Are you feeling overwhelmed by debt and unsure of where to turn? Navigating the world of financial solutions can be daunting, but you're not aloneâmany others find themselves in the same situation. In this article, we'll explore the ins and outs of crafting an effective letter template for contact-based debt resolution offers that can help bridge the gap between you and your creditors. Ready to take control of your financial future? Read more to discover how you can effectively communicate and negotiate your way toward a debt-free life.

Concise and clear language

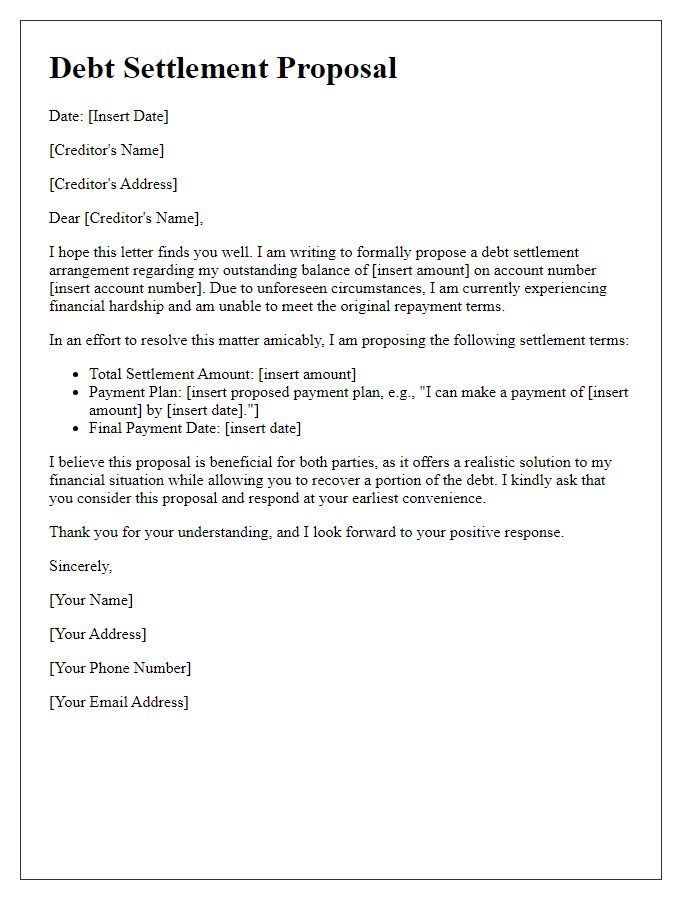

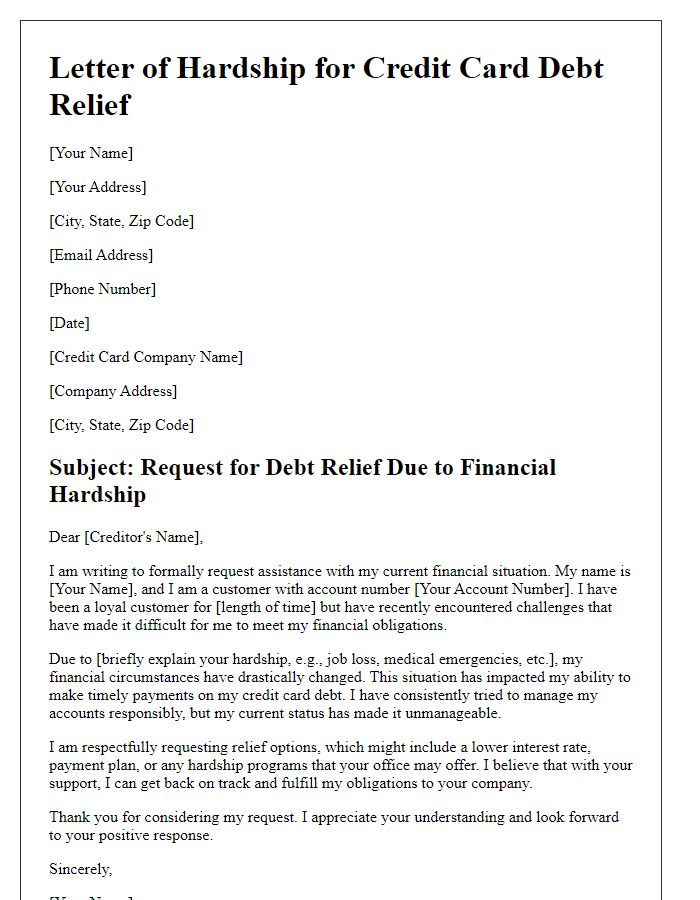

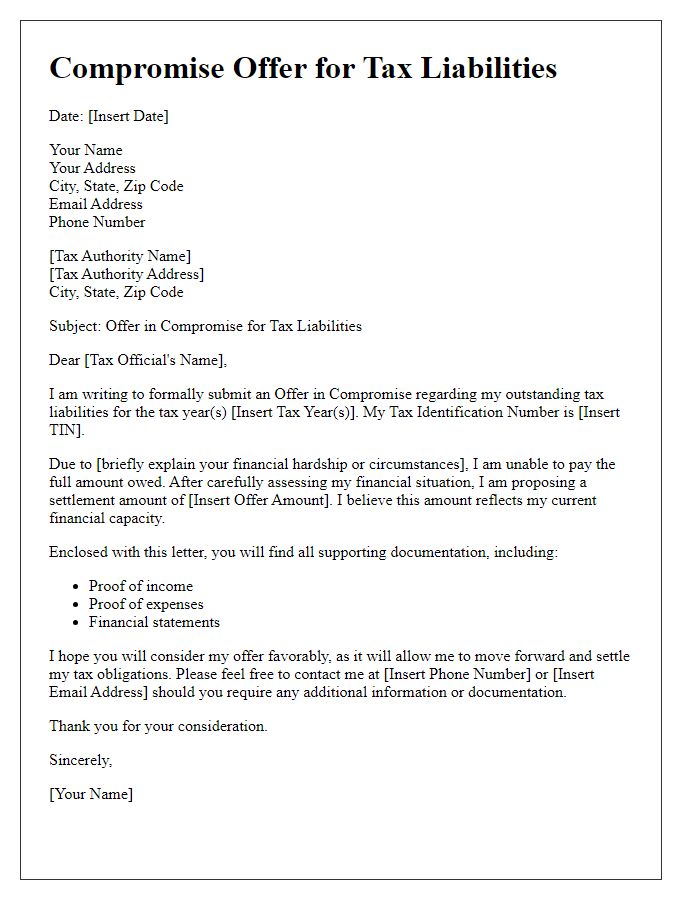

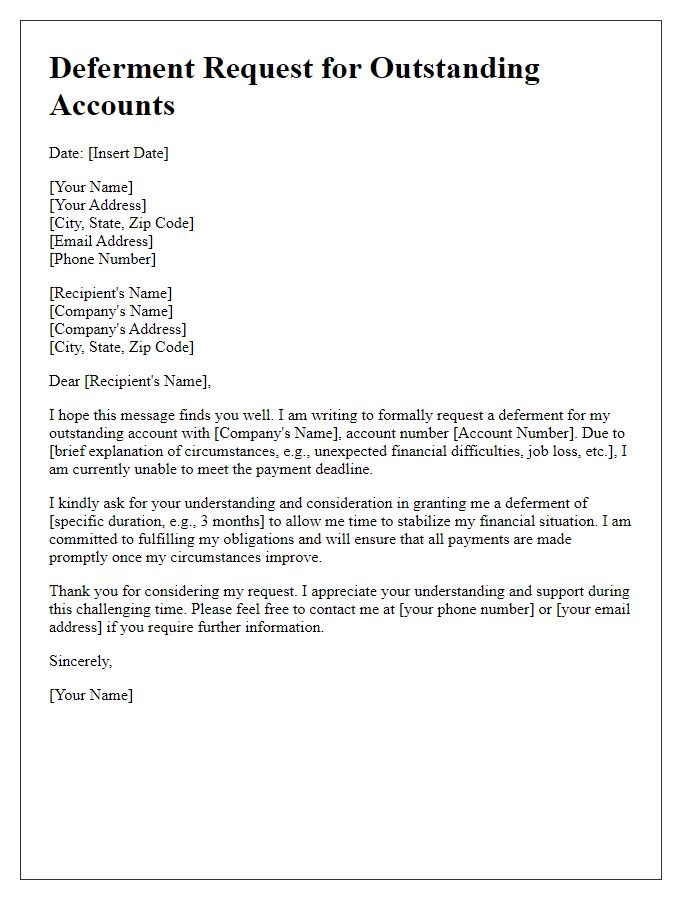

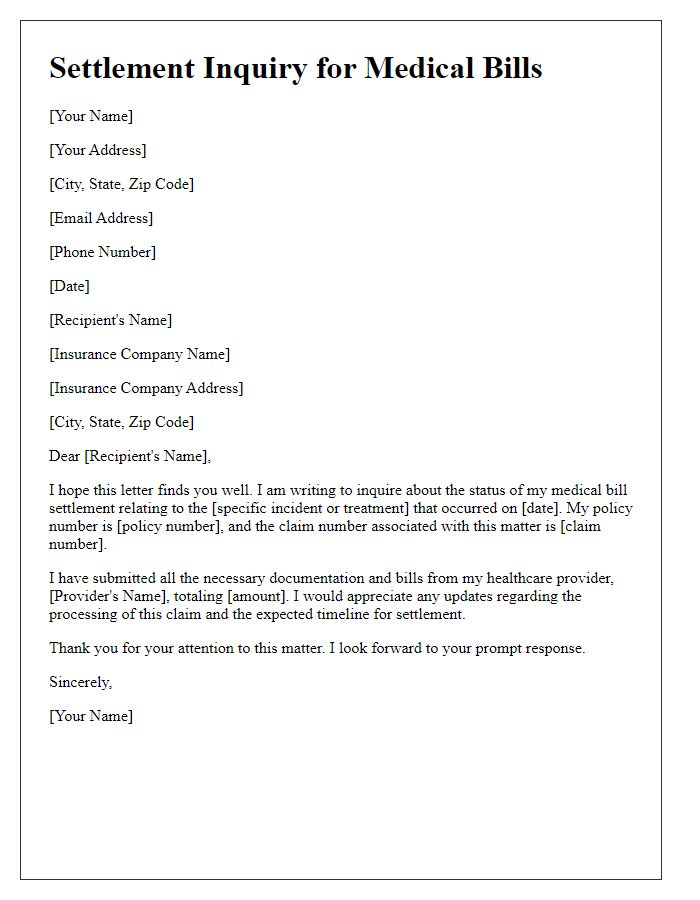

Debt resolution offers often focus on providing concise, clear communication about repayment terms. A well-crafted sample might convey the importance of addressing outstanding balances. Key terms include "total outstanding balance" (the precise amount owed), "settlement offer" (the proposed reduced amount for payment), and "payment plan" (the structured method for repayment). Clients should be informed about "benefits" (such as reduced stress and improved credit scores) and urged to respond by a specific deadline to facilitate swift resolution. Clear instructions on ways to contact the debt resolution team are essential for effective communication.

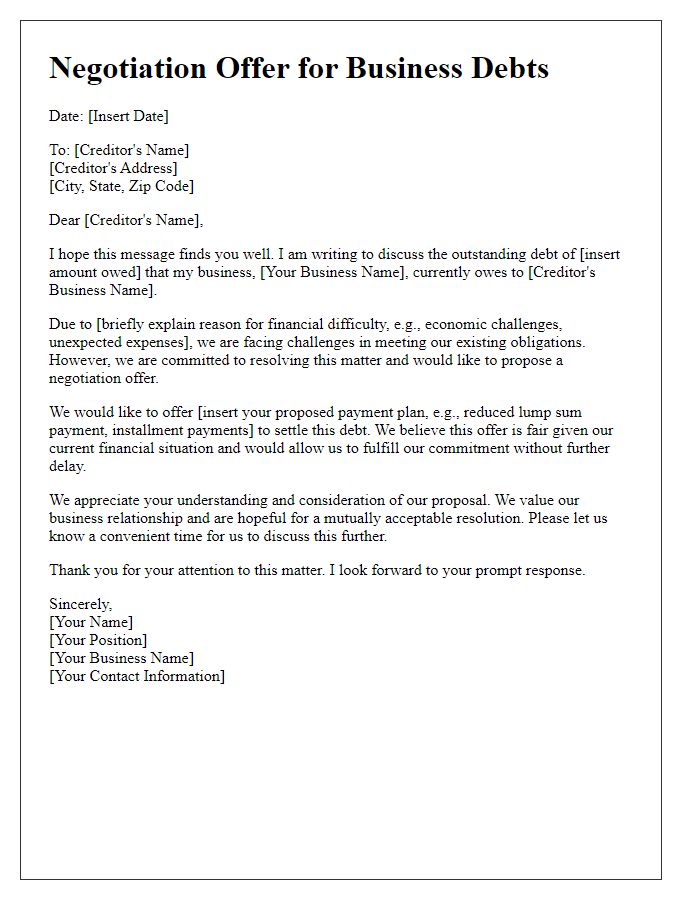

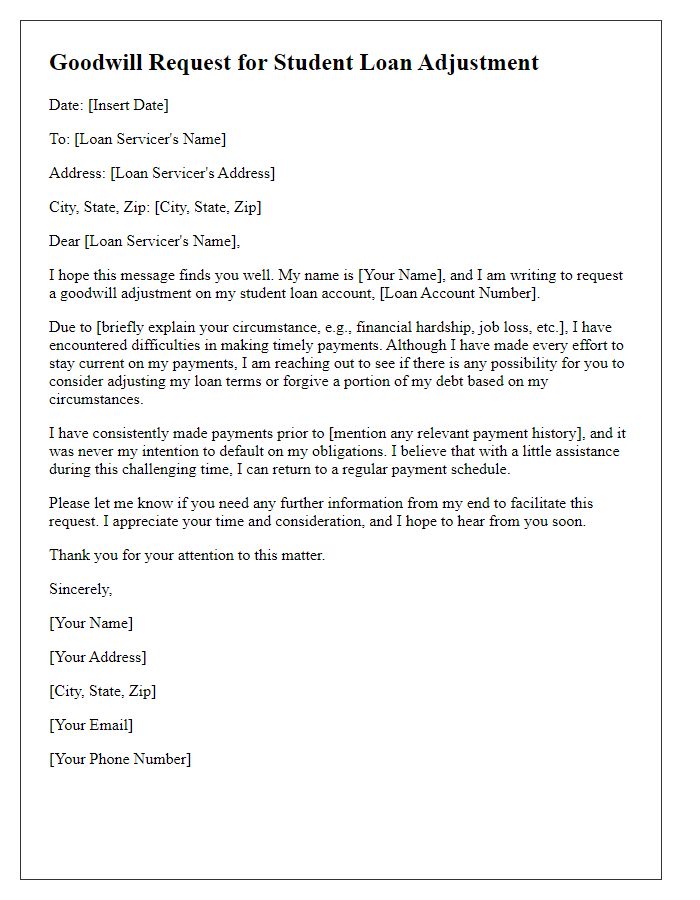

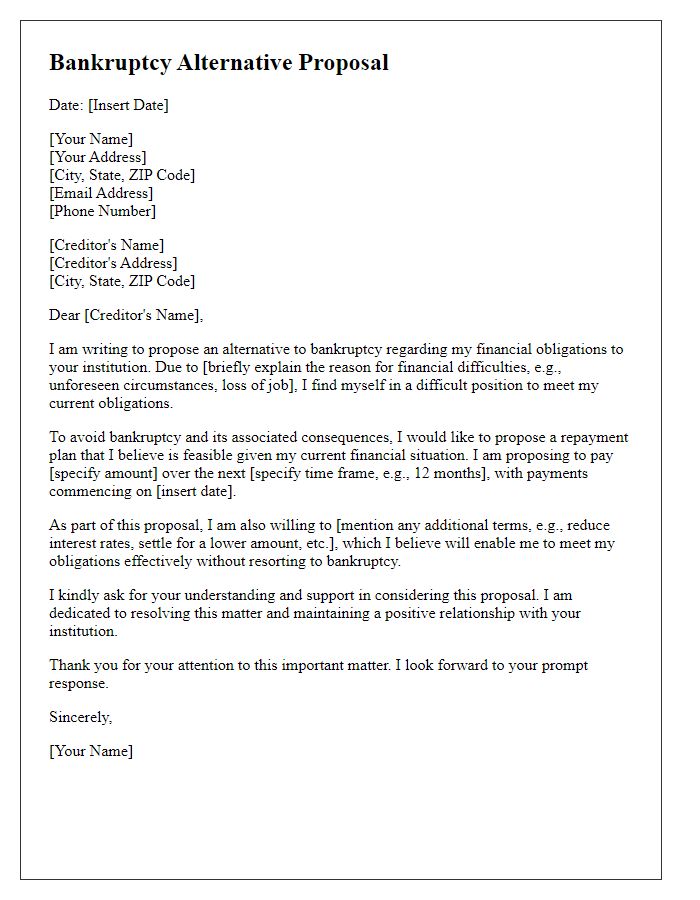

Personalization and debtor's specifics

A personalized debt resolution offer can significantly impact a debtor's willingness to engage in a resolution process. Tailoring the communication to address specific financial hardships, such as job loss or medical expenses, can create a more empathetic approach. Incorporating relevant details, like the exact amount owed (e.g., $5,000) and the debtor's payment history, can demonstrate an understanding of their situation. Highlighting flexible repayment options, such as a reduced lump-sum settlement or manageable monthly payments, can encourage prompt responses. By including the debtor's local context, such as economic conditions in their city or state, the offer can resonate more meaningfully, fostering a sense of connection and trust in the resolution efforts.

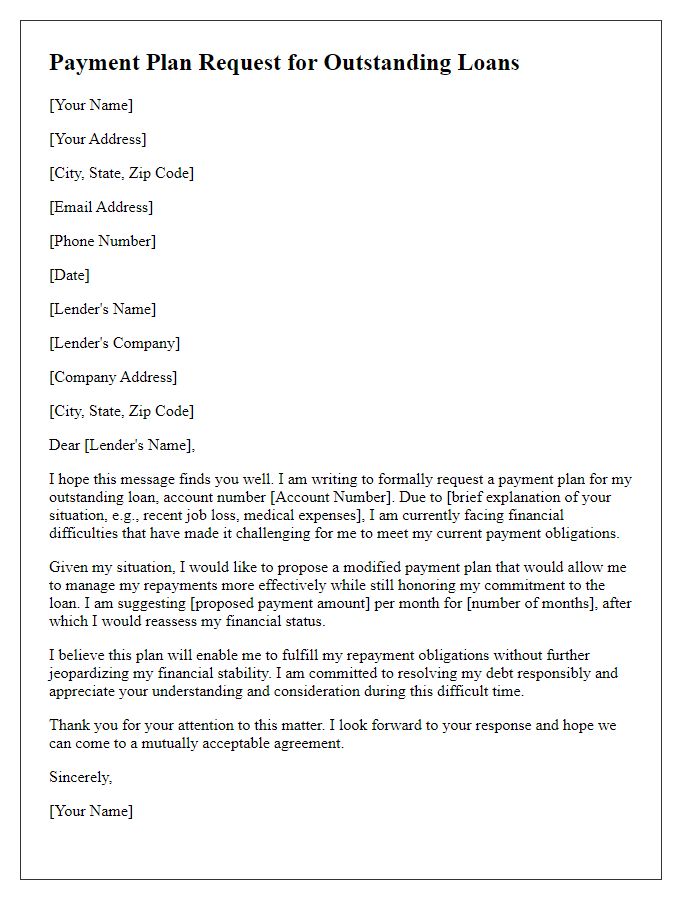

Proposed resolution terms

Proposed resolution terms for contact-based debt resolution involve a structured repayment plan designed to ease financial burden while ensuring creditor satisfaction. This plan may outline specific monthly payment amounts, such as $200, over a defined period, typically ranging from six months to two years. A key aspect includes a potential reduction of the total debt amount, for instance, forgiving 20% of outstanding balance if paid within the initial three months. In addition, the terms may specify a freeze on interest rates during the repayment duration, preventing further accumulation of debt. Payment methods could include options like online transfers or automatic withdrawals, facilitating easier management for the debtor. The agreement would require explicit consent from both parties, signed by the creditor's representative, ensuring legal validation and commitment to the outlined terms.

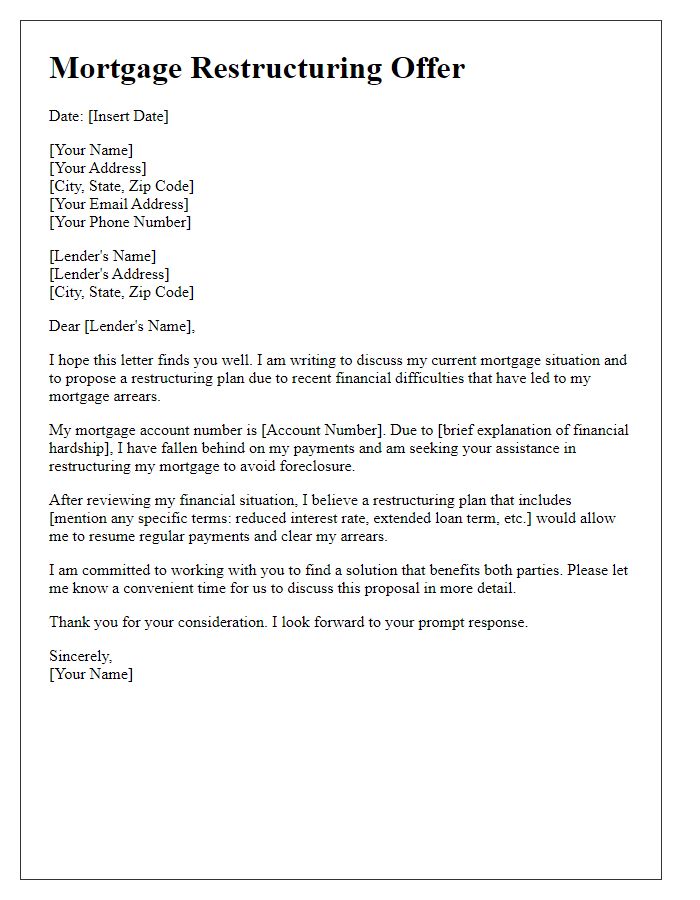

Legal and compliance considerations

Debt resolution offers require careful consideration of legal and compliance regulations to ensure fairness and transparency. The Fair Debt Collection Practices Act (FDCPA) governs the conduct of debt collectors, prohibiting harassment and requiring clear communication of the debt's nature, amount, and the creditor's information. Compliance with the Consumer Financial Protection Bureau (CFPB) guidelines ensures that borrowers are treated equitably. Clear disclosure of payment terms, balances, and consequences of non-acceptance must be articulated. Regional regulations, such as state-specific debt collections laws, may impose additional requirements, mandating accurate record-keeping and timely disclosures. Legal avenues for dispute resolution must be included to protect consumer rights while fostering a cooperative resolution atmosphere.

Call to action and follow-up instructions

Contact-based debt resolution offers often emphasize a proactive approach to managing financial challenges. Motivating clients to engage in discussions about repayment options, such as structured payment plans or potential settlements, is crucial. For instance, clients might respond positively to personalized outreach, which includes clear instructions on how to proceed. A succinct note detailing next steps could improve participation rates, such as providing convenient times to call or agreeing on a responsive method like email for further inquiries. Ensuring clients understand the importance of timely communication in resolving their debts can enhance trust and cooperation, ultimately leading to successful outcomes in financial recovery strategies.

Comments