We understand that staying informed about your account is crucial for effective planning and decision-making. That's why we're excited to share our latest updates that can enhance your experience with us. With these changes, we aim to provide you with more transparency and improved services tailored to your needs. Join us as we delve into the details; read more to discover how these updates can benefit you!

Personalization

Personalizing client account updates enhances engagement and strengthens the client relationship. Tailored communication should include specific account details like transaction history, balance summaries, and notifications about changes in services or fees relevant to the client's interests. For example, recent updates on investment portfolios for clients with financial accounts can highlight performance metrics versus market trends, providing valuable insights. Incorporating the client's name, preferred communication channels such as email or phone, and geographically relevant information like local branch events can create a more personalized experience. Utilizing advanced segmentation tools allows for targeted messages, ensuring each client receives information that resonates with their unique needs and preferences.

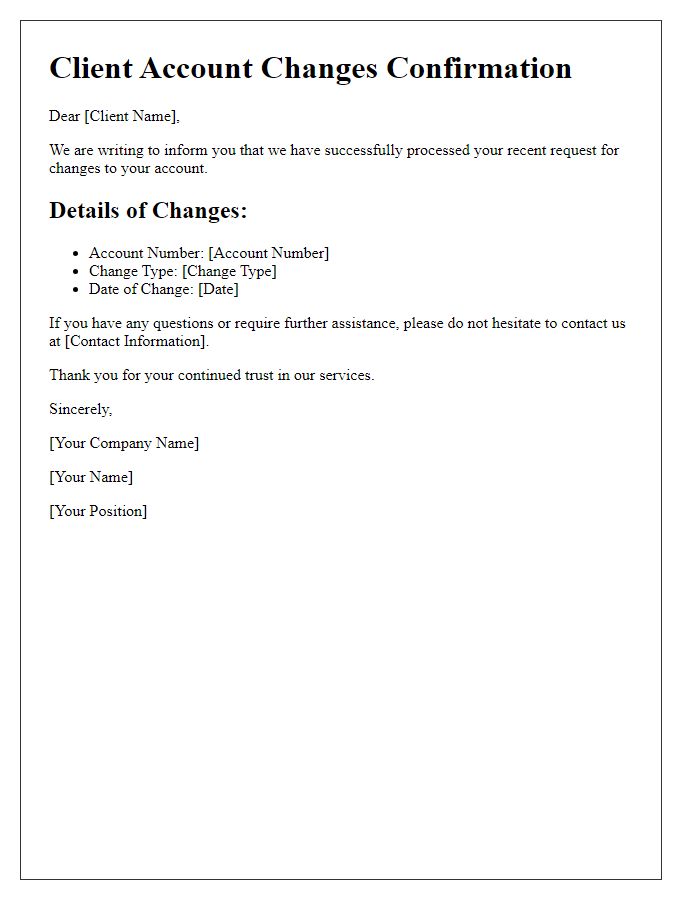

Clear subject line

Client account updates require precise communication to ensure clarity and efficiency. Subject lines like "Important: Update on Your Account Status" help convey urgency and relevance. Regular account updates may include critical changes such as account balances (e.g., $5,000), transaction history (last 30 days), and any outstanding fees (e.g., $25 late fee). Additionally, notifying clients about policy changes (e.g., new terms effective January 1, 2024) or upcoming deadlines (e.g., payment due by December 15, 2023) can enhance transparency. Including personalized greetings in client communications can foster a sense of connection and professionalism.

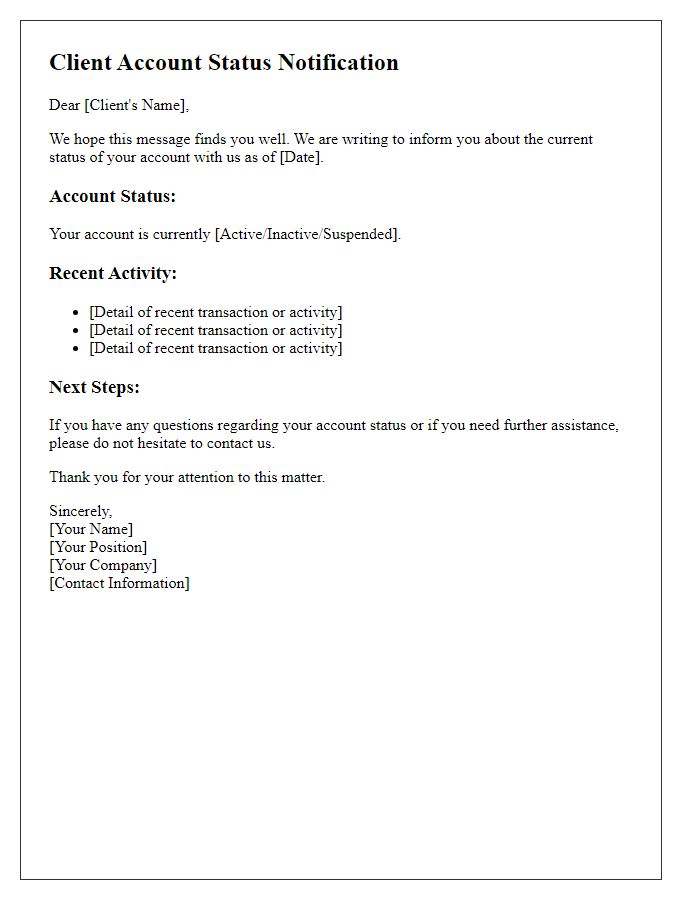

Key account information

Client account updates provide essential insights into account performance, such as transaction history, engagement metrics, and balance details. Key account information, including the client's name, account number, and contact information, ensures clear communication. Additionally, highlighting significant changes, like recent purchases, service modifications, or billing updates, keeps clients informed. Maintaining up-to-date records of account status, such as outstanding payments or credits, enhances transparency and trust. In specific industries, like financial services or retail, thorough documentation of these elements supports effective relationship management and fosters customer satisfaction. Regular updates play a crucial role in keeping clients engaged and aware of their account's health.

Contact details for assistance

Client account updates provide vital information regarding account changes and important actions. Customers should note accurate contact details for assistance, including email (support@company.com) and phone number (1-800-555-0199). These channels ensure timely communication for resolving issues or answering inquiries. Customer Relationship Management (CRM) systems often streamline this process, making it easier to track interactions. Additionally, digital platforms provide resources like frequently asked questions (FAQs) and chat support, enhancing customer service experiences. Keeping contact information updated is essential for efficient problem resolution and maintaining client satisfaction.

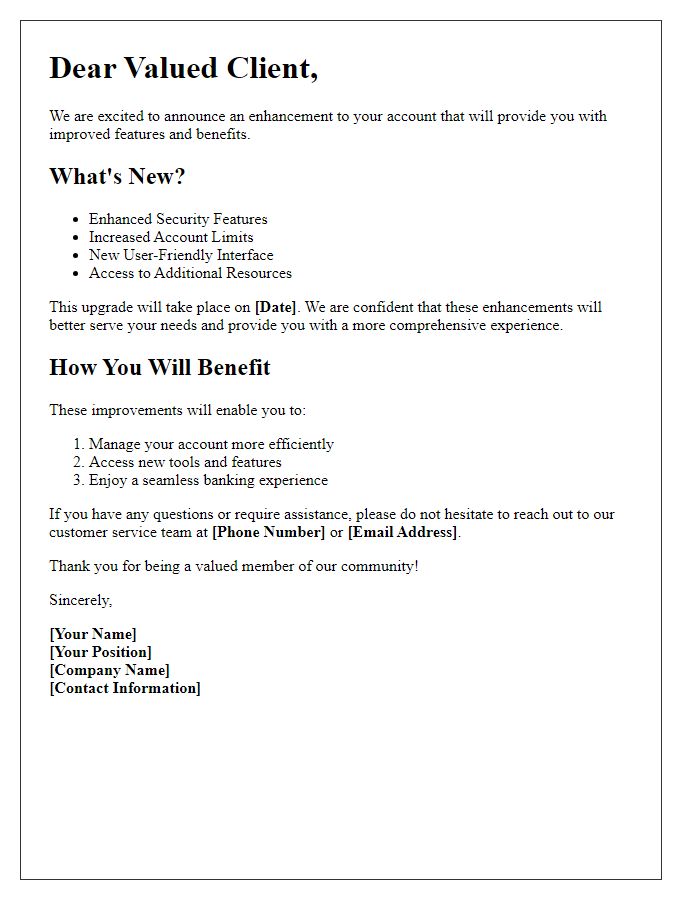

Call-to-action

Client account updates require clear communication to ensure transparency and engagement. Recent changes to account features may impact monthly billing statements and transaction limits. Clients may notice adjustments in available services, including new security protocols and enhanced user interfaces, aimed at improving overall experience. Personalized support options, such as dedicated account managers and 24/7 customer service hotlines, are now available for immediate assistance. Clients should review the update details on the official website by the end of the month to maximize benefits and ensure compliance with new policies. Immediate action on these updates will streamline future interactions and optimize account performance.

Comments