Are you looking to maximize the impact of your charitable donations? Many companies offer matching gift programs, where they match employee contributions to eligible nonprofits, effectively doubling or even tripling your generosity. Navigating the process can seem daunting, but with the right approach, you can easily enhance your contributions' effectiveness. Curious about how to request a matching gift and make the most of your efforts? Read on for our comprehensive guide!

Employee's personal donation details

Employees participating in matching gift programs may provide details about their personal donations to eligible non-profit organizations. The donation amounts can vary, typically ranging from $25 to $5,000, depending on company policies. Non-profit organizations, such as charities, educational institutions, or health-related entities, must meet the specific criteria set by the employer for matching arrangements. The request process may include submitting donation receipts, including the date and total contribution, alongside a completed matching gift form provided by the employer. Timely submission is essential, often required within a specific period, such as 12 months after the initial donation date, to ensure that matching funds can be disbursed effectively to amplify the impact of the employee's generosity.

Eligible nonprofit organization's information

Nonprofit organizations, such as 501(c)(3) entities, often participate in matching gift programs offered by corporations to maximize contributions from donors. These organizations typically provide essential services, such as educational programs, healthcare initiatives, or environmental conservation efforts. Details such as the nonprofit's name, mission statement, and IRS tax identification number are crucial for the matching gift process. Additionally, organizations usually need to highlight their achievements, project goals, and the specific impact of donor contributions (for example, $50 can provide meals for ten families). Corporations, such as Bank of America or Microsoft, may have specific requirements for the matching process, including deadlines for submission and minimum donation amounts, which nonprofit organizations must adhere to in order to facilitate these valuable contributions.

Matching gift program guidelines

Many corporations have established matching gift programs, allowing employees to amplify their charitable contributions to non-profit organizations. For instance, companies like Google and Microsoft may match donations dollar-for-dollar, potentially doubling an employee's impact. Typically, these programs require donors to submit a matching gift request form, along with proof of donation. Donation amounts usually range from $25 to $25,000, depending on company policies. It is crucial for non-profits to familiarize themselves with specific submission deadlines and eligibility criteria outlined by each corporation. Important notes include tracking total donation amounts and maintaining records of employee participation to maximize funding opportunities.

Deadline for request submission

Matching gift programs enable nonprofit organizations to amplify their fundraising efforts by encouraging donations from employees of corporate partners. Many companies, including notable names like Microsoft and Johnson & Johnson, offer these programs, significantly enhancing the impact of individual contributions. The deadline for request submission often varies by organization; for instance, some might require submission within 30 days of the donation date, while others maintain a fiscal year timeframe, typically concluding on December 31st. Potential donors should verify specific submission guidelines on their employer's HR portal to ensure compliance and timely processing of matching gifts, which can contribute substantially to the funding of charitable initiatives.

Contact information for HR or relevant department

A matching gift program can significantly enhance charitable contributions made by employees to non-profit organizations. Companies such as Google, Microsoft, and Bank of America actively participate in these beneficial programs. Employees often need the contact information for the Human Resources (HR) department or relevant departments responsible for facilitating these matching gift requests. Clarity is essential; names, phone numbers, and email addresses streamline communication. Organizations frequently require details including employee ID numbers, donation amounts, and recipient charity information. Understanding the deadlines and specific procedures outlined by each company can maximize the matching gifts' potential, doubling or even tripling the impact of employee donations.

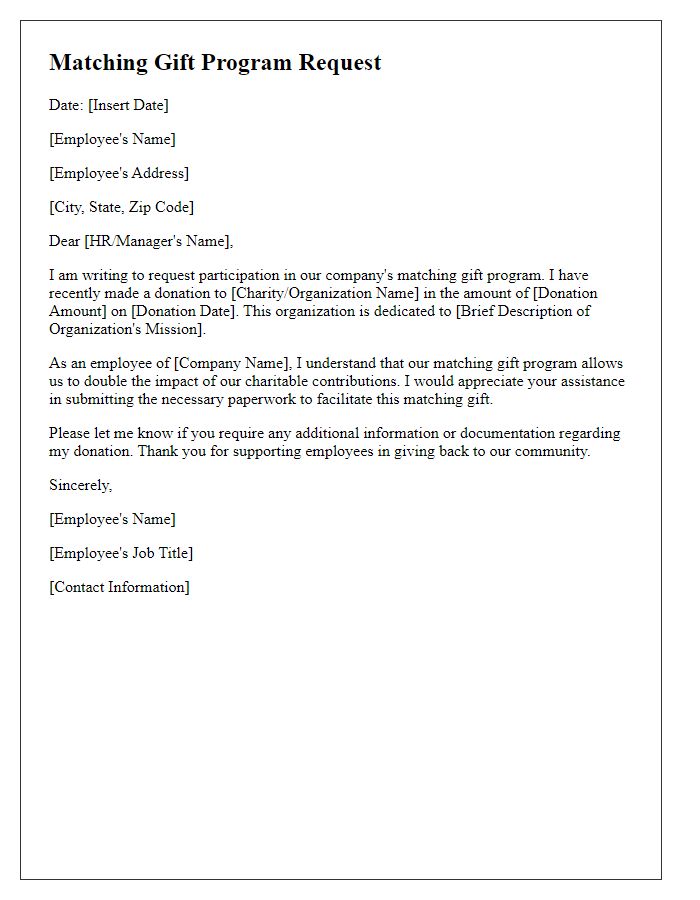

Letter Template For Matching Gift Program Requests Samples

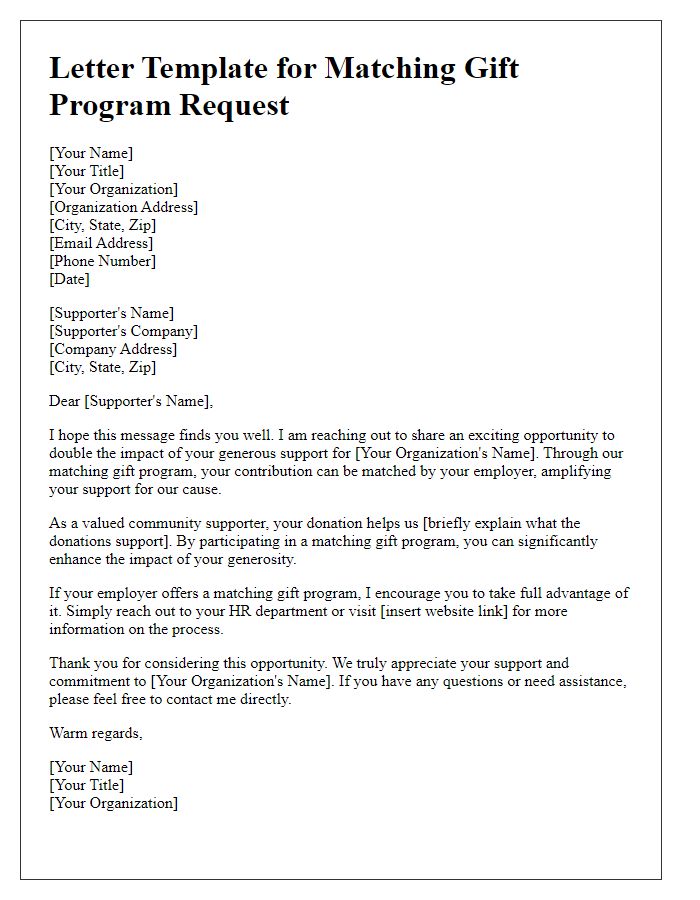

Letter template of matching gift program request for community supporters

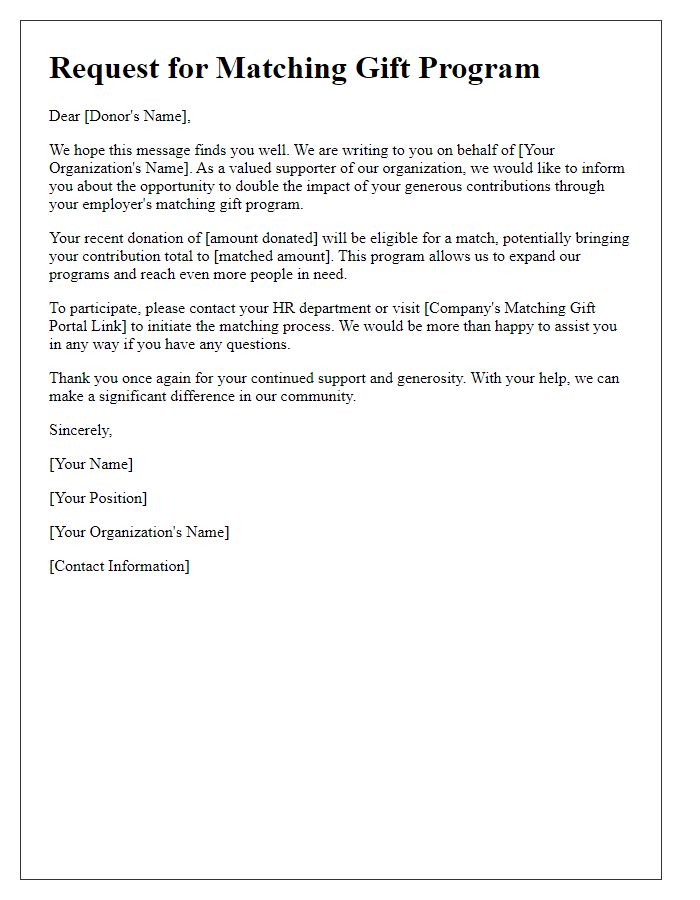

Letter template of matching gift program request for charitable organizations

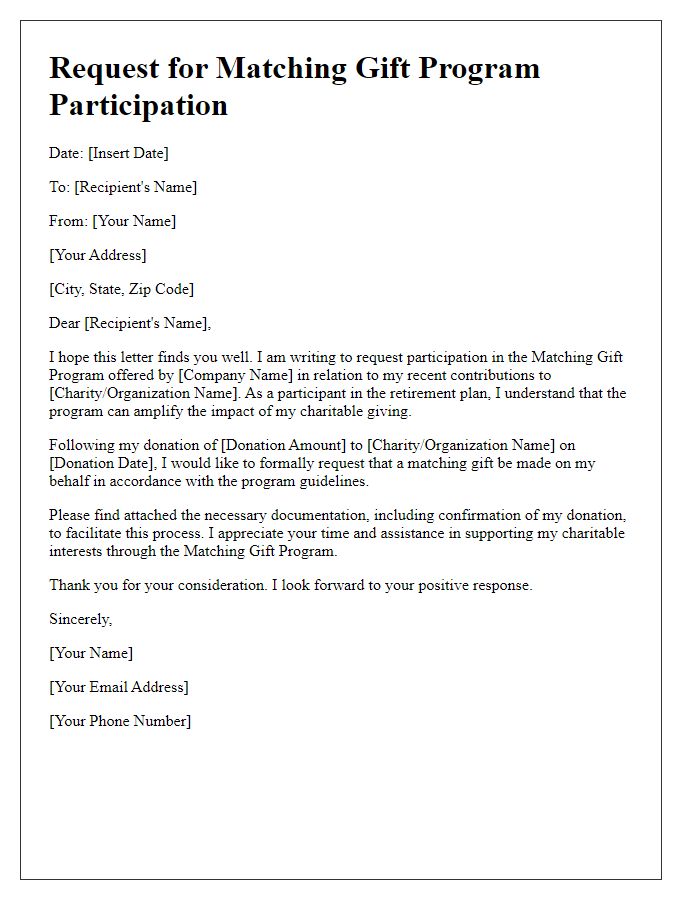

Letter template of matching gift program request for retirement plan participants

Comments