In today's fast-paced financial landscape, staying informed about your financial provisions is more crucial than ever. Whether you're adjusting your budget or exploring investment opportunities, understanding the nuances of your financial situation can lead to better decision-making. This article aims to break down the recent updates, providing clarity and actionable insights that can help you navigate your finances with confidence. So, let's dive in and explore what these changes mean for you!

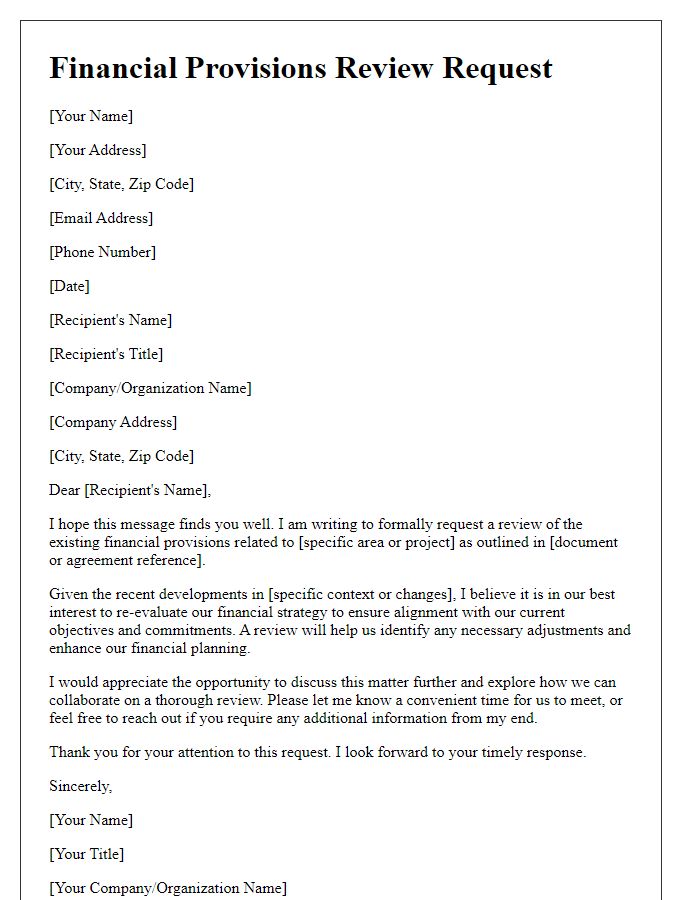

Clarity in communication

Clear communication regarding financial provisions updates is vital for stakeholder understanding. Detailed information about budget changes, revenue forecasts, and expense adjustments must be provided. Stakeholders, including investors (individuals or entities holding stock), employees (workers in an organization), and partners (collaborating businesses), require transparency. Specific metrics, such as projected profit margins (percentage of profit in relation to revenue) and cash flow (the net amount of cash being transferred in and out), should be highlighted. Regular updates, whether quarterly or annual reports, ensure all parties remain informed about the financial health of the organization and any strategic decisions that may impact future initiatives.

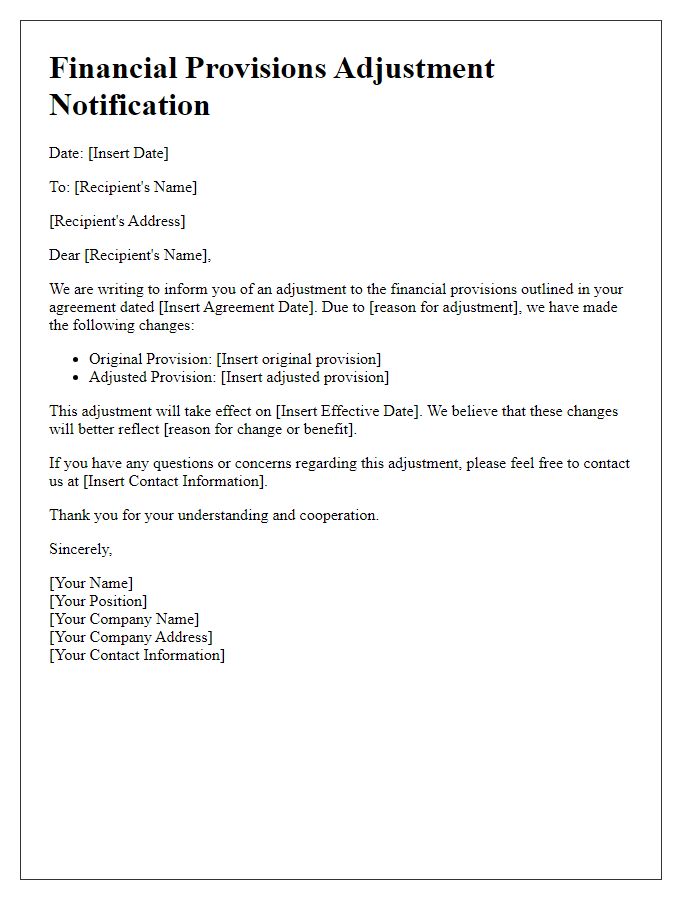

Accurate financial data

Accurate financial data is essential for organizations to make informed decisions regarding resource allocation, budgeting, and strategic planning. Detailed information such as quarterly revenue reports, annual expenditure summaries, and cash flow statements provides a clear snapshot of financial health. Specific metrics, including operating margins and return on investment percentages, enable stakeholders to assess performance against industry benchmarks. Additionally, comprehensive audits conducted by certified public accountants can uncover discrepancies or potential areas for improvement, ensuring compliance with financial regulations. This level of accuracy not only fosters transparency but also enhances trust among investors, employees, and regulatory bodies.

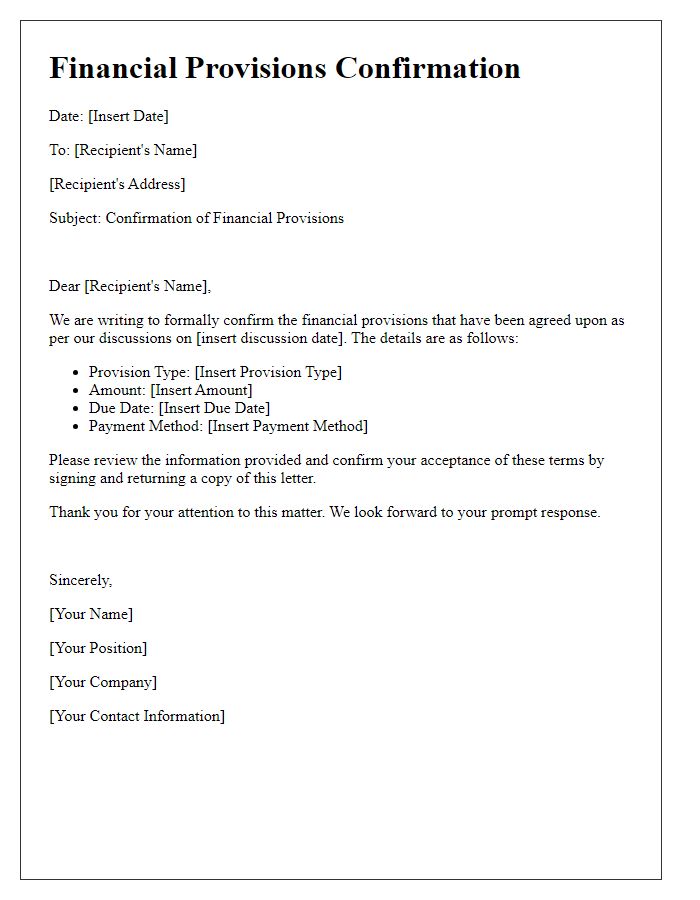

Updated budget forecasts

Updated budget forecasts indicate a significant shift in financial provisions for the fiscal year 2023-2024. The revised projections reflect an overall increase of 15% in expected revenue streams, driven primarily by a boom in e-commerce operations within major urban centers like New York City and Los Angeles. Expenditure plans have also been adjusted, with operational costs estimated to rise by approximately 10% due to inflationary pressures affecting essential supplies and labor costs. Departments such as marketing and research and development are poised to receive increased allocations, with a strategic focus on innovation and market expansion. Stakeholder meetings are scheduled for early November 2023 to review these adjustments and finalize the budgetary framework.

Compliance with regulations

Financial provisions updates are essential for maintaining compliance with regulatory frameworks, such as the International Financial Reporting Standards (IFRS) specific to various jurisdictions. Organizations must adhere to guidelines concerning provisions for potential liabilities, which include anticipated legal claims, employee benefits, and asset retirement obligations. For instance, the International Accounting Standards Board emphasizes the importance of accurately estimating and recognizing provisions to enhance transparency in financial reporting. Additionally, regulatory bodies like the Securities and Exchange Commission (SEC) monitor adherence to these financial provisions, ensuring companies provide investors with reliable and consistent information. Regular audits and reviews are necessary to verify compliance and update any estimates to reflect changes in regulations or business circumstances.

Stakeholder alignment

Incorporating collaborative stakeholder alignment is crucial for ensuring effective financial provisions within organizations. Stakeholder engagement (such as board members, investors, and department heads) plays a significant role in shaping financial strategies and decisions. Regular meetings (quarterly or biannually) allow for transparent communication, clarifying financial goals, resource allocation, and budget adjustments. Data analytics tools can enhance decision-making processes, providing real-time insights into financial performance and projections. Documenting stakeholder feedback creates a foundation for strategic alignment, ensuring that all parties remain informed and invested in financial outcomes. Ultimately, fostering an inclusive environment promotes collective responsibility, leading to sustainable financial health.

Comments