Are you feeling overwhelmed by the complexities of debt security realization? You're not alone! Understanding how to navigate this intricate process can seem daunting, but it doesn't have to be. In this article, we'll break down the essential steps and provide you with practical tips to make your journey smootherâso let's dive in together!

Clarity and Conciseness

Debt security realization involves understanding the process and implications of collecting on secured debt instruments. Debt securities, such as bonds, represent loans made by investors to borrowers, typically corporations or governments, which promise to repay the principal amount on maturity along with periodic interest payments. Effective realization of these securities requires accurate assessment of their market value, which fluctuates based on interest rates, credit ratings, and issuer default risks. Events like credit downgrades can impact bond prices significantly, while economic conditions influence investor confidence. Documenting the realization process involves precise communication of terms, due dates, and repayment strategies, ensuring clarity for stakeholders involved in the transaction.

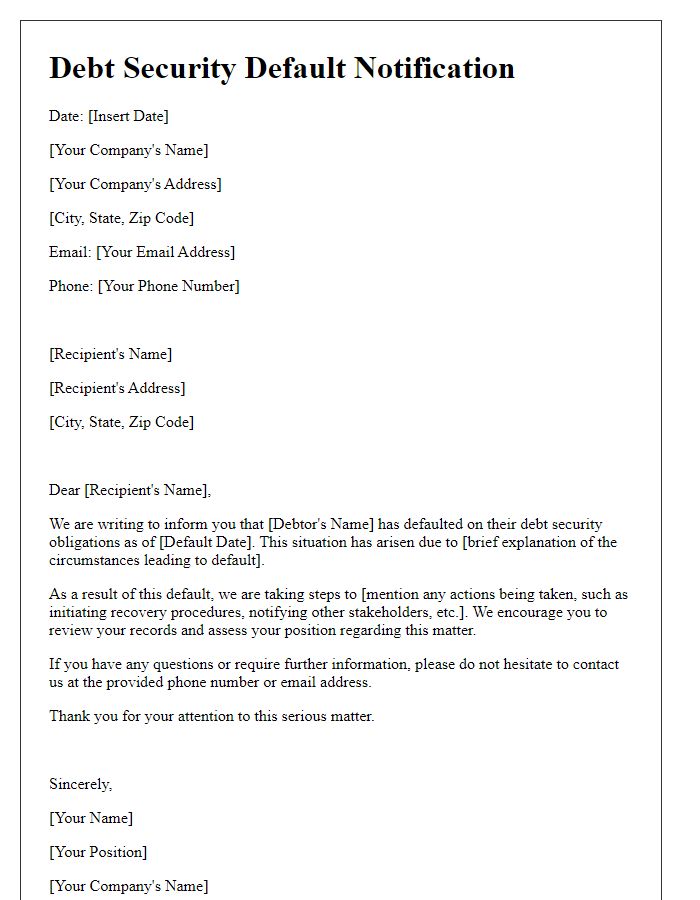

Accurate Legal Terminology

Debt security realization involves the legal process of recovering funds associated with defaulted loans or bonds. In the United States, entities can pursue actions under the Uniform Commercial Code (UCC), particularly Article 9, which governs secured transactions. Creditors often initiate foreclosure proceedings on collateralized assets, requiring adherence to proper notification protocols (often via certified mail) to the debtor. The role of the trustee or indenture agent is crucial, ensuring compliance with contractual stipulations defined in the bond indenture or loan agreement. Relevant statutes, including the Fair Debt Collection Practices Act (FDCPA), also influence the approach creditors take in recovery, aiming to safeguard debtor rights while facilitating the realization of the debt.

Detailed Description of Debt

The realization of debt security involves the assessment and management of various financial instruments, such as bonds or notes, issued by entities ranging from corporations to governments. A key factor includes the interest rate, which can vary significantly, often influenced by market conditions, credit ratings, and economic indicators. For instance, a corporate bond might offer a yield of 5% per annum, reflecting the risk profile of the issuer. Municipal bonds, issued by local governments, can provide tax advantages, attracting investors. The maturity date, often set between one and thirty years, determines when the principal amount will be returned to the investor. Furthermore, debt security may have specific features, including call provisions, allowing the issuer to redeem the bonds early, influencing overall investment attractiveness. A thorough understanding of these elements is crucial for stakeholders engaged in the realization of debt securities, as they navigate the complexities of financial markets.

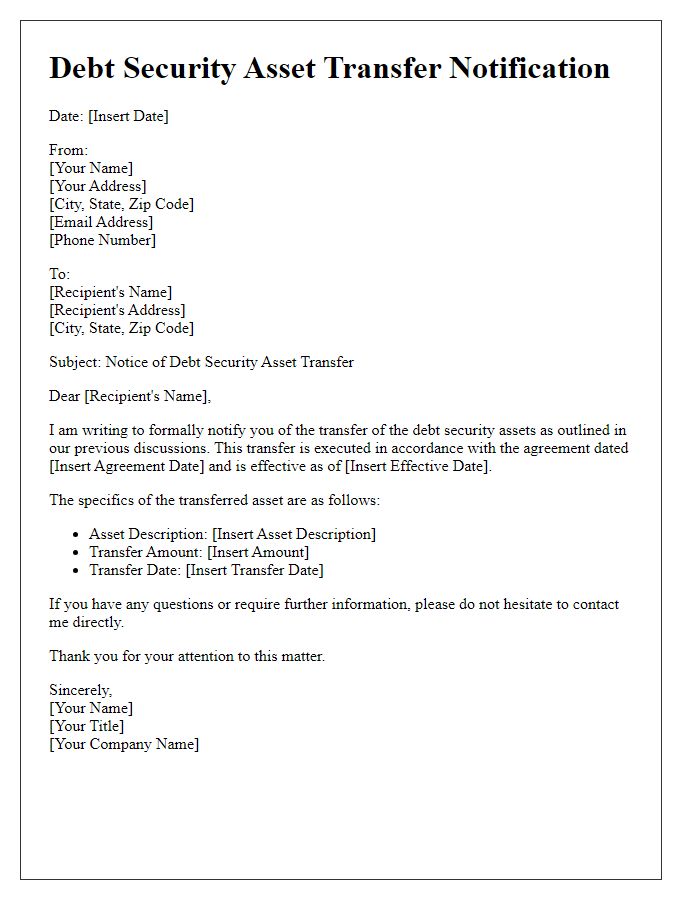

Clear Instructions for Payment

Debt security realization involves the process of recovering funds owed due to financial instruments like bonds or loans. Clear instructions for payment often necessitate specifying the payment amount, due dates, and acceptable payment methods such as bank transfers. Stakeholders should consider providing relevant account details, including the bank's name, account number, and payment reference. Timely communication through email or letters is critical, especially approaching deadlines (for example, 30 days post-invoice). Documentation should reflect accurate figures, notable notes on penalties for late payments, and legal considerations due to jurisdictional differences in enforcing such financial contracts. This context ensures transparency and avoids potential disputes between creditors and debtors in the financial landscape.

Contact Information for Resolution

Debt security realization involves various financial instruments like bonds or notes, issued by entities such as corporations or governments. In situations surrounding debt recovery, accurate contact information is essential. Key parties typically include financial institutions like banks or investment firms, loan servicers, and collection agencies. Specific contact details such as phone numbers, email addresses, and mailing addresses enable prompt communication. For instance, a bank like JPMorgan Chase may provide a dedicated recovery department reachable at 1-800-123-4567 for debt-related inquiries. The inclusion of a physical address ensures that legal documents can be sent efficiently, which is crucial during resolution processes, especially in jurisdictions that require formal notifications. Access to correct contact information fosters effective negotiation and settlement, ultimately aiding in the successful realization of debt securities.

Comments