When it comes to navigating the often complex world of loans, understanding your fees is crucial. If you've recently noticed unexpected loan origination fees that seem excessive or unjustified, it's important to take action. In this article, we'll guide you through crafting a compelling letter to dispute these charges and ensure your voice is heard. So, let's dive in and arm you with the tools to tackle those fees head-on!

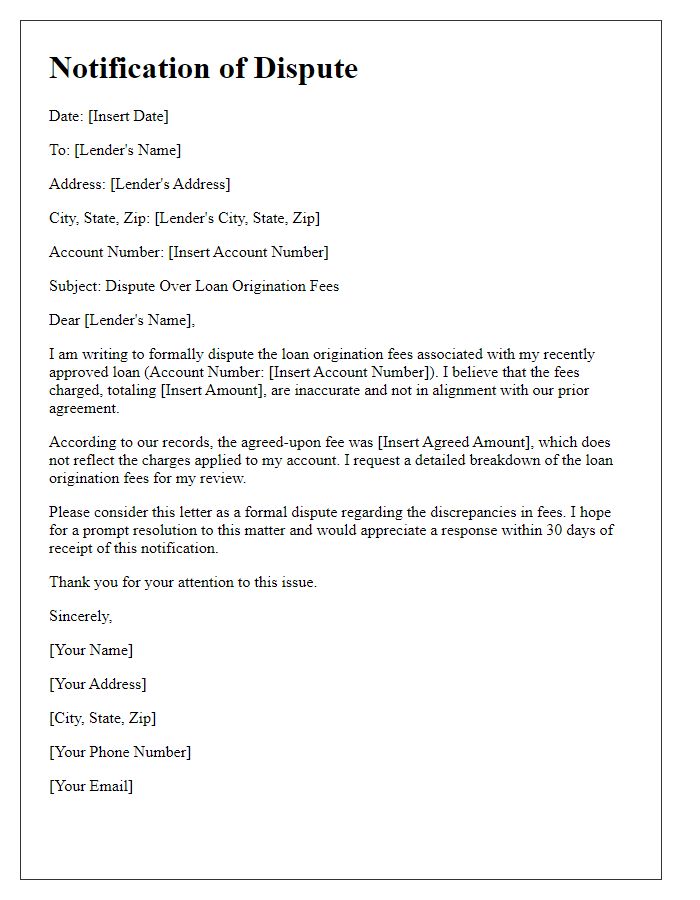

Clear Subject Line

Disputing Unjust Loan Origination Fees Charged by [Lender's Name] on [Loan Account Number] - Request for Review

Borrower's Personal Information

Loan origination fees can significantly impact the overall cost of borrowing. Typically, these fees range from 0.5% to 1% of the loan amount, affecting borrowers seeking financing for homes, cars, or personal loans. Disputes often arise when fees appear excessive or unjustified, leading to challenges in transparency and clarity. The Fair Lending Act, enacted in 1968, mandates fair treatment in loan originations, ensuring that lenders provide clear explanations for fees charged. For borrowers, an examination of the loan agreement and a detailed itemization of the fees can reveal discrepancies. Additionally, awareness of state regulations can influence the outcome of disputes, as laws vary by jurisdiction, addressing how fees must be presented and justified by lenders.

Loan Details

Disputing loan origination fees requires a clear presentation of loan details. Loan Amount: $25,000, Interest Rate: 5.5%, Loan Term: 60 months, Lender: XYZ Financial Services. Loan Origination Fee: $1,200, which constitutes 4.8% of the loan amount. The average origination fee in the industry typically ranges from 0.5% to 1%. Discrepancies in fees can arise if not aligned with agreed-upon terms in the loan agreement dated July 15, 2023. A thorough examination of the Loan Estimate document reveals an inconsistency in the listed fees compared to the Initial Disclosure statement provided before loan closing. Documentation should highlight the potential for recalibration based on regulatory guidelines set by the Consumer Financial Protection Bureau (CFPB) to ensure fair lending practices.

Specific Dispute Points

Loan origination fees, typically ranging from 0.5% to 1% of the total loan amount, can significantly impact the overall cost of borrowing. Disputes may arise if the lender does not disclose these fees upfront, violating the Truth in Lending Act (TILA) regulations. Borrowers should refer to their Good Faith Estimate (GFE) provided at the beginning of the loan process, ensuring the fees align with what was stated. Unjustifiable increases from the initially quoted fees, particularly in cases of pre-approval, can highlight potential predatory lending practices. Additionally, comparing origination fees against industry standards and examining the Annual Percentage Rate (APR) for discrepancies will strengthen the case for dispute, particularly if the loan is secured from a Federal Housing Administration (FHA) approved lender.

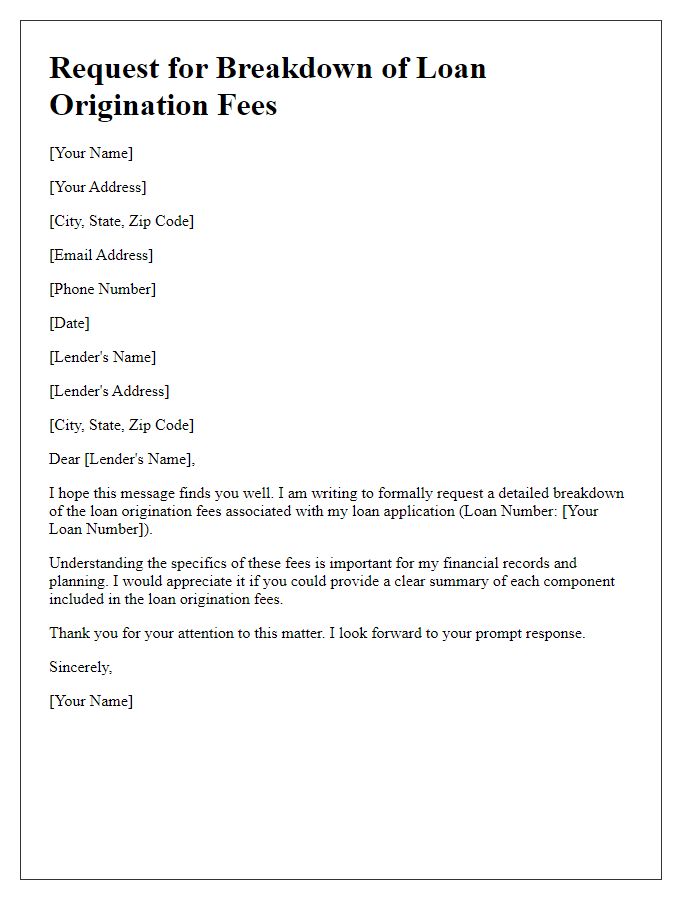

Request for Review and Resolution

Loan origination fees, often perceived as excessive or unjustified, can significantly impact borrowers' financial obligations. For instance, in a $200,000 mortgage, a 1% origination fee translates to $2,000 added to upfront costs. Borrowers are advised to scrutinize these fees outlined in the Loan Estimate document from their lender, typically provided within three business days after application. Loan origination fees are meant to cover administrative costs incurred during the loan approval process; however, discrepancies in these charges can lead to disputes. Instances of inflated fees resulting from aggressive lending practices can result in financial strain for borrowers, prompting the need for a formal review and resolution request directed at the mortgage lender.

Comments