If you're overwhelmed by multiple personal loans and looking for a way to ease that burden, you're not alone. Many individuals find themselves in similar situations, seeking peace of mind and financial stability. In this article, we'll explore a personal loan settlement letter template that can help you negotiate with your lenders effectively. So, let's dive in and discover how you can take the first step toward a more manageable financial future!

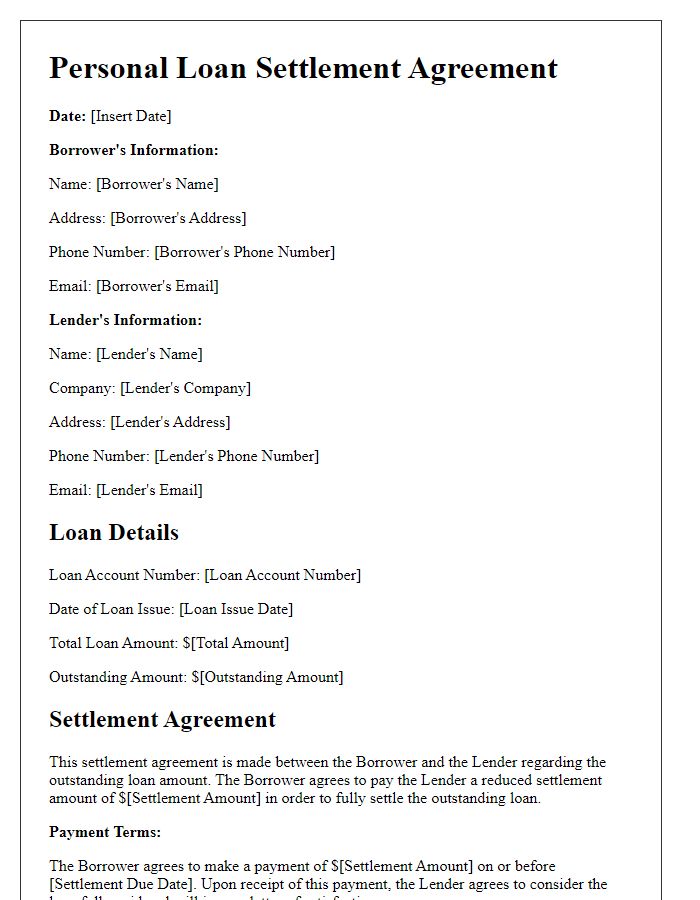

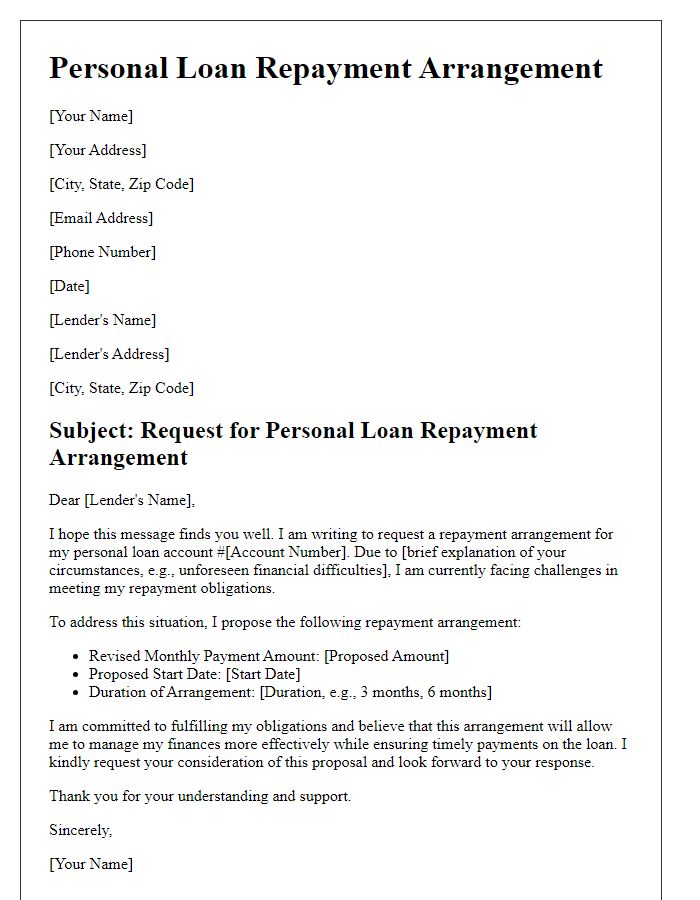

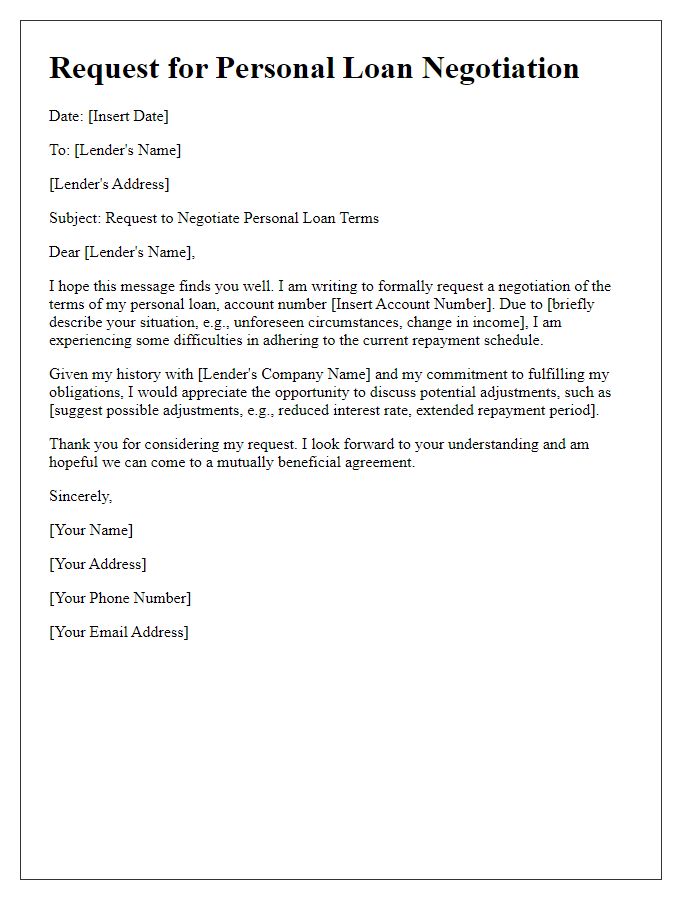

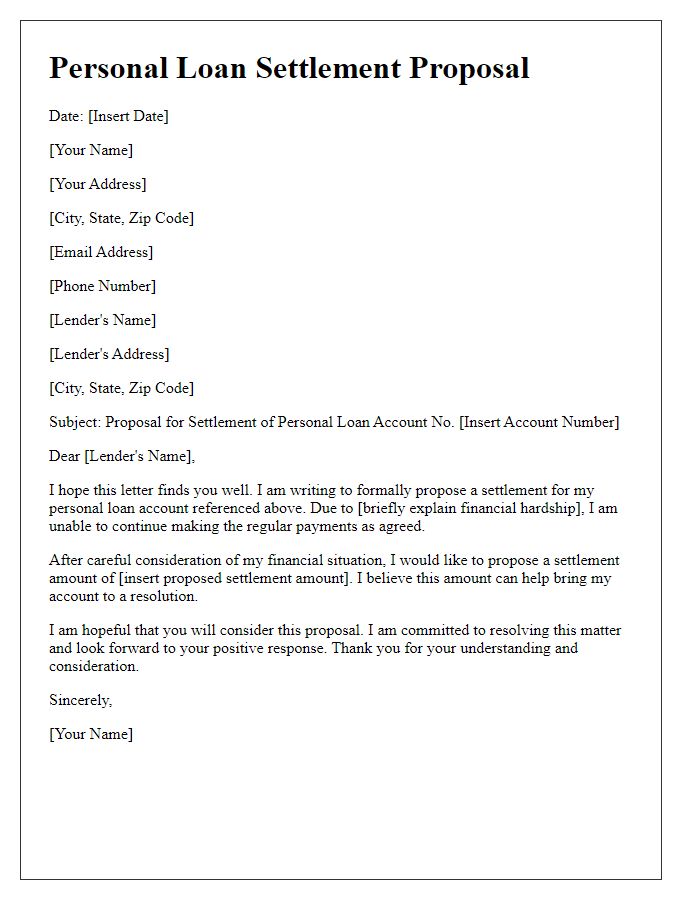

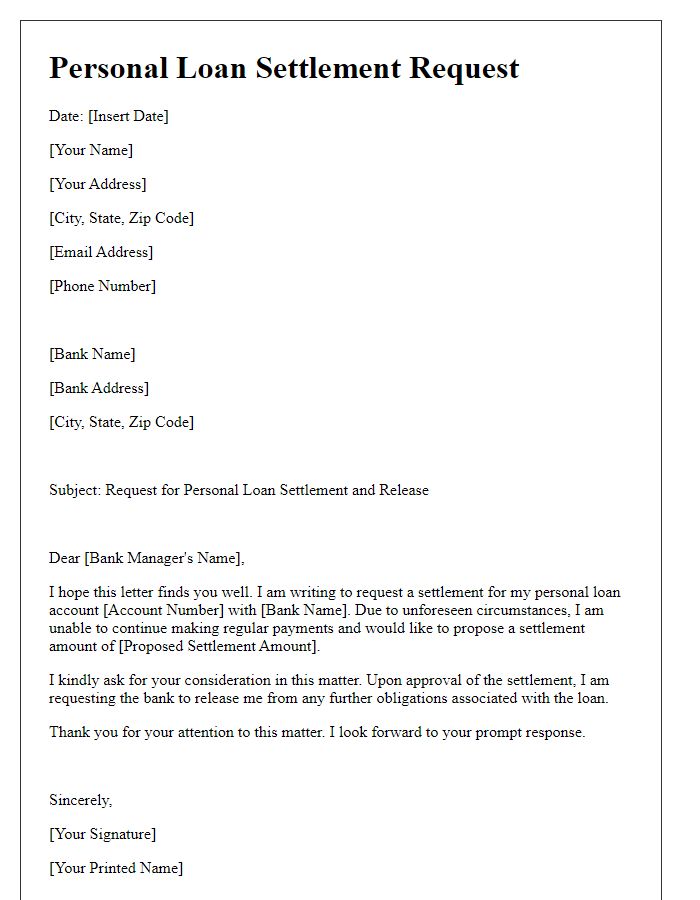

Borrower's Information

Personal loan settlements can significantly impact financial wellbeing. Borrowers looking to settle loans, typically those with institutions (banks, credit unions), must clearly present their information. Important details include full name, current address (including city, state, and zip code), contact number, email address, and account number related to the loan. Additionally, providing the loan amount, interest rate, and repayment history can strengthen the settlement proposal. Specifying the desired settlement amount (often a fraction of the outstanding balance) and the rationale behind it, such as financial hardship or job loss, will further clarify the borrower's situation. Understanding the lender's policies on settlements is also crucial for a successful negotiation.

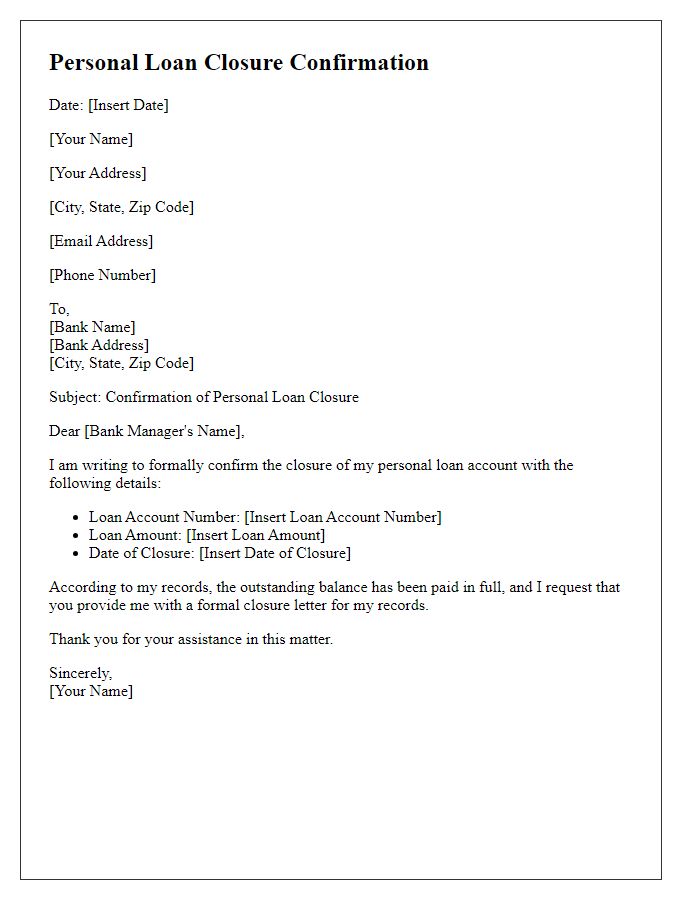

Loan Account Details

Loan account details include crucial information that reflects the status of a personal loan. The loan account number, typically a unique identifier consisting of 10-15 digits, provides a reference point for tracking all transactions and modifications. Loan amount signifies the principal sum borrowed, often ranging from $1,000 to $50,000, impacting repayment terms. Interest rate, usually expressed as an annual percentage rate (APR), varies widely, with figures potentially exceeding 20% for unsecured loans. Payment schedule indicates the frequency of repayments, which may be monthly or bi-weekly, dictating how quickly the loan will be settled. Outstanding balance represents the remaining amount owed, reflecting both principal and accrued interest, essential for negotiating any settlement terms. All these details converge to illustrate the overall financial obligation linked to the personal loan.

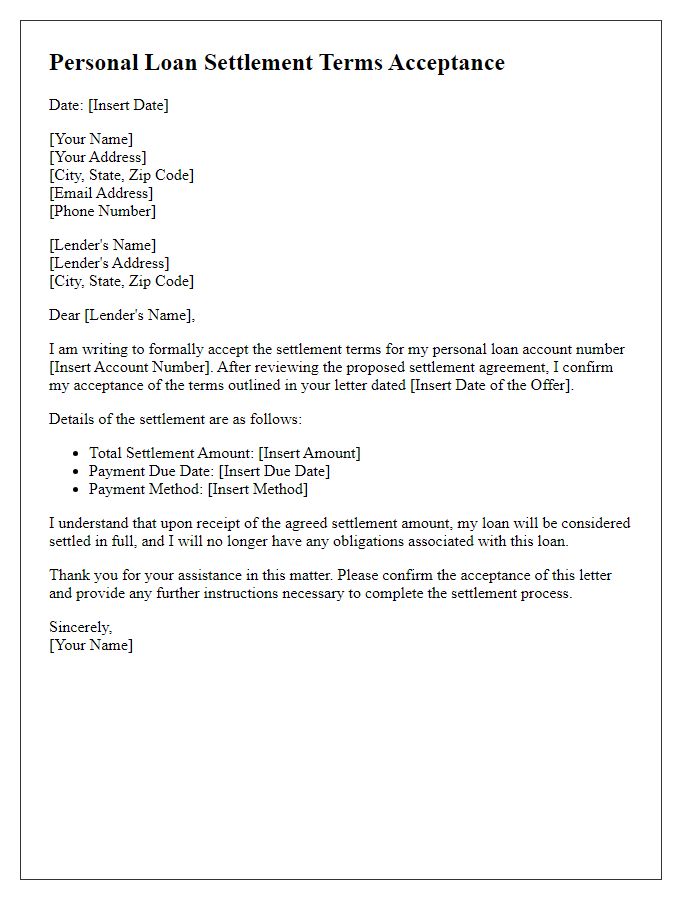

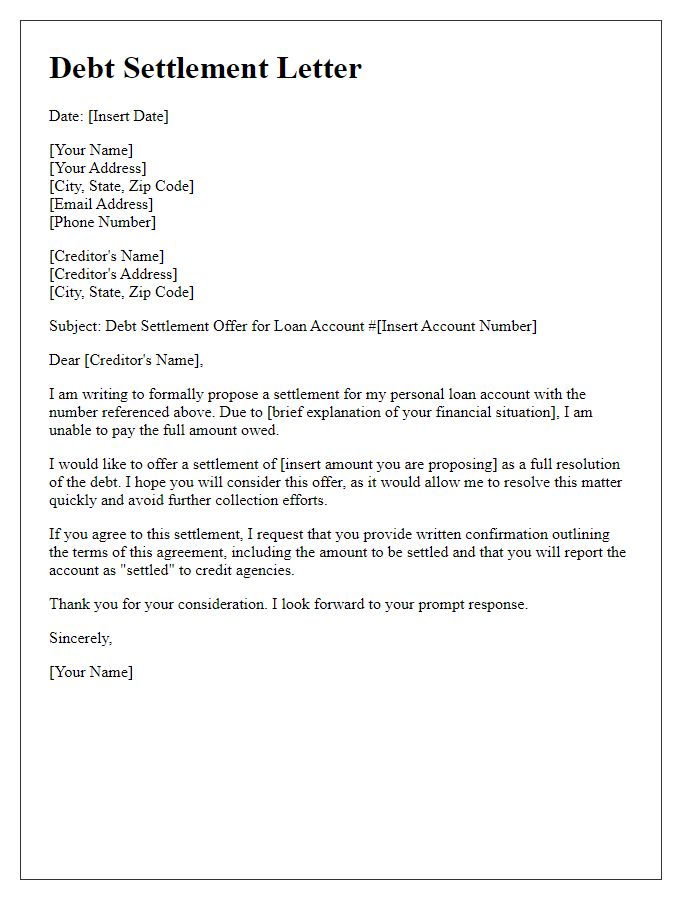

Settlement Agreement Terms

Settlement agreements for personal loans typically outline specific terms and conditions under which a borrower can resolve their outstanding debt with a lender. Such agreements may provide a reduced payment amount, often less than the total debt owed. Key details often include the original loan amount, the settlement amount agreed upon, payment deadlines, and any potential tax implications from debt forgiveness. Additionally, the agreement may specify the borrower's obligations post-settlement, such as maintaining timely payments on any remaining balance or handling the tax implications of forgiven debt, which can be significant per IRS guidelines. It is essential to ensure that the settlement agreement includes clauses for confirmation of payment and resolution of the account to prevent future claims by the lender regarding the settled debt. Proper documentation and a legal review of the settlement terms can protect the borrower's rights throughout the settlement process.

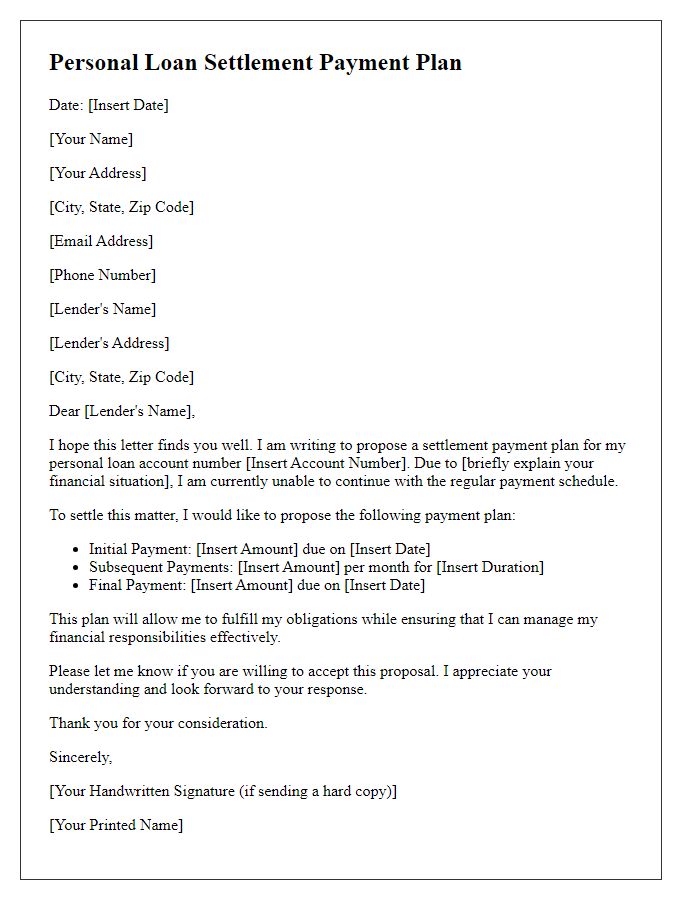

Payment Instructions

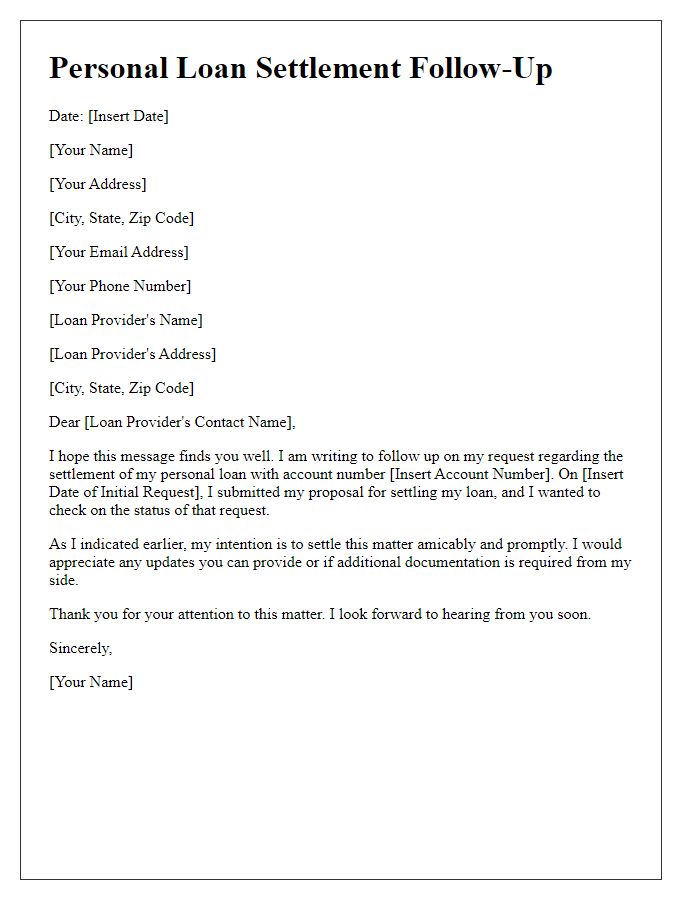

For personal loan settlement, clear payment instructions are essential. First, identify the lender's name, such as XYZ Bank, and the specific loan account number associated with the settlement. Next, outline the total settlement amount, which could be a reduced figure compared to the outstanding balance. Include payment methods accepted by the lender, such as bank transfer, personal check, or online payment portal. Specify bank details if a transfer is required, listing the bank name, account number, and routing number. Provide a deadline for the payment, which may be within 30 days of the settlement agreement. Additionally, remind the borrower to retain confirmation of the payment, which can be useful for record-keeping and potential disputes.

Contact Information for Confirmation

To achieve a successful personal loan settlement, it's essential to provide clear and concise contact information to lenders. Include full name, mailing address, phone number, and email address. Ensure the address aligns with any official documentation, such as bank statements or tax returns, to enhance authenticity. Making contact via a reliable and monitored phone number is crucial for receiving updates promptly. An email address should be professional and regularly checked to facilitate ongoing communication. Having this comprehensive contact information available can expedite the settlement process and help clarify any necessary documentation requests that the lender may require.

Comments