Are you feeling overwhelmed by debt and unsure where to turn? You're not aloneâmany individuals face similar financial challenges, and seeking help is a smart step toward regaining control of your finances. Our consumer credit counseling services are designed to provide you with the guidance and support you need to turn your financial situation around. Join us as we explore the resources available to you, and discover how we can help you pave the way to a brighter financial future!

Client's Financial Situation Overview

A meticulous financial assessment reveals the client's current economic landscape characterized by an accumulating debt burden amounting to $45,000 across various credit lines, including credit cards, personal loans, and medical bills issued by regional healthcare facilities. Monthly income stands at $3,200, creating a challenging financial disparity when juxtaposed with essential monthly expenses that total approximately $2,800. Analysis identifies discretionary spending habits, including dining and entertainment, which consume around $400 each month, further straining the budget. A comprehensive review of credit reports from major bureaus, including Experian and TransUnion, indicates a credit score of 580, qualifying as "fair" and limiting options for favorable financing solutions. Researching local financial literacy workshops, often held at community colleges, can offer educational resources to improve both financial stability and management skills.

Debt Details and Prioritization

Debt management involves analyzing outstanding balances, interest rates, and payment schedules to develop a structured repayment strategy. Credit card debt, typically with high-interest rates, requires prioritization due to potential late fees and negative credit score impact. Auto loans, with fixed monthly payments, need careful consideration to avoid repossession (the action of reclaiming assets). Medical debts, which often lack interest, can be flexible but should not be ignored as they may lead to collections. Student loans differ based on federal or private categorization, with various repayment plans available. Maintaining communication with creditors during this process is essential to negotiate payment terms and avoid additional fees.

Repayment Plan Structure

Developing a repayment plan structure for consumers seeking assistance from credit counseling services is essential for achieving financial stability. A detailed breakdown of payment options can aid individuals in managing their debts effectively, potentially involving monthly installments structured around income levels and necessary living expenses. Specific dates for payment deadlines must be clearly outlined, such as the first payment due on the 15th of each month. Additionally, establishing a fixed interest rate, for example, 5% annually on consolidated debt, can help borrowers grasp the total amount owed over time. It is crucial to involve creditors in creating a realistic repayment schedule, indicating willingness to negotiate terms, potentially reducing outstanding balances. Noteworthy is the importance of regular progress reviews, suggesting quarterly assessments to ensure compliance with the plan and make adjustments if necessary, ultimately guiding individuals towards financial recovery and peace of mind.

Counseling Service Benefits Explanation

Consumer credit counseling services play a vital role in helping individuals manage their finances effectively and improve their credit standings. These services provide personalized assessments through experienced counselors who analyze financial situations, debts, and income sources, determining the most viable debt repayment plans. A significant benefit includes access to educational resources that empower consumers with budgeting skills and financial literacy, aiming to prevent future fiscal mismanagement. Enrollment in a debt management plan consolidates payments, making them more manageable by potentially reducing interest rates on unsecured debts like credit cards. Additionally, these counseling services can offer ongoing support and accountability, which significantly enhance the likelihood of successful financial recovery and long-term economic health.

Contact Information and Next Steps

Consumer Credit Counseling Services provide essential support for individuals facing financial challenges. Upon reaching out for assistance, clients are typically required to provide their contact information, including full names, addresses, phone numbers, and email addresses. This information helps establish a personalized financial profile and allows counselors to suggest tailored solutions. Next steps often involve scheduling an appointment--either in-person or virtual (utilizing platforms like Zoom)--to review financial situations thoroughly. During this session, clients may discuss factors such as outstanding debts, monthly income, and budgeting strategies, enabling counselors to create actionable debt management plans. Important consumer resources, such as financial literacy workshops (offered frequently through local nonprofits), may be recommended to empower clients for long-term financial stability.

Letter Template For Consumer Credit Counseling Service Samples

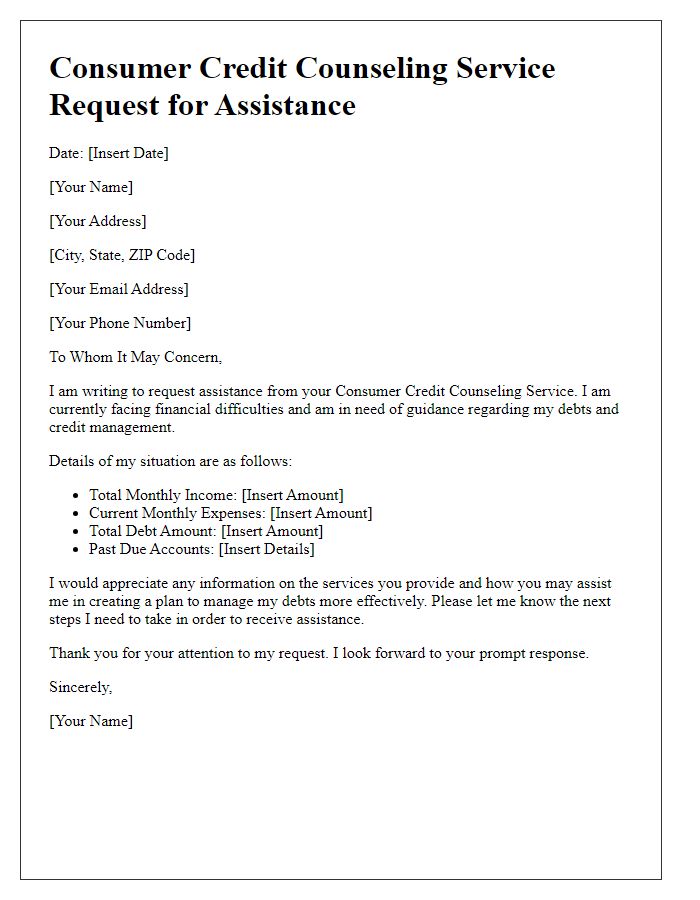

Letter template of consumer credit counseling service request for assistance.

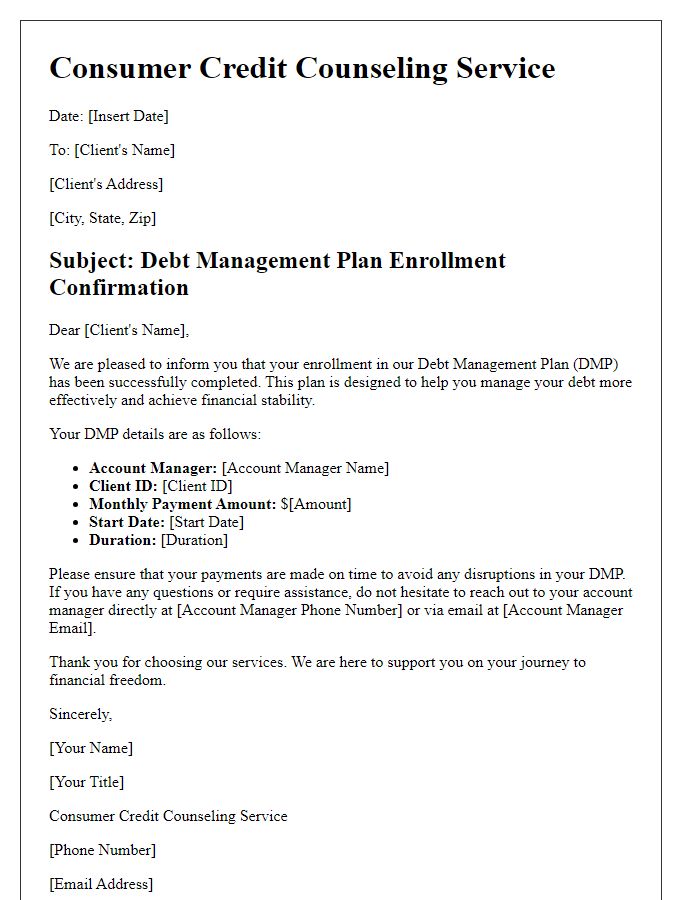

Letter template of consumer credit counseling service for debt management plan enrollment.

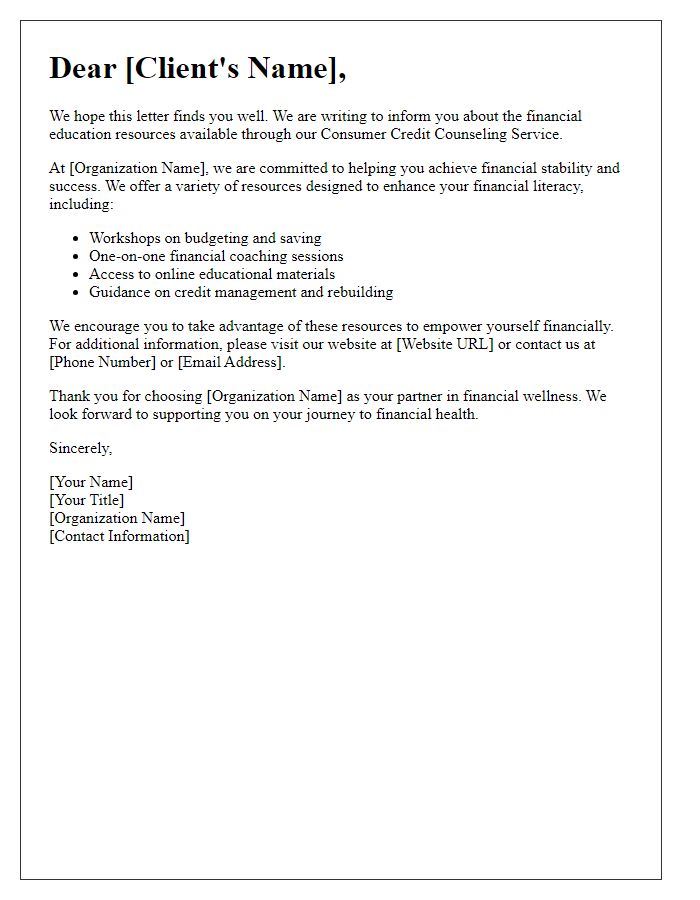

Letter template of consumer credit counseling service for financial education resources.

Letter template of consumer credit counseling service for a credit report review.

Letter template of consumer credit counseling service for budgeting assistance.

Letter template of consumer credit counseling service for negotiating with creditors.

Letter template of consumer credit counseling service seeking information on fees.

Letter template of consumer credit counseling service for progress update on debt repayment.

Letter template of consumer credit counseling service for withdrawal from a program.

Comments