Are you looking to make a difference in your community and create a lasting impact through charitable giving? Crafting a thoughtful donation letter can help you convey your intentions and inspire generosity from others. With the right template, you can communicate your passion, highlight the cause, and outline how individuals can contribute meaningfully. Join us as we explore effective strategies for planning your charity donation letter and discover how to ignite compassion in your readers.

Donor's Contact Information

Planning a charity donation requires careful consideration of the donor's contact information to ensure efficient communication and transparency. Key details include the donor's full name for personalized acknowledgment, phone number for prompt updates regarding the donation process, and email address for digital confirmation and receipts. Additionally, mailing address is essential for sending tangible thank-you letters or donations receipts, thereby establishing a connection. Incorporating notes for preferred communication method fosters a better relationship, while tracking donation history can enhance future engagement opportunities. Understanding these elements streamlines the fundraising efforts and cultivates lasting partnerships.

Recipient Charity's Contact Details

Planning a charity donation involves connecting with organizations dedicated to specific causes like education, health, or environmental protection. For effective communication, note the recipient charity's contact details: the organization's full name, street address, and postal code. Include an email address for digital correspondence and a phone number for direct conversations. Furthermore, the charity's website can provide additional information on their mission, programs, and other relevant initiatives, ensuring the donation aligns with your philanthropic goals. Carefully compiling these details not only facilitates the donation process but also strengthens potential partnerships with the charity's team.

Purpose and Goals of the Donation

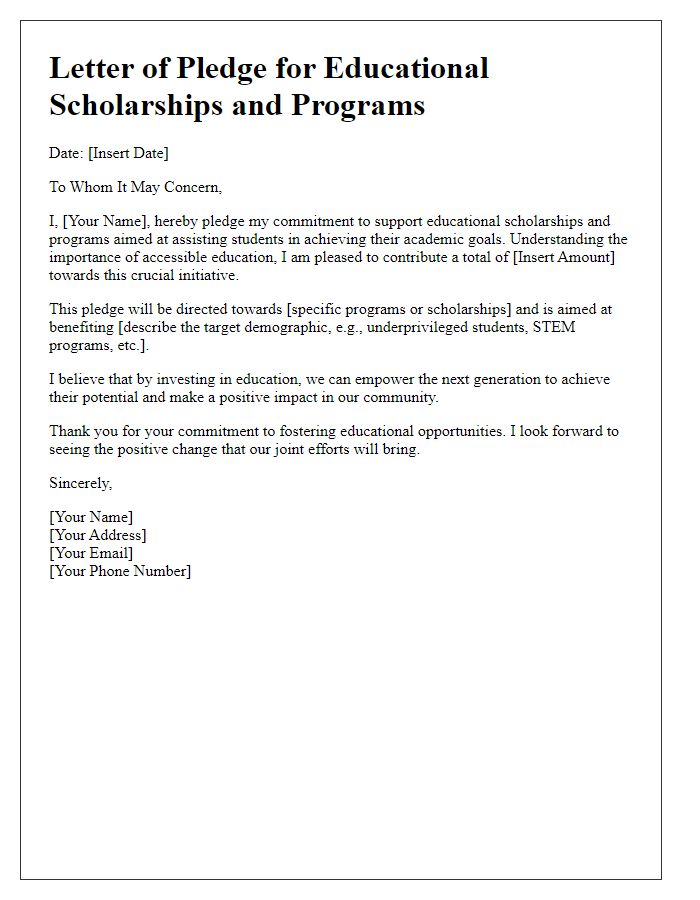

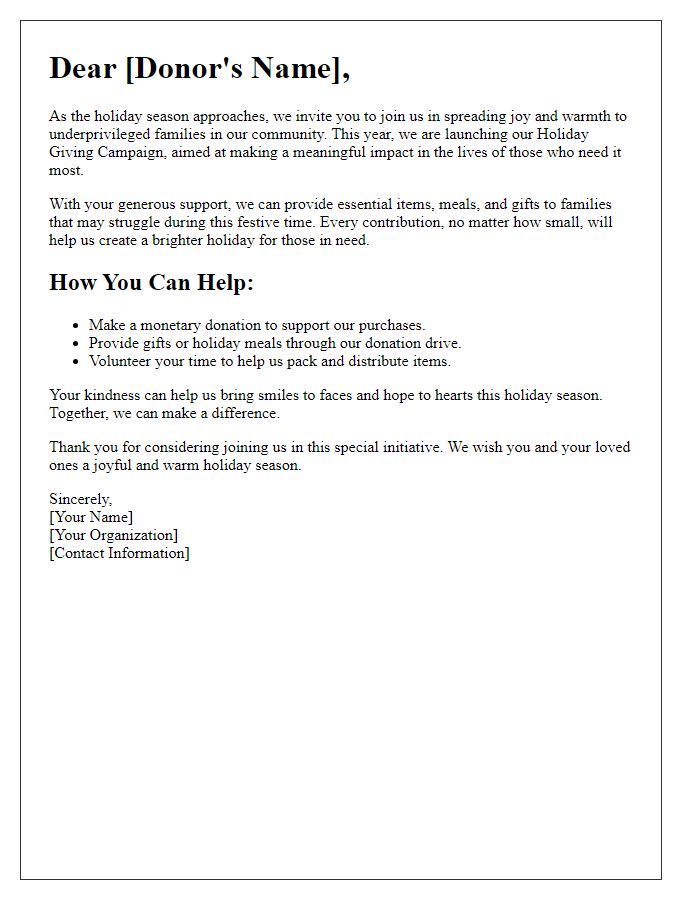

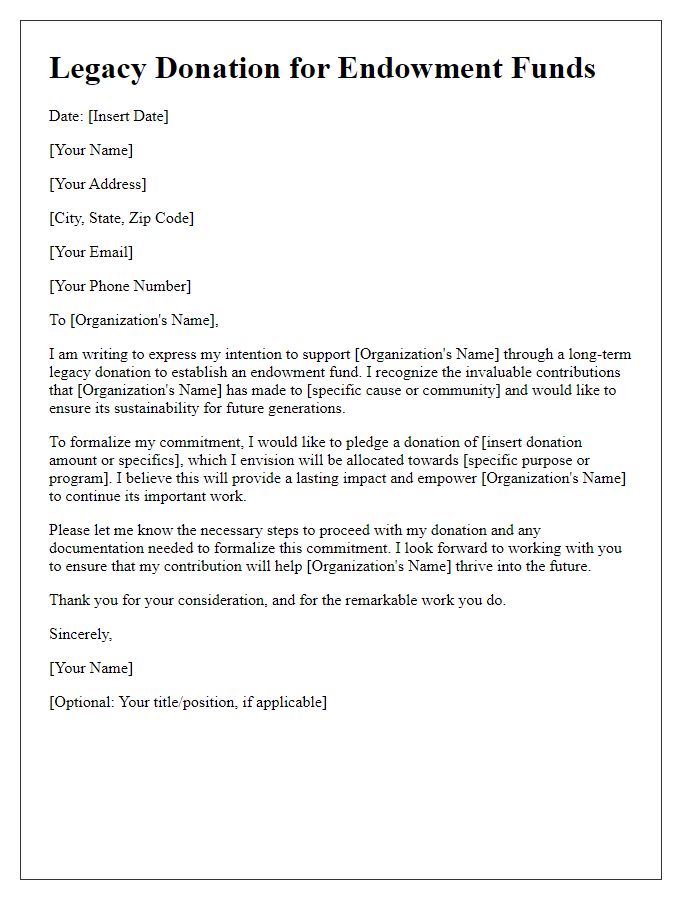

Charity donations play a crucial role in supporting various causes and helping communities in need. Their primary purpose is to alleviate poverty, improve education, and provide healthcare services to marginalized groups. By contributing financially or with resources, donors enable organizations to implement impactful programs that directly serve those affected by socioeconomic challenges. Specific goals of donations often include funding food assistance programs in areas with high food insecurity rates, supporting educational scholarships for underprivileged students, or facilitating healthcare initiatives in regions lacking adequate medical facilities. In 2022, charitable organizations reported a significant increase in donations totaling approximately $471 billion, highlighting the community's commitment to fostering societal change. Through structured donation planning, individuals can ensure their contributions make a lasting impact, addressing pressing issues faced by local and global communities alike.

Specific Donation Amount and Frequency

Charity organizations often rely on specific donation amounts and frequencies to budget and plan their programs effectively. A common strategy involves establishing monthly donations of $50, which can contribute significantly to operational costs. For example, if 200 donors commit to this giving level, the organization can anticipate an annual income of $120,000. This consistent financial support allows charities like food banks or health clinics to provide ongoing services to underserved communities. Moreover, annual donations might also be encouraged, such as a one-time gift of $500 during holiday seasons, which can help fund special initiatives or seasonal drives. Engaging donors within this structured approach fosters a reliable funding stream, assisting in long-term project planning and resource allocation.

Tax Deductibility and Acknowledgment Request

Tax-deductible donations to registered charitable organizations provide financial support for various community initiatives and social causes. The Internal Revenue Service (IRS) states that contributions to 501(c)(3) organizations are eligible for tax deductions, potentially reducing taxable income and providing financial relief. It's essential to obtain an acknowledgment letter from the charity, detailing the donation amount and the date for proper record-keeping during tax filing. Organizations like the American Red Cross and Habitat for Humanity often issue these letters to acknowledge contributions, ensuring both transparency and compliance for donors. Such documentation helps maintain records for IRS reviews and confirms the charitable intent of the donation.

Letter Template For Charity Donation Planning Samples

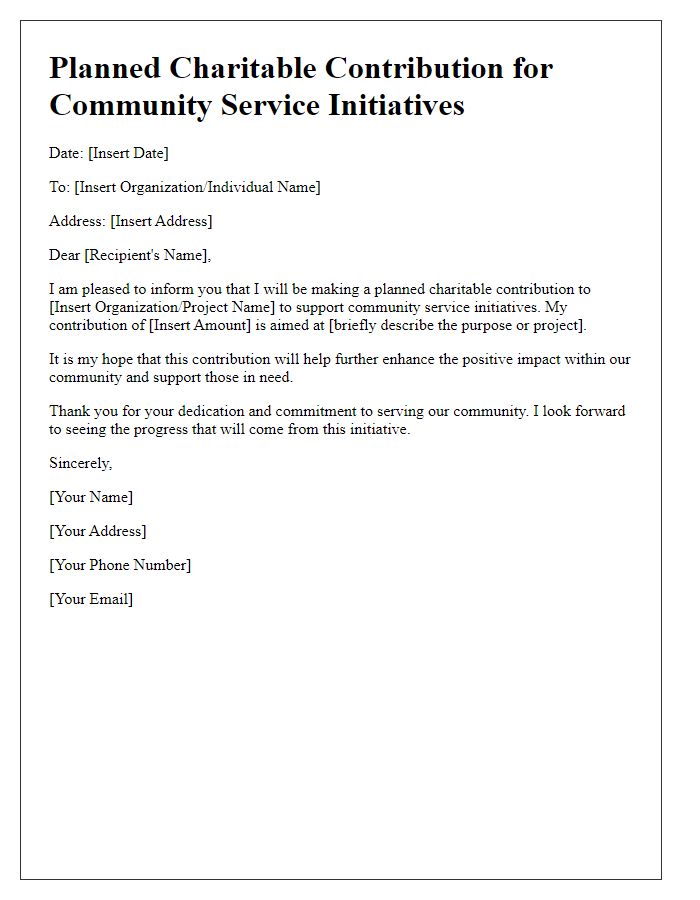

Letter template of planned charitable contribution for community service initiatives

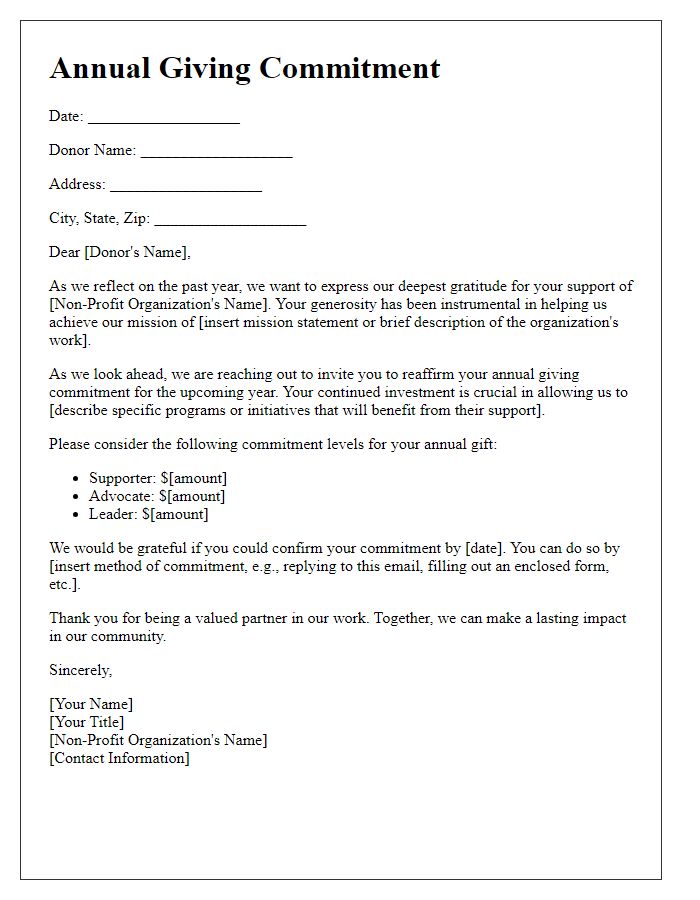

Letter template of annual giving commitment for non-profit organizations

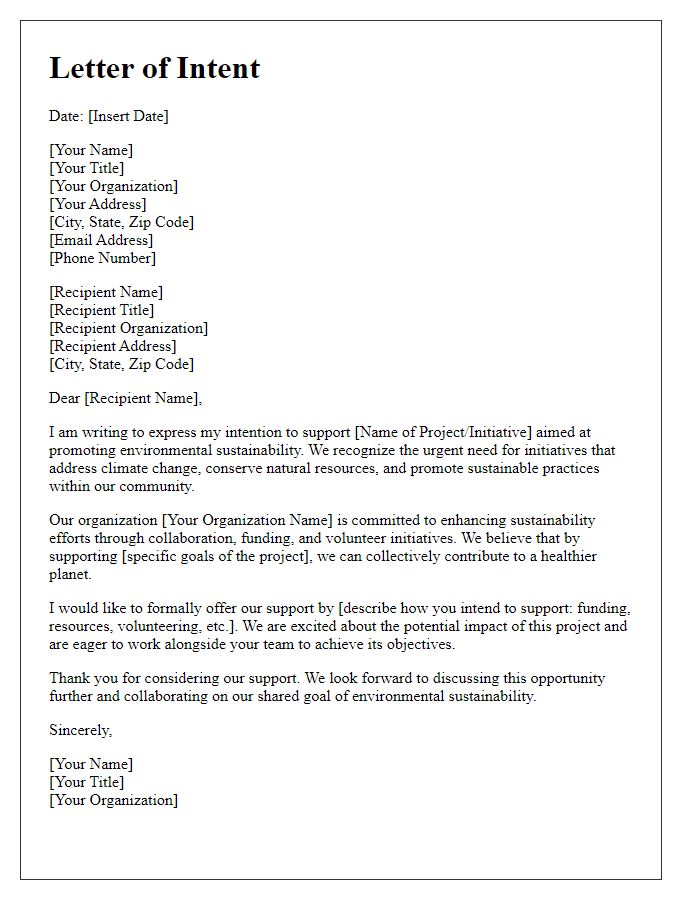

Letter template of intention to support environmental sustainability projects

Letter template of commitment to healthcare funding and medical research

Letter template of support for local animal shelters and rescue organizations

Letter template of corporate matching gift announcement for employee donations

Comments