Are you feeling overwhelmed by your current loan obligations? If so, you're not alone, and there's good news on the horizon! In this article, we'll discuss how you can successfully navigate the process of loan restructuring without incurring penalties. Stick around to discover valuable tips and insights that could lighten your financial load!

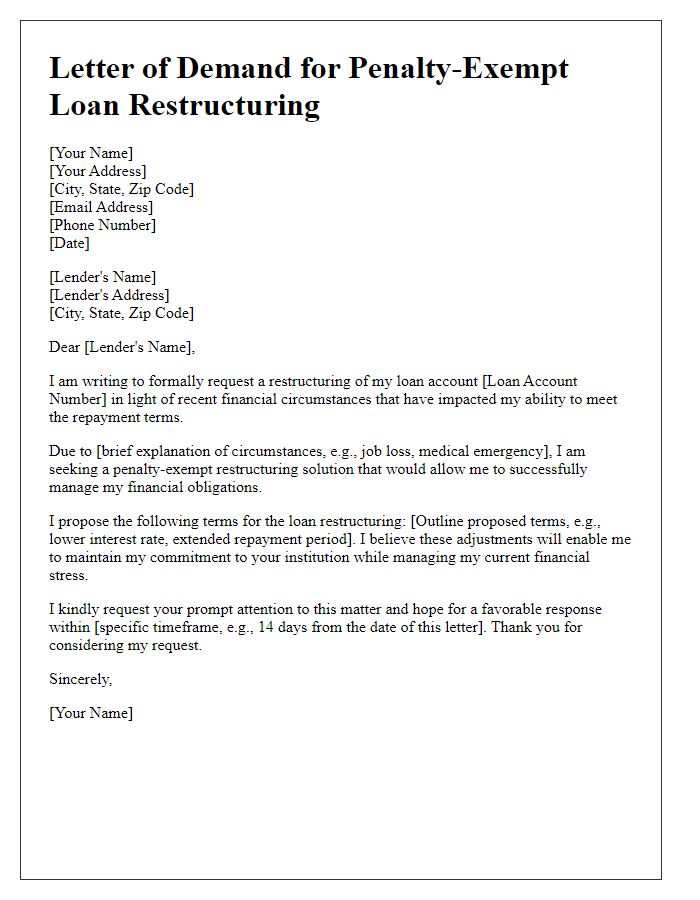

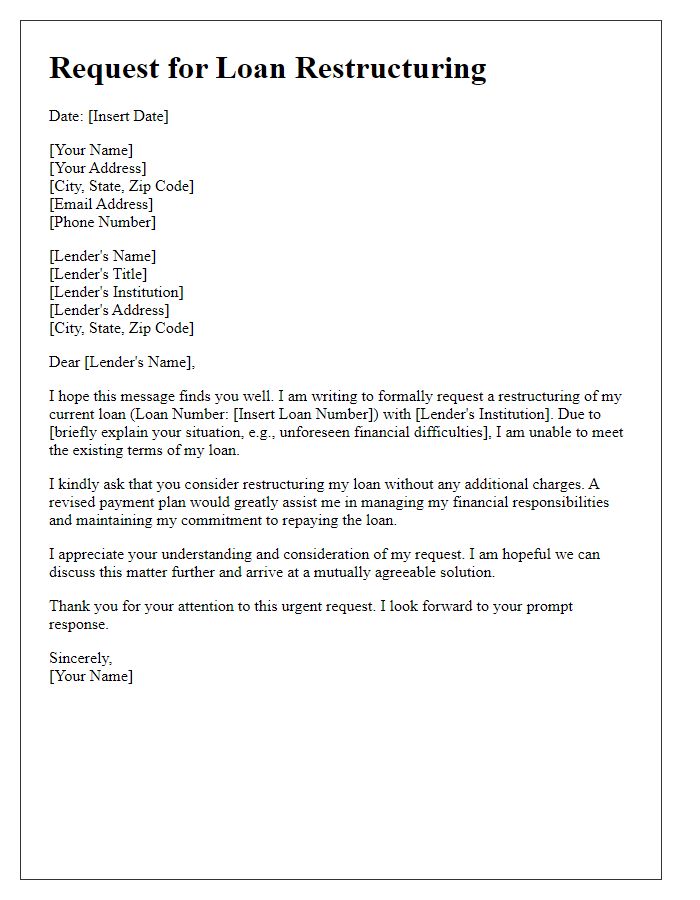

Clear subject line: "Request for Loan Restructuring Without Penalty

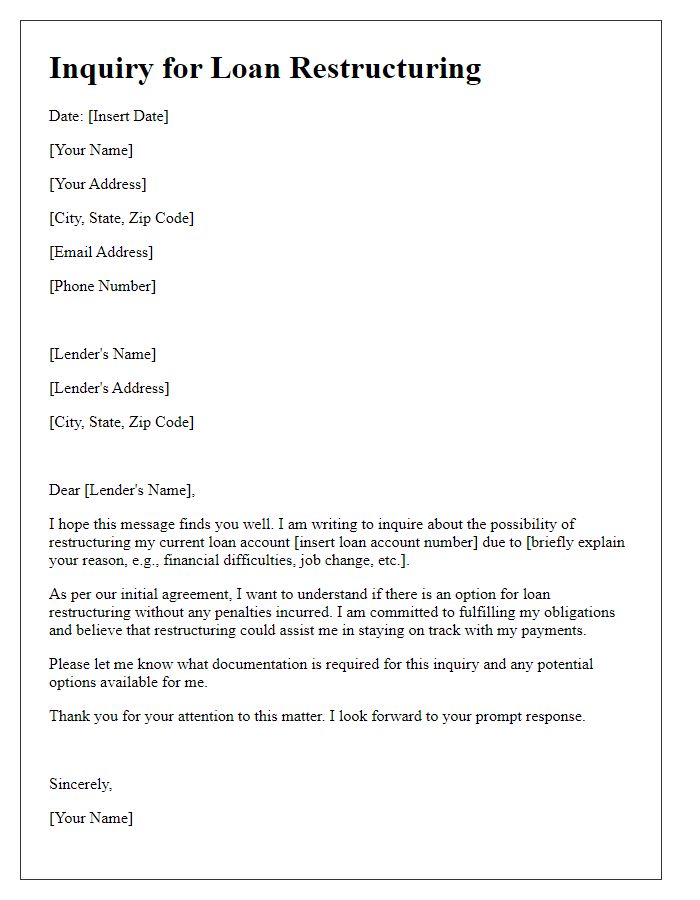

Loan restructuring is a financial process that allows borrowers to modify the terms of their current mortgage or loan agreement. This process can be initiated in various scenarios, such as experiencing a decrease in income or facing unexpected expenses. For instance, individuals may find themselves needing to restructure a home loan of $250,000 due to job loss or medical bills. In many cases, lenders may offer a temporary reduction in monthly payments or extend the repayment term without imposing penalties, which can be valuable during times of financial hardship. Key factors include the borrower's credit score, which significantly influences approval rates, and documentation such as income statements and hardship letters that detail the borrower's situation and justify the need for restructuring. Additionally, some lenders may require a formal application or assessment, making it essential for borrowers to understand their options and terms before proceeding.

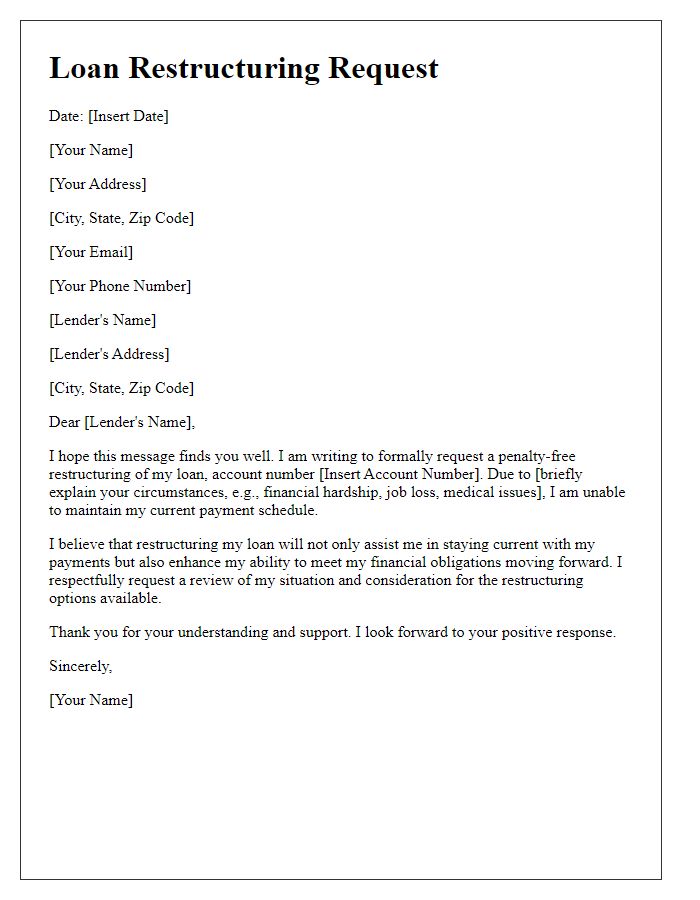

Borrower Identification: Name, account number, contact details

Loan restructuring requests often arise due to financial changes. A borrower may experience job loss, unexpected medical expenses, or significant life events. For instance, an individual named Alex Johnson (Account Number: 123456789), residing at 123 Elm Street, Springfield, with contact number (555) 123-4567, may require alterations to their loan terms. This request aims to adjust the repayment plan, extend the duration, or lower the interest rate without incurring penalties. Such adjustments ensure financial hardship management while maintaining the lender's interests. Increased flexibility enhances the borrower's capacity to meet obligations, ultimately promoting successful loan fulfillment and reducing the risk of defaulting.

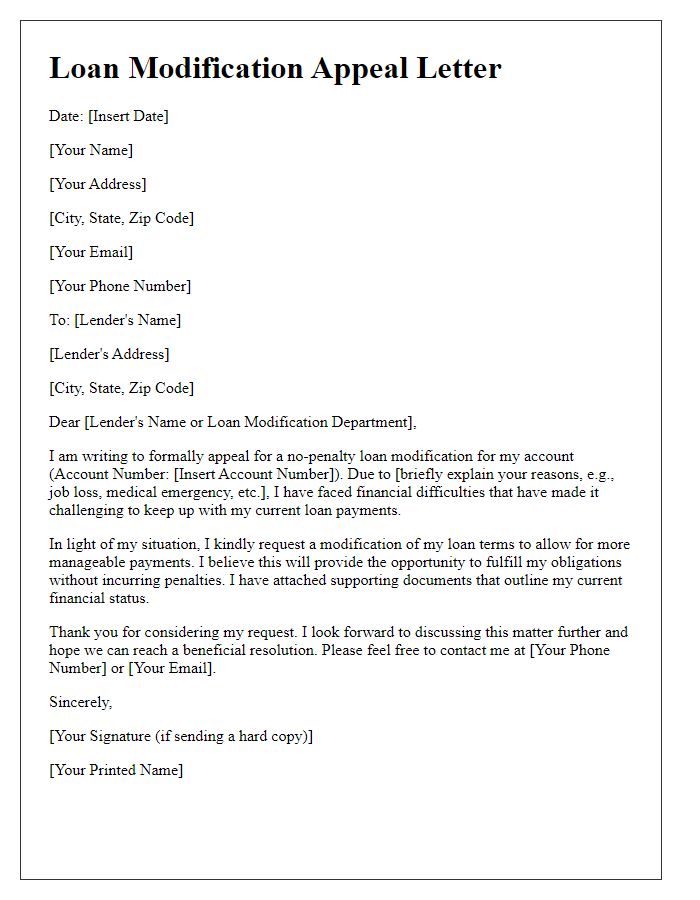

Reason for Request: Financial hardships, unforeseen circumstances

A loan restructuring request can significantly alleviate financial burdens for individuals facing unexpected challenges. Financial hardships can arise from events such as job loss, medical emergencies, or global crises like the COVID-19 pandemic. Unforeseen circumstances may disrupt monthly income, making it difficult to meet existing loan obligations. By seeking loan restructuring without penalties, borrowers can negotiate for more manageable payment terms or extended repayment periods, easing immediate financial strain and promoting long-term stability. This approach not only helps maintain a positive credit history but also fosters a supportive relationship between lenders and borrowers during challenging times.

Restructuring Proposal: New terms, payment plan, expected outcomes

A loan restructuring proposal outlines new terms for existing debts, tailored to improve repayment conditions without incurring penalties. Key elements include reduced interest rates, extended loan duration, and adjusted monthly payment plans designed to lower financial strain for borrowers. The expected outcomes include improved cash flow, enhanced borrower creditworthiness, and a stronger partnership between lender and borrower. The proposal ideally fosters a sustainable repayment strategy that aligns with the financial capability of the borrower, thus preventing defaults and promoting long-term fiscal stability. Such restructuring can be particularly beneficial during economic downturns or personal financial difficulties that disrupt regular payment cycles.

Assurance and Compliance: Commitment to timely payments, appreciation for consideration

Loan restructuring, particularly without penalty, serves as a crucial financial relief mechanism for borrowers facing unexpected hardships. This process allows individuals to modify existing loan agreements, often resulting in reduced monthly payments or extended repayment periods, thereby easing the financial burden during challenging times. Timely payments become essential, highlighting a borrower's commitment to maintaining a positive credit history which can significantly affect future borrowing opportunities and interest rates. Appreciation for the lender's consideration plays a vital role, fostering a collaborative relationship that encourages open communication regarding financial difficulties and potential solutions. Compliance with new terms established during the restructuring process reinforces the borrower's dedication to meet obligations, further enhancing trust between borrower and lender.

Letter Template For Loan Restructuring Without Penalty Samples

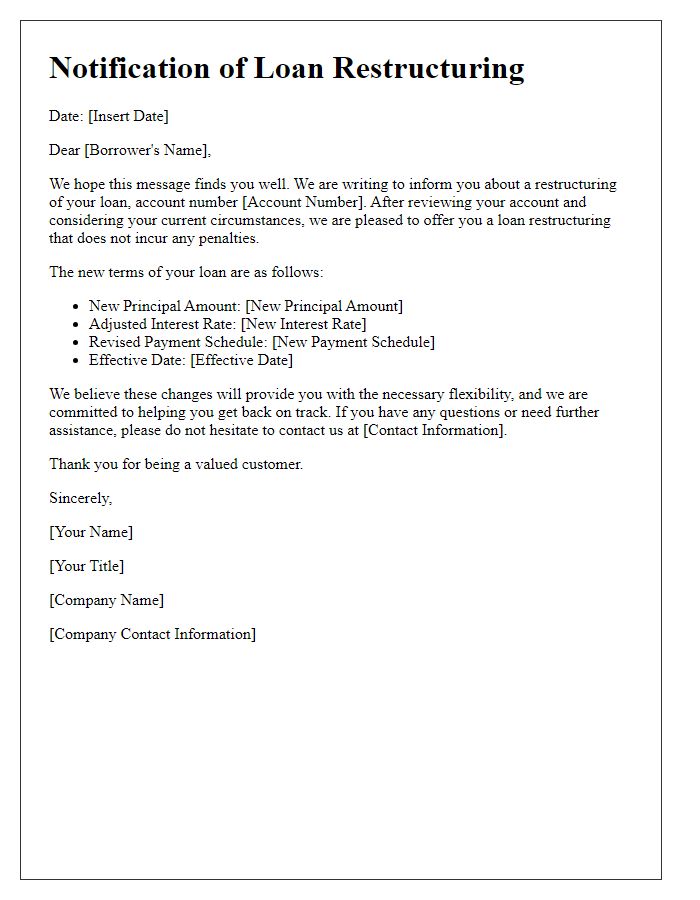

Letter template of notification for restructuring loan with no penalties

Comments