Writing a letter to request the closure of a debt account can feel daunting, but it doesn't have to be. It's essential to express your intentions clearly while ensuring that all necessary details are included for a smooth process. By crafting a concise and effective letter, you can take a significant step towards regaining control of your financial health. Curious about the key elements to include? Let's dive in!

Account Information and Details

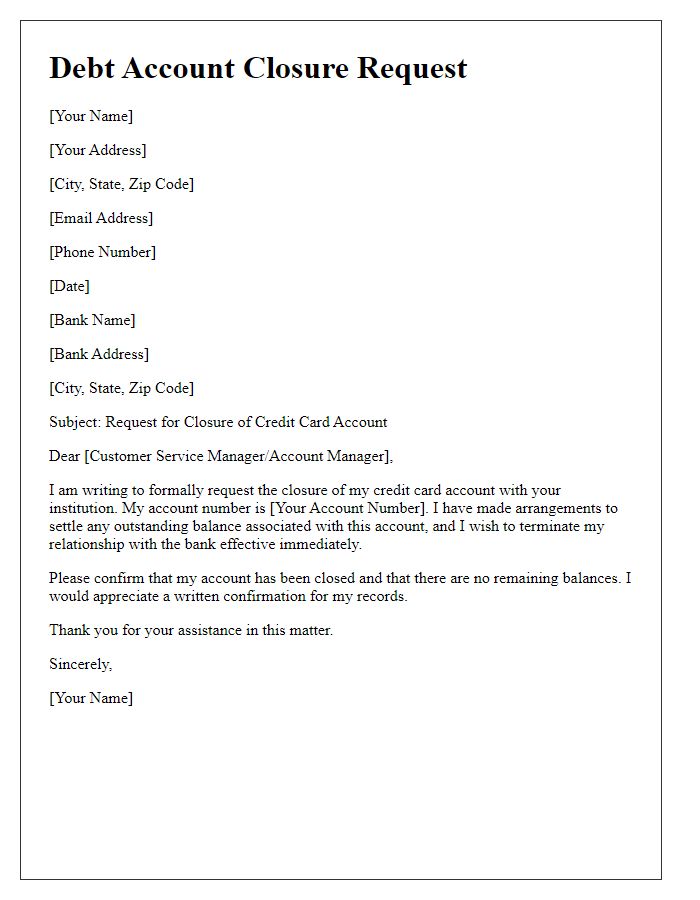

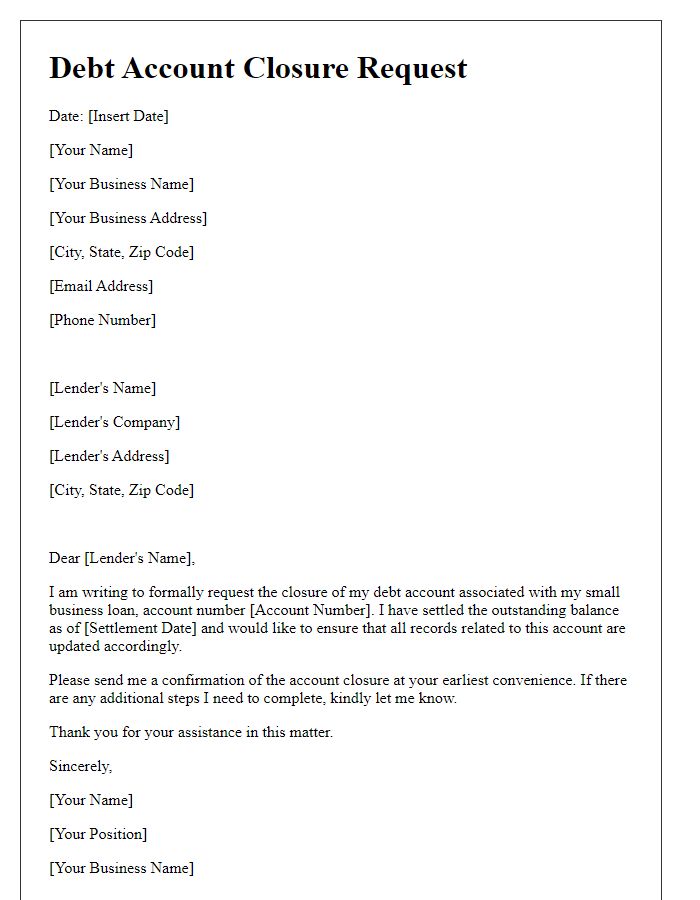

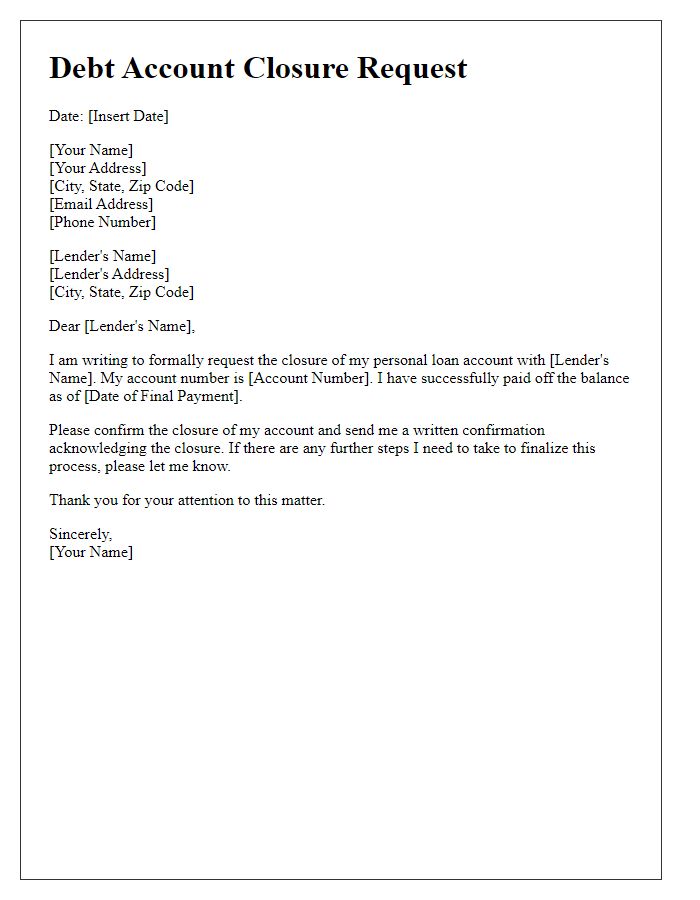

When requesting the closure of a debt account, it's important to include relevant account information and specific details. Provide the account number, associated creditor name (such as XYZ Bank), and account type (e.g., credit card or personal loan). Include any outstanding balance information, payment history, and closure date preference (preferably within 30 days). Indicate a request for confirmation of closure in writing and ensure compliance with legal obligations regarding account status. Additionally, mention your contact information for any follow-up. Professional tone and clarity are crucial for efficient processing.

Request for Confirmation and Acknowledgment

Debt account closure involves specific financial procedures and requires careful documentation to ensure that the request is handled efficiently. Once a debtor clears their balance, they must formally request the closure of their debt account, typically with a letter sent to their creditor or financial institution, such as a bank or credit union. This letter must include the account number, the date of the final payment, and a request for written confirmation of the account closure. Additionally, it should request acknowledgment of zero balance on the account, safeguarding against future claims of debt. Accurate detail, such as the exact amount paid, the method of payment (e.g., bank transfer, check), and any reference numbers related to the transaction, enhances the credibility of the request and serves as a record for both parties involved.

Contact Information and Communication Preference

Debt account closure requests require precise communication for effective resolution. Key details include the account number, customer's full name, and contact information, such as phone number or email address for follow-ups. Preferred communication methods should be specified, like postal mail, email, or phone calls for confirmation and updates. This ensures an efficient closure process by providing clear channels for any necessary correspondence or additional information required by the financial institution. Customers must ensure that all information is accurate to avoid delays.

Enclosure of Necessary Documentation

A request for debt account closure requires specific documentation and details pertaining to account status. This documentation often includes the account number, a statement indicating the desire for closure, and verification of debt settlement, if applicable. Necessary enclosures may consist of identification proof, recent account statements, and any letters from creditors confirming the debt's paid status. Properly formatted requests increase efficiency in processing, ensuring that the financial institution, such as a bank or credit union, can verify the information swiftly and take appropriate action. Additionally, records of previous communications regarding the debt might be included to provide context and support the request for closure.

Polite and Formal Tone

A debt account closure request involves important financial communication. When drafting such a request, it's essential to ensure clarity and politeness while addressing the concerned financial institution. The request should state the account number, the specific request to close the account, and any relevant dates to facilitate a smooth process. Additionally, mention the desire for confirmation of the closure in writing to maintain a clear record of the transaction. This approach enhances the likelihood of a swift and courteous response from the bank or creditor.

Letter Template For Debt Account Closure Request Samples

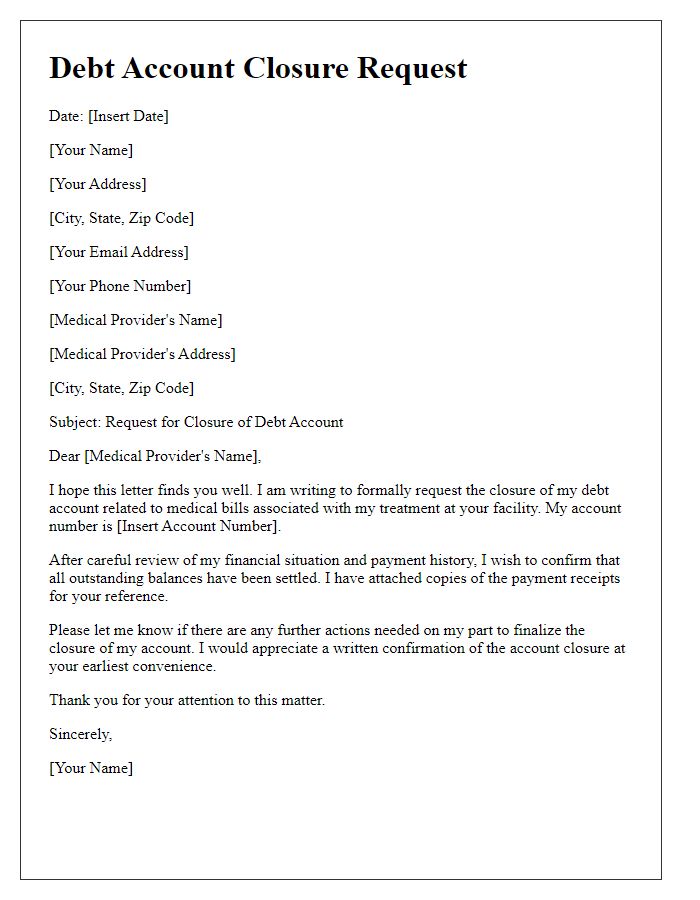

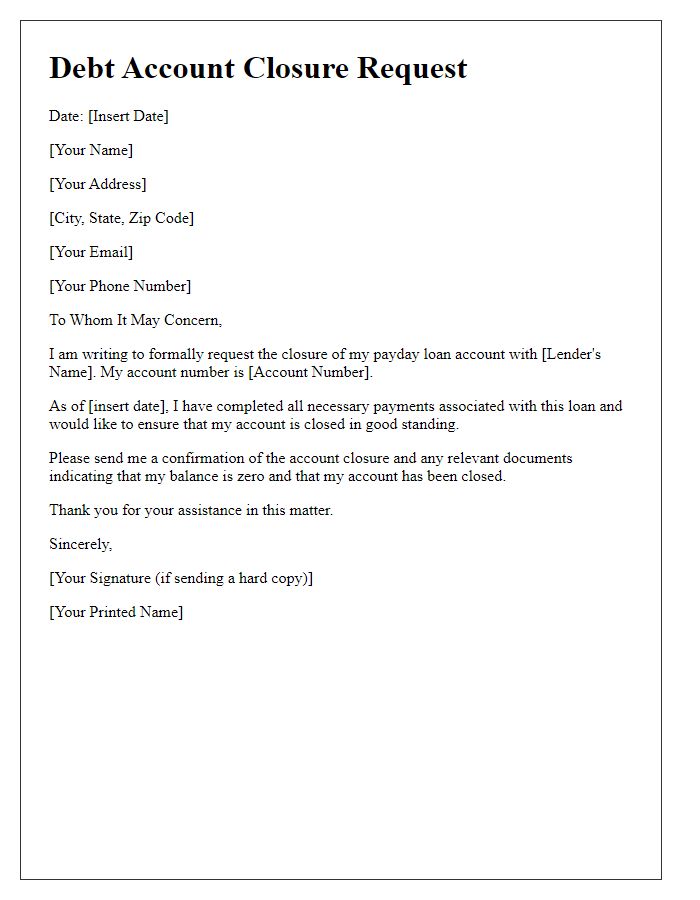

Letter template of debt account closure request for credit card accounts.

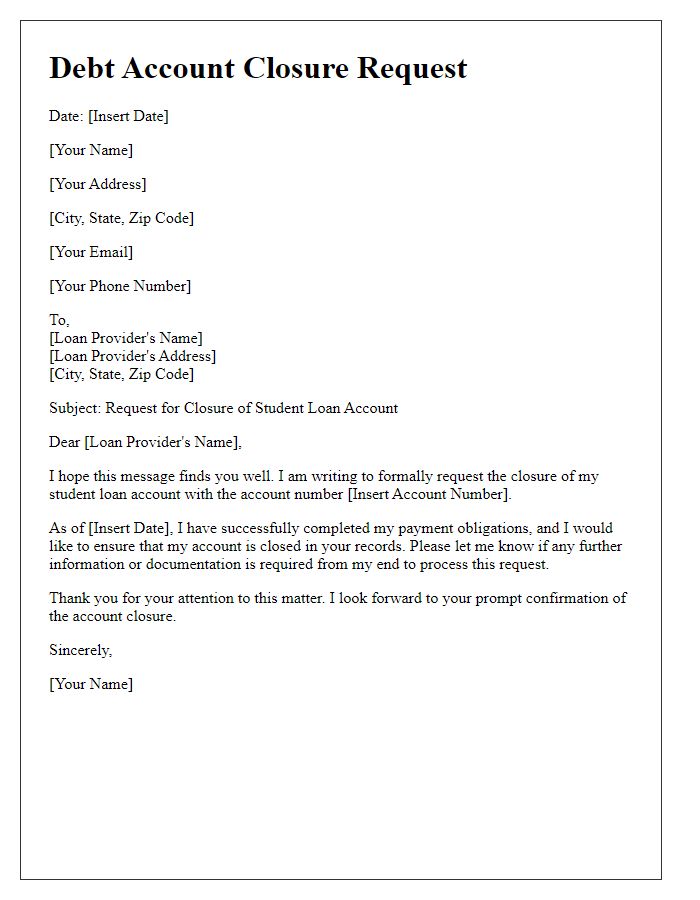

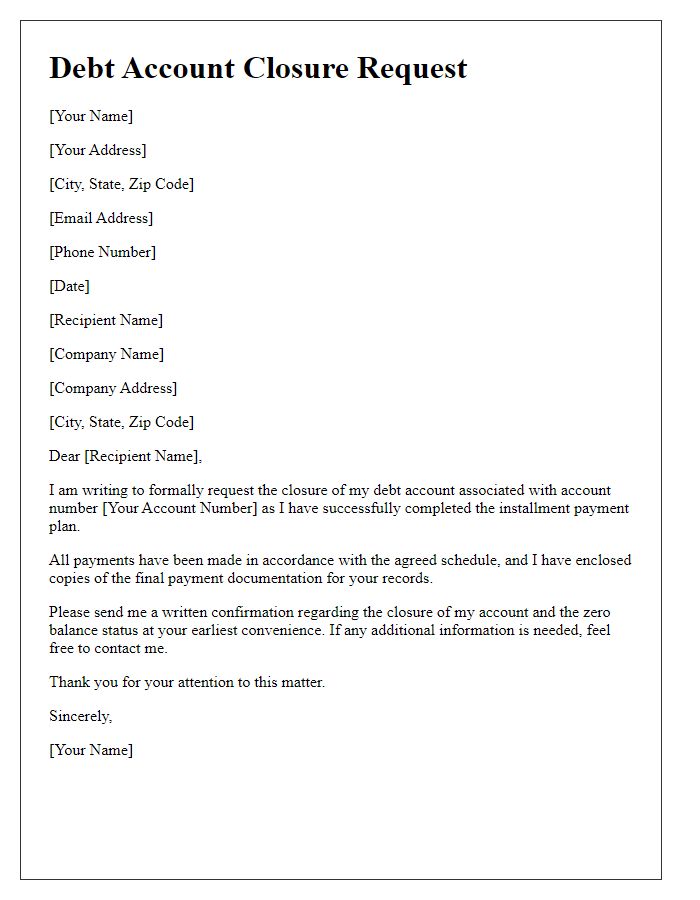

Letter template of debt account closure request for small business loans.

Comments