When dealing with debt collectors, crafting the right letter can be a game-changer in your negotiation efforts. It's essential to express your willingness to settle while also keeping the conversation open and respectful. By outlining your circumstances and proposing a fair settlement amount, you can pave the way for a mutually beneficial resolution. Ready to take control of your financial situation? Let's dive into some effective letter templates that can help you negotiate with confidence!

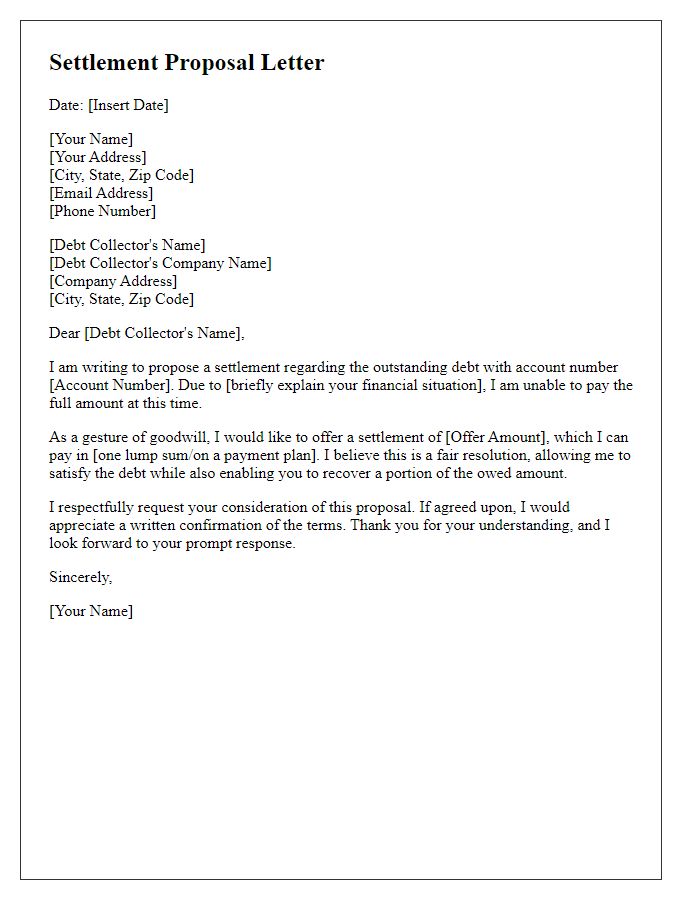

Concise introduction stating purpose

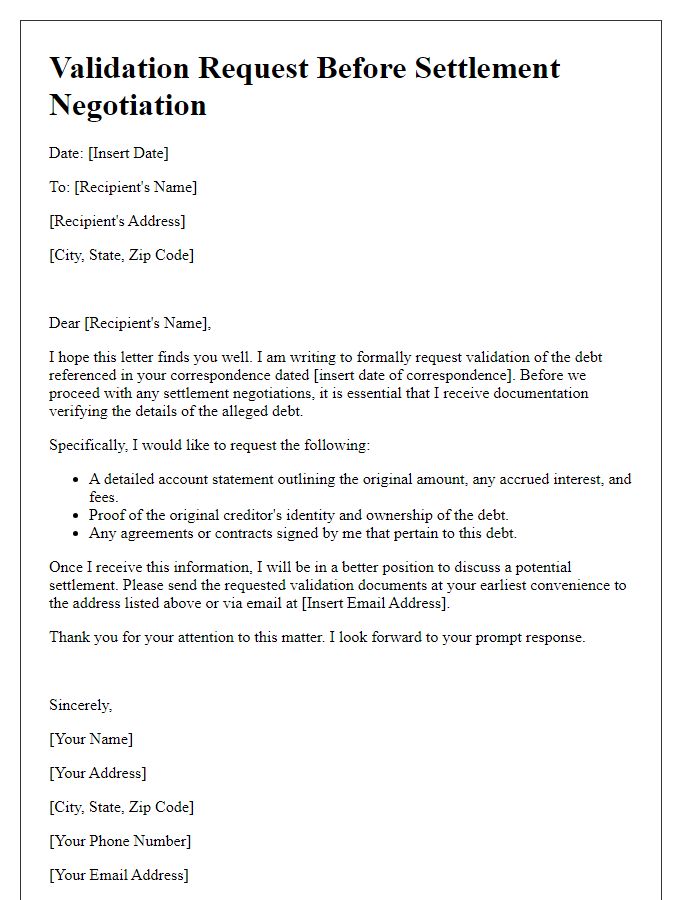

Negotiating a settlement with debt collectors requires a clear understanding of the terms and the context surrounding the debt. Debt collectors, such as those employed by agencies like ERC (Enhanced Recovery Company), often purchase consumer debts for less than the original amount. When initiating a settlement negotiation, it is essential to establish a concise introduction that clearly states the purpose of communication. For instance, specify the debt amount, the original creditor (such as a credit card company), and any specific concerns or circumstances prompting the request for a settlement. Providing relevant details such as account numbers, dates of initial contact, and the collector's company name can enhance the clarity and urgency of the negotiation. This well-structured approach can facilitate a more productive dialogue towards achieving a favorable settlement agreement.

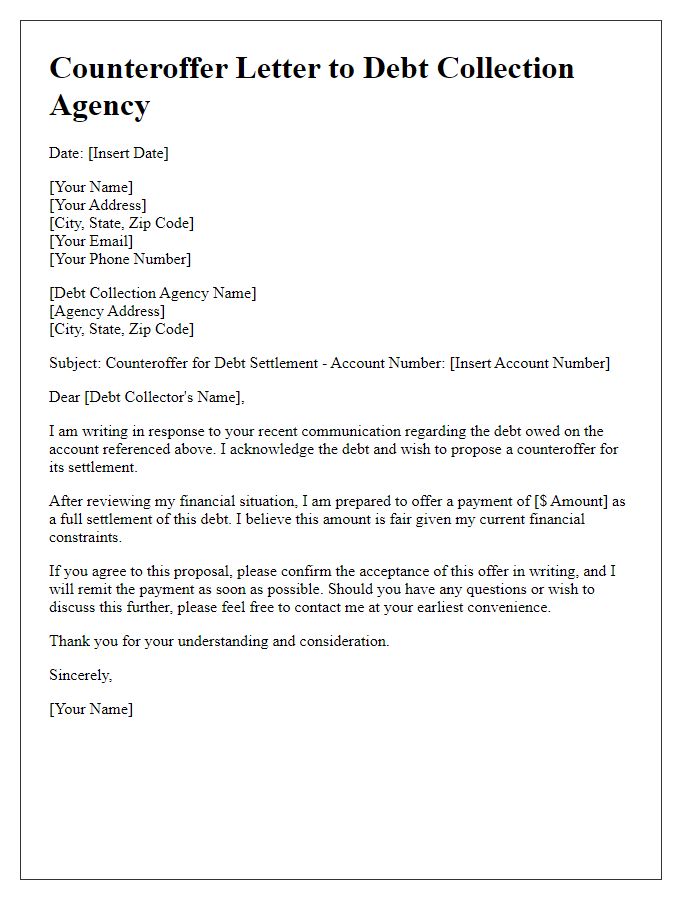

Acknowledgment of debt and willingness to negotiate

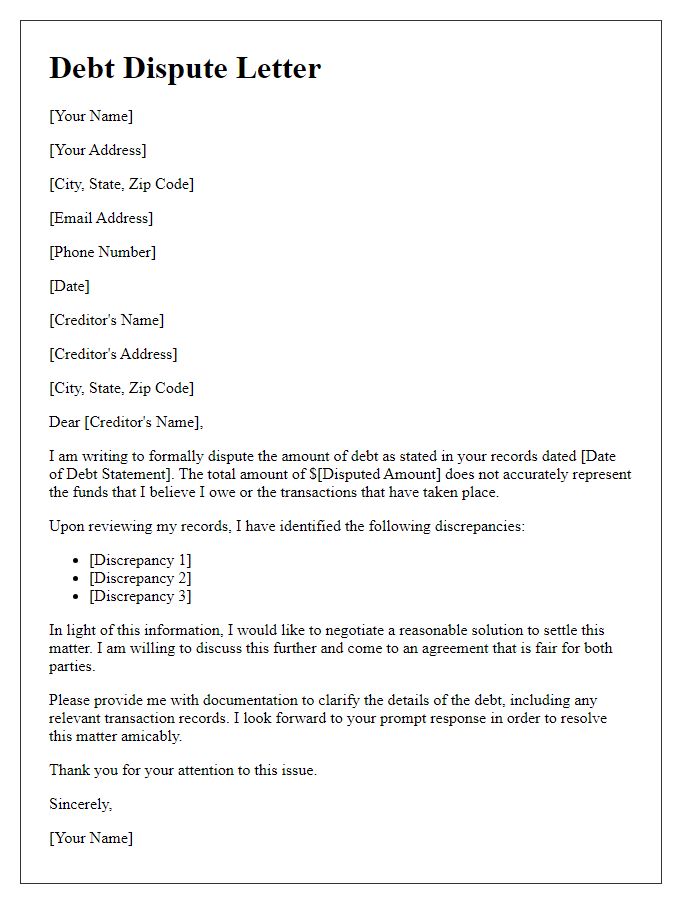

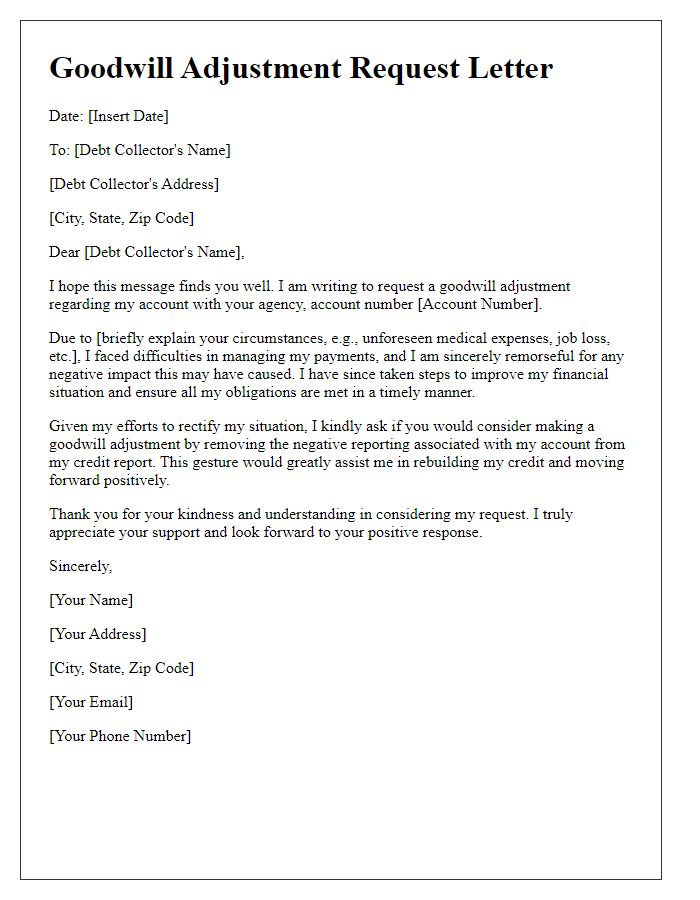

Debt acknowledgment letters serve as formal communications to debt collectors, indicating recognition of outstanding balances. Such letters typically include essential details, including the total debt amount, the original creditor's name (for instance, Bank of America), and the specific account number. A sender's willingness to negotiate often signifies intent to settle for a reduced amount, highlighting a financial hardship, which might be due to events such as medical expenses or unemployment. Offering a lump sum or a structured payment plan can be mentioned as potential solutions for resolution. This approach fosters an environment conducive to negotiations between the debtor and the creditor, possibly leading to beneficial outcomes for both parties.

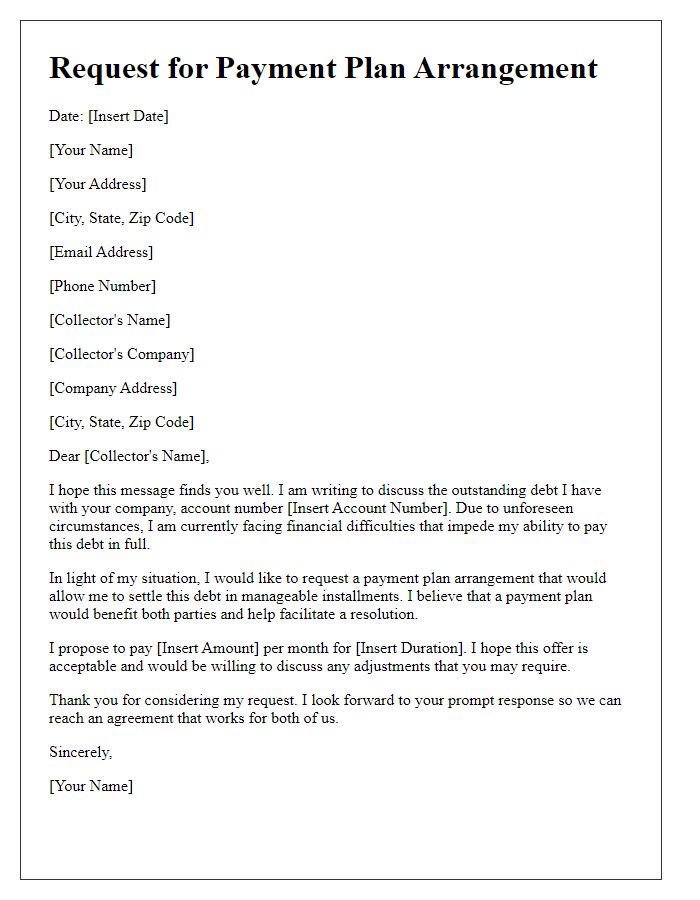

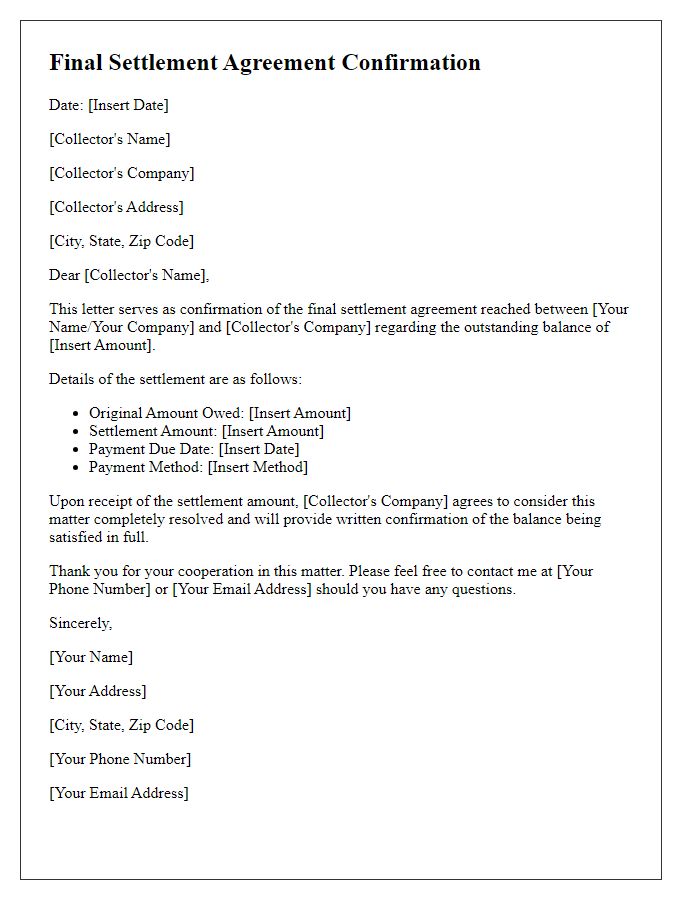

Proposed settlement amount and terms

Negotiating a settlement with debt collectors can be a strategic way to resolve outstanding debts while minimizing the financial burden. A proposed settlement amount should reflect a reasonable compromise, taking into consideration the total debt owed, typically negotiated at a percentage (commonly 30-70% of the original balance). Clear terms for the settlement should be established, including payment deadlines, the format of payments (lump sum or installment), and the request for a written confirmation of the settlement agreement. The effectiveness of such negotiations often relies on understanding the collector's willingness to accept reduced payments and any possible legal implications. Additionally, potential impact on credit scores should also be evaluated. Note: When discussing specific figures during negotiations, always remain aware of state laws regarding debt collection which may influence both the negotiation process and settlement terms.

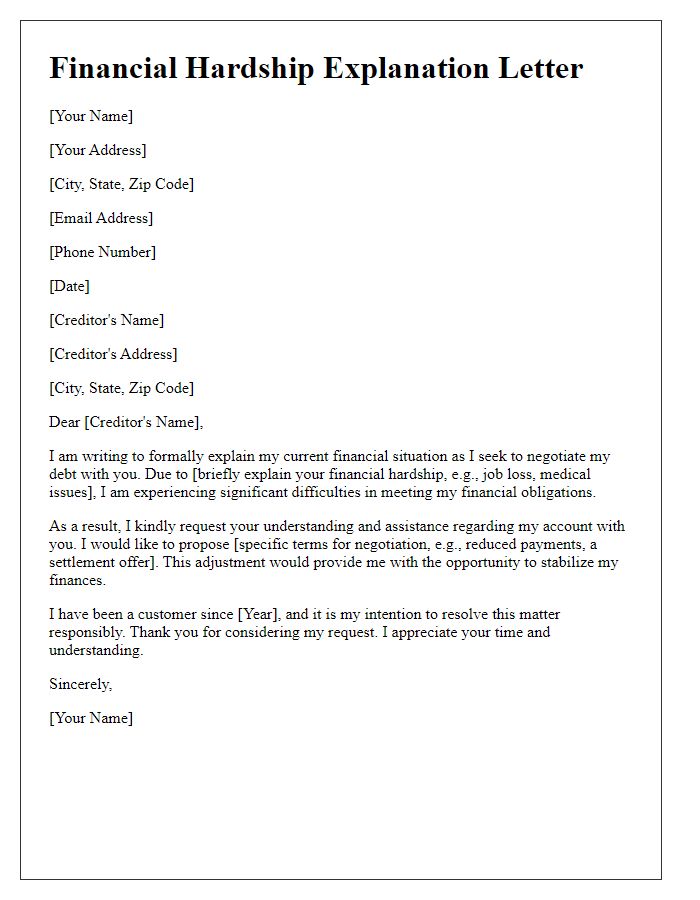

Justification for proposed terms based on financial situation

Negotiating a settlement with debt collectors requires a clear understanding of financial circumstances and a well-articulated justification for proposed terms. Key elements, such as total debt amount, monthly income, essential living expenses (rent, utilities, groceries), and any other financial obligations (medical bills, child support), play a critical role in this negotiation process. For instance, if a person's monthly income is $3,000 while their essential expenses total $2,500, this leaves only $500 for debt repayment. Highlighting unexpected financial burdens, like loss of employment or medical emergencies, further supports the proposed settlement terms, giving collectors a clearer picture of the individual's ability to meet financial commitments. Furthermore, referencing consumer protection laws, such as the Fair Debt Collection Practices Act, emphasizes the importance of fair and reasonable negotiation practices.

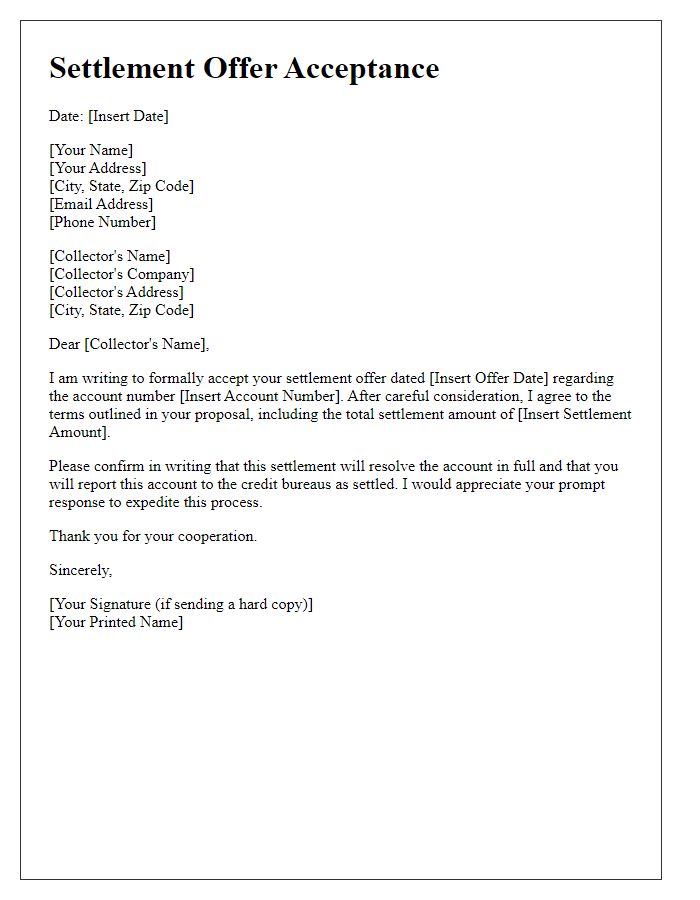

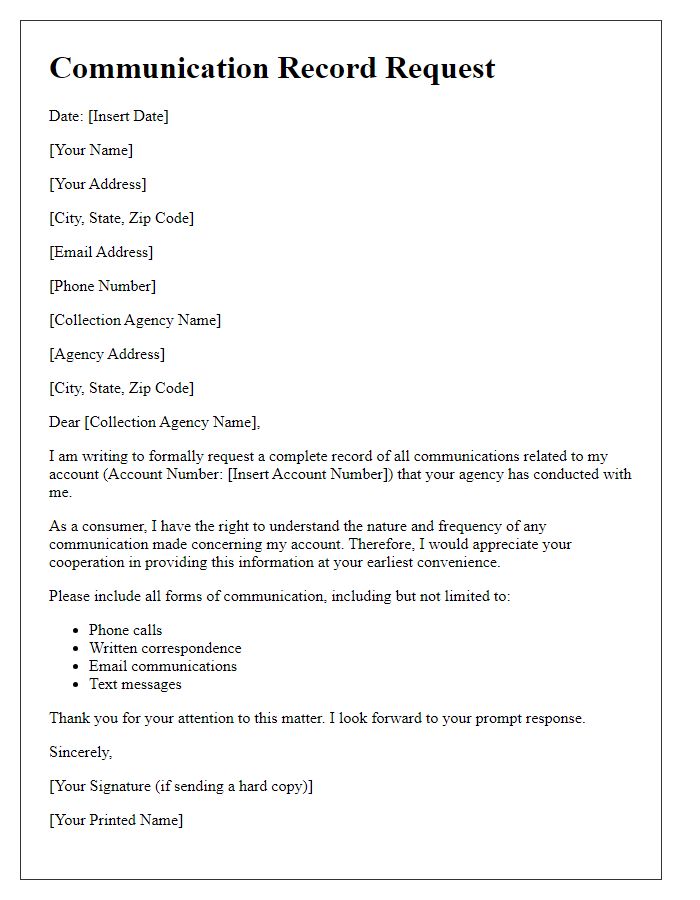

Request for written confirmation if accepted

Negotiating settlements with debt collectors requires clear communication. Include essential details like the collector's company name, outstanding debt amount, and specific terms you propose. Highlight your willingness to settle the debt for a specific sum, ensuring the amount is feasible considering your financial situation. Request written confirmation that the settlement terms are accepted, noting the importance of documented agreements for future reference. Specify a deadline for their written response, typically within 30 days, to maintain urgency and clarity in the negotiation process. This structured approach not only conveys professionalism but also solidifies your intent to resolve the matter amicably.

Comments