Are you considering refinancing your mortgage but feeling overwhelmed by the options available? You're not aloneâmany homeowners are unsure of where to start or what steps to take. In this article, we'll explore the ins and outs of mortgage refinancing, including tips for finding the best rates and understanding the process. So, grab a cup of coffee and dive in as we guide you through this important financial decision!

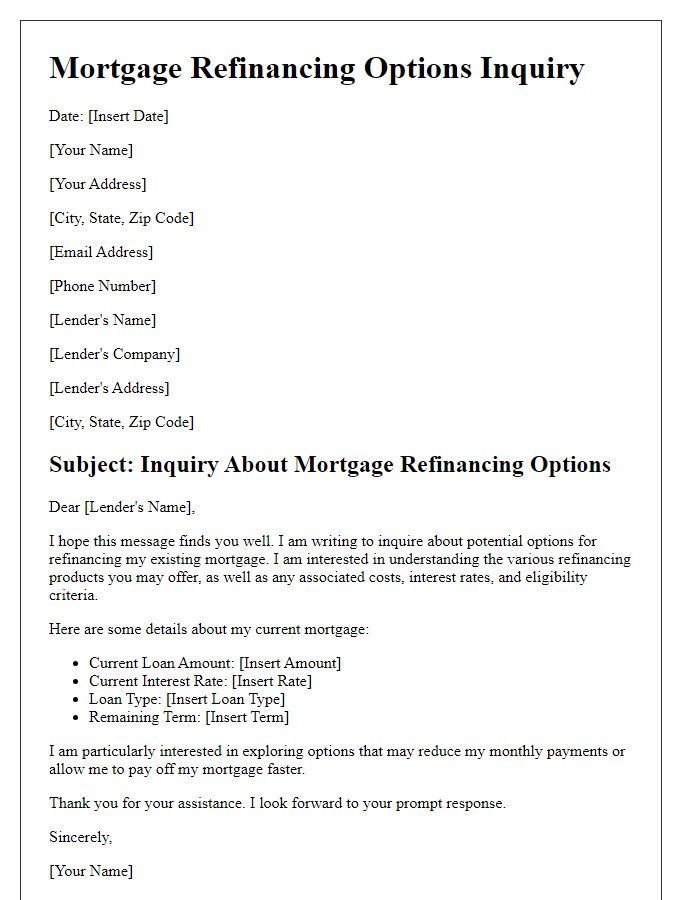

Loan Terms and Interest Rates

Mortgage refinancing can significantly impact homeowners' financial situations. Current interest rates, hovering around historic lows (2.5% to 3.5% in many cases), provide opportunities for substantial savings. Loan terms, typically ranging from 15 to 30 years, define the duration homeowners commit to repay their loans, influencing monthly payments and total interest paid over time. Adjustable-rate mortgages (ARMs) may offer lower initial rates but carry risks of future rate increases, affecting long-term budgeting. Fixed-rate mortgages guarantee consistent payment amounts, providing stability in fluctuating market conditions. Evaluating these options and comparing lenders can lead to informed decisions, ensuring optimal financial management for homeowners seeking refinancing solutions.

Closing Costs and Fees

Mortgage refinancing involves various closing costs and fees that can significantly impact the overall savings and benefits of the refinance process. Typical closing costs range from 2% to 5% of the loan amount, encompassing expenses such as loan origination fees (often around 0.5% to 1% of the loan), title insurance fees (which can vary based on national averages of $1,000 to $3,000), appraisal fees (typically between $300 and $500), and attorney fees (which might range between $400 to $1,500 depending on the region). Additionally, certain lender-specific costs, such as application fees or processing fees, can further add to the total expenses associated with mortgage refinancing. Awareness of these charges is crucial for homeowners in places like California, where property taxes and local regulations can influence the final amount. Engaging with a mortgage advisor can provide clarity on these costs, helping homeowners to navigate the refinancing landscape effectively.

Credit Score and Financial Standing

A strong credit score significantly impacts mortgage refinancing options, influencing interest rates and loan terms. A credit score, commonly categorized as exceptional (800+), good (700-799), fair (600-699), or poor (below 600), determines eligibility for lower rates. Lenders assess financial standing, which includes debt-to-income ratio, employment history, and savings. A debt-to-income ratio above 43% can hinder refinancing opportunities. Consistent employment over two years can enhance trust from lenders. Additional savings in checking and savings accounts, ideally three to six months of expenses, provide reassurance regarding payment capabilities, increasing chances for favorable refinancing terms.

Home Equity and Property Value

Home equity represents the portion of a residential property that the owner truly possesses, determined by subtracting outstanding mortgage balances from the property's current market value. In metropolitan areas like San Francisco or New York City, property values (often exceeding $1 million) can fluctuate based on demand, local economic conditions, and recent sales of comparable homes. Successful refinancing can leverage home equity, allowing homeowners to tap into this value for purposes such as home renovations, debt consolidation, or funding education. It is crucial to consider interest rates, which may vary between lenders, as well as associated costs like closing fees and appraisal expenses, which can affect overall refinancing benefits. Monitoring the property market and understanding the implications of home equity can ultimately enhance financial opportunities for homeowners.

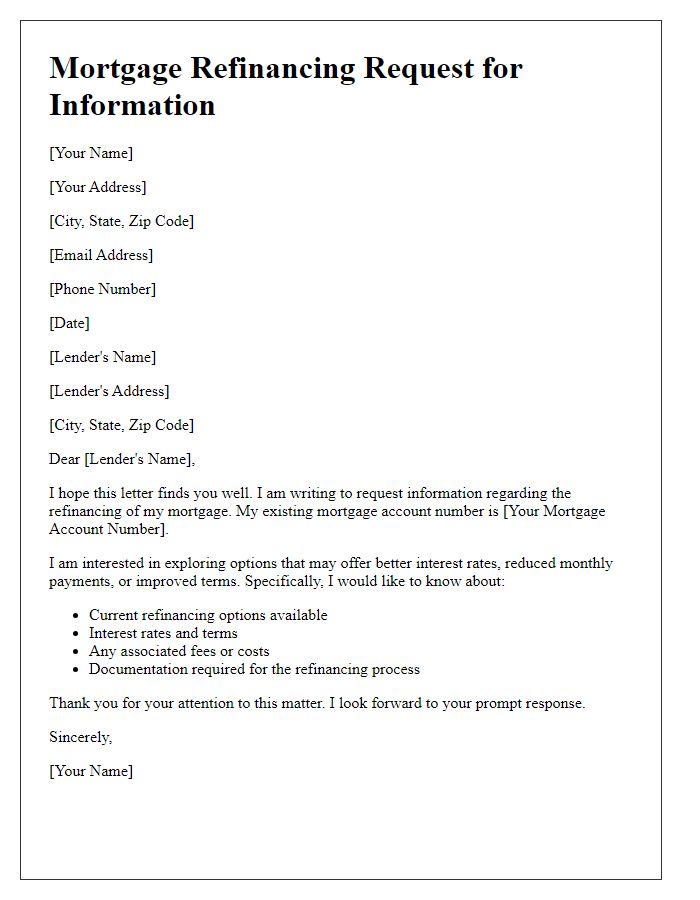

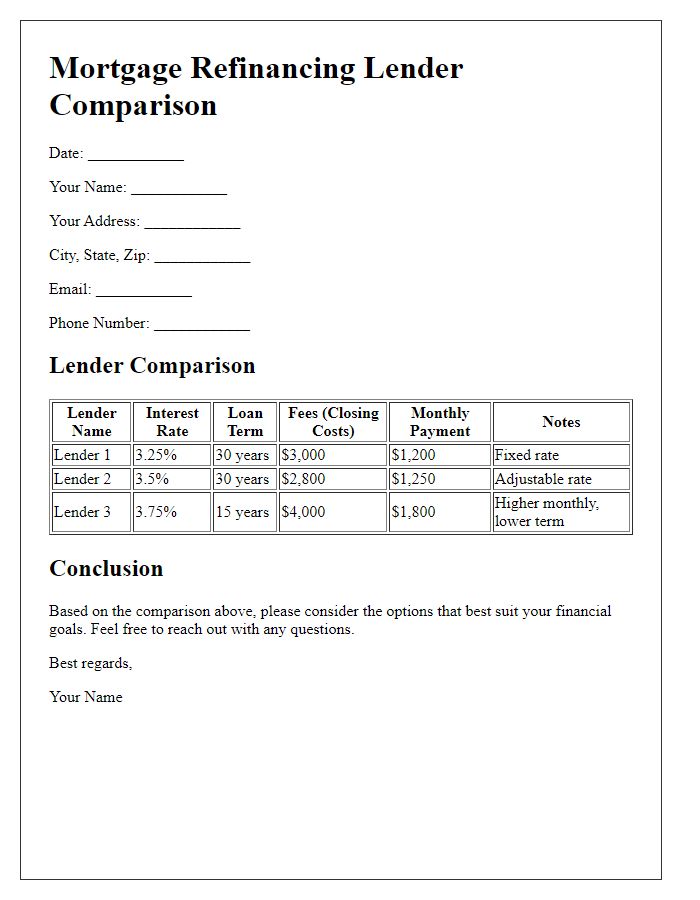

Lender Comparison and Offers

Mortgage refinancing involves evaluating various lenders to secure the most favorable rates and terms that suit individual financial needs. Different lenders, such as local banks, credit unions, and online mortgage companies, offer distinct refinancing options, with interest rates potentially varying by as much as 0.5% or more, depending on credit scores and loan-to-value ratios. Specific offers may include reduced closing costs, cash-out refinancing opportunities, or lower monthly payments, impacting overall loan affordability. Borrowers should pay attention to key documents such as the Loan Estimate and Closing Disclosure, which provide essential breakdowns of fees and provide clarity on long-term financial implications. Taking the time to compare at least three offers can result in significant savings over the loan's lifespan, making refinancing a valuable financial strategy for many homeowners.

Comments