Are you feeling overwhelmed by debt and unsure where to turn? You're not aloneâmany people find themselves in similar situations, seeking relief from their financial burdens. One effective solution could be submitting a debt offset request to your creditors, which may help you navigate the path towards financial stability. If you're curious about how to craft the perfect letter for this purpose, keep reading for an insightful guide!

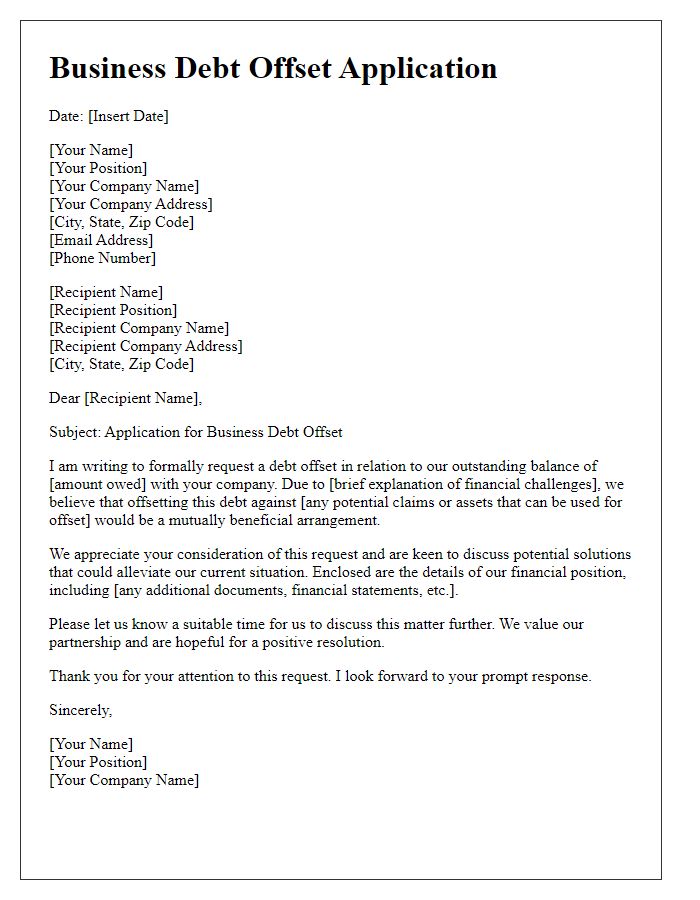

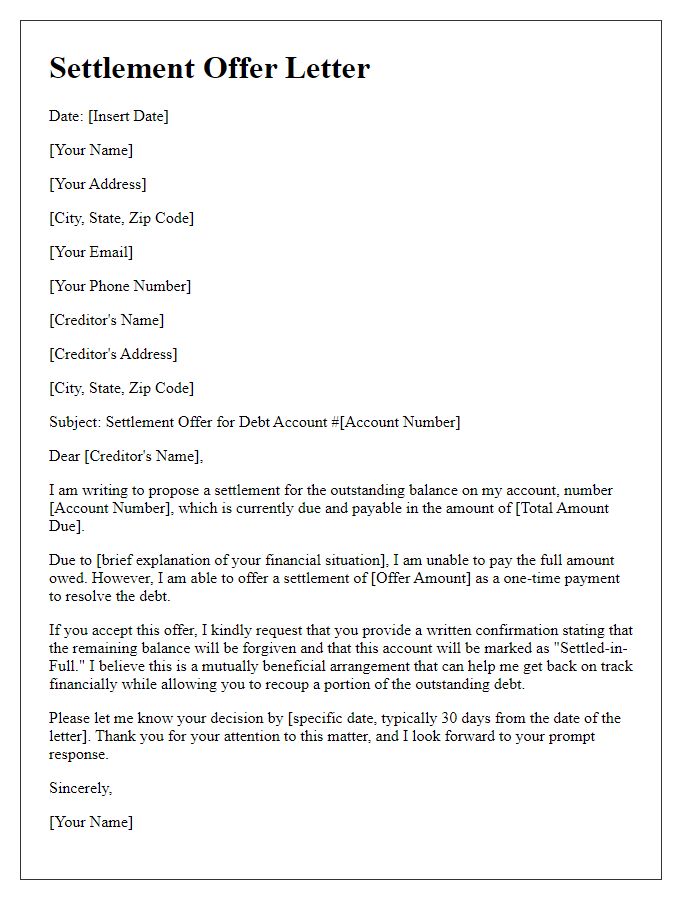

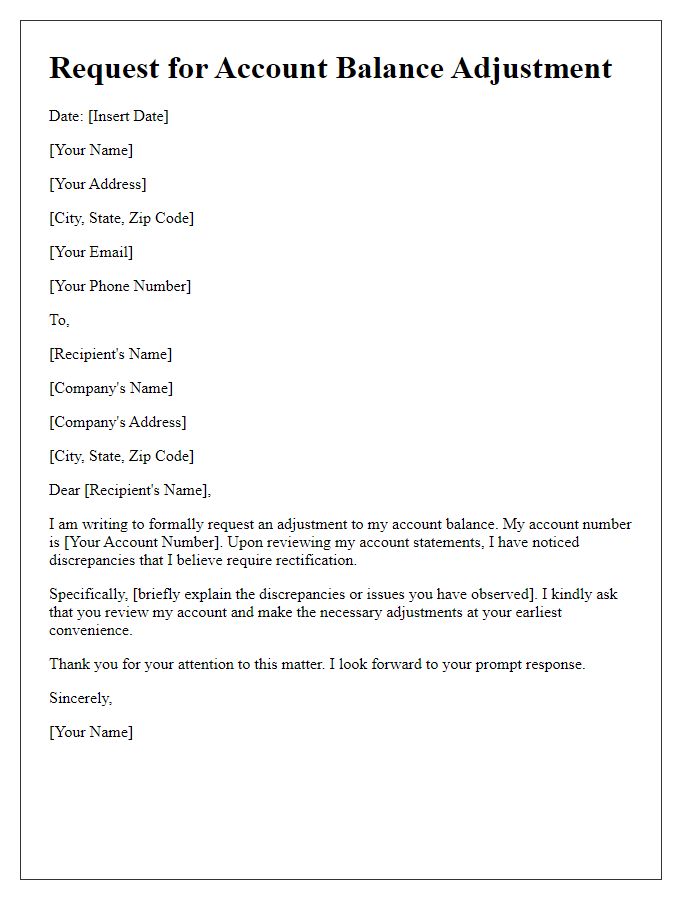

Purpose and Account Information

A debt offset request aims to utilize available funds to settle outstanding debts, enhancing financial wellness. The account information typically includes specific details such as account numbers, financial institution names, and total outstanding balances. For example, an individual may request to offset a credit card debt totaling $5,000 at a major bank (e.g., Bank of America) using funds in a savings account with a balance of $6,000, which could lead to reduced interest payments and improved credit scores. The purpose of this formal request emphasizes the intent to alleviate financial burdens while maintaining transparent communication with the relevant financial institution.

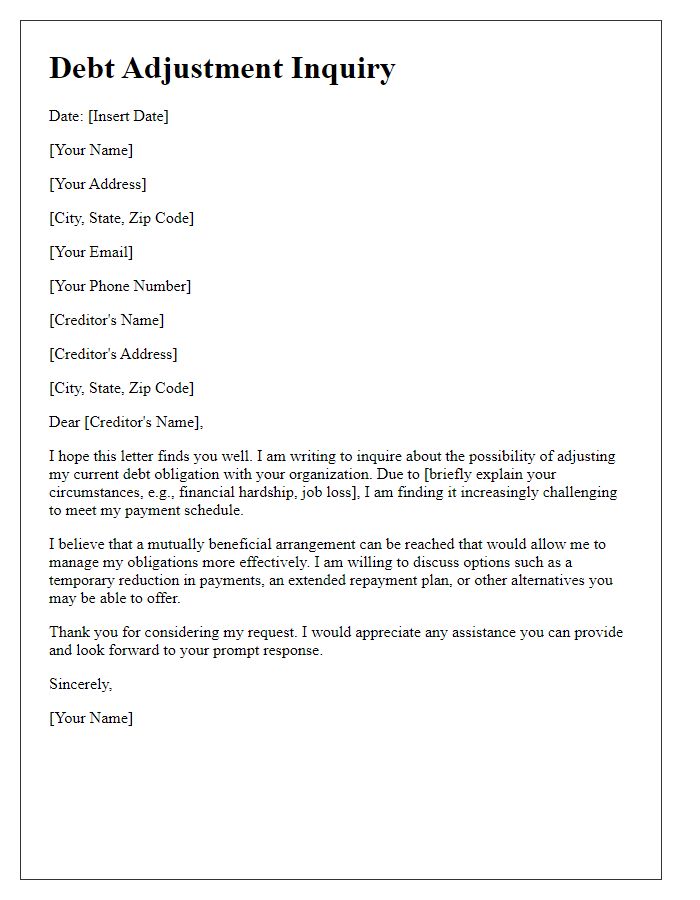

Explanation of Debt and Offset Proposal

Debt management is a critical financial process in which individuals or organizations consolidate their obligations, often in the form of loans or credit lines. In the context of a debt offset proposal, a strategic plan is presented to negotiate the terms or amount of outstanding debts, often involving a formal request to specific creditors for reconsideration. Essential details include the total owed amount, such as $10,000 in credit card debt, the proposed offset percentage, typically around 25%, and the timeline for repayment, often set over 12 months. Additionally, the request may highlight the debtor's financial situation, including income details, monthly expenses, and potential hardship situations, such as job loss or medical expenses. By addressing these components, the proposal aims to demonstrate a commitment to resolve the debt while ensuring financial stability moving forward.

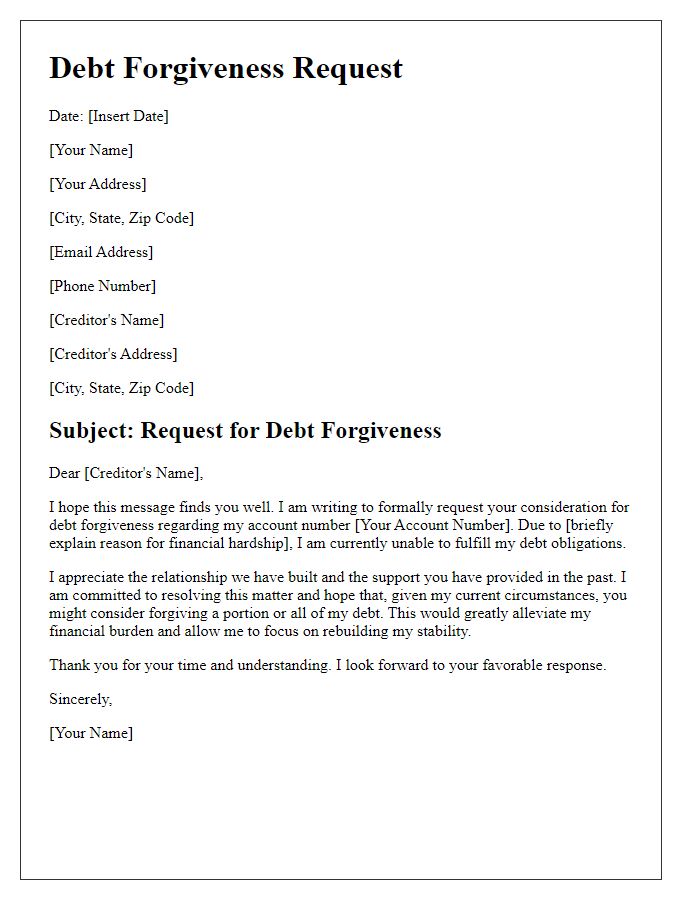

Supporting Documentation

Supporting documentation for debt offset requests typically includes essential financial records. These documents might consist of tax returns, bank statements, credit reports, and proof of income. Tax returns (such as 1040 forms) provide insight into annual earnings, while bank statements can illustrate current financial standing. Credit reports from agencies like Experian or TransUnion offer information on existing debts and payment history. Proof of income could involve payslips or employer letters confirming job status. Collecting these documents ensures a comprehensive view of financial responsibility, aiding the approval process for debt adjustments.

Contact Information and Response Deadline

A debt offset request should include crucial details such as full name, account number, and contact information (including email and phone number) for effective communication. Clearly specified response deadlines, typically 30 days from the date of submission, help ensure prompt action on the request. Providing supporting documentation, such as payment history and relevant agreements, can also strengthen the case for debt offset consideration. Timely acknowledgment of the request from the creditor is essential for tracking progress and resolving any potential issues.

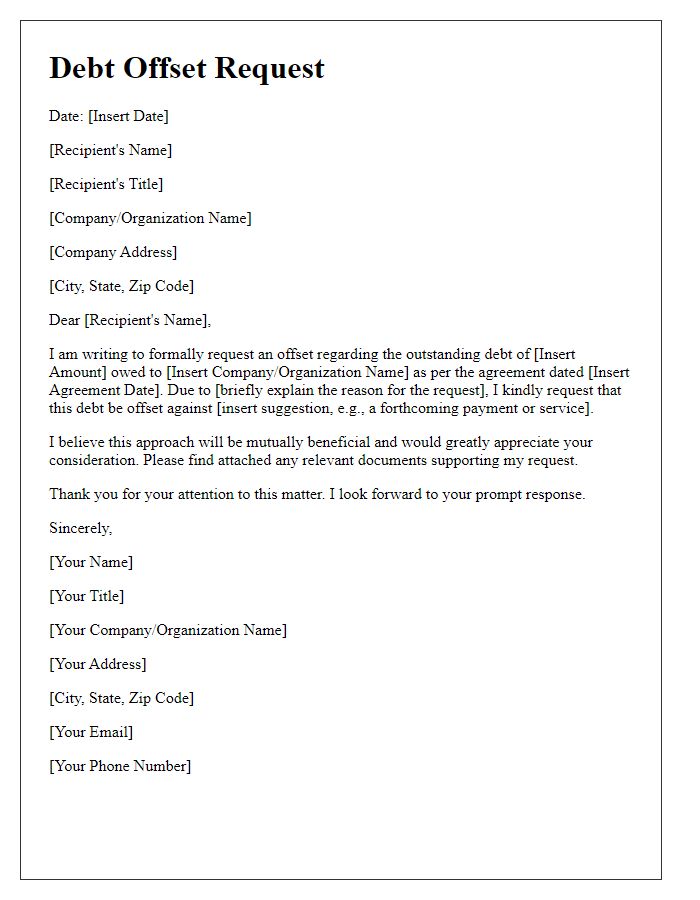

Formal Request and Signature

In the financial sector, a debt offset request involves formally asking for the application of funds from one account to offset a debt in another account. This is typically relevant to banking institutions such as Wells Fargo or Chase, where customers may have both a savings and a loan account. The request often cites specific account numbers and relevant balances, emphasizing the urgency of the situation. Such requests should be appropriately dated--usually including the day of submission--and clearly signed by the account holder, ensuring that it is legally binding. Contact information, including phone numbers and email addresses, may also be included for follow-up purposes.

Comments