Are you tired of running out of personal checks at the most inconvenient times? Reordering checks can feel like a hassle, but it doesn't have to be! In just a few simple steps, you can ensure your banking needs are met without the stress. Keep reading to discover the easy way to reorder your checks and get back to managing your finances with ease!

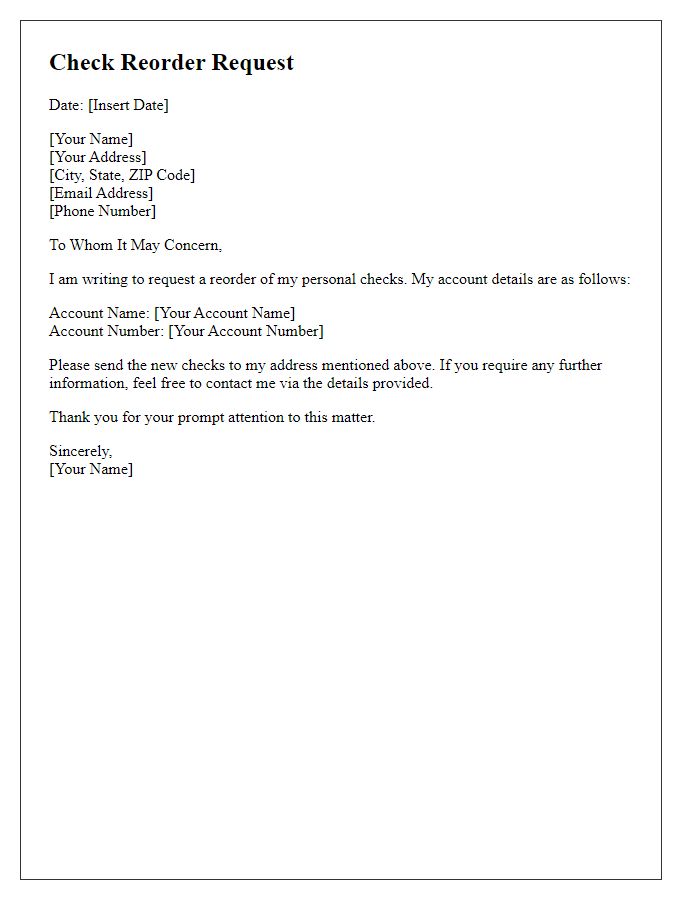

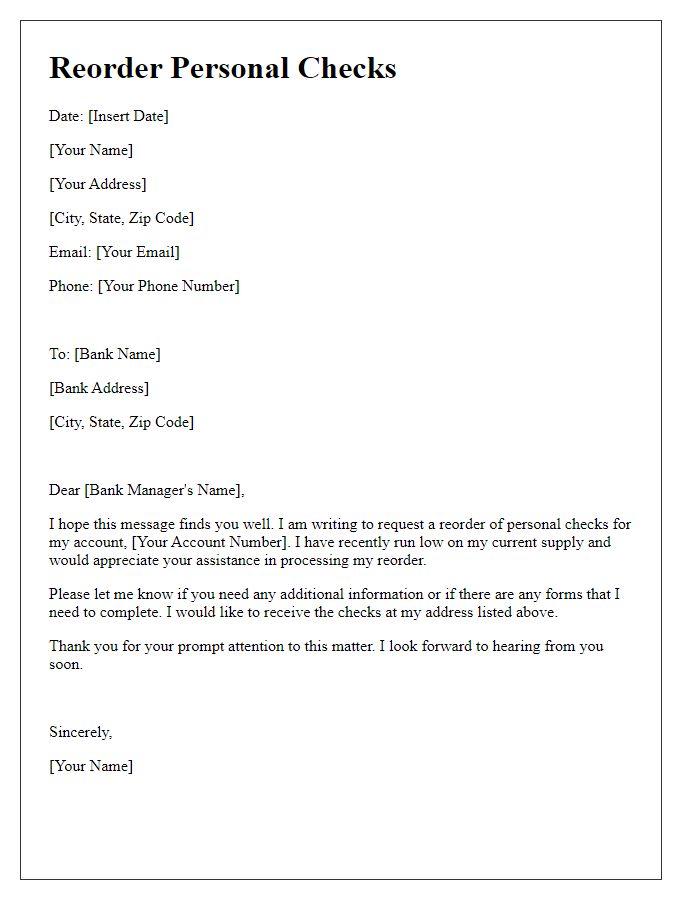

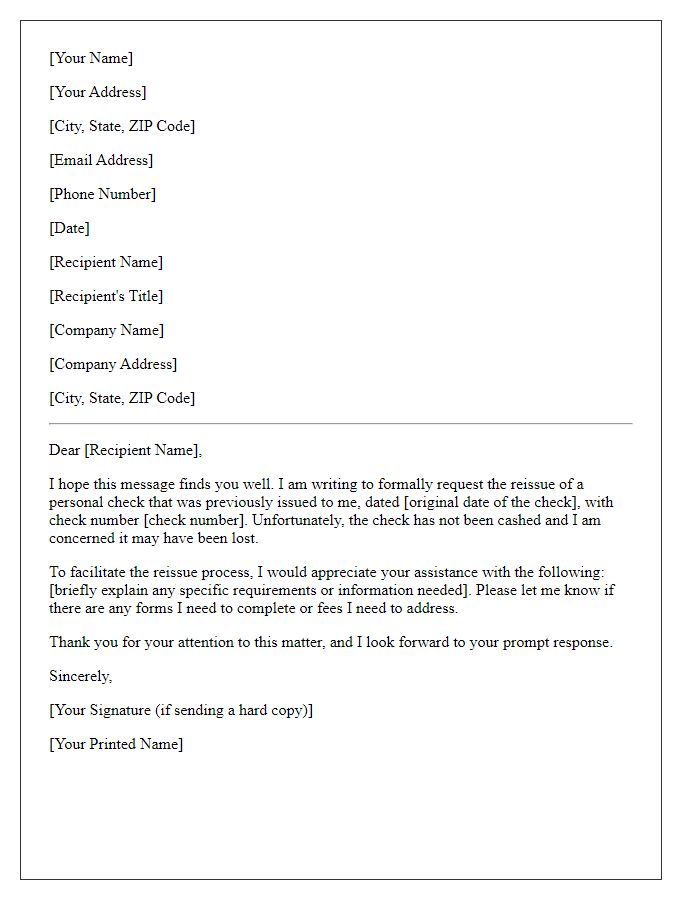

Bank account information

Reordering personal checks requires specific bank account information for processing, such as the account number (typically a unique identifier consisting of digits, often eight to twelve digits long) and routing number (a nine-digit code that identifies the bank branch). Additionally, personal details including the account holder's name (as it appears on the account) and address (typically includes city, state, and zip code) are necessary for personalization. When requesting a reorder, mentioning the check design (such as floral or abstract patterns) and the quantity needed (often in increments of 100) can also streamline the process with the bank's customer service.

Check design preference

When reordering personal checks, various designs such as floral, scenic landscapes, or modern graphics may be available. A preferred style could be the classic check design, characterized by navy blue accents and a simple layout, providing a professional appearance. Checking options for security features is crucial; such as watermarks or microprinting, which enhance protection against fraud. Specify the quantity needed, often in bundles of 100, and ensure that the bank account information includes correct routing (ABA) and account numbers for accuracy. Review delivery timeframes, which may vary from 7 to 14 business days, as efficient processing ensures timely access to payment methods.

Quantity of checks required

Submitting a personal check reorder allows individuals to replenish their supply of checks, essential for various transactions. A typical order may require a specific quantity, often ranging from 50 to 250 checks, depending on personal usage. It's crucial to specify details such as the preferred design (e.g., floral patterns, classic blue, or professional styles) to reflect personal taste. Additionally, including information such as the account number and bank name (like Bank of America or Wells Fargo) ensures accurate processing of the reorder request. Timely reordering helps avoid running out during important payment periods, ensuring seamless financial management.

Delivery address

Reordering personal checks involves an organized process ensuring that the correct details are submitted. When placing an order with a check printing company, use a reliable delivery address to ensure timely arrival of the checks. Include the street name, apartment or suite number (if applicable), city, state, and zip code to prevent any delivery issues. Double-check the address for accuracy to avoid delays. Some companies may also allow the inclusion of specific instructions for handling or delivery preferences. Always seek secure storage for personal checks to protect against theft or fraud after delivery.

Contact information

To reorder personal checks, customers must provide essential contact information. This typically includes the full name of the account holder, mailing address (including street, city, state, and ZIP code), phone number for verification, and email address for order confirmation. It's crucial to specify the bank name associated with the account and the account number linked to the checks being reordered. Customers may also need to mention specific design features or quantities needed, as well as any special instructions pertinent to the reorder process.

Comments