Are you a member of a homeowners association (HOA) looking to stay updated on your insurance policy? Keeping your community safe and secure is vital, and understanding the nuances of your HOA insurance can make all the difference. In this article, we'll break down the key updates you should be aware of, making it easier for you to navigate your policy. Join us as we explore essential insights that can help you protect your investment and ensure peace of mind!

Subject line: Concise and specific.

Homeowners Association Insurance Policy Update Notification.

Greeting: Formal and appropriate.

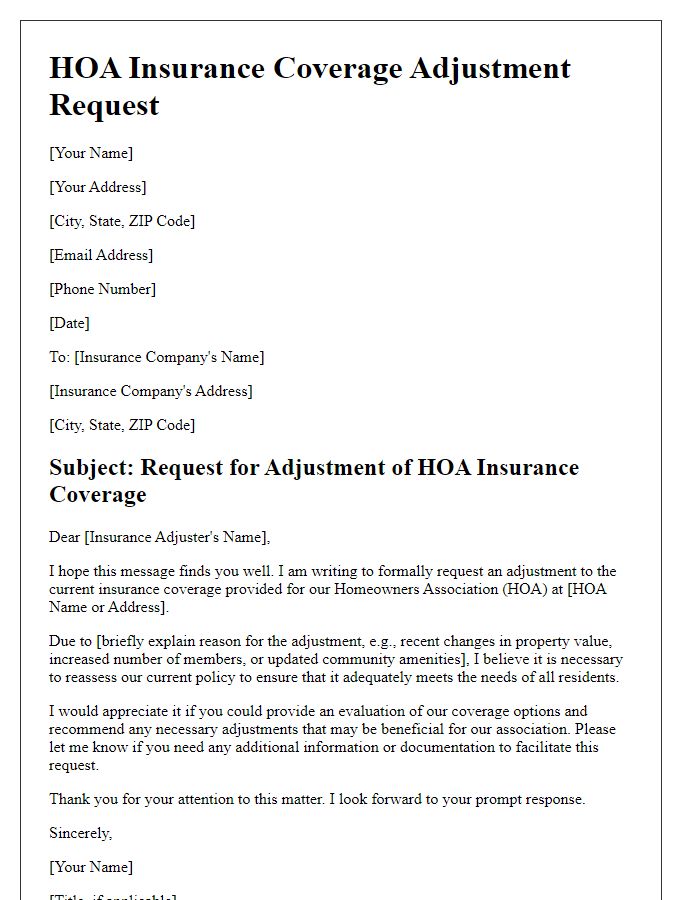

Homeowners Associations (HOAs) require periodic updates to their insurance policies to ensure comprehensive coverage for properties and communal assets. Such updates address critical areas such as liability protection, property damage, and reserve funds, safeguarding against unforeseen events like natural disasters or vandalism. Key elements to review in an insurance policy include coverage limits, deductibles, and premiums, which can vary significantly based on the location, such as areas prone to hurricanes or wildfires in Florida or California, respectively. Regular assessments of insurance needs contribute to financial stability and community confidence in managing shared spaces and properties.

Introduction: Brief overview of the purpose.

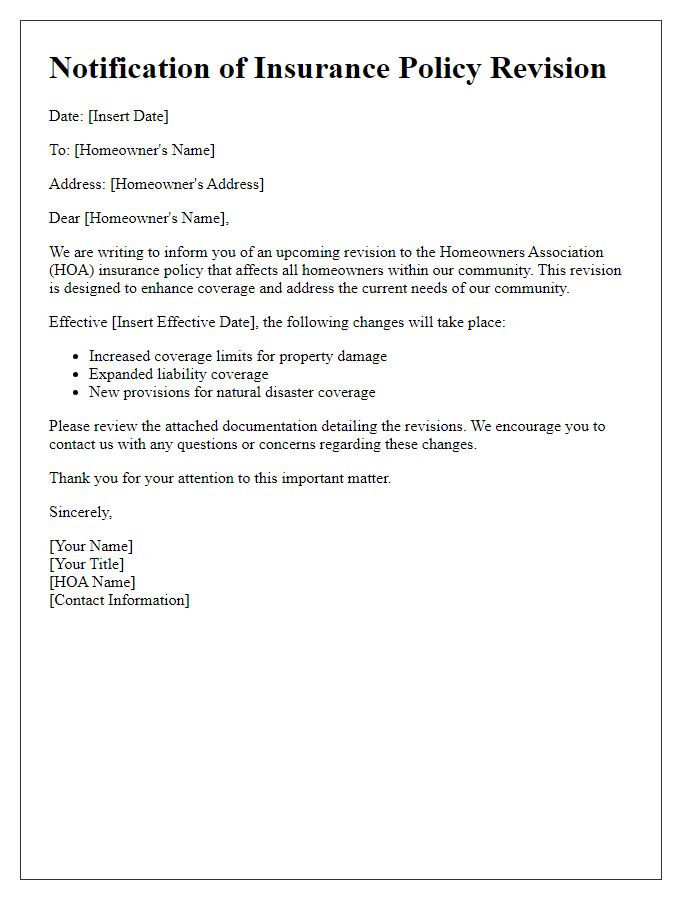

The HOA (Homeowners Association) insurance policy update is essential for ensuring financial protection against potential liabilities and property damage affecting the community. This update outlines improvements and changes to the existing coverage, including enhancements to property insurance, liability coverage adjustments, and updates on mandatory regulations. The goal is to provide residents with a comprehensive understanding of how these changes will impact their coverage, the associated costs, and steps to opt-in or update their individual policies accordingly. Regular reviews of the insurance policy uphold the community's safety and financial stability, reflecting the evolving needs of the residents in the community.

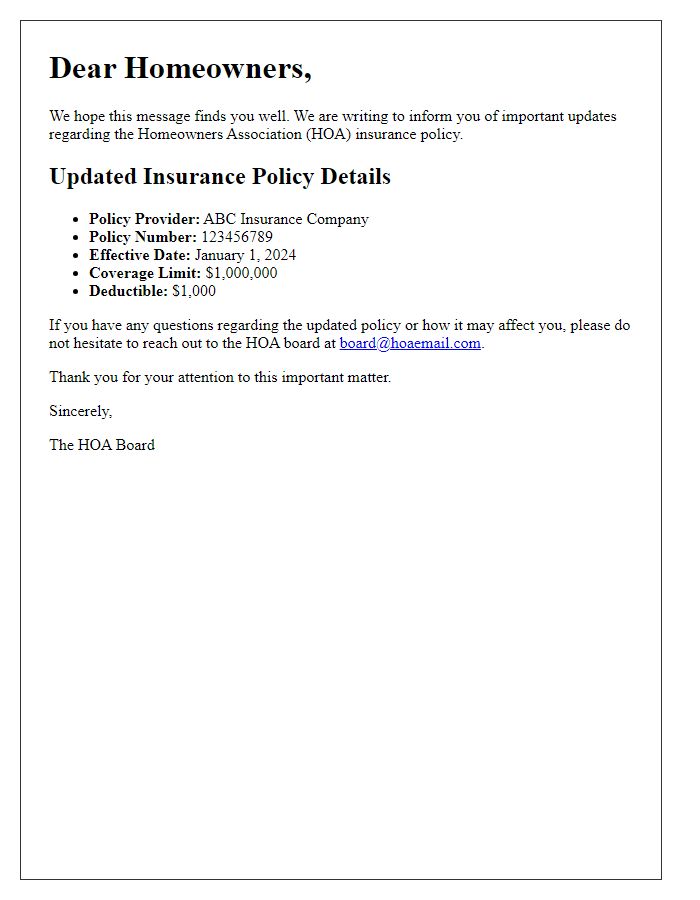

Policy details: Specific updates and changes.

The recent update to the Homeowners Association (HOA) insurance policy, effective November 1, 2023, includes several crucial changes aimed at enhancing coverage for all residents within the community. The updated policy now features an increased coverage limit of $2 million for liability insurance, providing greater financial protection against accidents occurring in common areas such as the pool and clubhouse. Additionally, there is an expanded coverage for property damage, raising the deductible to $1,500 for incidents involving vandalism or natural disasters like hurricanes, which are prevalent in regions such as Florida and Texas. Notably, a new provision addressing cyber liability has been introduced, protecting the HOA against potential data breaches affecting personal information of residents. Residents are encouraged to review the detailed policy changes outlined in the attached document for a comprehensive understanding of how these updates may impact individual homeowner coverage.

Contact information: For further inquiries and support.

HOA insurance policies require regular updates to ensure comprehensive coverage for the community association and its members, including liability protection, property damage, and against natural disasters such as hurricanes or floods. Maintaining up-to-date contact information for policy inquiries is critical, with specific details such as a phone number and email address provided for residents to reach out for support. In addition, regular review meetings may be conducted to discuss changes in policies and claims processes, enhancing communication among homeowners and the management team. This proactive approach aims to mitigate risks and ensure that all residents feel informed and secure regarding their community insurance.

Comments