Are you feeling overwhelmed by credit card debt and unsure of where to turn? You're not aloneâmany people find themselves in similar situations, struggling to make sense of their financial obligations. This article will guide you through the process of negotiating debt forgiveness with your credit card company, providing valuable tips and strategies to help you regain control. Read on to discover how you can take the first step towards financial freedom!

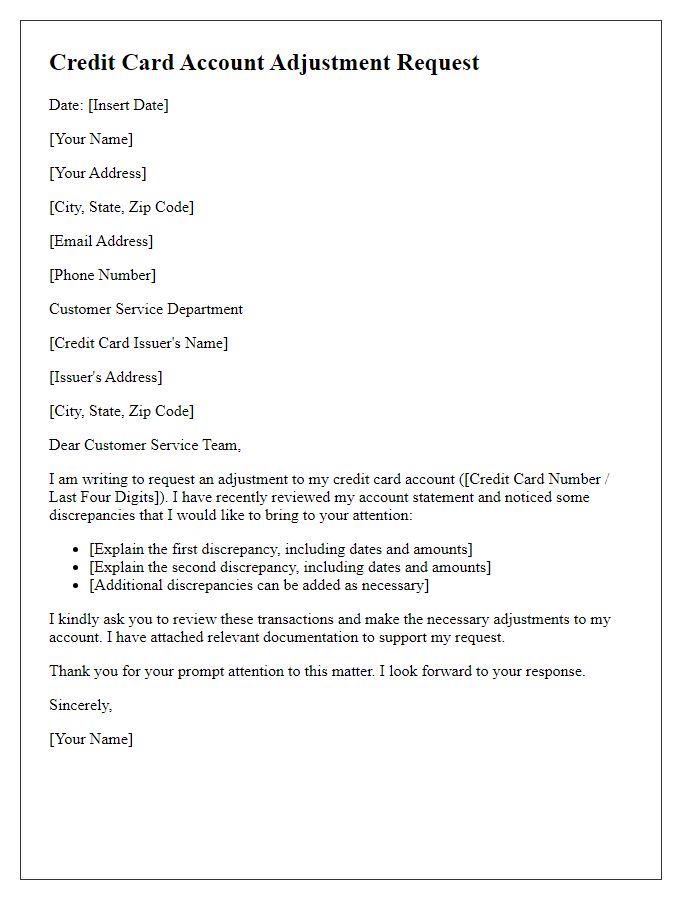

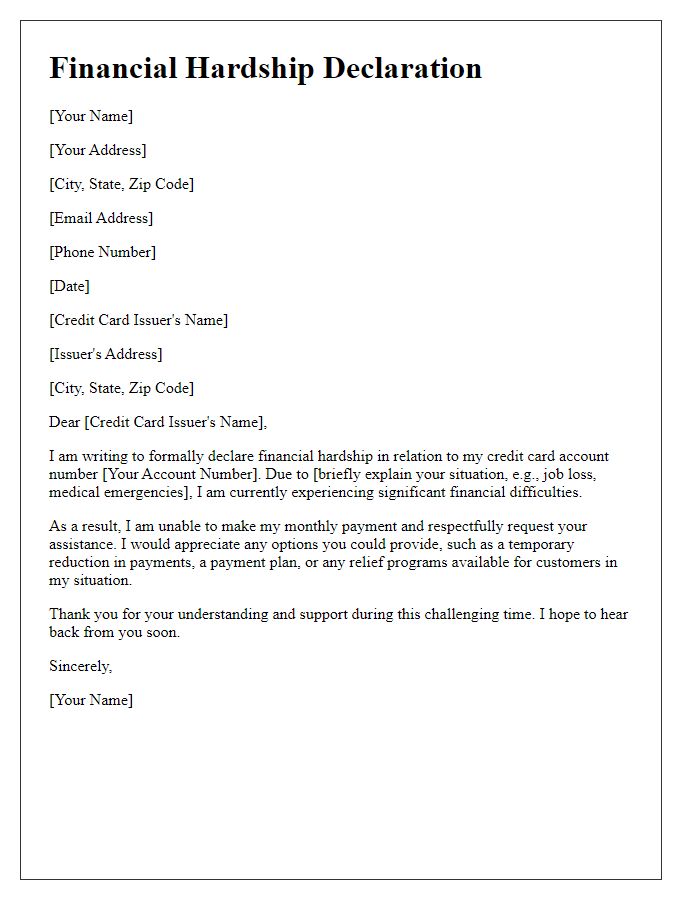

Personal Information

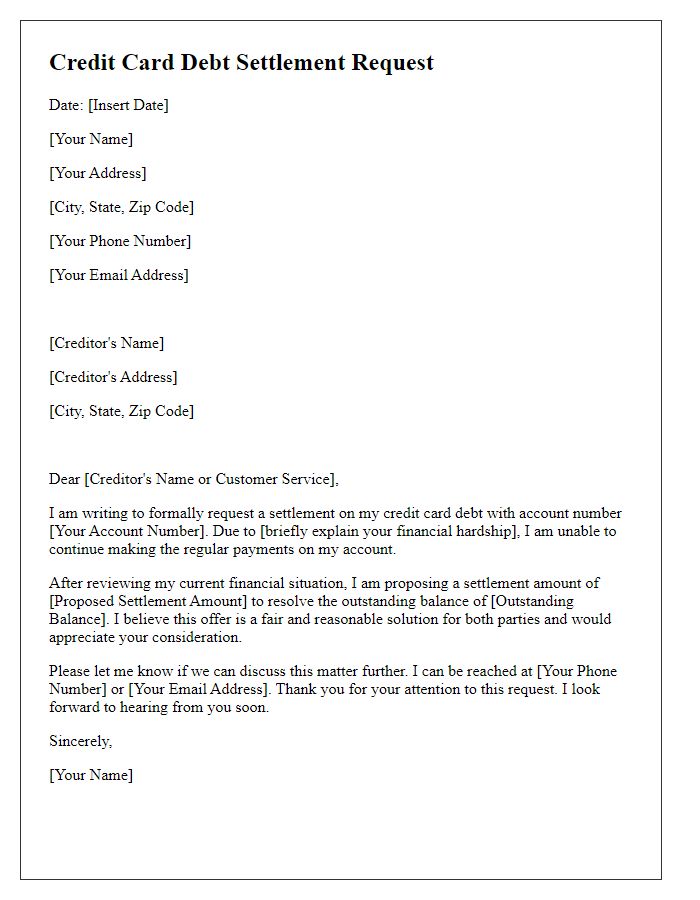

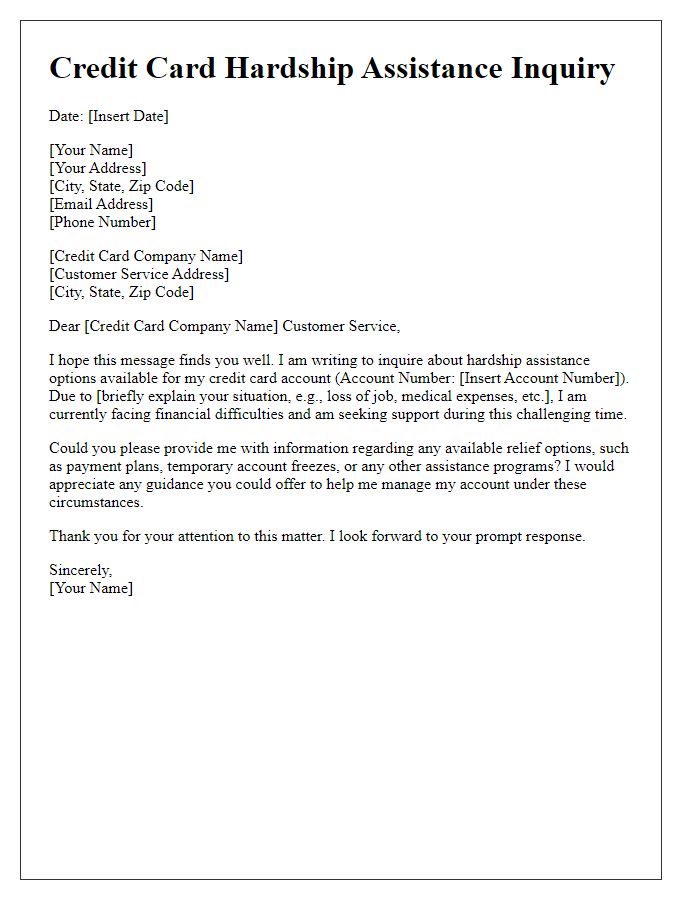

Navigating credit card debt can be overwhelming, particularly when dealing with multiple accounts and high-interest rates. Negotiating for debt forgiveness or a reduction in overall balances can provide significant relief for individuals struggling to meet their financial obligations. In this context, personal information, including the individual's name, address, and account number, is crucial for identifying the specific debts being addressed. Additionally, providing financial background, such as income details and monthly expenses, allows creditors to assess the request's legitimacy. Essential documents, like income statements or budget plans, can strengthen the negotiation process, highlighting a genuine need for assistance and fostering more favorable outcomes with credit card companies.

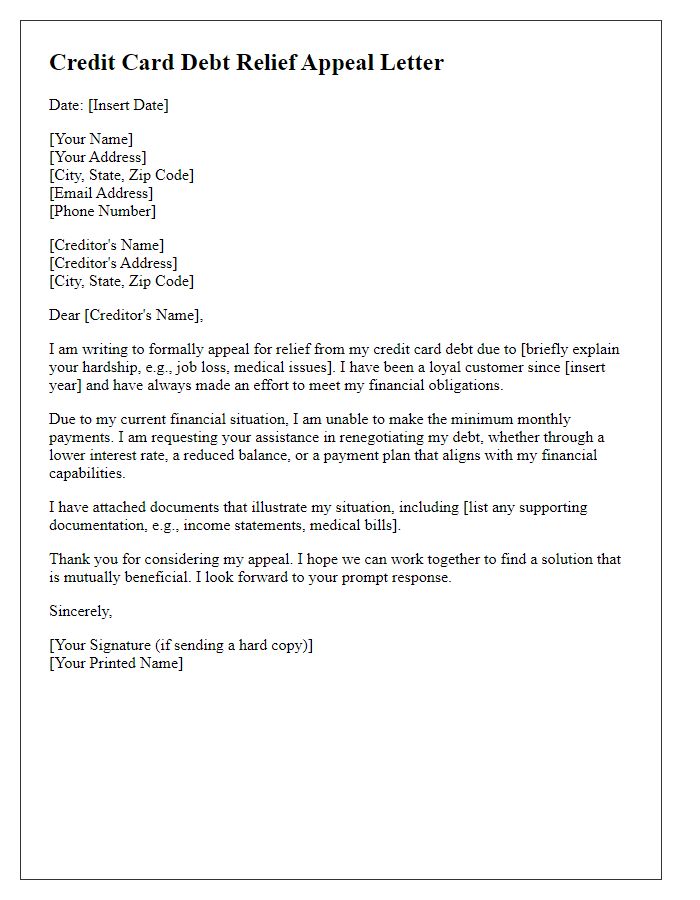

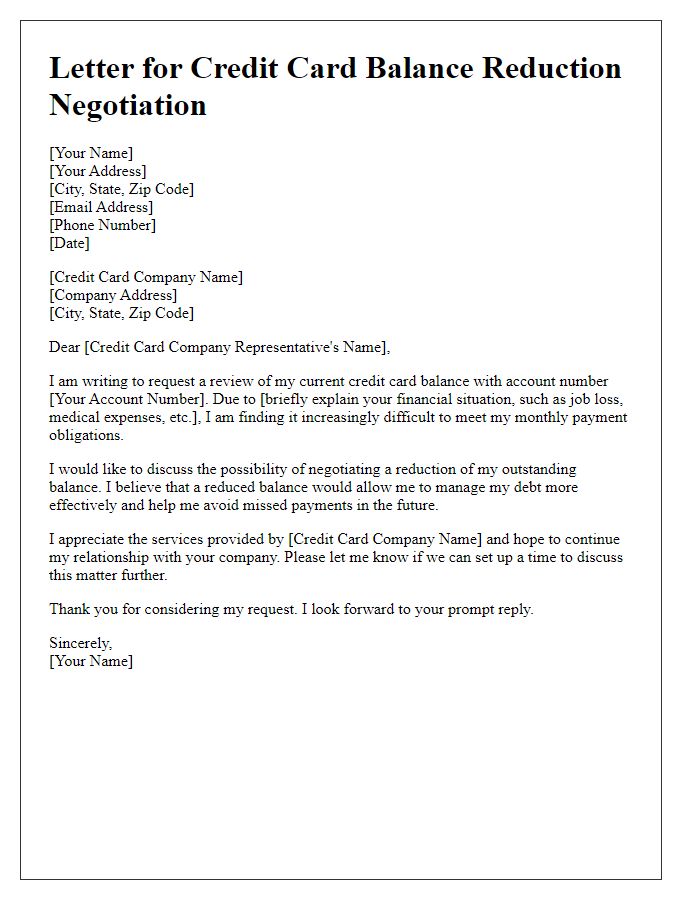

Financial Hardship Explanation

Numerous individuals face financial hardship, often leading to overwhelming credit card debt, a situation exemplified by statistics indicating that approximately 40% of U.S. households carry some form of credit card debt. Specific events such as job loss, medical emergencies, or unexpected home repairs increase vulnerability to financial strain. For instance, medical bills often exceed $3,000 for hospital visits, severely impacting the ability to meet monthly credit obligations. Furthermore, interest rates on credit cards can reach as high as 30%, exacerbating the debt cycle. In locations like California, where the cost of living continues to rise, families find it increasingly difficult to manage monthly expenses, leading to a need for negotiation regarding credit card debt forgiveness. Engaging financial institutions for potential relief or restructuring can provide a vital lifeline, allowing individuals to regain financial stability and prevent long-term detrimental impacts on their credit scores, which typically fall between 300 and 850.

Specific Debt Details

When negotiating credit card debt forgiveness, details about the specific debt are crucial. Credit card debt (revolving credit accounts) often comes with high-interest rates, typically ranging from 15% to 30%. For instance, if the outstanding balance is $10,000 with a 22% interest rate, monthly payments can exceed $400 depending on the repayment terms. Collectively, the average American household carries approximately $8,000 in credit card debt, leading to significant financial strain, especially if the cardholder experiences a loss of income or unexpected medical expenses. Citing specific financial hardship as a reason for negotiation can strengthen the case, especially in light of events such as economic downturns or job losses. Additionally, mentioning potential alternatives like debt settlement offers or payment plans can further enhance the negotiation strategy. It's important to keep records of all communication with creditors, as well as any documentation relating to outstanding payments or hardship situations.

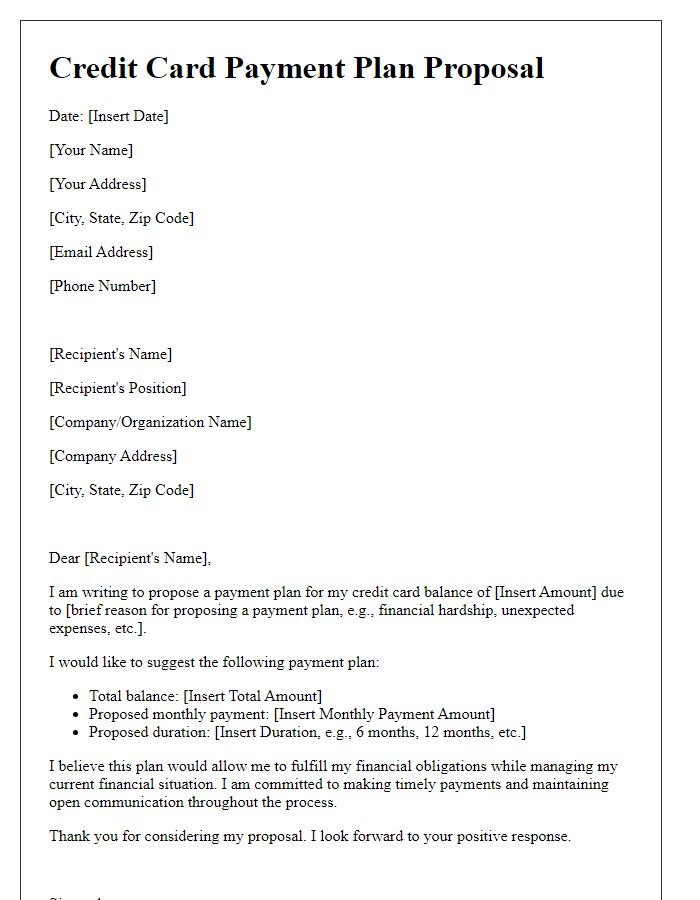

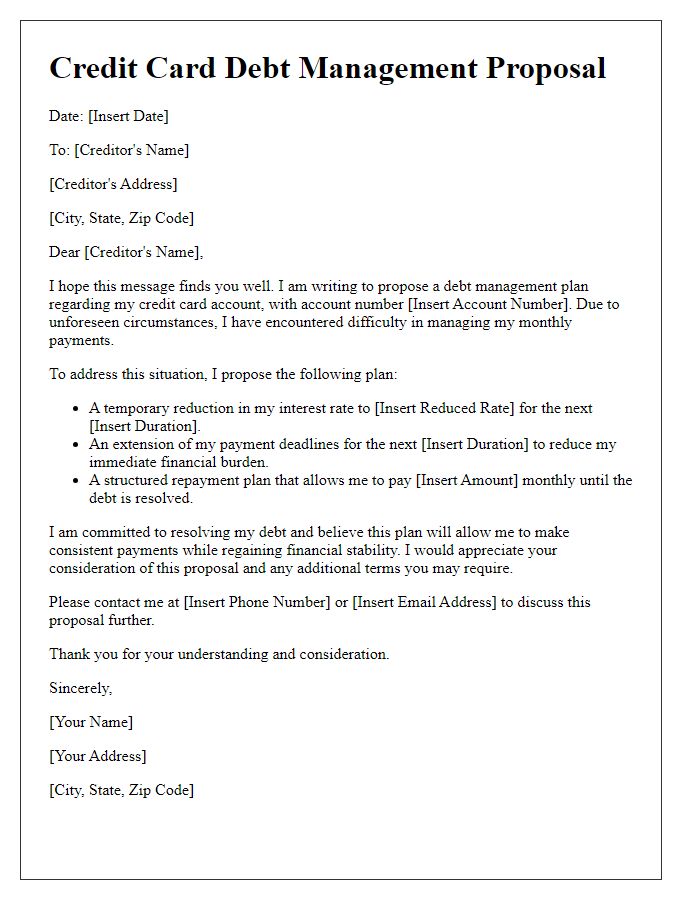

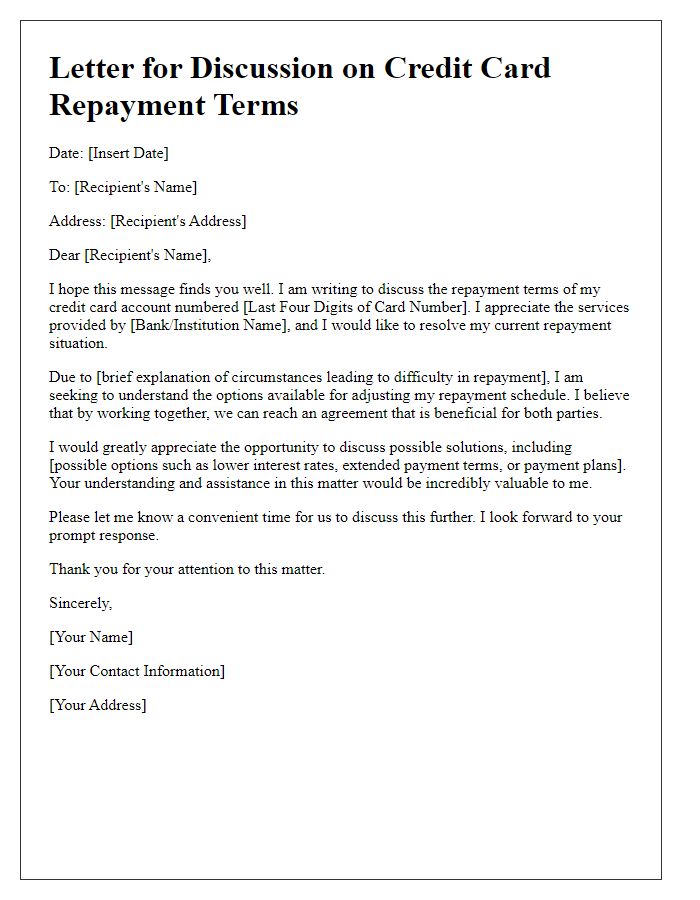

Proposed Settlement or Payment Plan

Credit card debt forgiveness negotiations involve discussing potential settlements or payment plans with creditors. Effective communication can lead to favorable outcomes for financial relief. When proposing a settlement, clearly state the amount you can offer, considering your financial situation and any hardship (such as job loss or medical expenses). Detail key data points such as total debt amount, outstanding balance, and your proposed payment terms. Additionally, mention relevant dates to facilitate a prompt response, indicating your commitment to resolving the matter. Crafting a respectful and concise communication can increase the likelihood of acceptance by creditors.

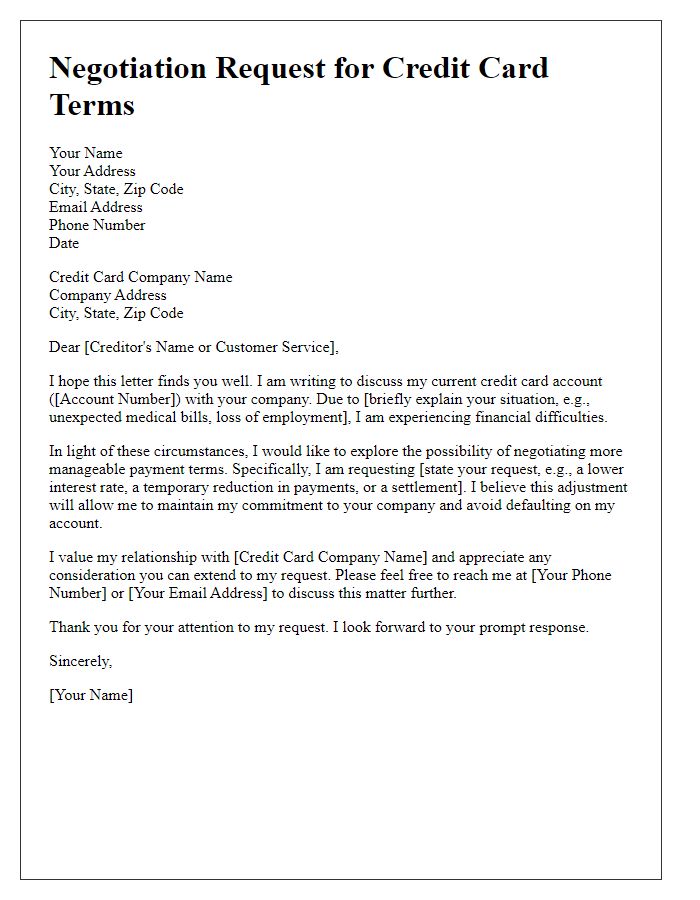

Request for Response and Next Steps

Negotiating credit card debt forgiveness involves various factors including outstanding balances, interest rates, and creditor policies. Credit card debt often accumulated due to high-interest rates, typically ranging between 15% to 25%. A debtor may seek forgiveness to alleviate financial burdens arising from unforeseen personal circumstances such as job loss or medical expenses. It is essential for debtors to gather documentation of income, expense statements, and any correspondence with their creditors, which can enhance their negotiation position. The creditor's willingness to negotiate can vary significantly; some larger institutions may have specific programs for hardship cases or may accept settlement offers. A well-constructed proposal should emphasize the debtor's intent to resolve the debt while outlining the difficulties faced. Timely follow-up communication is crucial, adding structure to the negotiation process and nurturing the relationship with the creditor for future interactions.

Comments