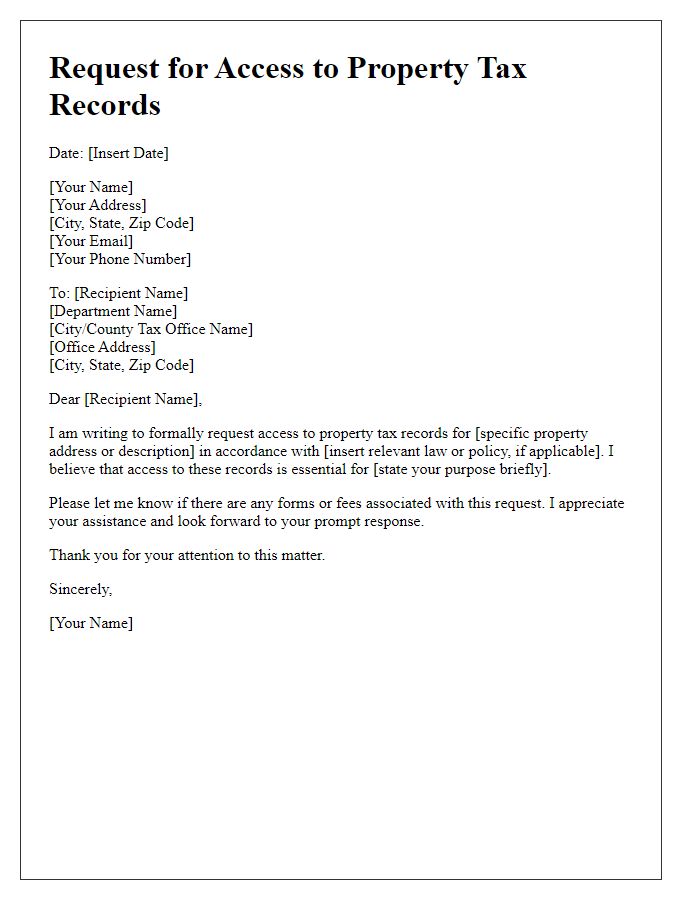

Property tax records serve as vital documents for homeowners and investors alike. Accurate property details include the specific address, which indicates the physical location of the property, and the parcel number, a unique identifier assigned by the local tax authority for administrative purposes. Property taxes, determined by local government entities, may vary significantly depending on factors like property value, county tax rates, and jurisdiction assessments. In the United States, property tax calculation often involves the assessed value obtained from an appraisal, which in many states occurs annually or biannually. Understanding local tax regulations and potential exemptions, such as homestead exemptions for primary residences, is crucial for homeowners seeking to optimize their tax liabilities.

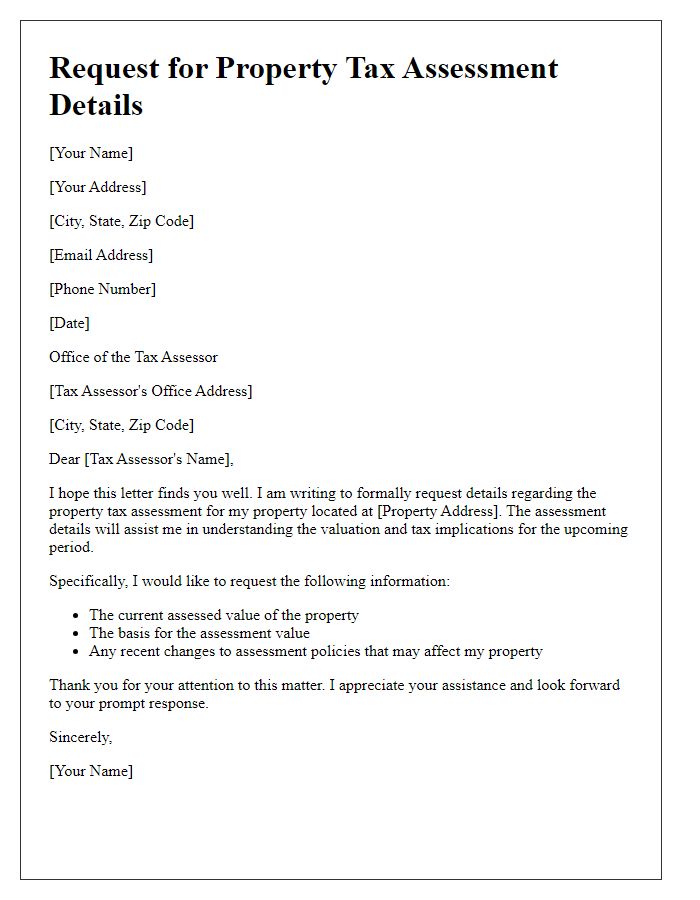

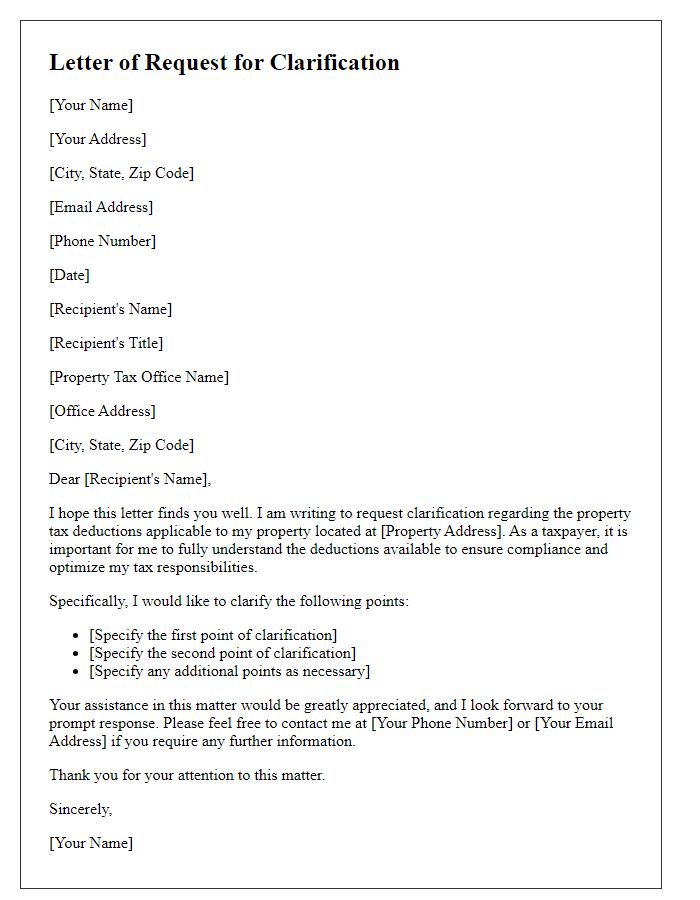

Owner's information: Name and contact details

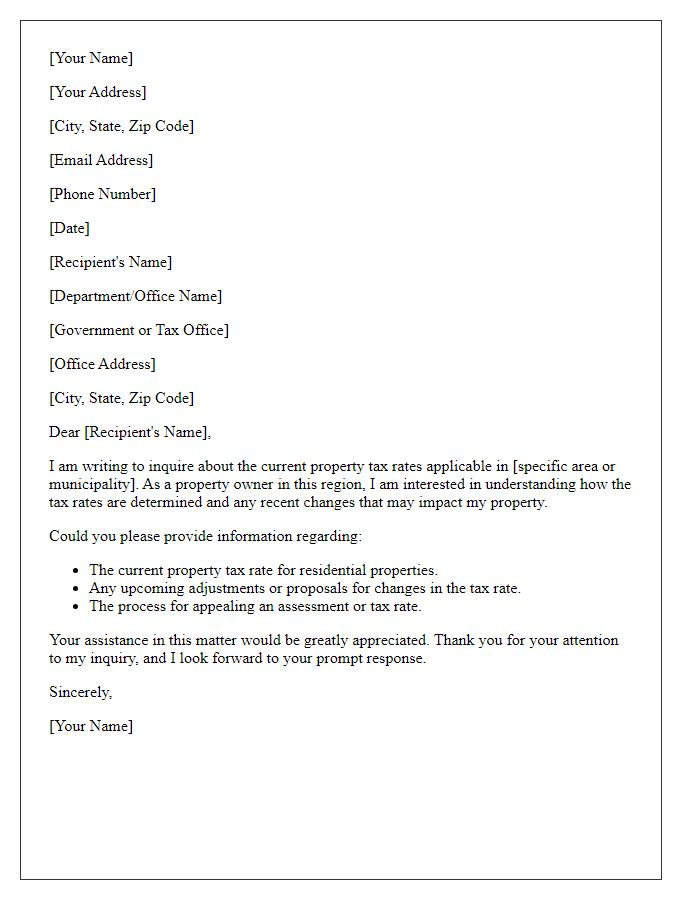

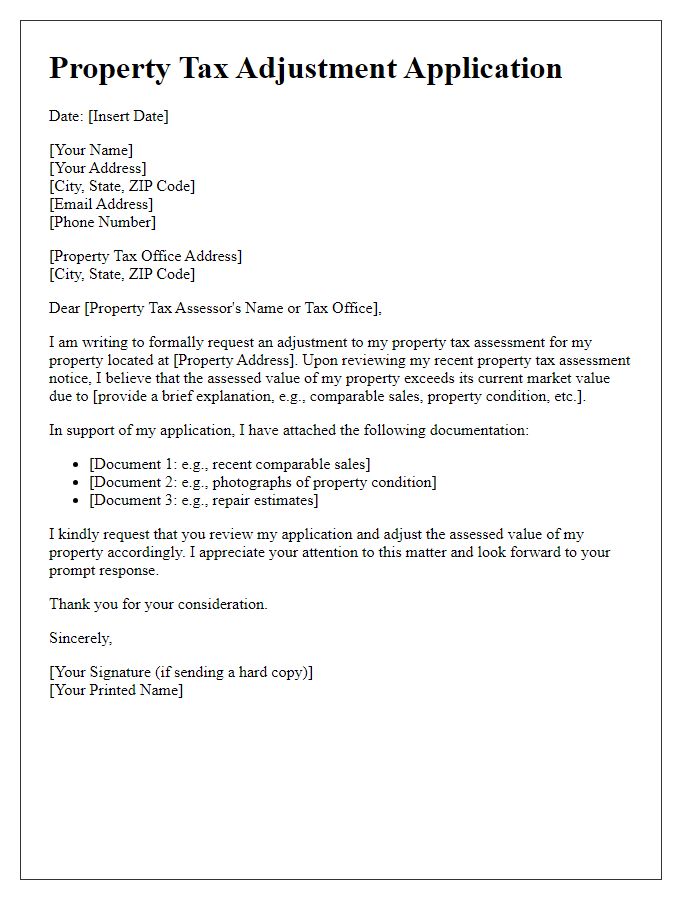

Property owners often seek detailed information regarding property tax assessments for their real estate investments, including residential homes, commercial buildings, or land. In many jurisdictions, this inquiry can be directed to the local tax assessor's office, which typically requires the owner's full name, mailing address, phone number, and email address for efficient communication. Tax records are maintained by municipalities, highlighting property values, assessed amounts, and any exemptions that might apply. Additionally, property tax inquiries can also encompass potential changes in tax rates, payment due dates, and appeals processes for disputed assessments, ensuring owners are well-informed about their financial responsibilities.

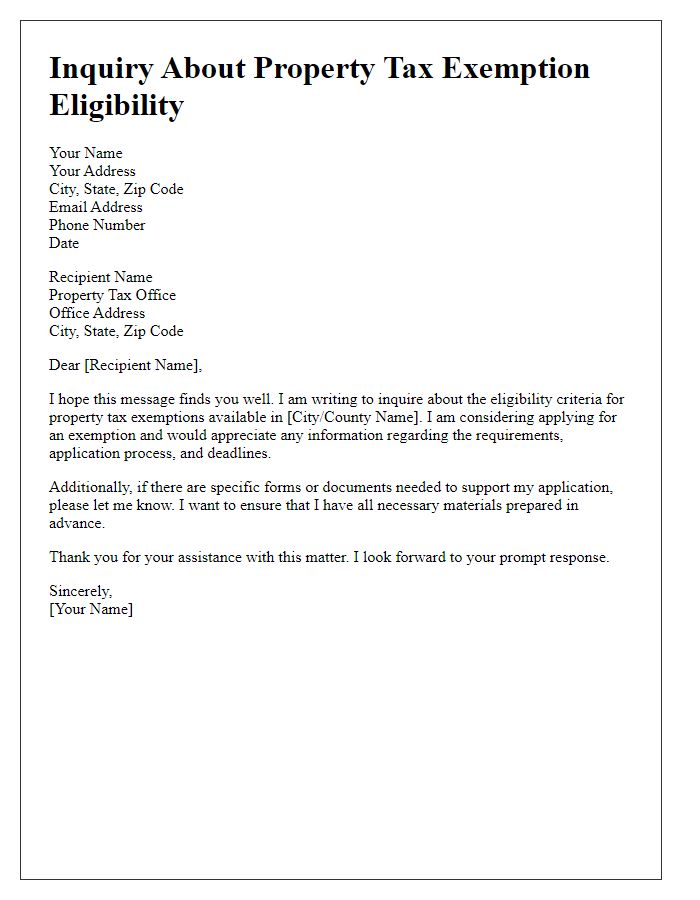

Inquiry specifics: Tax period and assessment details

Property tax inquiries often require specific details regarding the tax period and assessment information. For instance, property tax statements typically include the tax year, which may range from January 1 to December 31 in many jurisdictions, and the assessed value of the property, typically determined by the local assessor's office. It's common for the tax assessment to be based on factors like property size, location, and market trends, with possible adjustments reflecting recent sales of comparable properties. Understanding these details is crucial for property owners seeking clarity on their tax obligations, potential appeals, or adjustments in tax rates. Additionally, specific local laws and timelines for assessment notifications may vary, underscoring the importance of timely inquiries to the respective municipal tax office.

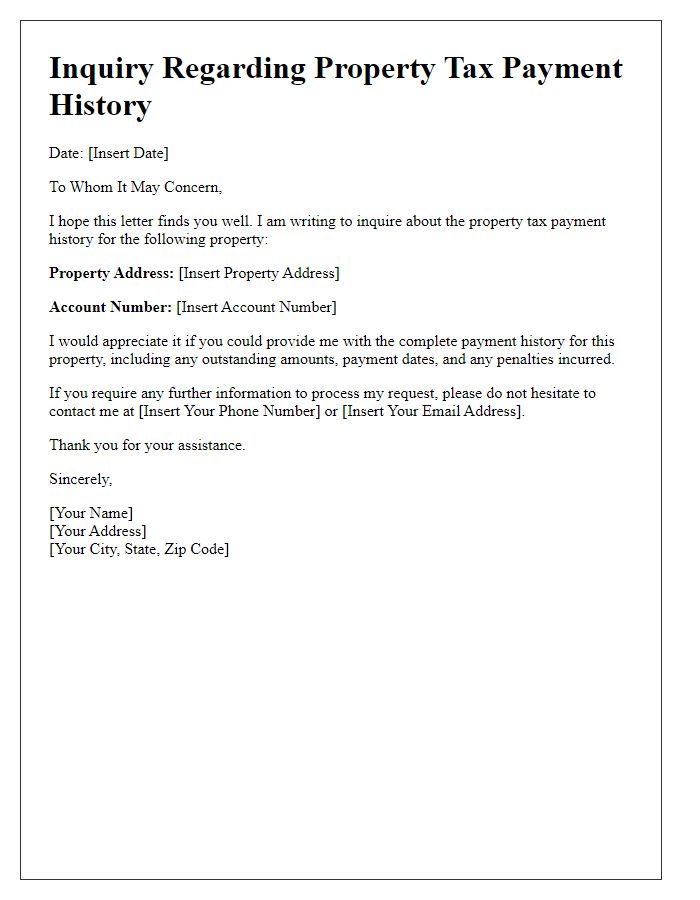

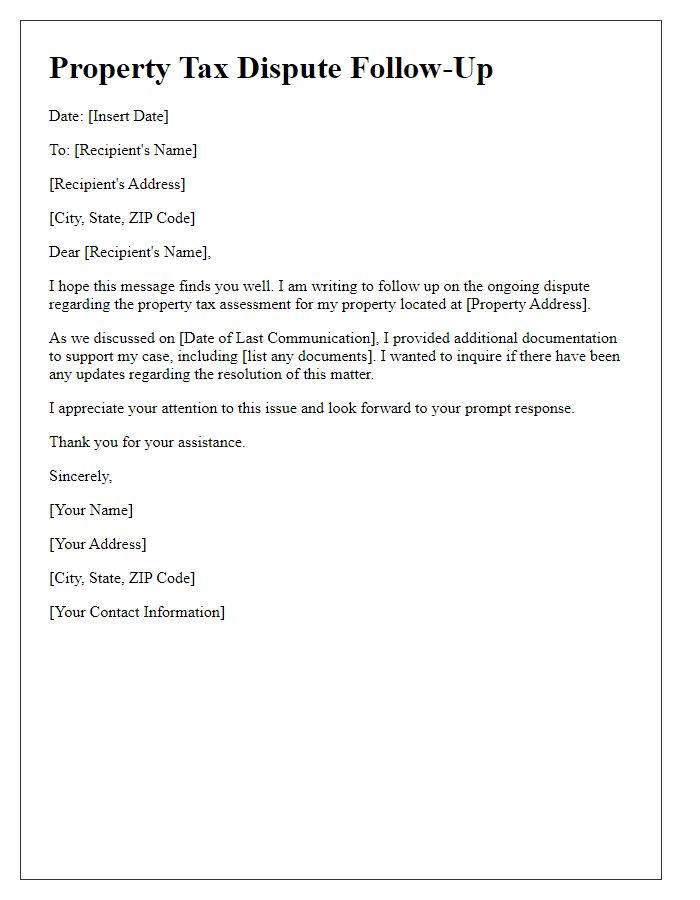

Request for documentation: Current bill and payment history

Property tax inquiries often arise due to discrepancies or clarifications needed regarding tax assessments and billing. Homeowners may seek documentation such as the current property tax bill, outlining the total amount owed, assessment details, and due dates. Additionally, payment history records are essential for tracking past payments, understanding any outstanding balances, or identifying potential overpayments. Access to these documents helps ensure transparency and accuracy in fiscal matters related to local governments, enhancing homeowner engagement with the community they reside in.

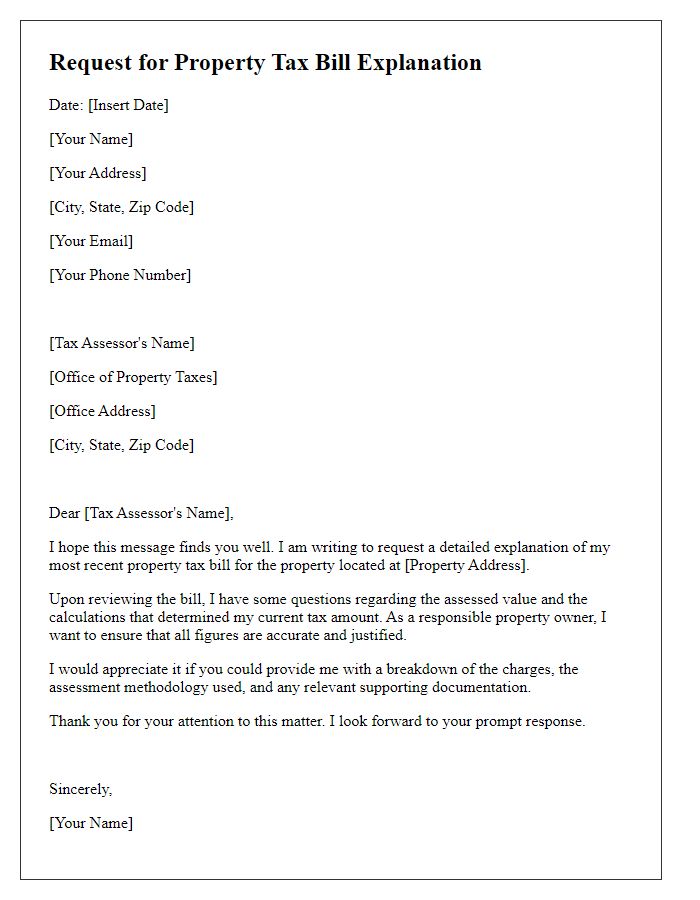

Contact preference: Email, phone, or postal correspondence

Property tax assessments in various regions can be complex and may differ significantly based on local regulations or municipality requirements. For instance, residents in Cook County, Illinois, may face varying property tax rates depending on property classification, which could range from residential to commercial. The property tax assessment process typically involves an evaluation of property value conducted by local assessors, utilizing comparable sales data and property condition. Homeowners may seek clarification via email, phone, or postal correspondence to gather detailed explanations regarding assessment discrepancies or payment options. Additionally, deadlines for payment, often set by local tax authorities, can influence property owners' inquiries, as delinquency may result in penalties or interest accrual.

Comments