Are you tired of chasing down late payments and feeling frustrated by the lack of response? You're not alone, as many individuals and businesses find themselves in similar predicaments, grappling with the challenges of timely financial transactions. In this article, we'll discuss effective strategies for drafting a formal complaint letter that gets noticed and prompts action. So, let's dive deeper into the details and help you take control of your late payment woes!

Recipient details and sender's contact information

Late payment issues can significantly impact cash flow for businesses. In many cases, invoices overdue by 30 days or more can lead to a strained relationship between companies and their clients. For example, a small enterprise based in New York may rely on timely payments to meet its payroll obligations and supplier commitments. Persistent delays could force the business owner to consider legal options or hire collection agencies to recover funds, leading to additional costs. Furthermore, accumulating late fees can damage credit ratings, affecting future operations. Effective resolution requires clear communication with the recipient, including relevant invoice details and specified terms as outlined in contracts, such as payment dates and penalties.

Clear subject line specifying complaint

Late payment issues can significantly impact cash flow and operational efficiency for businesses. Inconsistent payment schedules may pose challenges to managing financial obligations, such as payroll and vendor payments. The occurrence of delays, particularly beyond a 30-day grace period, can strain relationships with suppliers and service providers, potentially affecting ongoing contracts. Documenting these instances, including specific dates and amounts, can provide a clearer picture of the issue, facilitating more effective communication with the responsible parties, such as invoices issued in January 2023 and March 2023 that remain unpaid. Addressing late payment concerns promptly is crucial to maintaining healthy business operations and ensuring financial stability.

Detailed description of payment issue

A persistent late payment issue has emerged, significantly impacting cash flow management for small businesses. Invoices, due within 30 days as per agreed contract terms, have repeatedly been delayed for over 45 days. This situation has led to financial strain, necessitating urgent outreach to clients. For instance, a recent invoice totaling $5,000, issued on March 1, 2023, remains unpaid as of April 15, 2023. Such delays hinder the ability to meet operational expenses, including payroll and suppliers. Communication attempts, including two follow-up emails and a phone call, have yet to yield a resolution. This ongoing issue heightens stress levels and strains professional relationships. The need for a prompt and effective resolution is critical to restoring confidence and ensuring smooth business operations moving forward.

Reference to previous communication attempts

Late payment issues can significantly disrupt business operations, particularly when dealing with clients who have a history of outstanding invoices. In cases where payments exceed 30 days past due, organizations often find themselves in a precarious cash flow situation, affecting payroll or project continuity. Previous communications regarding these overdue invoices, sent via email on September 1, September 15, and again on September 30, highlighted the need for resolution. Legal frameworks, such as the Fair Debt Collection Practices Act (FDCPA), emphasize the importance of timely payments in maintaining professional relationships and operational integrity. Addressing these late payments is crucial for fostering trust and ensuring future collaborations remain financially viable.

Request for specific corrective action and deadline

A formal complaint regarding late payment issues can significantly impact financial operations. Companies often face disruptions when payments exceed 30 days from the invoice date. For instance, a small business that submits an invoice for $5,000 to a major corporation may find its cash flow severely affected if payment is delayed past the typical 30-day term. This situation necessitates specific corrective actions, such as immediate processing of the overdue payment and implement a revised payment protocol to prevent recurrence. Establishing a deadline, ideally within the next 14 days, for receiving payment would also maintain operational stability. Addressing these matters promptly can improve relationships and ensure smoother transactions in future dealings.

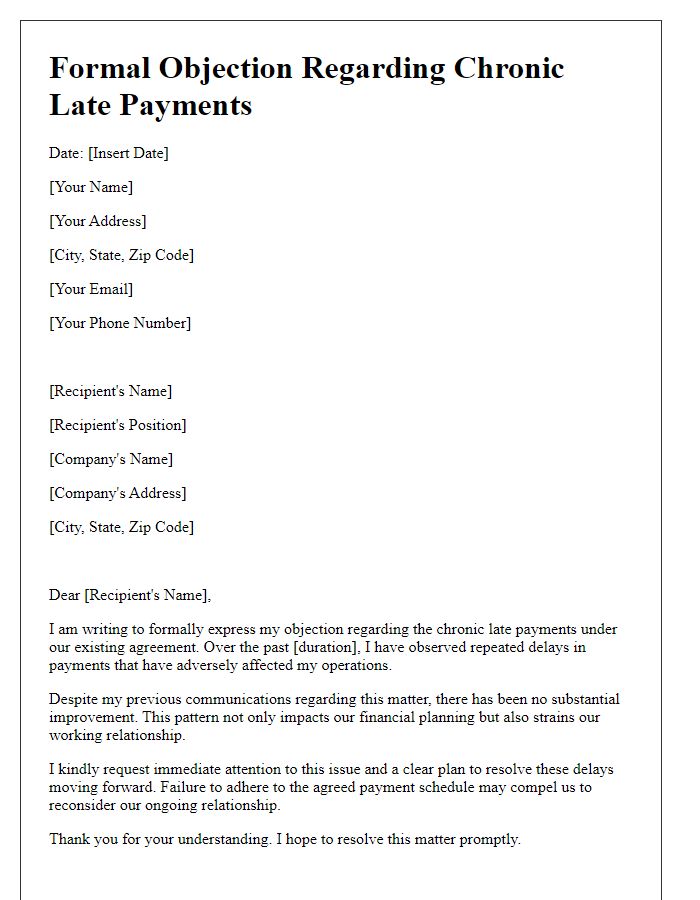

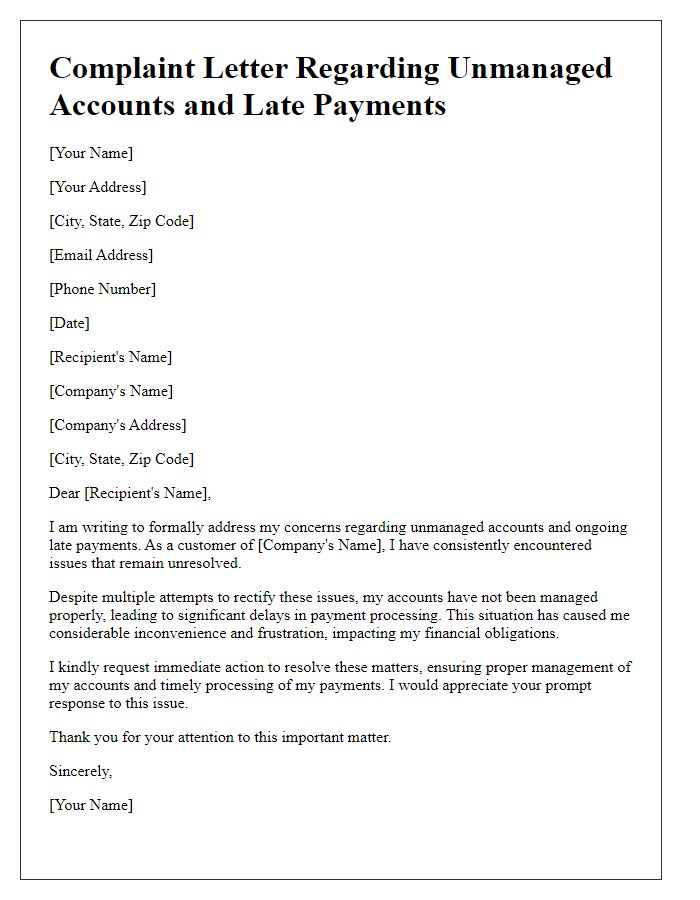

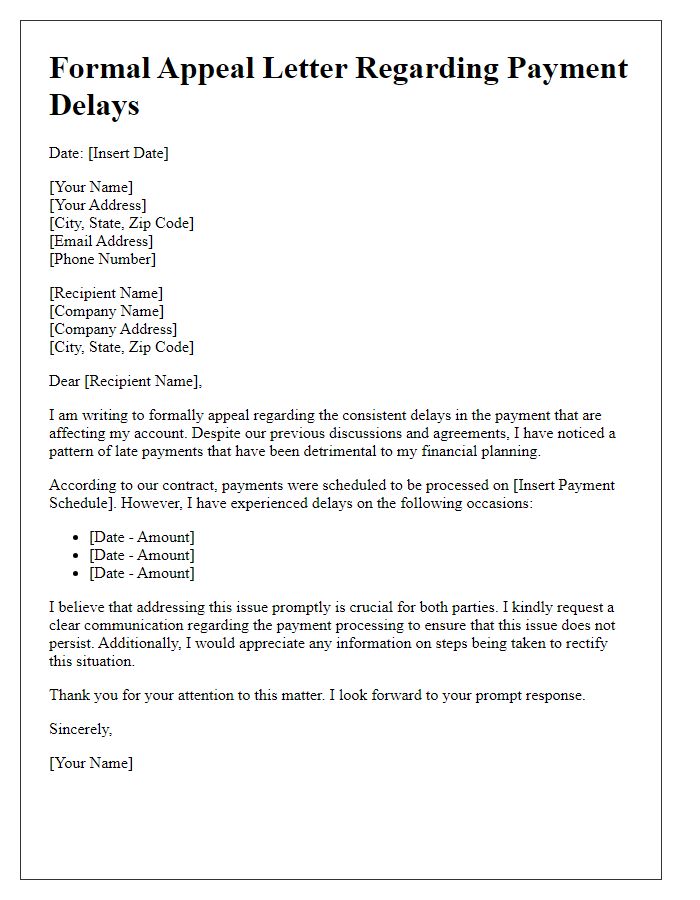

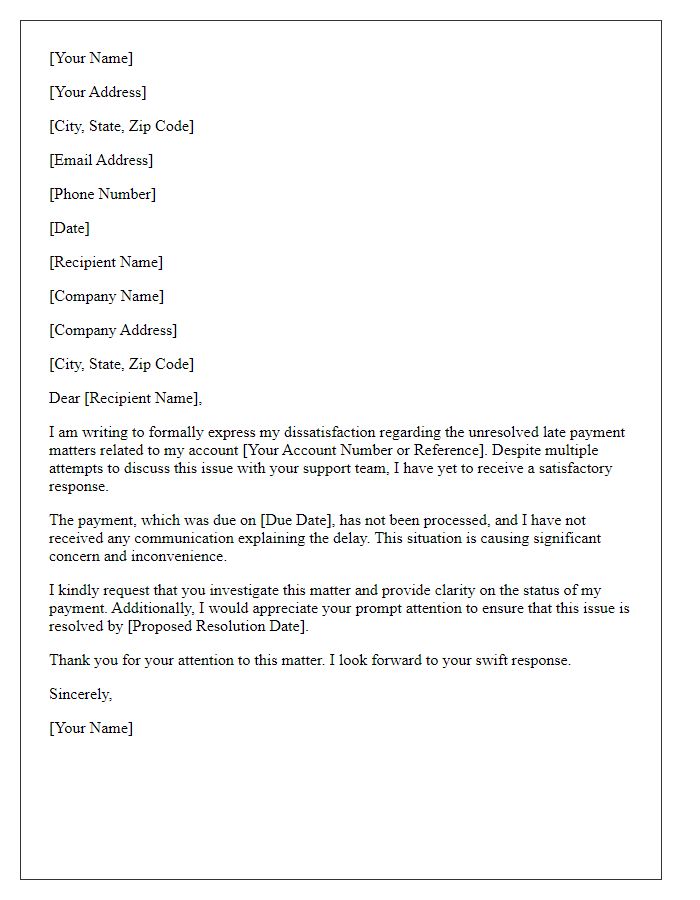

Letter Template For Formal Complaint Regarding Late Payment Issues Samples

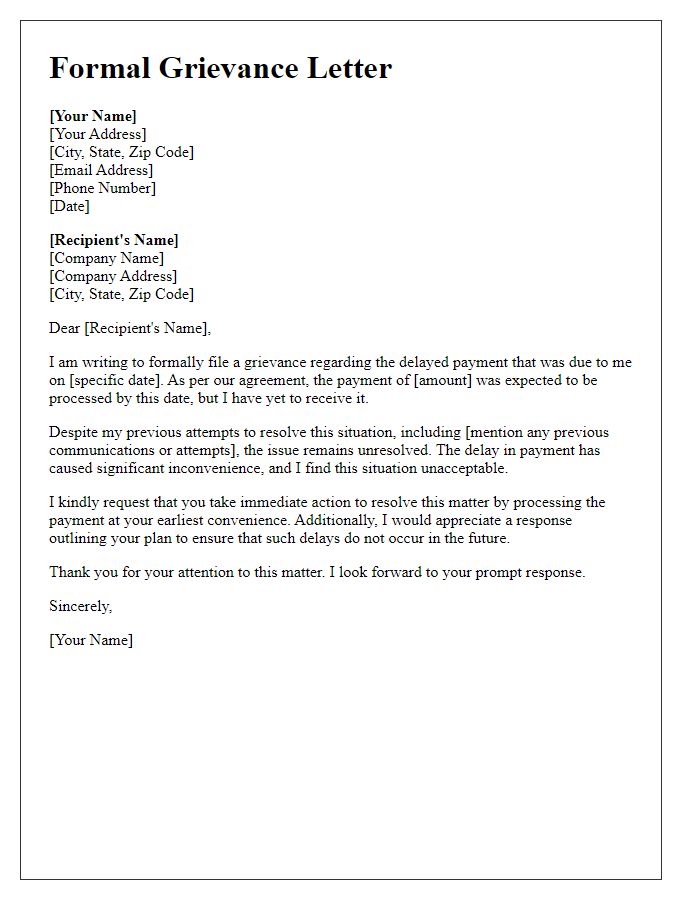

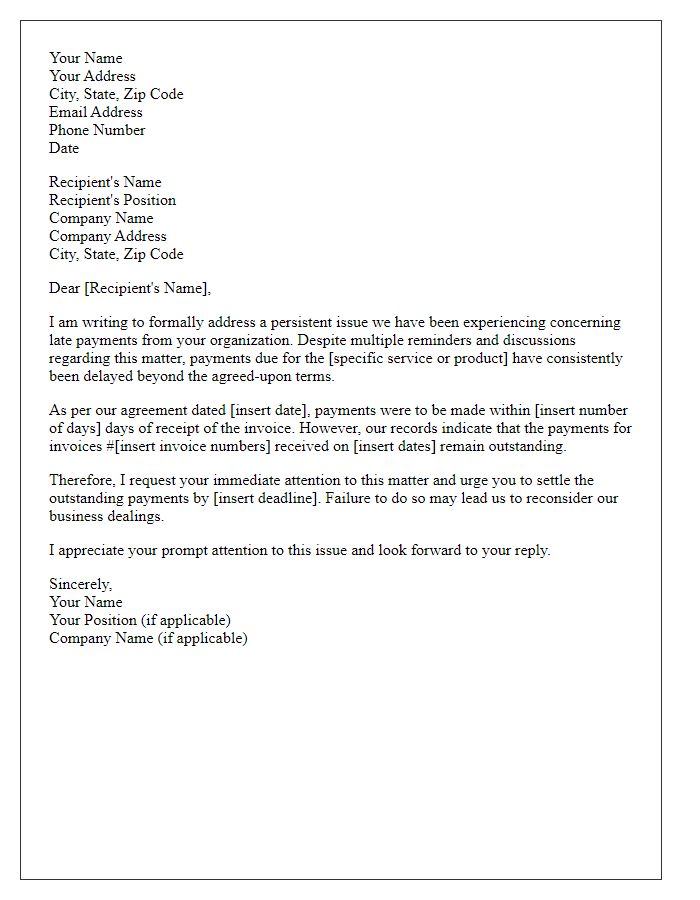

Letter template of formal grievance related to delayed payment resolution.

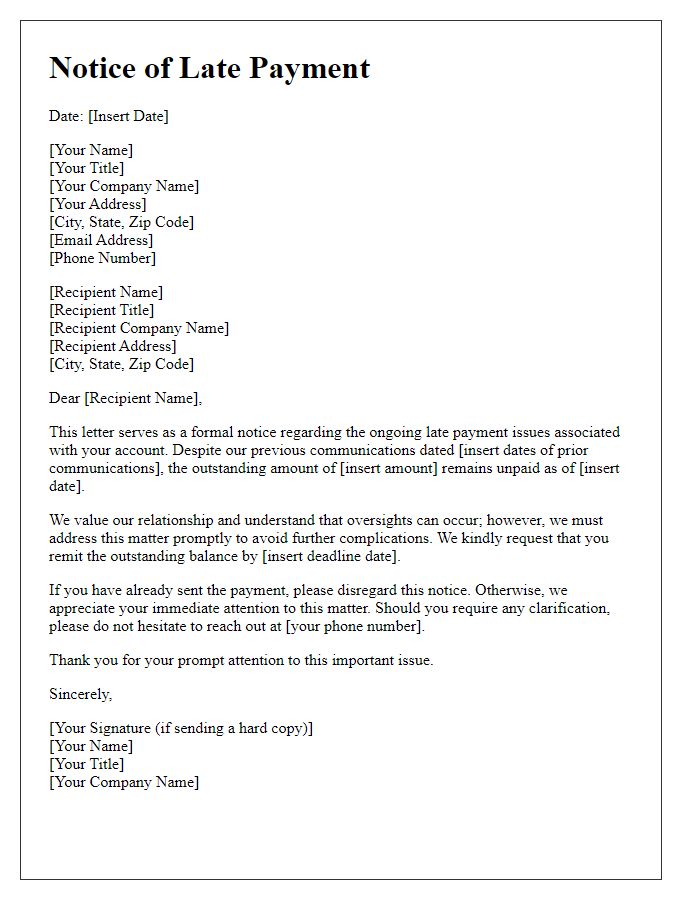

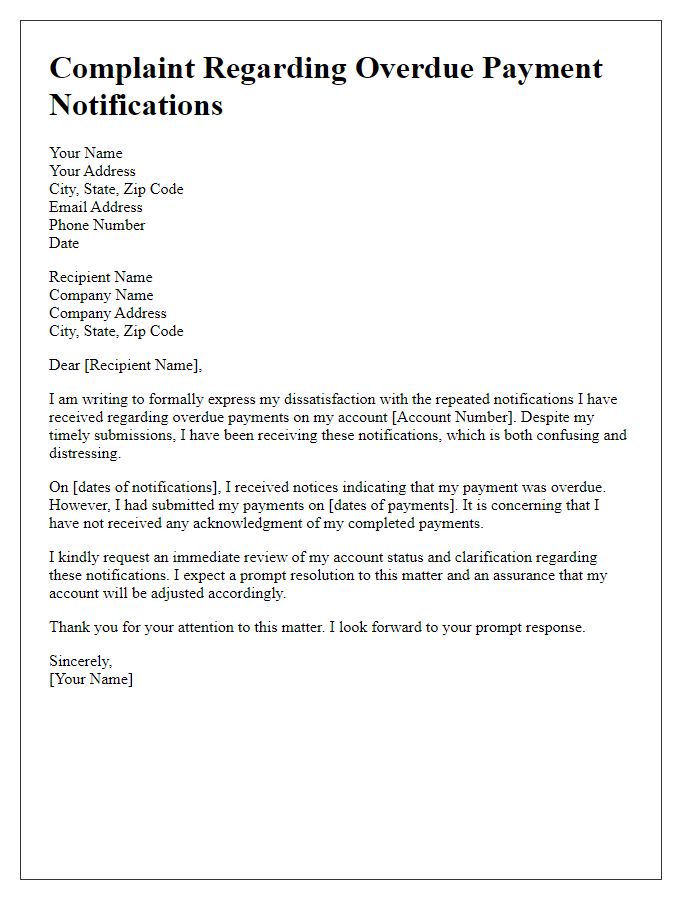

Letter template of formal notice concerning ongoing late payment issues.

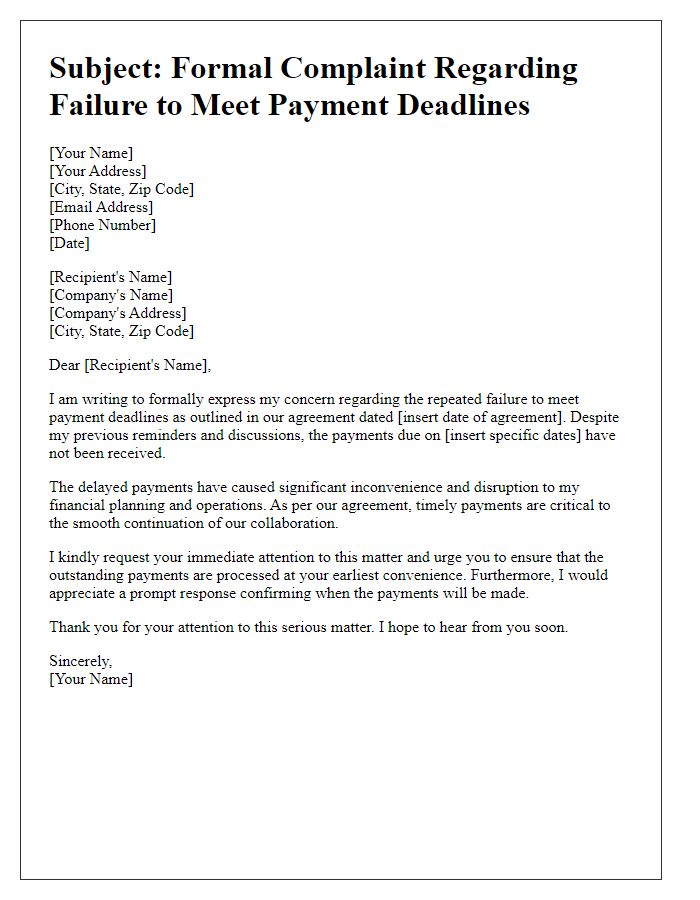

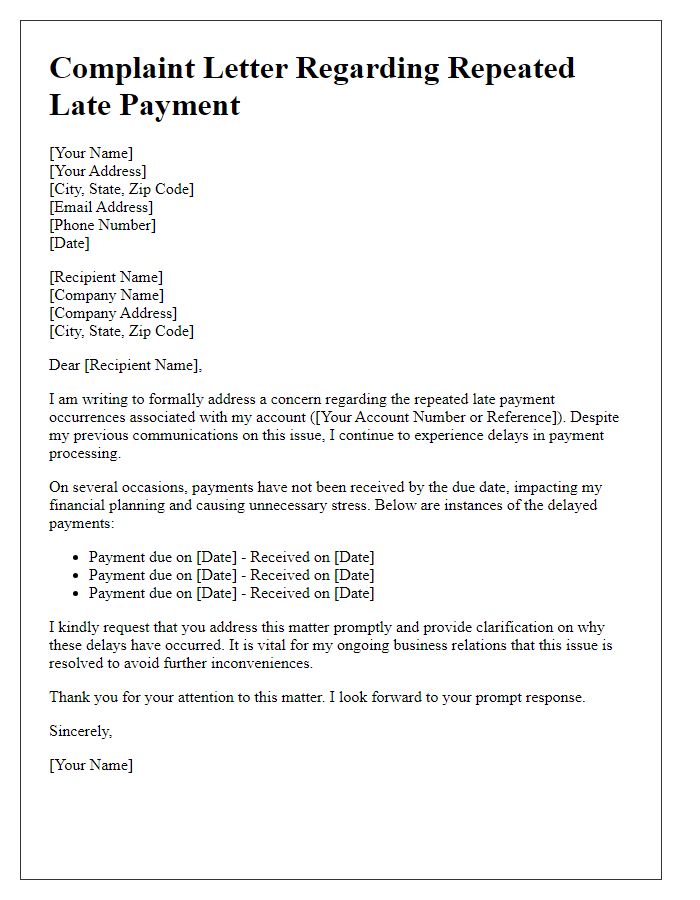

Letter template of complaint addressing failure to meet payment deadlines.

Comments