Are you feeling frustrated with your insurance broker and unsure how to voice your concerns? Writing a formal complaint letter can be an effective way to express your dissatisfaction and seek a resolution. In this article, we'll guide you through the essential elements of a complaint letter that will not only outline your issues clearly but also convey your expectations for a remedy. Ready to take the first step toward resolution? Let's dive in!

Clear identification of parties involved (Your details and Broker's details)

A formal complaint regarding an insurance broker involves clear identification of the disputing parties. The complainant's details include full name, address, and contact information, typically including a phone number and email. The insurance broker's details must also be specified, including the name of the brokerage firm, the broker's name, address, and any relevant identification numbers like a license number. The context of the complaint should articulate the service issue, failure to deliver promised benefits, or any unethical conduct, supported by specific dates and documented interactions, ensuring clarity and a strong standing in the complaint process. This structured approach provides a precise framework for addressing grievances effectively.

Specific description of issue(s) encountered

Experiencing significant delays in claim processing from the insurance broker, ABC Insurance Services, has been frustrating. The initial claim submission was made on July 15, 2023, regarding a car accident that occurred on July 1, 2023. Despite multiple follow-ups via email and phone calls, responses have been vague and often exceeded two weeks. This lack of timely communication has hindered my ability to seek necessary repairs for my vehicle, which remains inoperable. Furthermore, discrepancies in coverage details were discussed during an initial consultation on June 10, 2023, where the broker assured comprehensive coverage for all vehicle damages. However, the policy documents received later revealed exclusions that contradict this assurance, leading to confusion and dissatisfaction with the service provided.

Reference to policy number or relevant documents

A formal complaint against an insurance broker often arises from issues related to policy management, claims handling, or customer service inefficiencies. For instance, referencing a specific insurance policy number, such as Policy No. 123456789, can provide clarity on the context of the complaint. Details regarding incidents, such as delays in claim payments or lack of communication, should include dates and specific interactions--perhaps a phone call on March 15, 2023, during which critical information was not conveyed. Emphasizing the broker's role in facilitating insurance coverage and expectations can highlight the responsibilities that were not met. Additional relevant documents, such as previous correspondence or claim forms, can bolster the complaint, providing a comprehensive picture to support the grievance.

Timeline of events and communication

The timeline of events concerning the formal complaint against the insurance broker illustrates a series of critical communications and actions. On March 15, 2023, a policy was initiated with ABC Insurance Brokers regarding comprehensive coverage for my property located in Springfield, a city known for its variable weather patterns. Following this, on April 2, 2023, I contacted the broker via telephone to clarify coverage details, but the responses were vague and unsatisfactory. A follow-up email was sent on April 5, 2023, documenting the conversation and seeking clarification on policy terms. On April 20, 2023, I received an email response that contradicted previous discussions, raising red flags regarding the broker's professionalism and accuracy. Subsequently, I lodged a formal complaint directly with the company on April 25, 2023, detailing the discrepancies in service and communication. Despite multiple assurances of investigation, no substantive feedback has been provided by May 10, 2023, prompting the need for further escalation of the complaint.

Desired resolution or action

Inadequate service from insurance brokers can lead to significant financial loss and distress for policyholders. Many individuals rely on these professionals to navigate complex insurance products, including home, auto, and life insurance, to ensure comprehensive coverage. When brokers fail to provide accurate information regarding policy details, premium costs, or claims processes, it can prevent clients from making informed decisions. Customers often seek a formal resolution such as a thorough investigation into the broker's practices, a refund of any misplaced premiums, or corrective measures to ensure adherence to ethical standards. Additionally, affected clients may request the involvement of regulatory authorities like the Financial Conduct Authority (FCA) to ensure accountability and prevent future misconduct in the insurance sector.

Letter Template For Formal Complaint Against Insurance Broker Samples

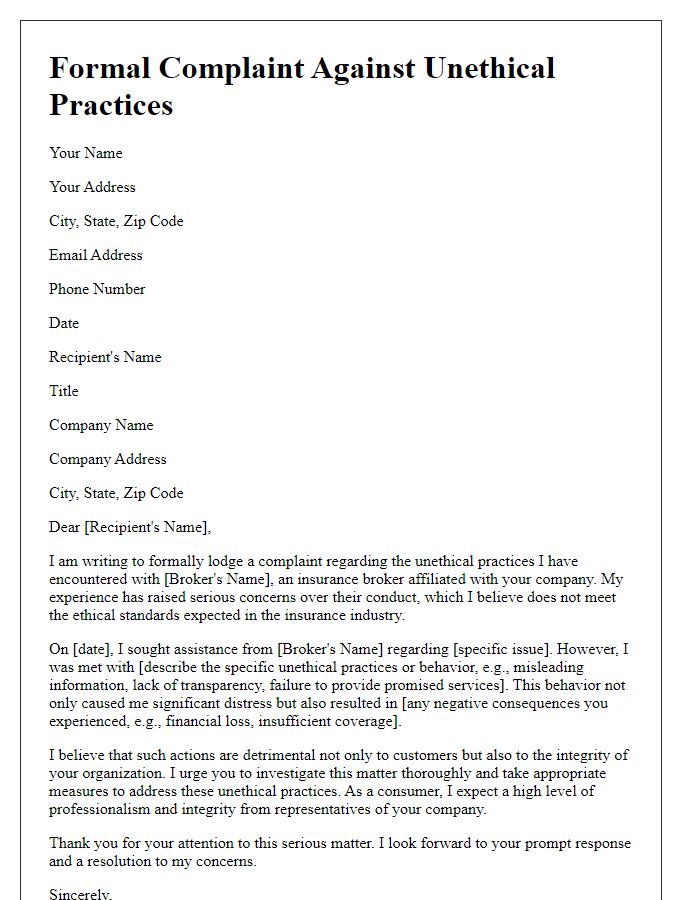

Letter template of formal complaint regarding insurance broker misconduct.

Letter template of formal complaint against unprofessional behavior of insurance broker.

Letter template of formal complaint about inadequate service from insurance broker.

Letter template of formal complaint related to misleading information by insurance broker.

Letter template of formal complaint for failure to provide promised insurance coverage.

Letter template of formal complaint concerning the unresponsiveness of insurance broker.

Letter template of formal complaint regarding delayed processing of insurance claims by broker.

Letter template of formal complaint about policy discrepancies presented by insurance broker.

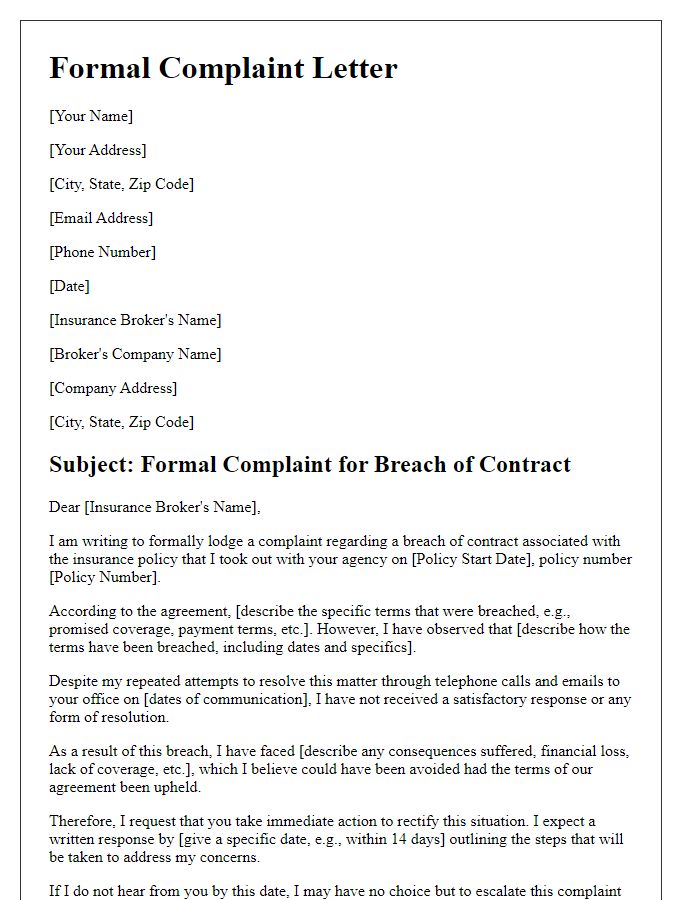

Letter template of formal complaint for breach of contract by insurance broker.

Comments