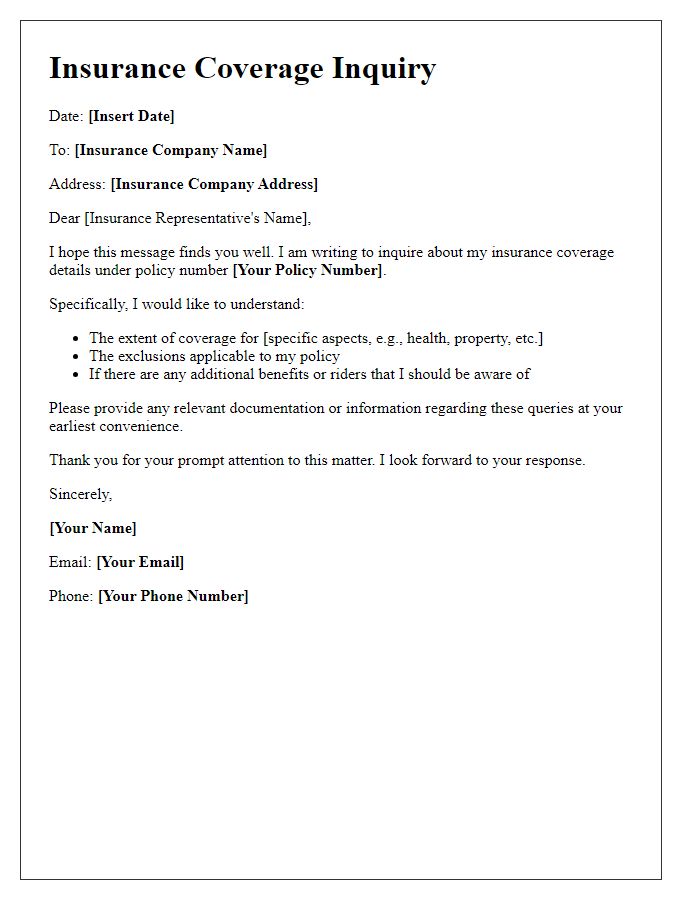

Are you curious about whether your insurance coverage is truly protecting what matters most to you? Reviewing your insurance policy can uncover gaps and make sure you're not overpaying for coverage you might not need. This is an essential step to ensure that you have the right protection as your life changes over time. Let's dive deeper into the importance of a coverage review and how to make the most of it!

Policy Details

Insurance coverage reviews provide essential insights into the specifics of your policy, such as coverage limits, deductibles, and exclusions. For instance, a typical homeowner's insurance policy may cover dwelling protection, usually valued at $300,000, personal property coverage up to $150,000, and liability protection, often set at $100,000. Understanding events like natural disasters (earthquakes, floods) and their potential impact on coverage can aid in assessing your risk. Additionally, knowing the renewal date of your policy, such as annually on January 1st, can help ensure regular assessments. Contacting your insurance agent in cities like New York or Los Angeles may provide more personalized information based on local laws and regulations.

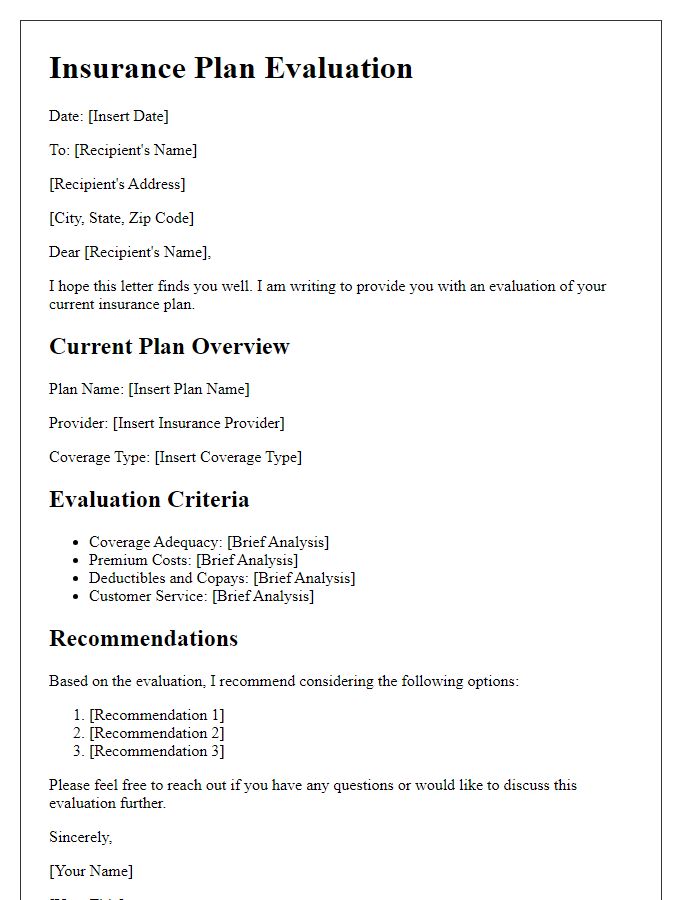

Coverage Limits

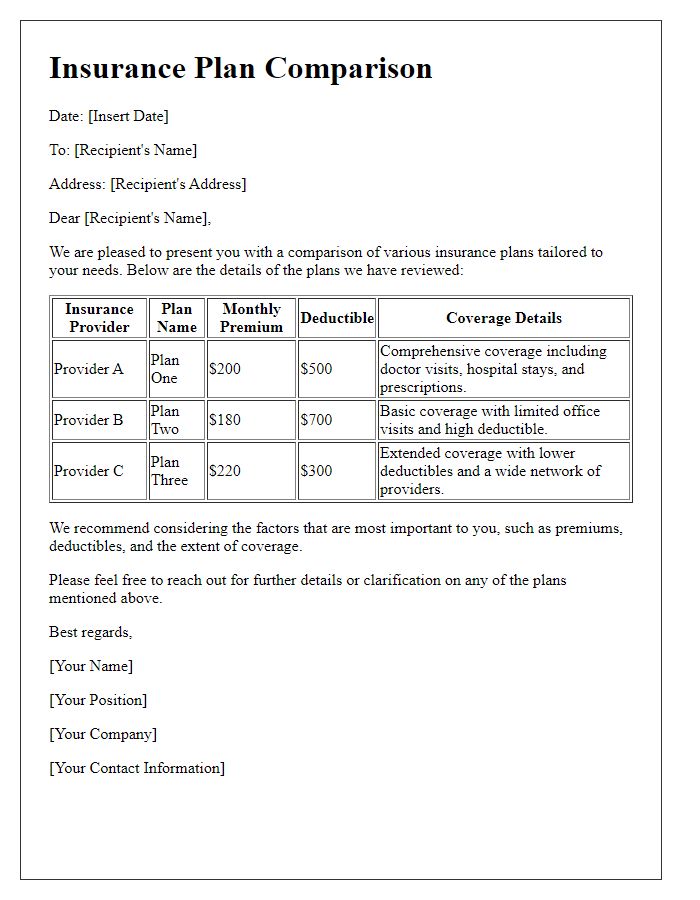

Insurance coverage limits define the maximum amount an insurer may pay for a covered loss, typically outlined in a policy document. For instance, homeowners insurance policies may have coverage limits for dwelling protection, personal property, and liability coverage, often ranging from $100,000 to several million dollars, depending on the policyholder's needs and the property's value. Auto insurance policies generally specify coverage limits for bodily injury and property damage liability, often structured as a split limit, such as 100/300/50, indicating $100,000 for individual bodily injury, $300,000 for total bodily injury per accident, and $50,000 for property damage. Regular reviews of these coverage limits are essential, especially after significant lifestyle changes, renovations, or purchasing new assets, ensuring adequate protection against potential financial exposure in cases of accidents, damages, or losses. Proper assessment of personal risks and assets can help tailor coverage limits that align with individual circumstances, providing peace of mind and financial security.

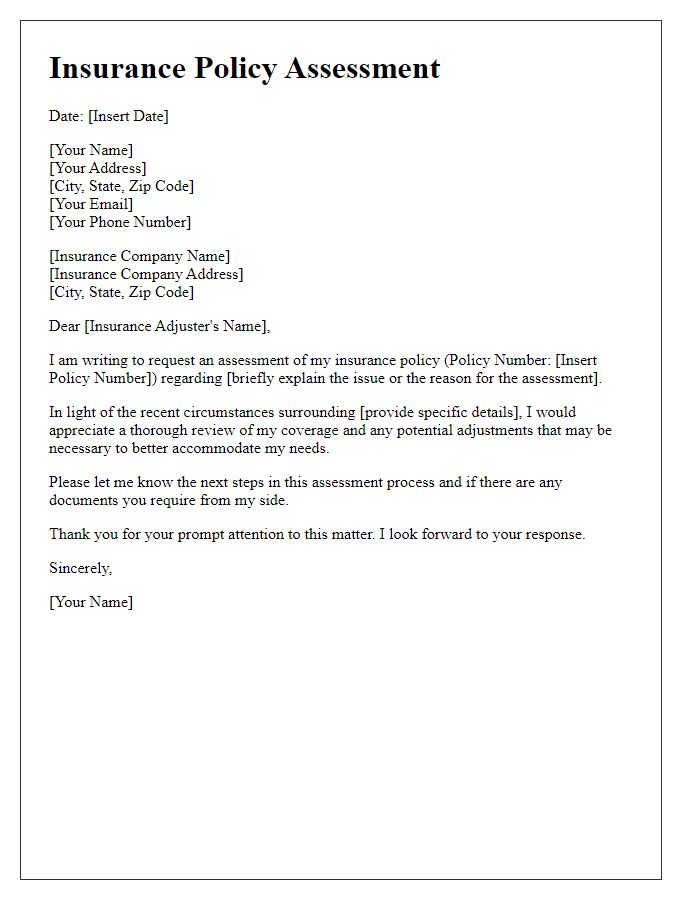

Claim History

Insurance coverage reviews often require thorough examination of claim histories, particularly for property insurance policies like homeowners or renters insurance. Claim history documents incidents such as fire damage, water leaks, theft occurrences, or liability claims. These records highlight the number of claims filed, dates of events, monetary payouts, and reasons for claims denials. Analyzing this history can reveal patterns indicating risk levels that could influence policy renewals and premium adjustments. Insurance companies may also consider factors such as state regulations and individual claims made by policyholders, ensuring they comply with guidelines for fair underwriting practices. This analysis becomes pivotal during coverage adjustments to facilitate understanding of policy efficacy and eligibility for potential discounts or additional coverage options.

Exclusions and Conditions

Insurance coverage reviews often highlight critical exclusions and conditions defined in policy documents. Common exclusions can include natural disasters like floods, earthquakes, or acts of terrorism, which are often not covered under standard policies. Conditions like deductibles specify the amount required to be paid out-of-pocket before coverage applies, potentially reaching thousands of dollars depending on the selected plan. Additionally, pre-existing conditions or specific high-risk activities, such as skydiving or rock climbing, may result in reduced coverage options or complete exclusions. Understanding these intricacies, including the insurer's claims process and time limits, is essential for policyholders wishing to navigate their insurance protections effectively.

Renewal Terms and Adjustments

Insurance coverage reviews, particularly during renewal periods, can highlight important adjustments that impact coverage options and premium costs. Detailed assessments of current policies, including liability limits, deductibles, and specific endorsements, should be conducted to ensure adequate protection against potential risks. For instance, changes in property values (such as a home's market value since the last assessment) or modified health conditions (affecting life or health insurance premiums) can prompt necessary revisions in coverage. Notably, specific events like natural disasters (such as hurricanes or floods) in designated risk zones may also lead to altered insurance needs, reflecting the importance of staying informed about local changes to underwriting criteria and state regulations. Regular reviews not only enhance understanding of insurance needs but also provide an opportunity to negotiate terms and secure optimal protection for assets and personal well-being.

Comments