Are you feeling overwhelmed by a recent tax assessment that doesn't seem fair? You're not alone, and navigating the appeal process can often feel daunting. Thankfully, crafting a clear and effective appeal letter can make all the difference in your case. Stick around to learn how to write a compelling template that will help you contest your tax assessment with confidence!

Taxpayer Identification Information

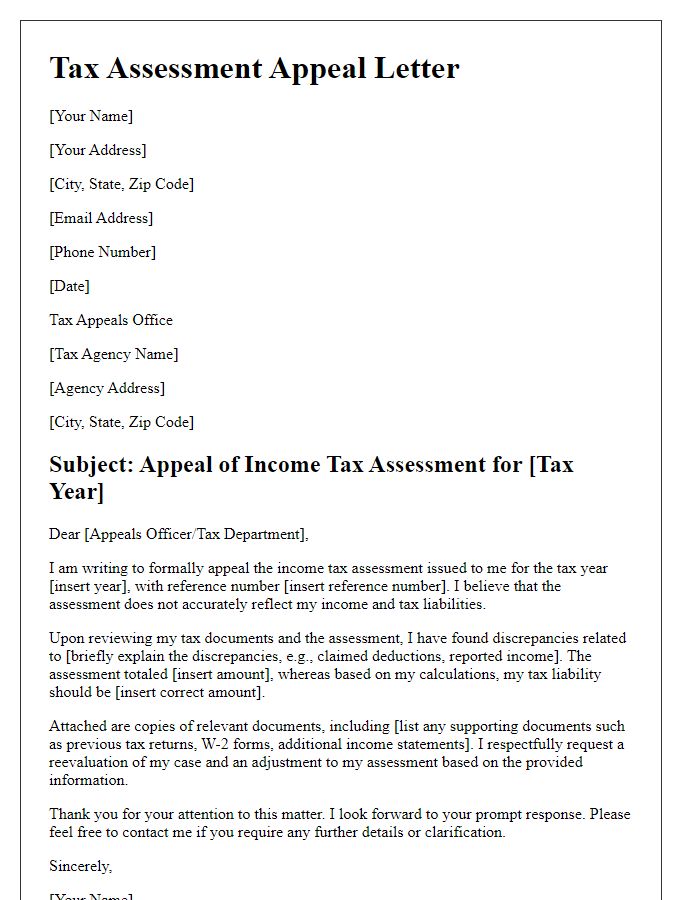

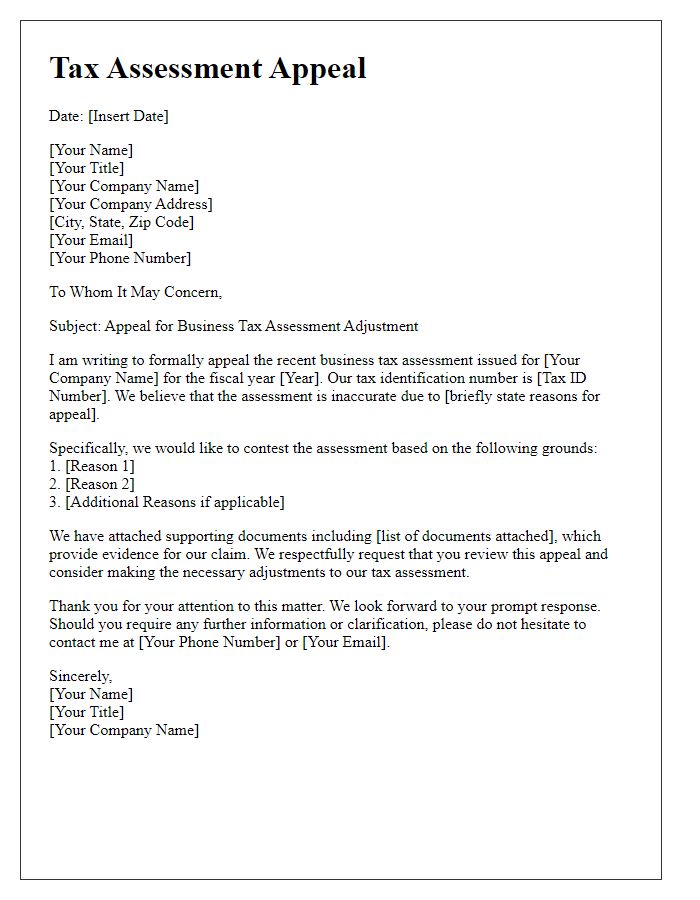

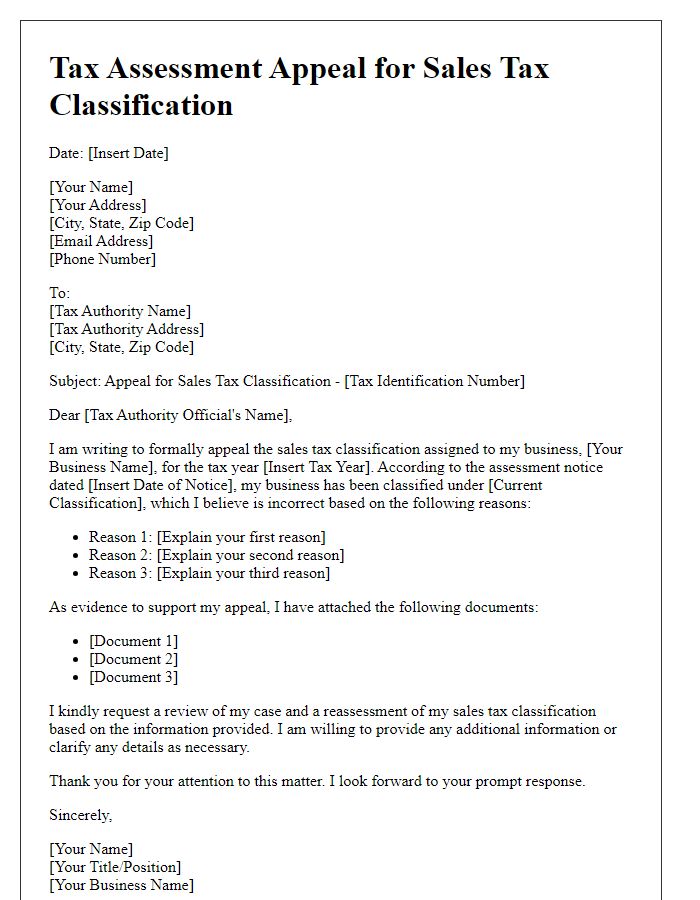

Taxpayer identification information, including a unique Tax Identification Number (TIN), is essential for the accurate assessment of federal and state tax liabilities. Maintaining precise records of identification ensures streamlined communication with the Internal Revenue Service (IRS) or state tax authorities. This usually includes the taxpayer's full name, address, Social Security number (SSN) for individuals, or Employer Identification Number (EIN) for businesses. Tax assessments may be challenged if discrepancies arise; incorrect identification can lead to misapplied tax rates or wrongful penalties. Therefore, ensuring complete and accurate taxpayer identification information is critical for effective appeal processes regarding tax assessments.

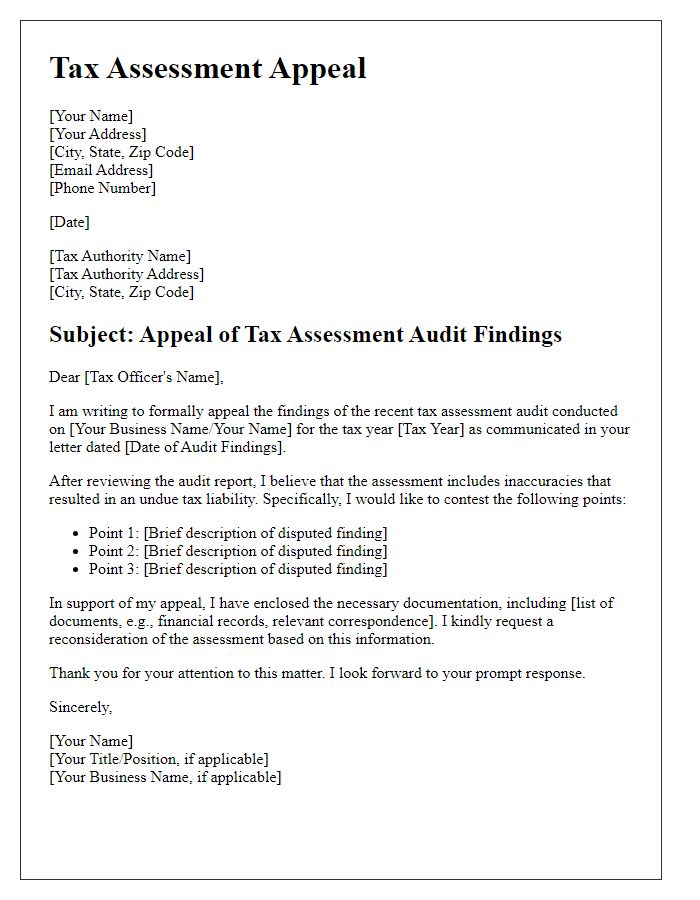

Assessment Details and Discrepancies

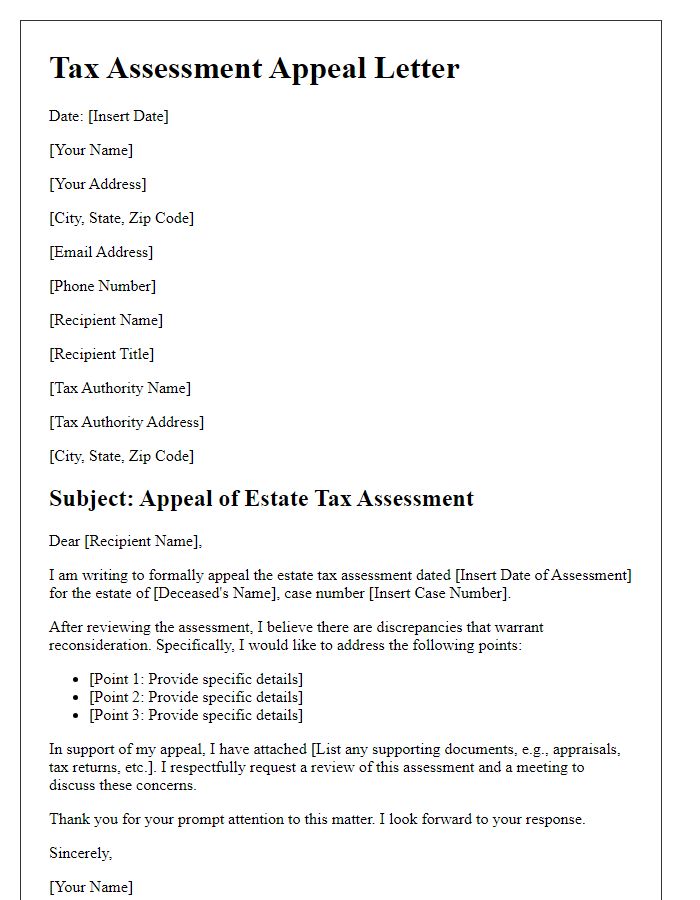

In the appeal notice regarding tax assessment discrepancies, specific details of the assessment must be clearly outlined for effective comprehension. The assessment date (for example, June 15, 2023) should be noted, alongside the assessed amount (e.g., $15,000) that has prompted the appeal. Detailed discrepancies, such as incorrect income reporting or misclassified deductions, should be specified, highlighting any discrepancies in documentation or calculations from the tax authority (for instance, the Internal Revenue Service). Additionally, referencing relevant tax codes or regulations that support the appeal--such as Section 1012 for capital gains adjustments--strengthens the argument. Timelines for submission, including the appeal deadline (perhaps 30 days from the assessment notice), must also be clearly indicated to ensure compliance with local tax regulations.

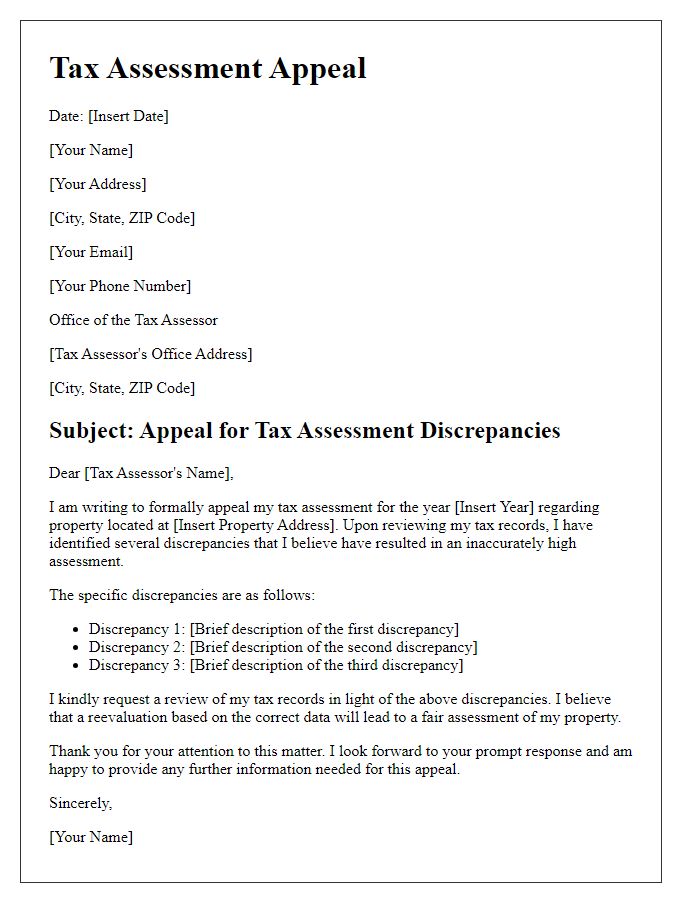

Reason for Appeal and Supporting Evidence

A tax assessment appeal notice requires a clear presentation of the reason for the appeal, supported by specific evidence. The taxpayer should state discrepancies in property valuation, such as a significant overestimation compared to similar properties in the area. Recent sales data (e.g., properties sold within the last six months) can serve as supporting evidence. For example, if a comparable property in Springfield sold for $250,000 while the assessed value is $350,000, this significant difference highlights potential overvaluation. Additionally, any recent renovations or maintenance issues, such as a roof leak or outdated electrical systems, should be documented, including inspection reports or photographs as further substantiation of the property's true value. This comprehensive approach strengthens the appeal and increases the likelihood of a favorable reassessment outcome.

Legal References and Compliance

Navigating the process of a tax assessment appeal requires a thorough understanding of legal references and compliance. Tax assessment appeals typically fall under jurisdiction-specific regulations, such as the Internal Revenue Code in the United States or local tax laws pertinent to individual states or municipalities. For instance, taxpayers may refer to Section 6015 for equitable relief from joint liability, enhancing their arguments against unfair assessments. Compliance involves adhering to the prescribed timelines for filing notices, often stipulated within 30 days of receiving the assessment notice to ensure eligibility for appeal. Documentation such as prior tax returns, supporting financial statements, and evidence of the assessed property's value plays a critical role in substantiating claims during hearings before tax appeal boards or administrative law judges. Knowledge of venue selection, whether it be local tax courts or appellate tribunals, is vital for effective advocacy in tax assessment disputes.

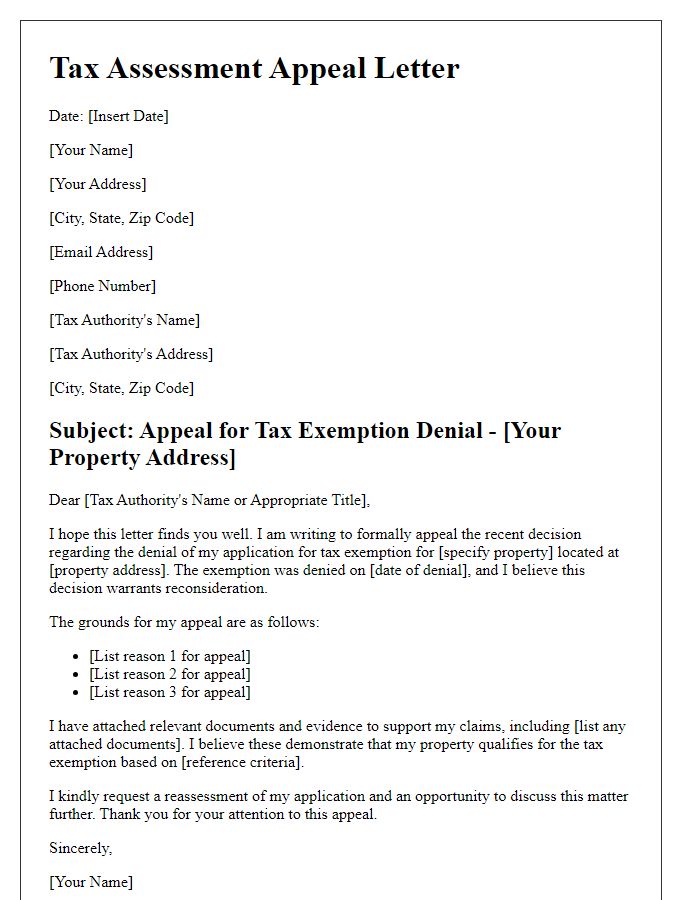

Contact Information and Request for Acknowledgment

In the realm of tax assessment appeals, clear communication is crucial. A tax assessment appeal notice comprises essential contact information, including the taxpayer's name, address, phone number, and email address, ensuring that tax authorities can reach the individual easily. Additionally, the notice should request an acknowledgment of receipt, which serves as a formal confirmation that the appeal has been received and is under review. This acknowledgment is important for tracking the appeal process, providing a documented reference for both the taxpayer and the tax authority, particularly in jurisdictions with specific response timelines, such as the Internal Revenue Service (IRS) in the United States, which allows 30 days for acknowledgment in many cases. The notice must be concise, maintaining clarity to facilitate an efficient review process.

Letter Template For Tax Assessment Appeal Notice Samples

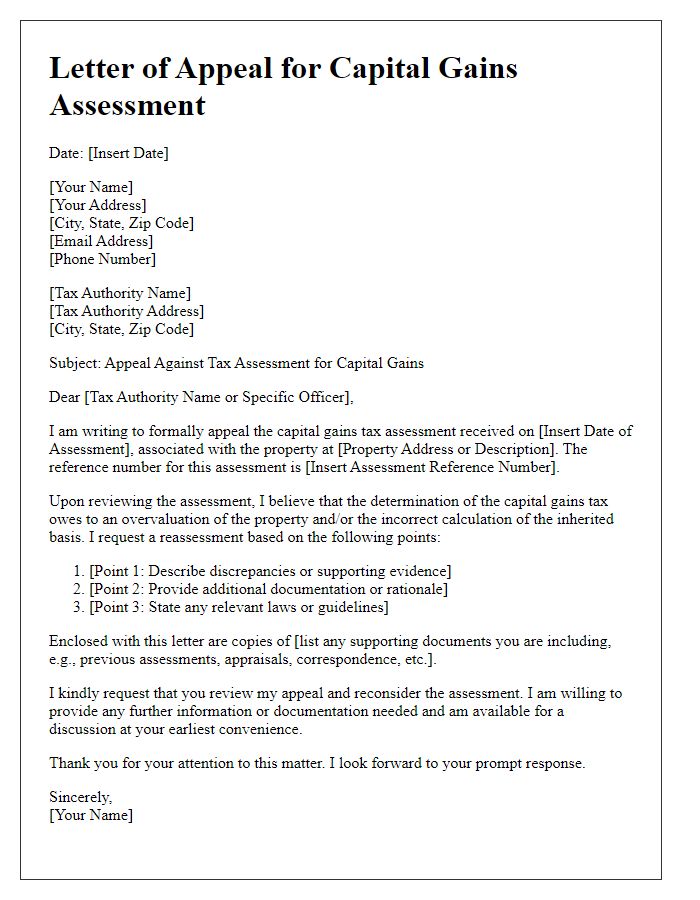

Letter template of tax assessment appeal regarding capital gains assessment

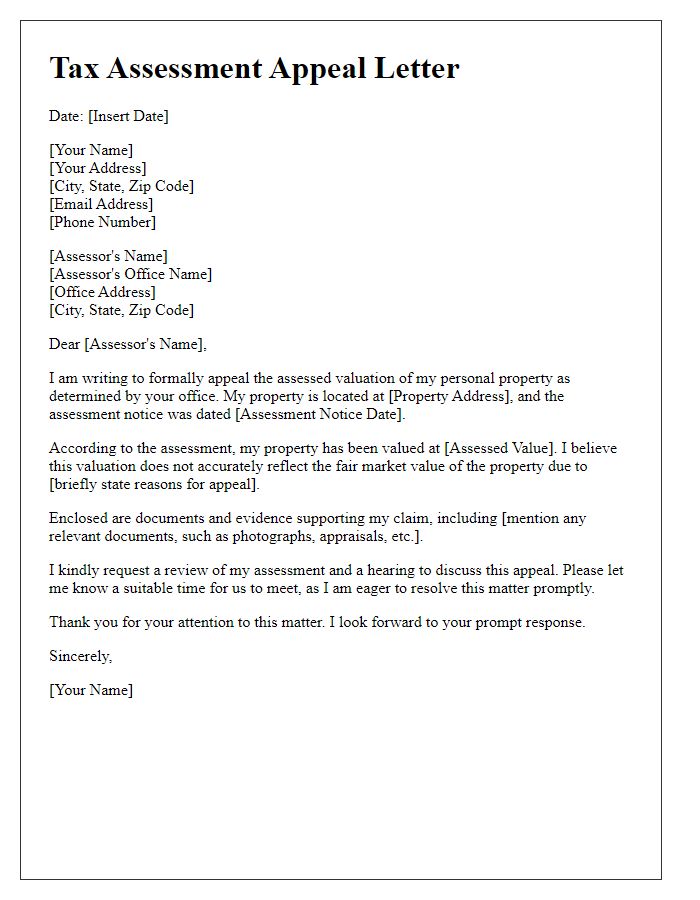

Letter template of tax assessment appeal for personal property assessment

Comments