Are you struggling with duplicate debt entries on your credit report? It's frustrating to see incorrect information that could impact your financial well-being. In this article, we'll guide you through crafting a clear and effective dispute letter to resolve these discrepancies. Read on to learn how to take control of your credit report and ensure it accurately reflects your financial history!

Personal Information and Account Details

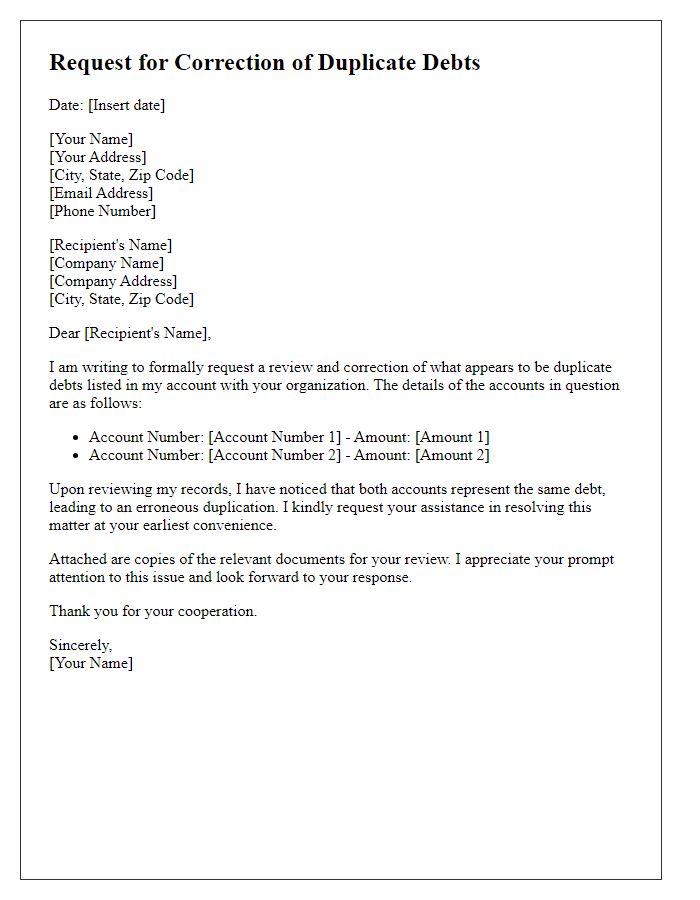

Disputing duplicate debt entries can be essential for maintaining accurate financial records. Affected individuals should prepare a comprehensive document including their full name (ensuring identification accuracy), current address (to facilitate communication), and contact information (such as phone number and email). Details of the disputed debts should include the names of creditors (specific financial institutions involved), account numbers (unique identifiers for borrower accounts), dates of transactions (indicating when debts were incurred), and original amounts owed (in order to define the scope of the dispute). Incorporating supporting documentation (like payment records or correspondence) will further substantiate the claims. This thorough documentation is critical when addressing inaccuracies with credit reporting agencies or challenging creditors directly.

Specific Details of Duplicate Entries

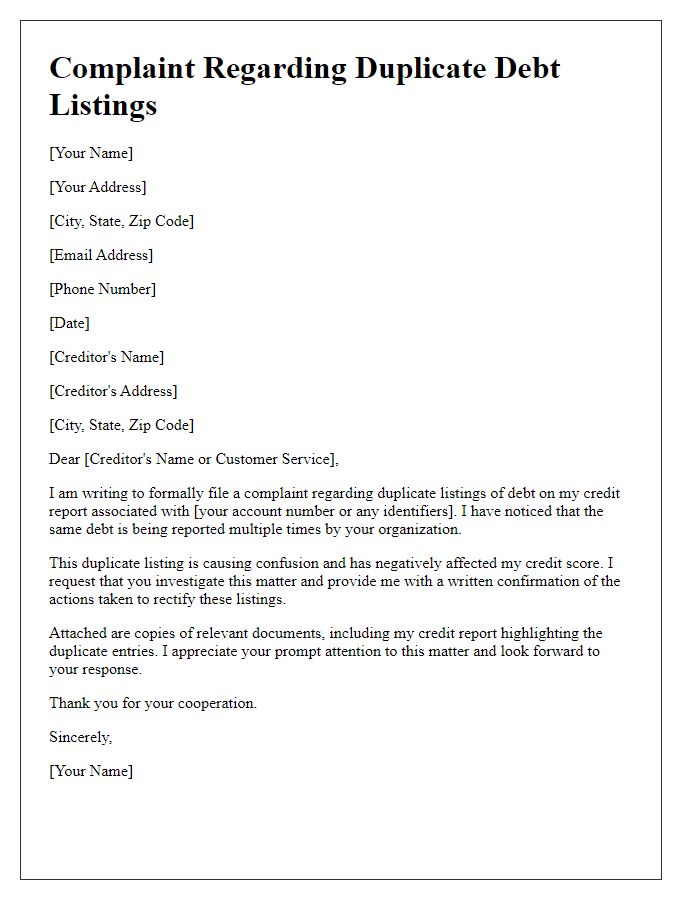

Duplicate debt entries in credit reports can severely impact credit scores, leading to challenges in obtaining loans or credit cards. For instance, if the same account appears multiple times, creditors may perceive it as outstanding debt, even when it has been resolved. Entities like Experian and Equifax, which process over 1 billion credit reports annually, emphasize the importance of accurate information. A review of reports from these agencies may reveal discrepancies, such as two identical accounts with the same balance and creditor name listed, creating confusion. Timely disputes, within the 30-day investigation period mandated by the Fair Credit Reporting Act, are crucial to rectify such errors and restore financial reputation.

Dispute Reason and Supporting Evidence

Disputing duplicate debt entries in credit reports is crucial for maintaining accurate financial records. Duplicate entries can negatively impact credit scores, leading to unfair lending practices and increased interest rates. In this context, the Fair Credit Reporting Act (FCRA) provides a framework for consumers to challenge inaccuracies. When preparing a dispute, it is essential to gather supporting evidence such as credit reports, correspondence with creditors, and payment records. For example, if the same debt is reported by two different collection agencies, documenting the original creditor's account number and payment history can substantiate the claim. Timely submission of the dispute to credit reporting agencies like Experian, Equifax, or TransUnion can initiate the investigation process, forcing the agencies to verify the legitimacy of the entries in question and potentially resulting in the removal of erroneous records.

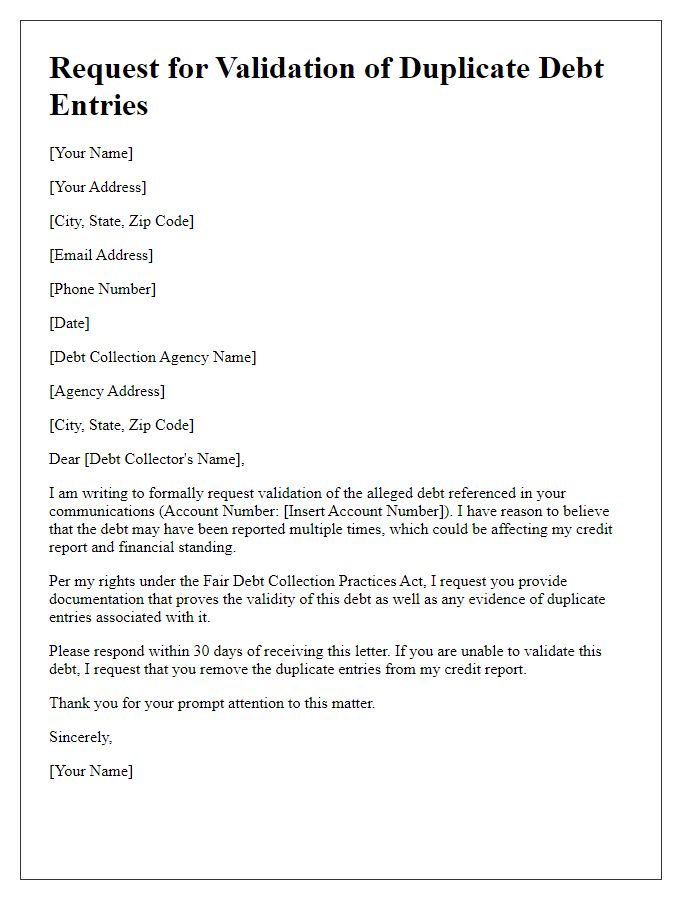

Legal References and Fair Credit Reporting Act (FCRA) Notice

Disputing duplicate debt entries is crucial for maintaining accurate credit reports. Under the Fair Credit Reporting Act (FCRA), consumers have the right to dispute incorrect information appearing on their credit reports, specifically regarding duplicate entries from creditors. Duplicate debts can signify potential fraud or errors, undermining credit scores and financial opportunities. Affected individuals can leverage Section 609 of the FCRA, which mandates accurate reporting by creditors, to challenge these discrepancies. Submitting a formal dispute through certified mail, including relevant details such as credit report copies, debt account numbers, and a clear statement of the dispute, aids in obtaining a thorough investigation by credit reporting agencies, ensuring compliance and accuracy within 30 days per FCRA regulations.

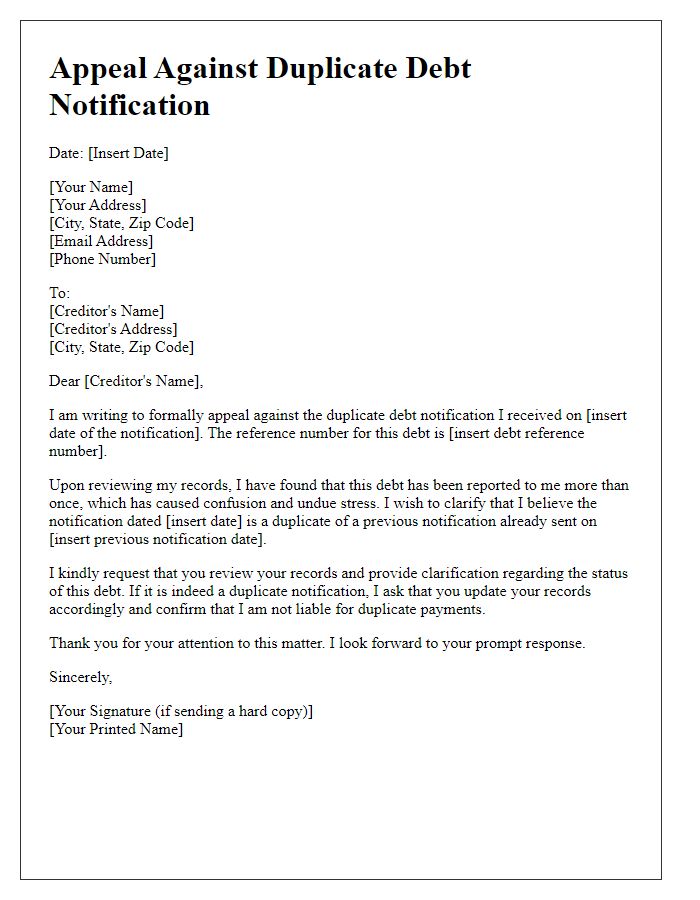

Request for Confirmation and Response Timeframe

Duplicate debt entries can complicate credit reports for consumers, potentially leading to financial discrepancies and confusion. When such issues arise, it's essential to seek clarification from creditors or credit reporting agencies. A request for confirmation should include specific details such as the account numbers associated with the disputed debts, the dates when the debts were reported, and the corresponding amounts. Consumers may also inquire about the timeframe for receiving a response, as regulatory guidelines often dictate a standard period of 30 days for investigations. Clear communication regarding timelines not only assists in resolving the dispute more efficiently but also ensures that consumers remain informed about their credit status throughout the process.

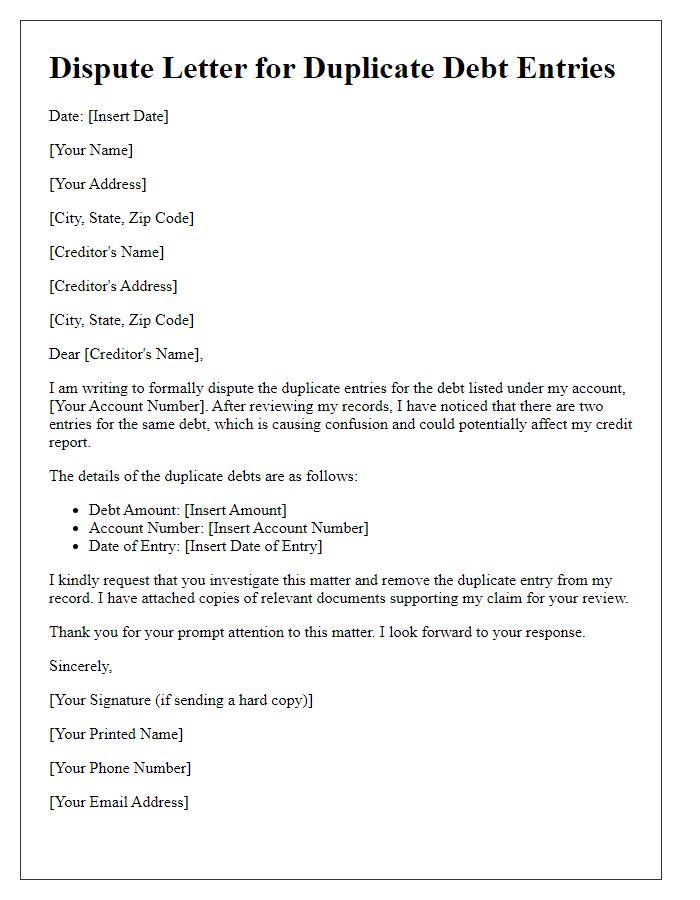

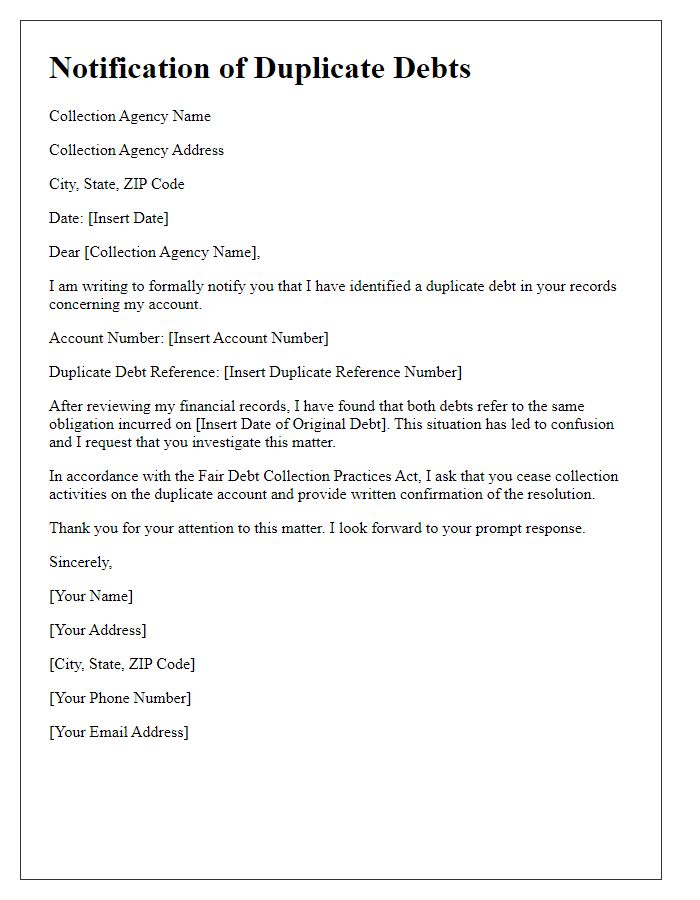

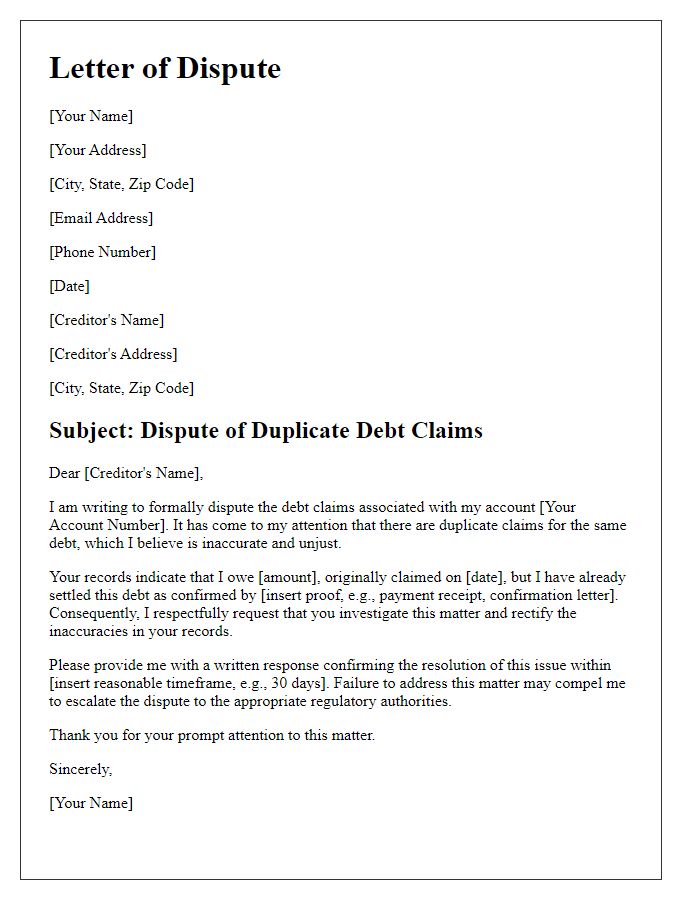

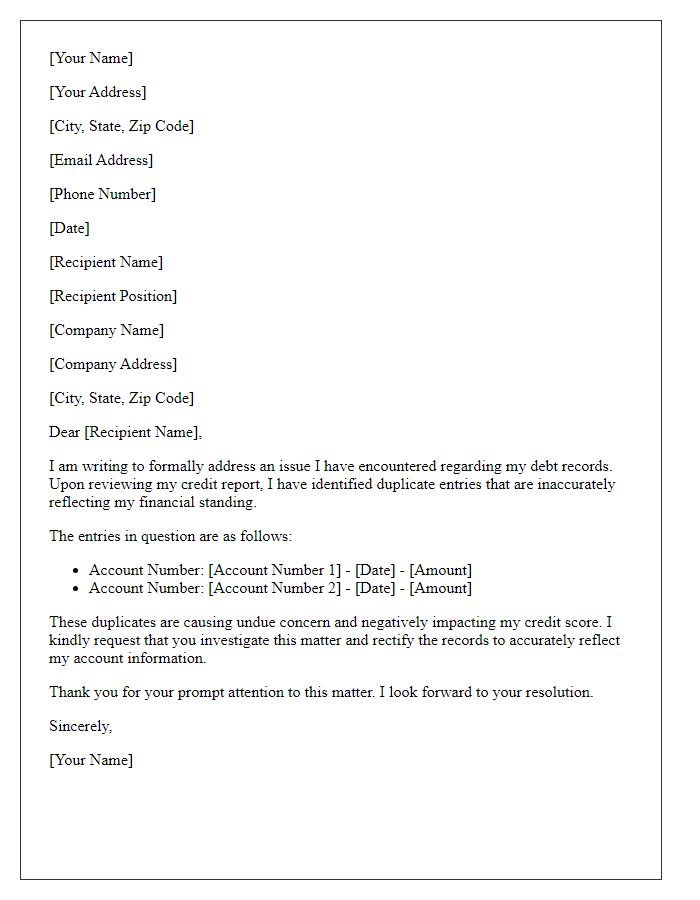

Letter Template For Disputing Duplicate Debt Entries Samples

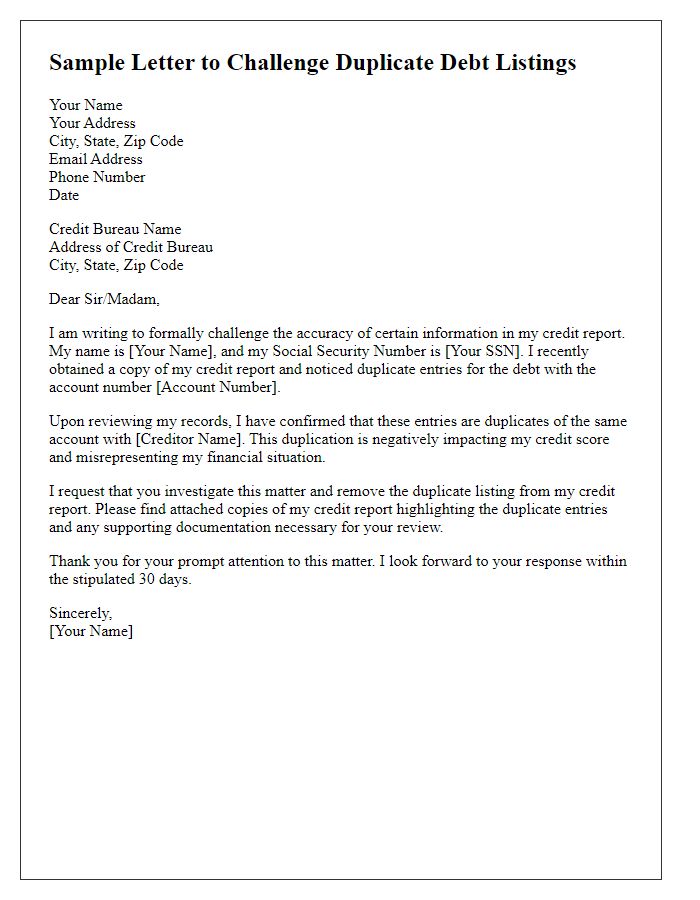

Letter template of challenging duplicate debt listings on credit report.

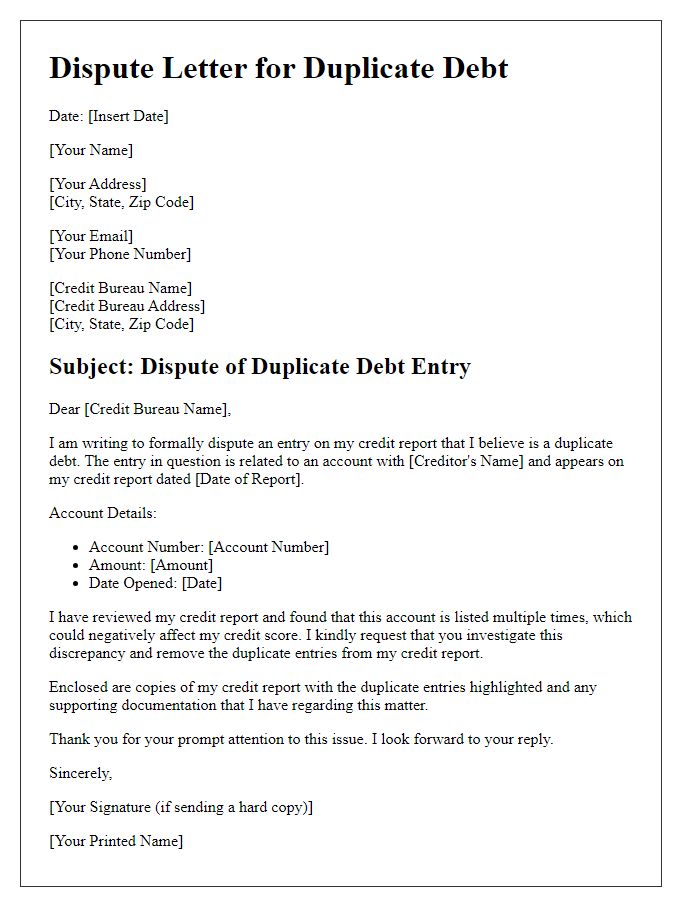

Letter template of informing credit bureaus about duplicate debt discrepancies.

Comments