Are you considering making a withdrawal from your investment account? Understanding the process can be daunting, but we're here to help simplify it for you. In this article, we'll guide you through the essential steps and key considerations to ensure your withdrawal goes smoothly. So, grab a cup of coffee and let's dive into the details together!

Account Identification

To initiate an investment account withdrawal successfully, it's essential to include specific account identification details. This includes the account holder's full name, account number (typically a unique alphanumeric code assigned by the financial institution), and any associated brokerage firm name to ensure accurate processing. Also, consider including the date of the request to avoid any confusion regarding the timeline. Providing complete contact details, such as phone number and email address, enhances communication throughout the withdrawal process, ensuring that any potential issues or confirmations can be addressed promptly.

Withdrawal Amount

To initiate an investment account withdrawal effectively, include critical details such as the specific 'Withdrawal Amount,' which represents the sum of money intended to be withdrawn from the investment account, typically noted in the currency of the account, like USD. Clearly state the account number associated with the investment, ensuring reference for accurate processing. Specify the method of withdrawal preferred, such as bank transfer or check, recognizing the financial service providers often have defined protocols for each method. Include identification details, such as the account holder's full name and contact information, which are vital for verification purposes. Timely submission is essential, as processing can vary, with some financial institutions indicating a timeline of 3 to 5 business days for withdrawals.

Reason for Withdrawal

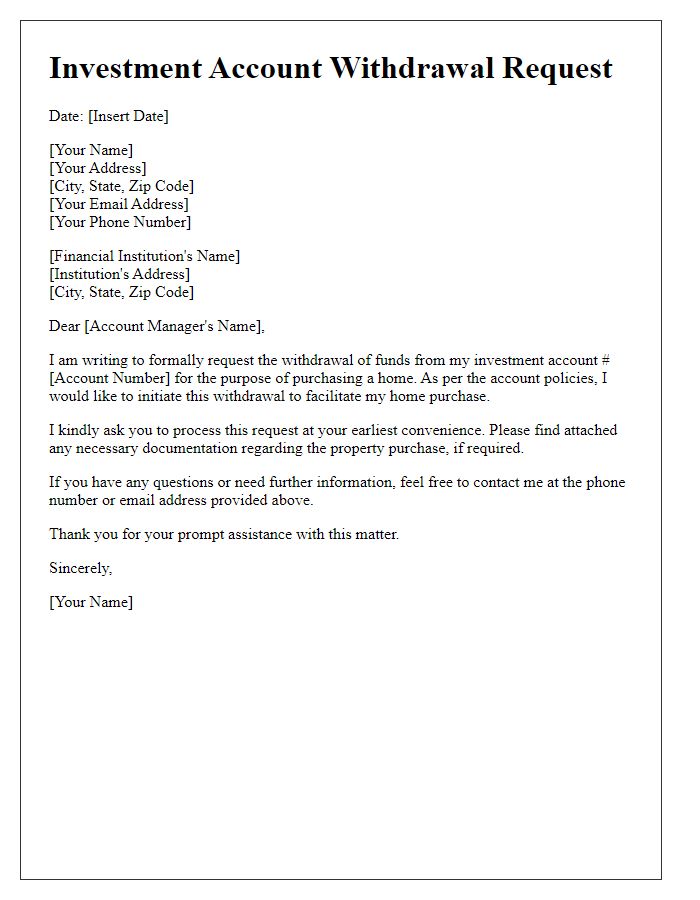

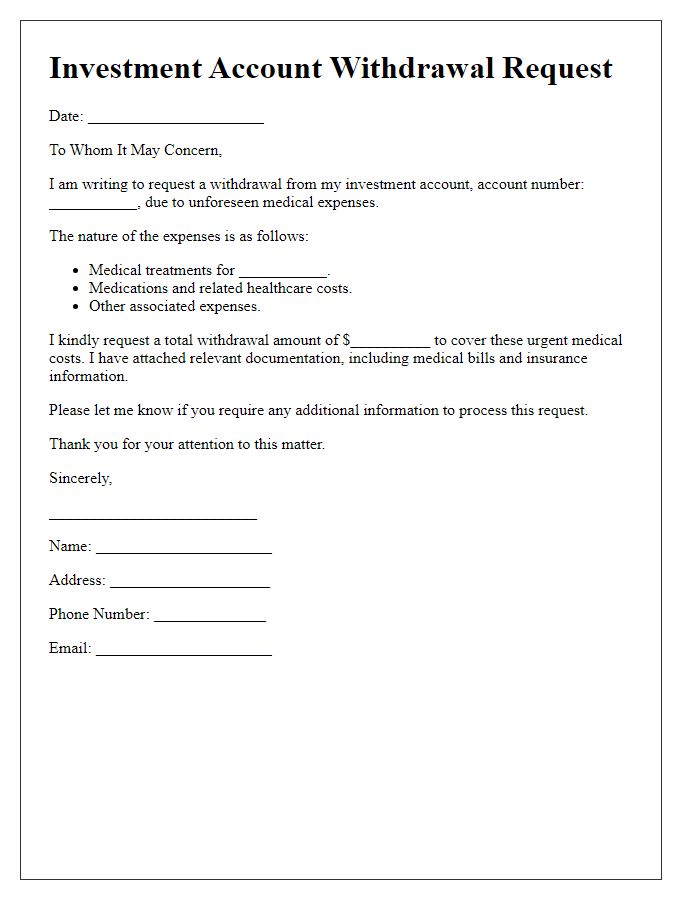

Investment account withdrawals often stem from various personal or financial circumstances. Some common reasons include unexpected medical expenses, significant life events like marriage or buying a home, or needing to rebalance a portfolio following market fluctuations. Individuals may also withdraw funds to reinvest in more profitable assets or to cover personal obligations during economic downturns. Crafting a clear explanation for the reason behind a withdrawal can streamline the process, ensuring compliance with financial regulations and addressing any potential concerns the financial institution may have regarding the transaction.

Contact Information

To initiate the withdrawal process from an investment account, provide accurate contact information. Ensure your full name, which matches account documentation, appears prominently. Include a phone number, preferably a direct line for immediate communication, along with a current email address for digital correspondence. Define your residential address (street name, city, state, and zip code) to verify identity and facilitate any necessary mailing of documents. Inclusion of these key elements streamlines the withdrawal process, maintaining clear and efficient communication with the financial institution.

Signature and Date

Due to the nature of your request regarding a letter template for investment account withdrawal, please note that the response will not include a letter format. The investment account withdrawal process typically requires specific details. This includes account number (a unique identifier for your investment account), withdrawal amount (the specific sum of money to be withdrawn), and a signature (authorizing the transaction as a legal requirement). The date (the day of the request) is also crucial to ensure timely processing. Compliance with brokerage or financial institution guidelines is essential to facilitate the transaction smoothly.

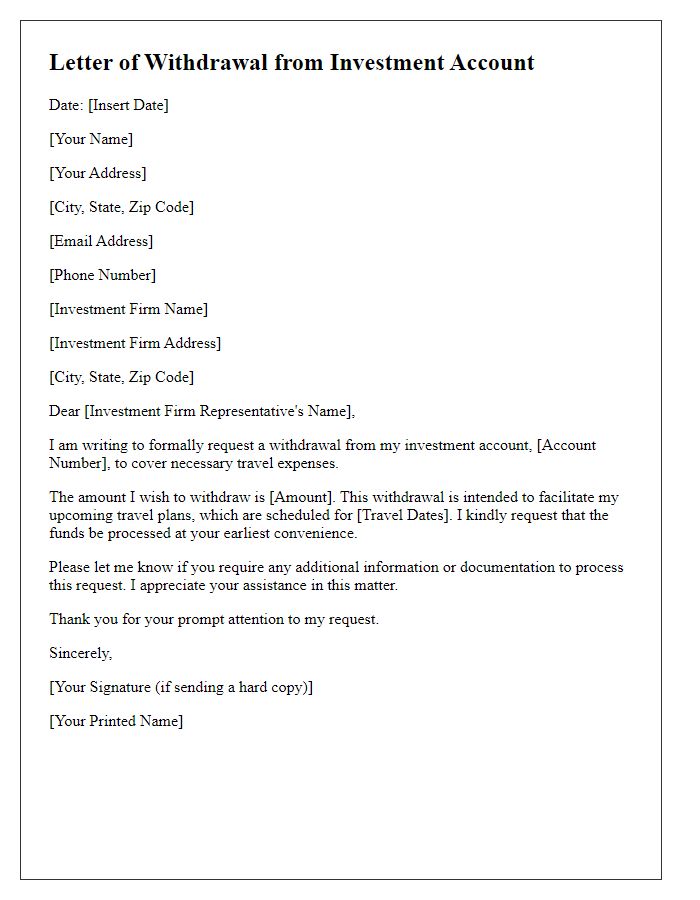

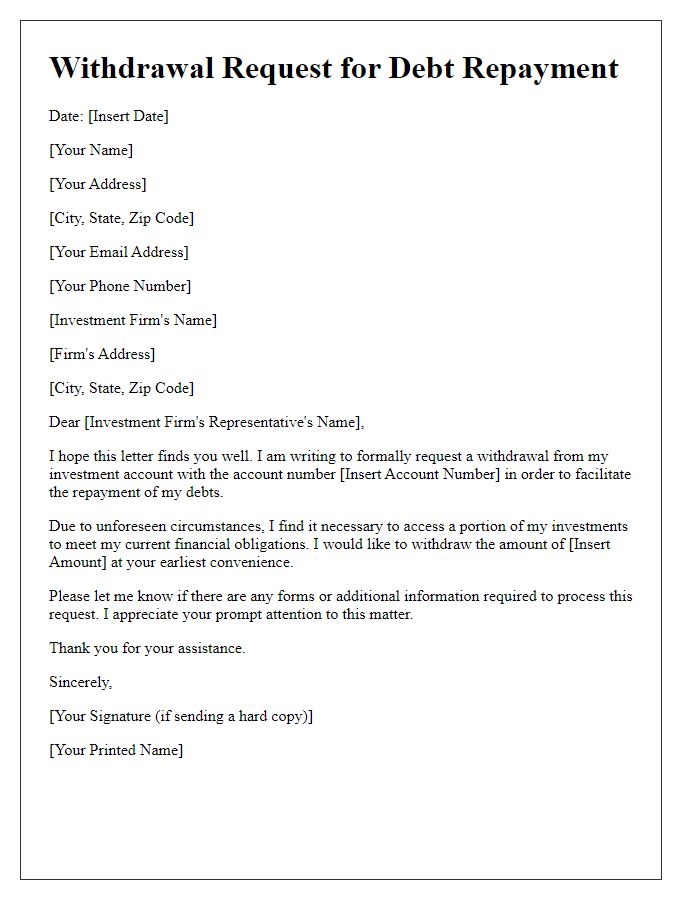

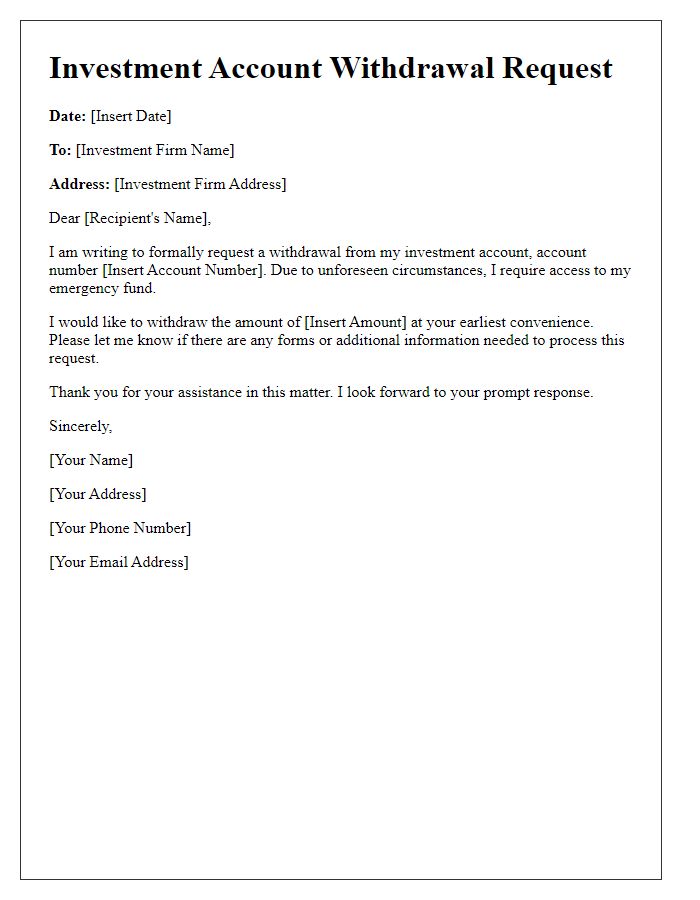

Letter Template For Investment Account Withdrawal Samples

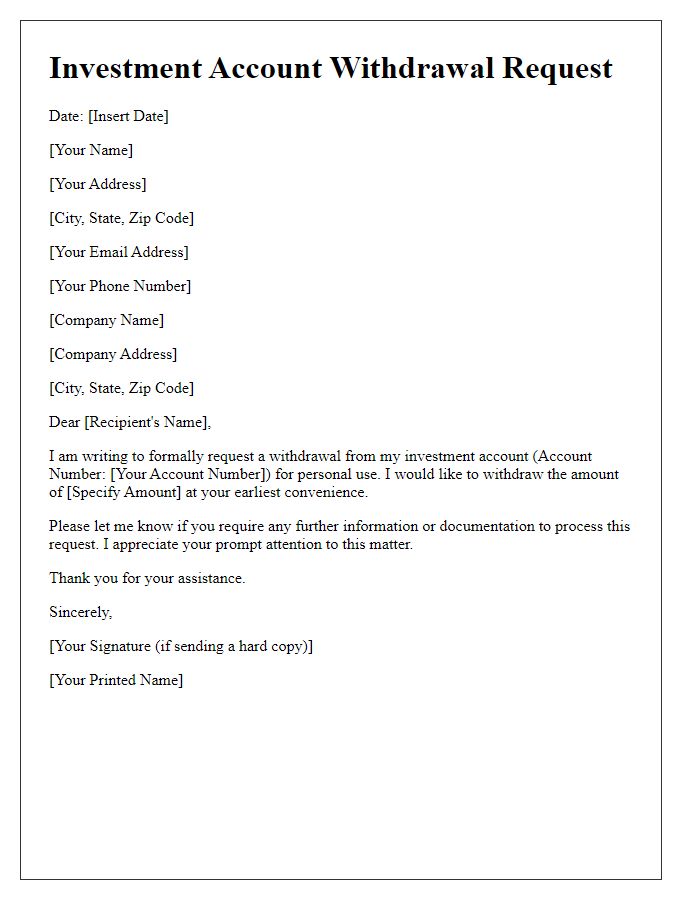

Letter template of investment account withdrawal request for personal use

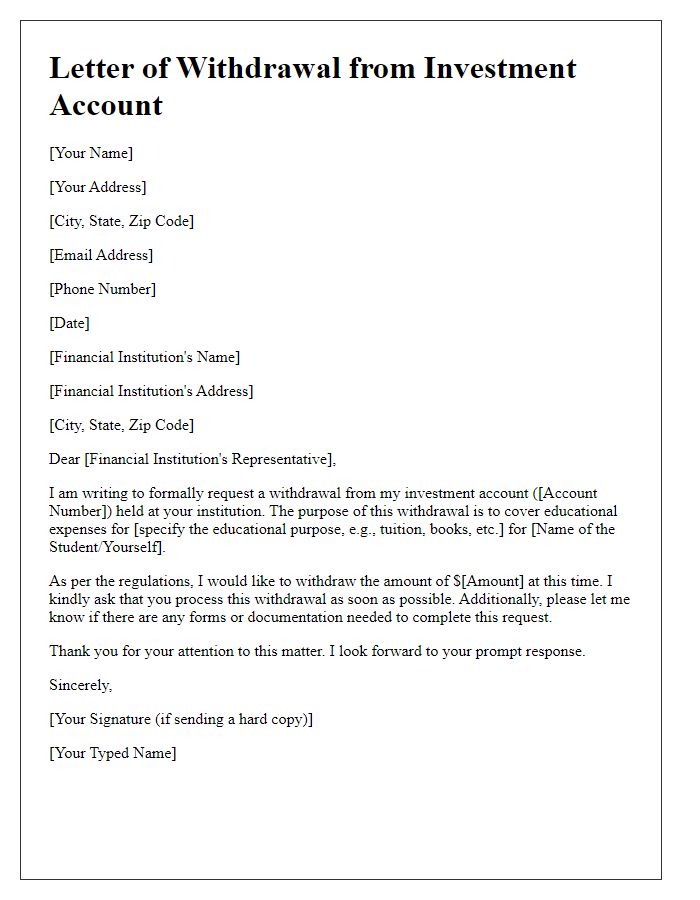

Letter template of investment account withdrawal for educational expenses

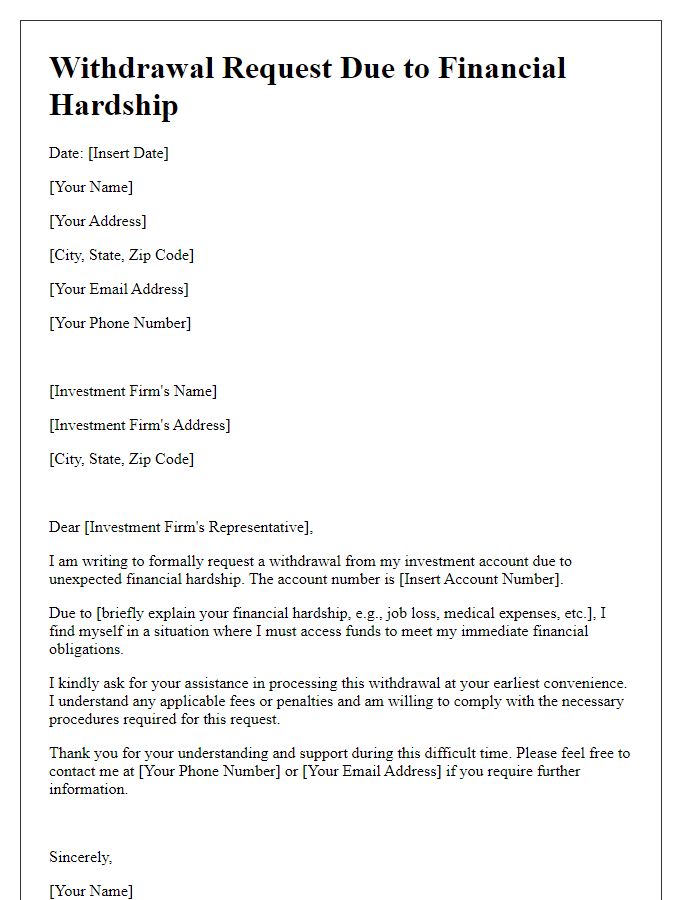

Letter template of investment account withdrawal due to financial hardship

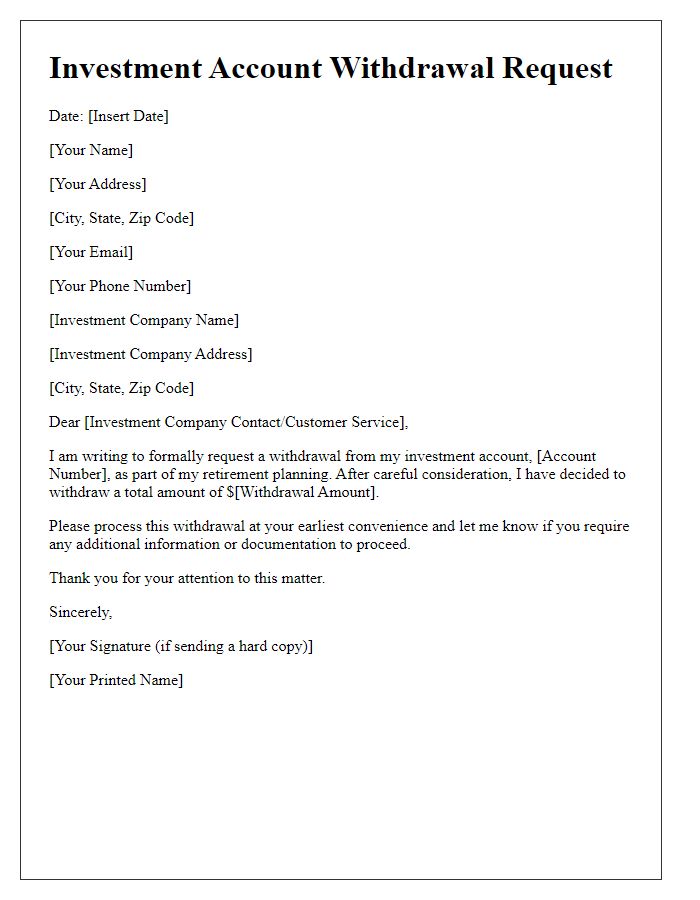

Letter template of investment account withdrawal for retirement planning

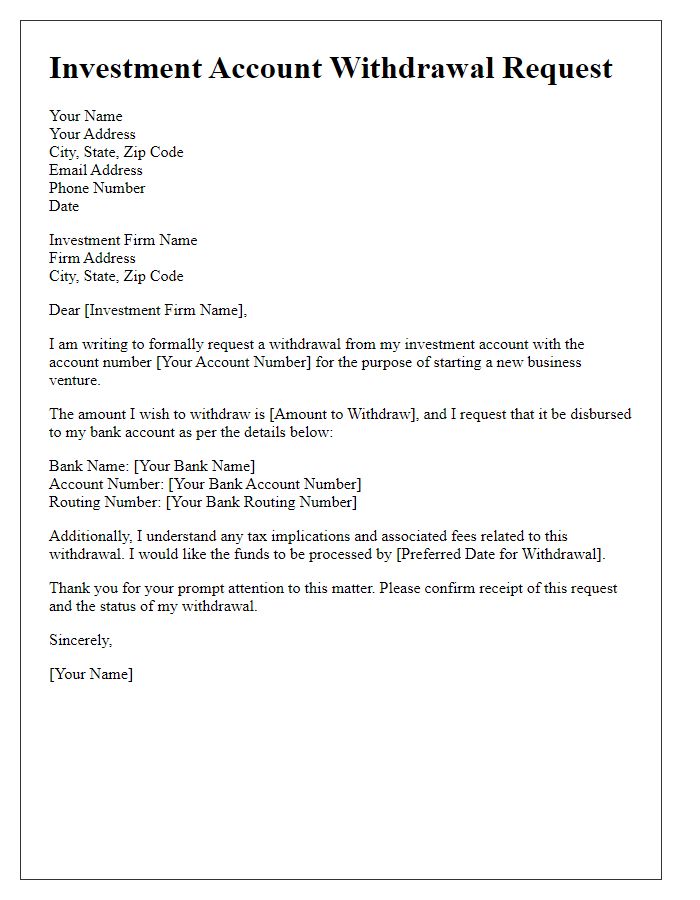

Letter template of investment account withdrawal for starting a business

Comments