Facing financial hardship can be a daunting experience that many people encounter at some point in their lives. Whether it's due to unexpected medical bills, job loss, or other unforeseen circumstances, it's essential to communicate your situation clearly and compassionately. In this article, we'll provide a practical letter template to help you explain your financial challenges effectively, all while maintaining a respectful tone. Join us as we guide you through this process, and feel free to read more to discover valuable tips and insights!

Detailed explanation of financial circumstances

Facing financial hardship often stems from unexpected life events and circumstances that disrupt stability. Events such as sudden job loss, which affects roughly 4% of the workforce annually, can lead to significant income reductions, creating challenges in meeting monthly expenses. Medical emergencies, with average costs exceeding $1,000 for out-of-pocket expenses, further strain budgets, particularly for families without adequate health insurance. In cities like San Francisco, where the cost of living is approximately 80% higher than the national average, even minor fluctuations in income can result in difficulty paying rent, which typically averages around $3,000 for a one-bedroom apartment. Additionally, rising inflation rates, recently hitting 9.1%, have increased the prices of everyday necessities such as groceries and utilities, placing additional pressure on already tight budgets. These factors collectively contribute to a dire financial situation that hinders the ability to maintain a stable and secure life.

Specific impact on income and expenses

Financial hardship significantly influences both income and expenses, often creating a challenging situation for individuals and families. Job loss, with unemployment rates reaching 6.1% in certain regions, can drastically reduce monthly income, leading to difficulties in meeting essential obligations. Rising living costs, such as a 15% increase in rent prices over the past two years in urban areas, further strain budgets. Unexpected medical expenses, averaging $3,000 annually for uninsured individuals, can lead to depletion of savings, highlighting the precarious balance between income stability and necessary expenses. As revenue diminishes and costs rise, individuals are often forced to make difficult decisions, such as forgoing necessities or relying on credit, compounding the financial strain over time.

Relevant supporting documentation

Financial hardship often necessitates the submission of relevant supporting documentation to substantiate claims. These documents may include recent pay stubs highlighting income from employment, bank statements detailing monthly expenses, and tax returns reflecting overall financial status. Additional evidence such as medical bills from healthcare providers or eviction notices from landlords can illustrate urgent financial situations. Other crucial documents like unemployment benefit statements or letters from financial institutions related to debt can provide a comprehensive overview of monetary challenges. Presenting clear, organized paperwork enhances credibility and aids in the evaluation process.

Request for assistance or specific relief

Financial hardships can significantly impact families, leading to challenges in meeting basic living expenses such as rent, utilities, and groceries. Many individuals face job loss, reduced work hours, or unexpected medical expenses, which can create a substantial burden. For families living in urban areas, like New York City, where the cost of living is notably high, these hardships can be magnified, making it increasingly difficult to navigate daily financial responsibilities. Various assistance programs offered by local governments and nonprofit organizations aim to provide relief, helping to alleviate some of these pressures during difficult times. These programs often include emergency financial aid, food assistance through local food banks, and resources for job placement services to support individuals in stabilizing their financial situations.

Contact information for follow-up communication

Individuals facing financial hardship often need to communicate their situation clearly and effectively. Financial hardship may arise from various circumstances like sudden job loss, medical expenses, or unforeseen personal crises. Providing specific contact information for follow-up communication is essential to ensure ongoing support. Effective communication can expedite assistance from organizations like government agencies or non-profits. Incorporating essential details such as telephone numbers, email addresses, and preferred contact times can facilitate timely responses. Clear communication of financial difficulty can guide creditors or service providers in offering flexible solutions or tailored payment plans.

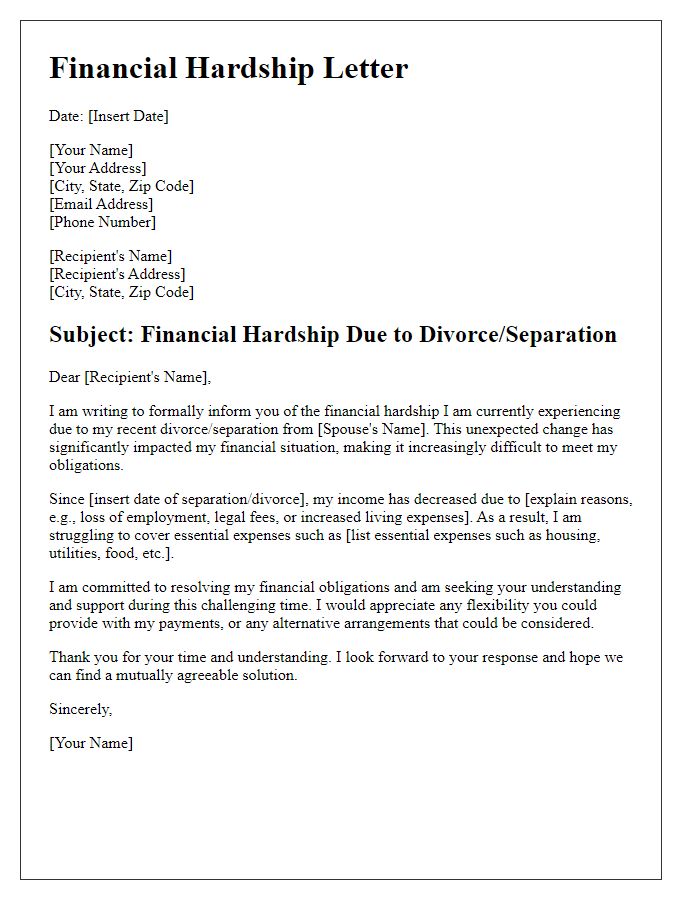

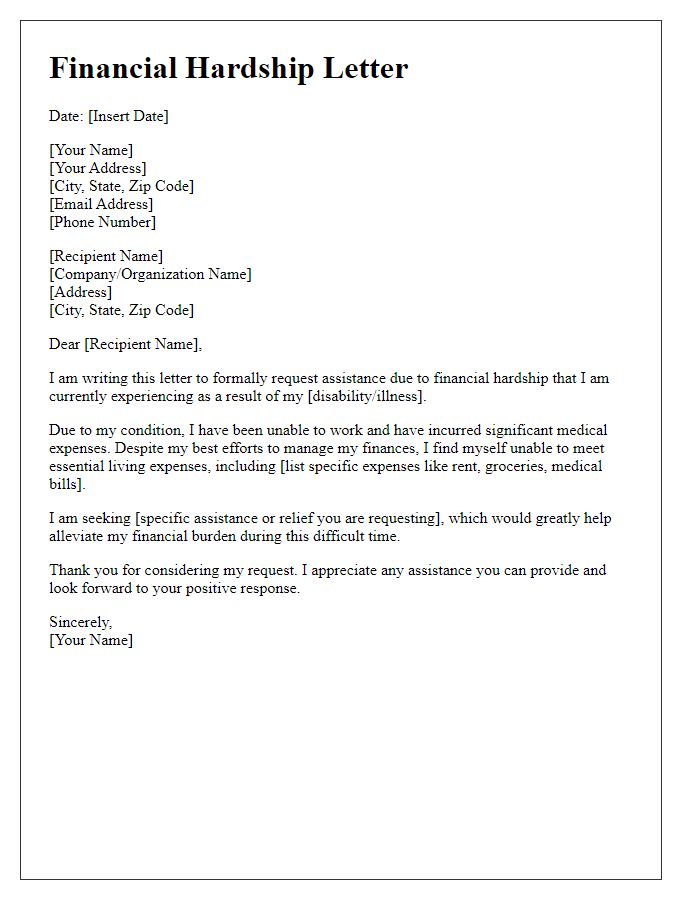

Letter Template For Explaining Financial Hardship Samples

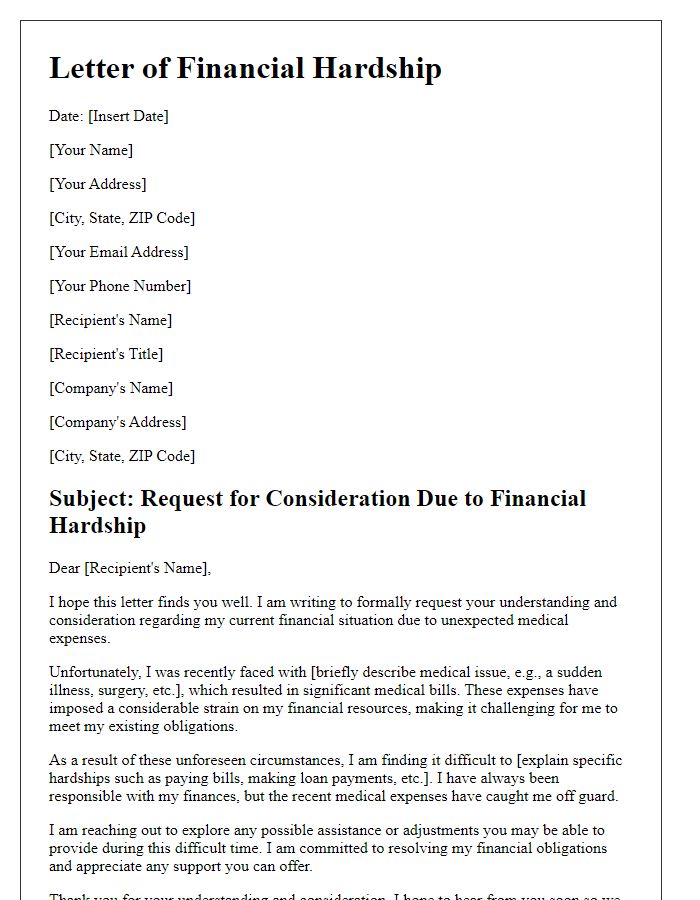

Letter template of financial hardship due to unexpected medical expenses.

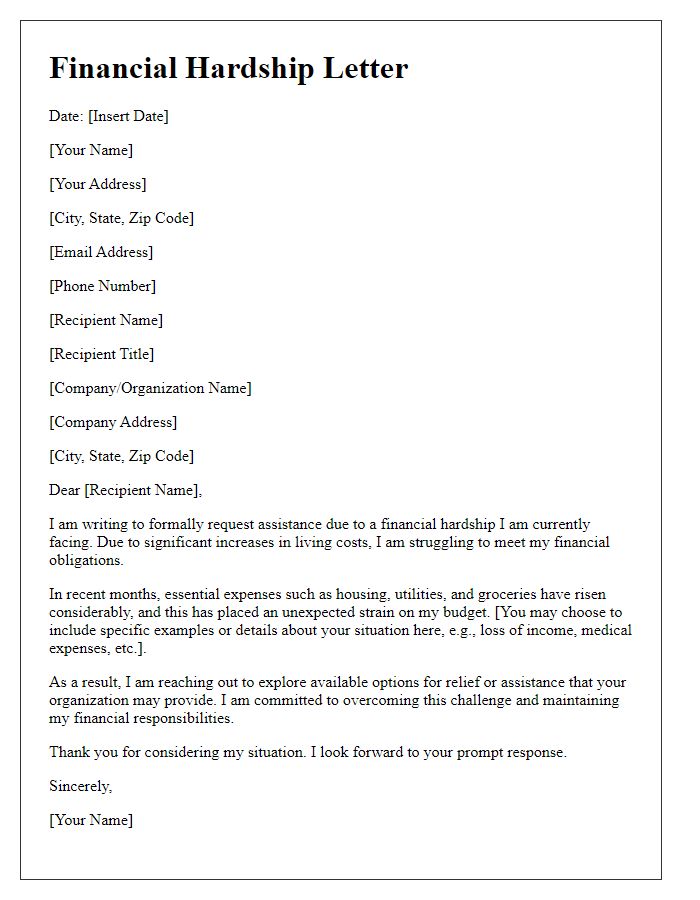

Letter template of financial hardship stemming from increased living costs.

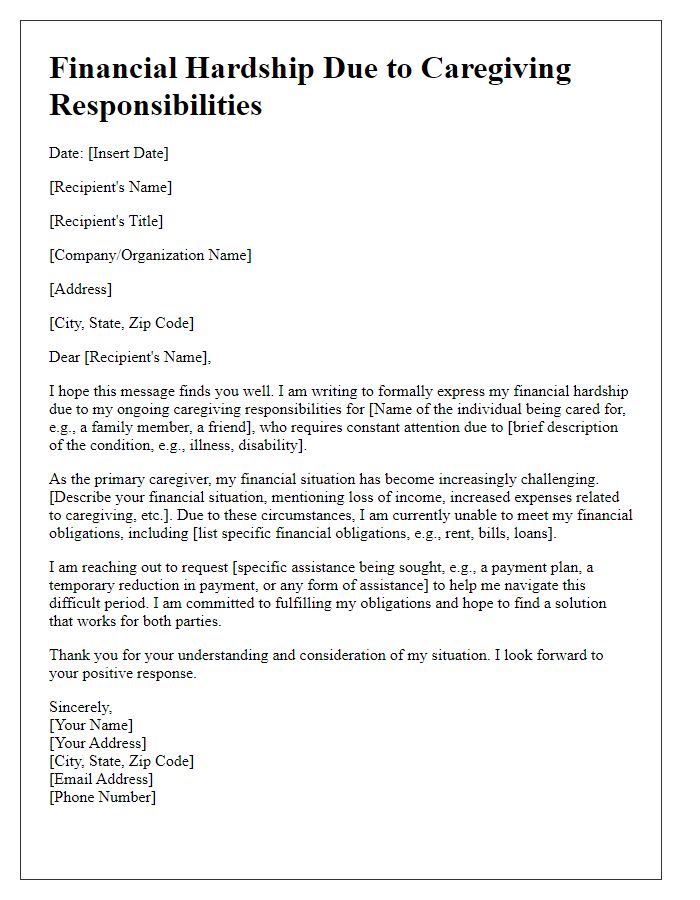

Letter template of financial hardship due to caregiving responsibilities.

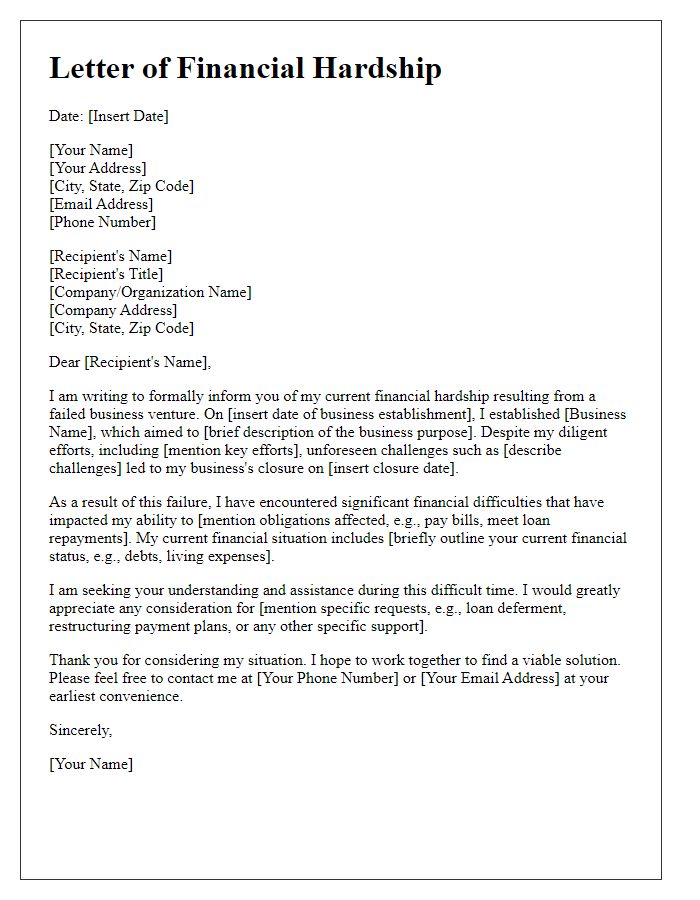

Letter template of financial hardship arising from a failed business venture.

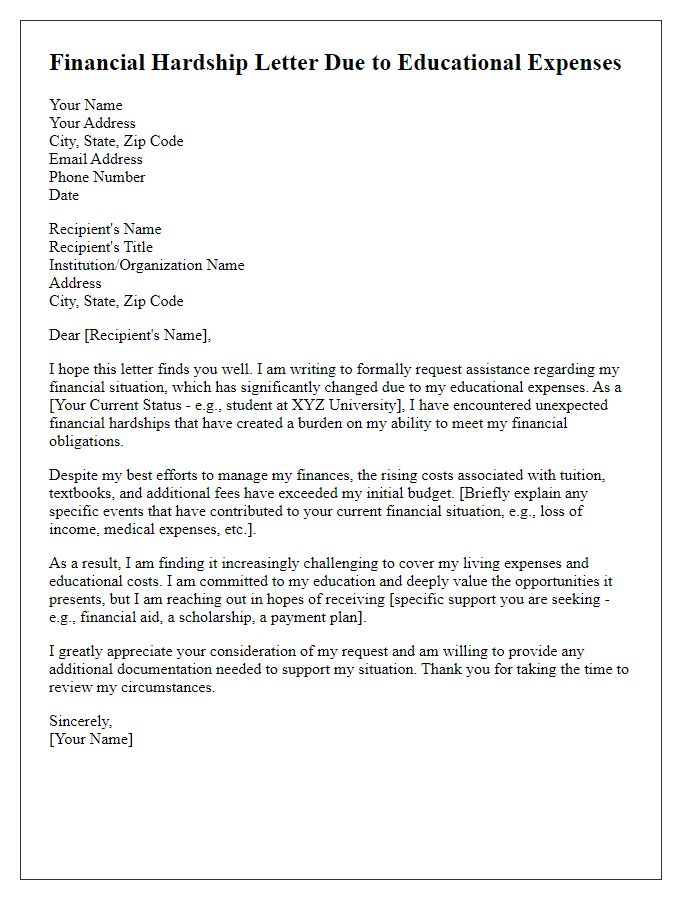

Letter template of financial hardship resulting from educational expenses.

Comments