Navigating unexpected financial challenges can feel overwhelming, but with the right strategies in place, you can regain control and find a way forward. In this article, we'll explore practical tips for managing sudden expenses and maintaining your financial well-being. From creating an emergency budget to accessing community resources, there are numerous ways to tackle these curveballs. So, let's dive in and discover how to better prepare for the unexpected!

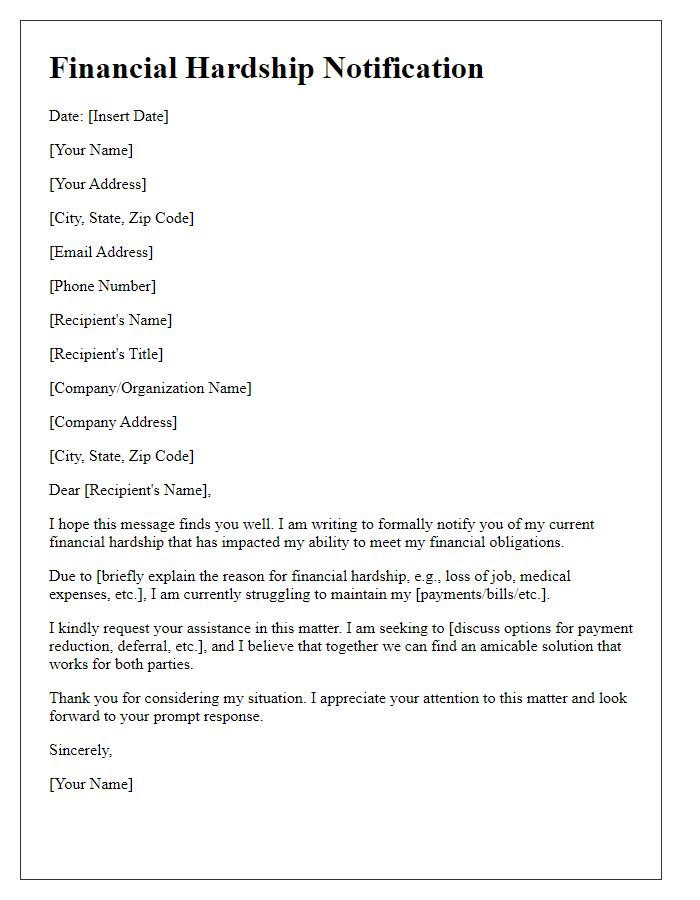

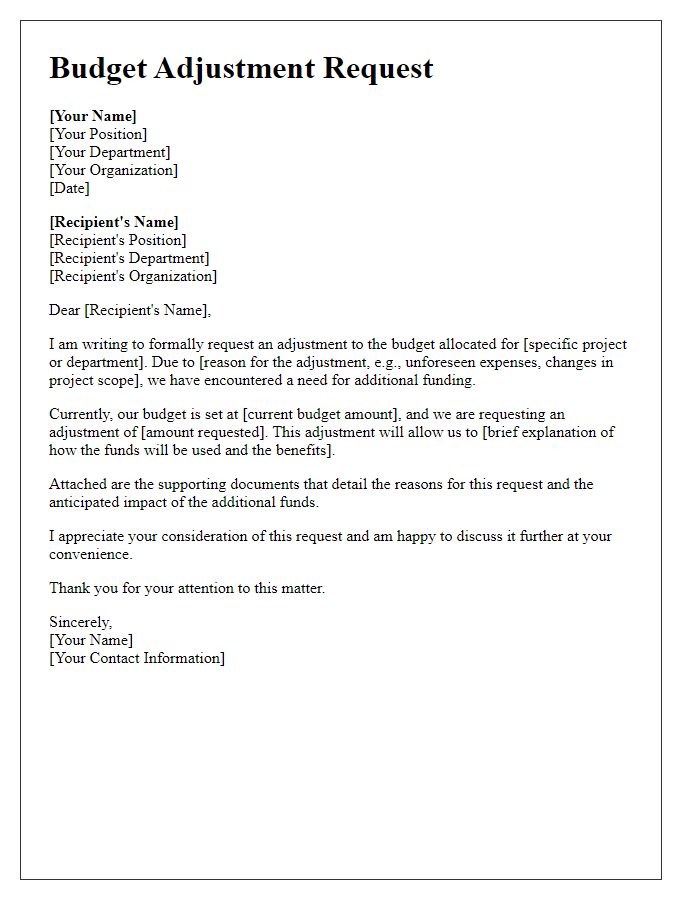

Clear communication

Effective communication during financial unexpectedness involves clear articulation of issues, options, and potential impact. Financial statements, such as budget reports from the previous quarter, must be analyzed thoroughly, showing discrepancies or sudden expenses defined as "unexpected costs," including medical emergencies or natural disasters. Stakeholders, including employees, investors, or creditors, require transparent updates regarding cash flow challenges, emphasizing the projected timeline for resolution. Financial forecasts, detailing projected income and expenses over the next few months, enhance understanding. Articulate a proactive approach, outlining contingency plans like budget cuts or temporary financing solutions, ensuring all parties remain informed and engaged throughout the process.

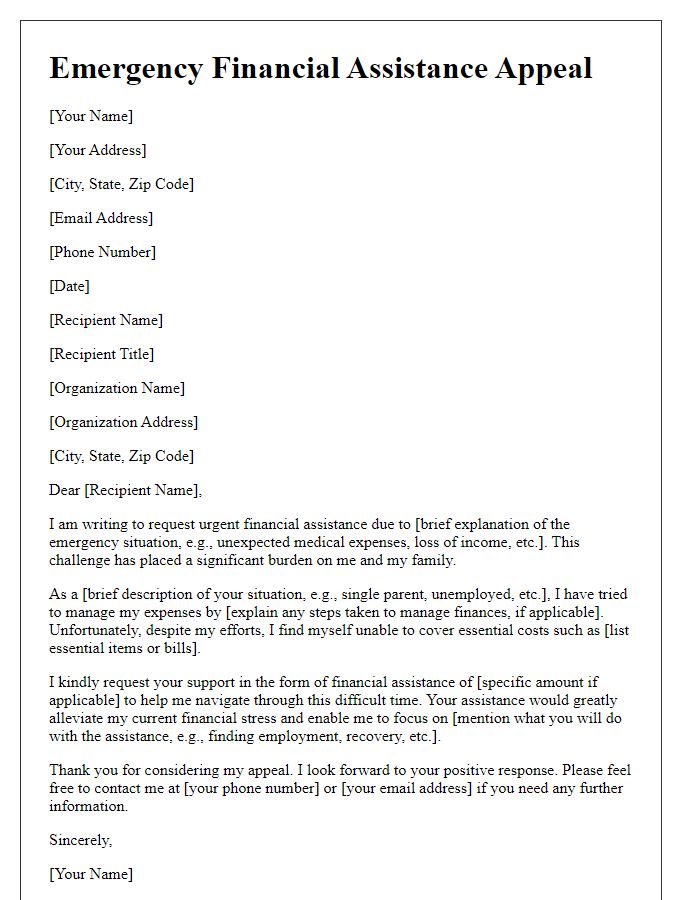

Empathy and understanding

Unexpected financial challenges can significantly affect individuals and families, often causing stress and uncertainty. Many households faced unforeseen expenses, such as medical emergencies, job loss, or property damage, which can disrupt monthly budgets and savings plans. While these occurrences are not uncommon--a study by the Federal Reserve in 2021 revealed that nearly 40% of American adults cannot cover a $400 emergency expense without borrowing--it's crucial to approach such situations with empathy and understanding. Financial institutions and support services offer resources, such as flexible payment plans or emergency loans, to help navigate these tough times, fostering a sense of community and support during difficult financial periods. Programs designed to provide counseling and financial education can also empower those affected, enabling them to develop coping strategies and long-term financial resilience.

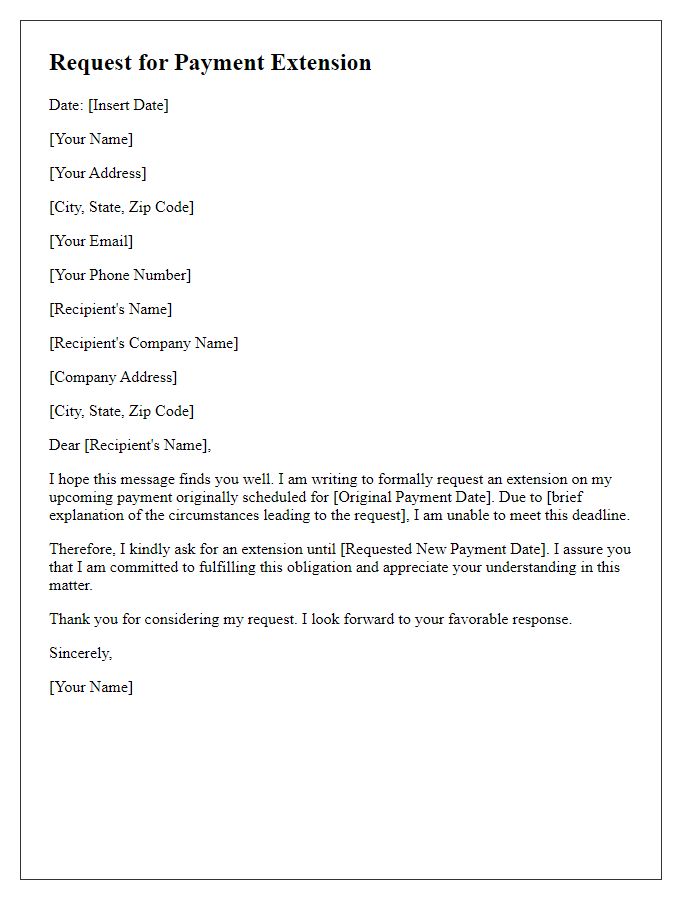

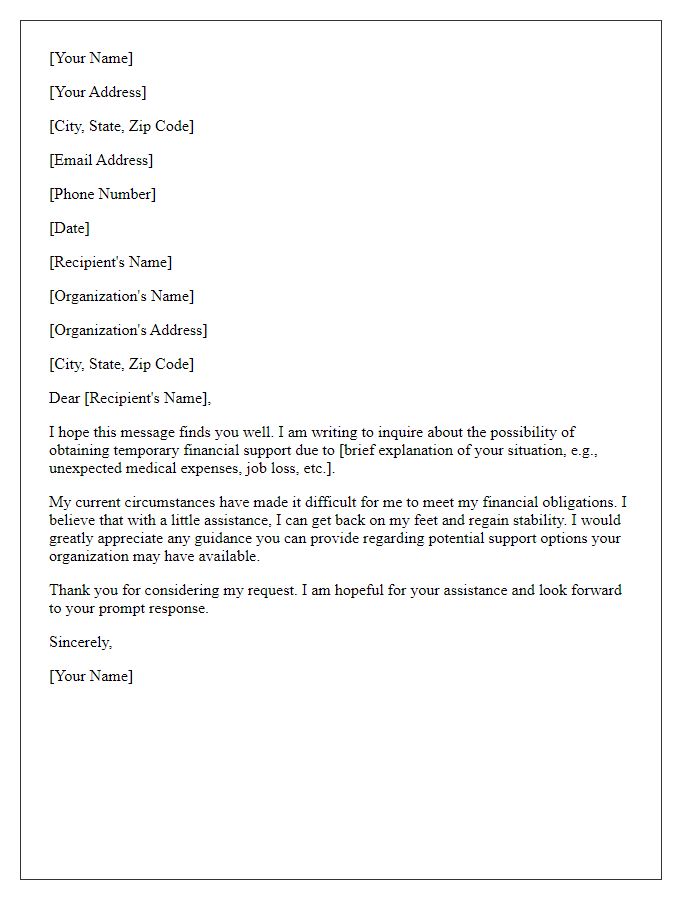

Transparent financial status

Maintaining a transparent financial status is crucial for businesses navigating unexpected financial challenges. Regularly updating stakeholders with clear insights into cash flow fluctuations, expense management, and revenue streams fosters trust and collaboration. For instance, during a financial crisis, an organization might report a sudden decline in revenue by 30% due to a significant global event, such as the COVID-19 pandemic. Additionally, detailing specific budget adjustments, like a 15% reduction in operational costs or prioritizing essential expenditures over non-essentials, can highlight proactive approaches to maintaining fiscal health. This openness helps in aligning team efforts towards strategic financial recovery and reinforces a culture of accountability.

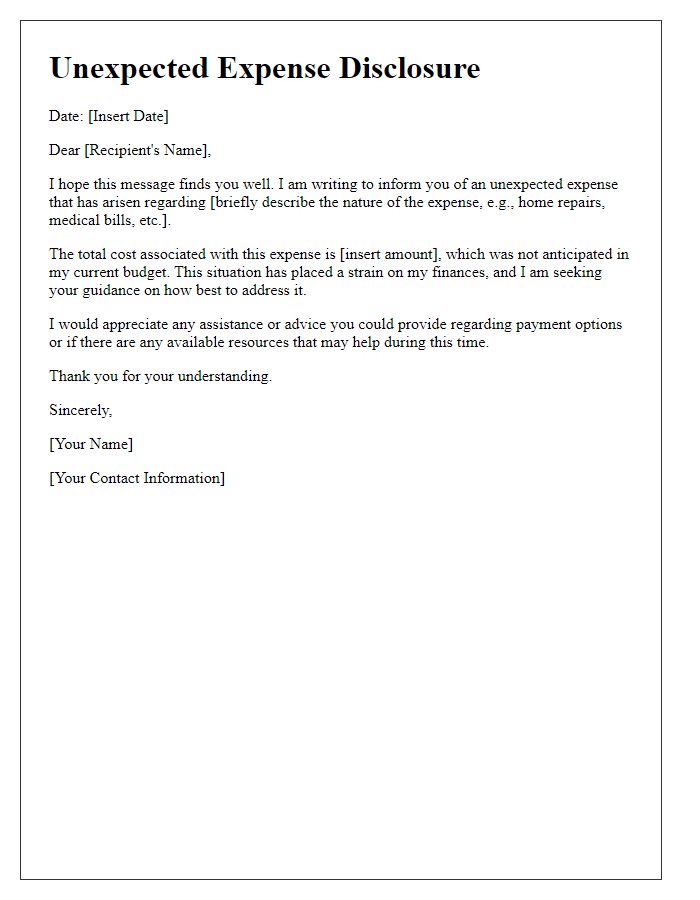

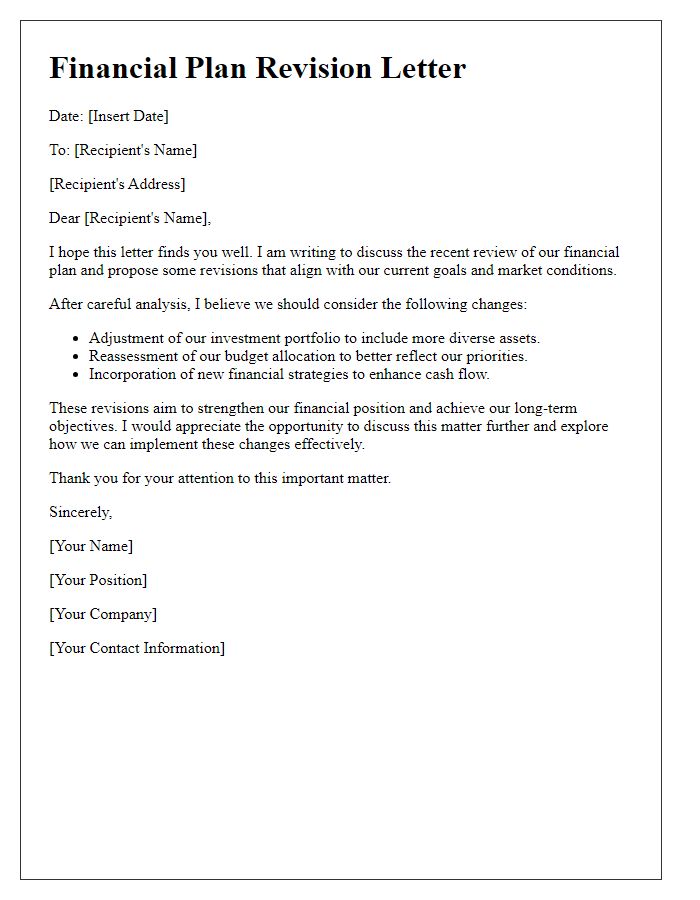

Proposed solution or action plan

Unexpected financial challenges can arise unexpectedly, such as sudden medical expenses or job loss, impacting personal budgeting and financial stability. Implementing a comprehensive action plan is crucial for navigating these difficulties. Creating an emergency budget involves reassessing monthly expenses, identifying non-essential expenditures, and reallocating funds to necessities like housing and food. Establishing an emergency savings fund (aiming for three to six months of living expenses) can provide a financial cushion against future uncertainties. Seeking additional income sources, such as part-time work or freelance opportunities, can help alleviate strain. Additionally, exploring community resources, including food banks and financial counseling services, offers practical support. Overall, proactive financial planning and resourcefulness play critical roles in successfully managing financial unexpectedness.

Invitation for feedback or collaboration

Unexpected financial challenges can significantly impact small businesses, especially during economic downturns like the one experienced globally in 2020. Budget discrepancies (surpassing 20% of projected expenses) may force companies to reevaluate operational costs. Seeking collaboration with financial advisors or accountants can provide new perspectives on managing cash flow and developing contingency plans. Moreover, conducting surveys or focus groups with team members can yield valuable insights into potential cost-saving measures. Open channels for feedback allow for collective problem-solving, fostering a resilient organizational culture. Engaging stakeholders increases adaptability, enhancing recovery strategies in uncertain financial environments.

Comments