Are you feeling overwhelmed by your debt? Creating a repayment schedule can be a game-changer, helping you regain control of your finances and reduce that burden. In this article, we'll explore simple steps to establish an effective debt repayment plan tailored to your situation. So, if you're ready to take the first step toward financial freedom, keep reading!

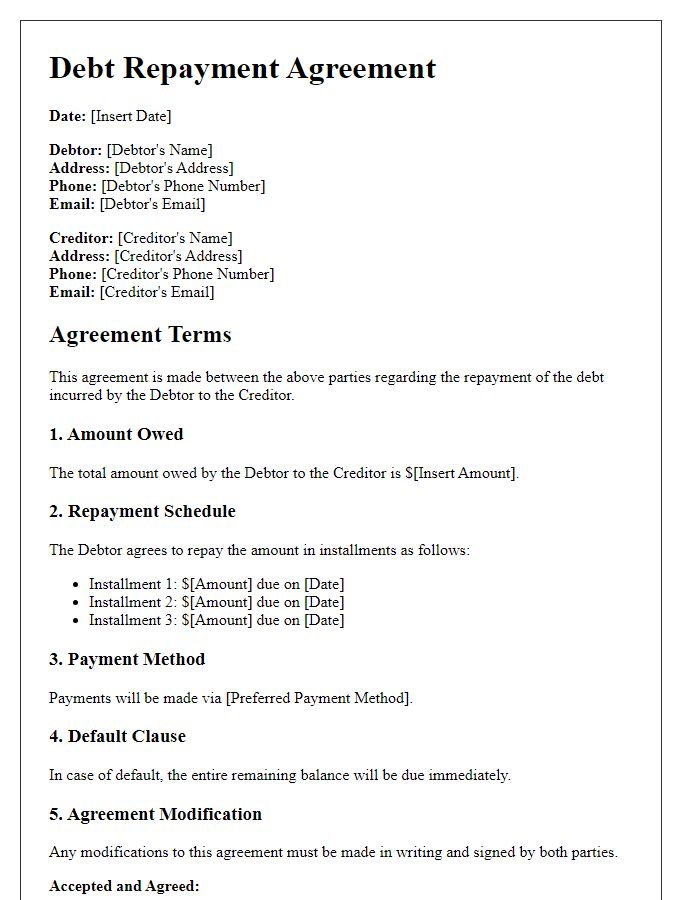

Loan and payment details

A debt repayment schedule outlines the specifics of a loan agreement, detailing the repayment terms and amounts. The schedule typically includes the principal amount (the total loan of $10,000), interest rate (5% annual), and repayment period (five years). Each monthly payment amount (approximately $188.71) breaks down how much goes toward the principal balance and how much serves as interest. Important dates such as due dates (e.g., the 15th of every month) and the total number of payments (60) provide clarity. The remaining balance should also be tracked at the end of each month, ensuring accurate accounting and financial planning. Payments may also include provisions for early repayment without penalties or a late fee clause, enhancing borrower knowledge.

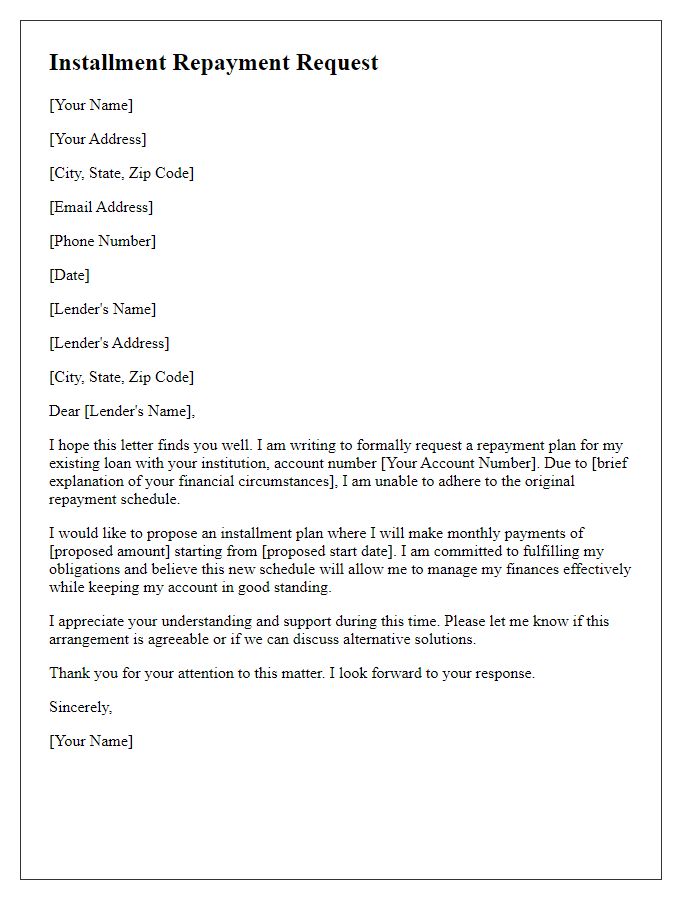

Interest rates and charges

Debt repayment schedules are essential for managing financial obligations, including interest rates (annual percentage rates ranging from 3% to 20%) and service charges associated with loans. Lenders, such as banks or credit unions, outline specific terms governing repayment periods (typically between six months to five years), ensuring clarity on monthly payment amounts. Missed payments can incur late fees (often around $25 to $50), and potential increases in interest rates may apply after defaults. Understanding these components is crucial for maintaining financial health and avoiding escalation of debt due to accumulating charges or interest.

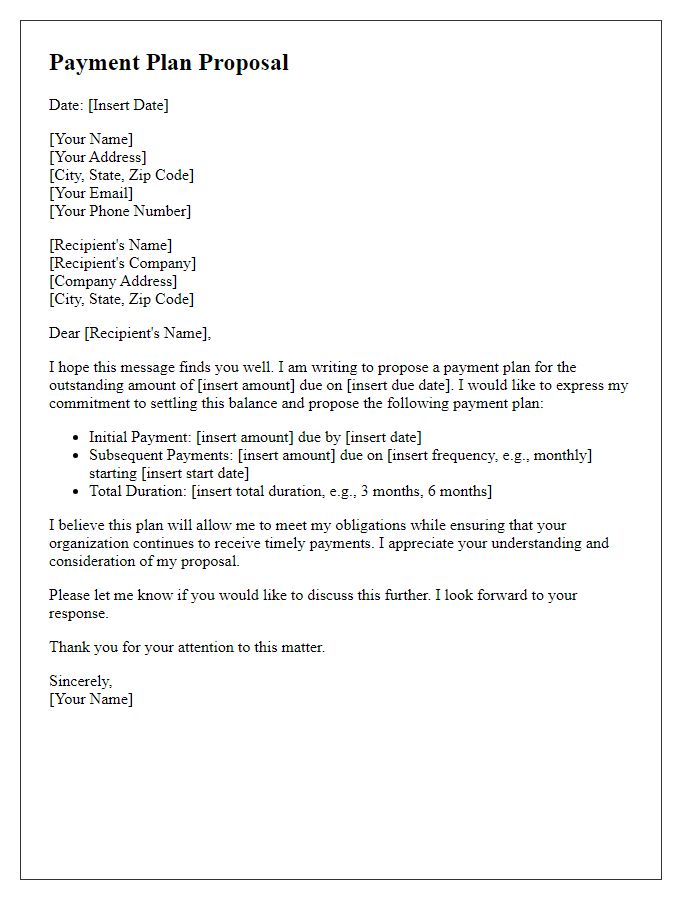

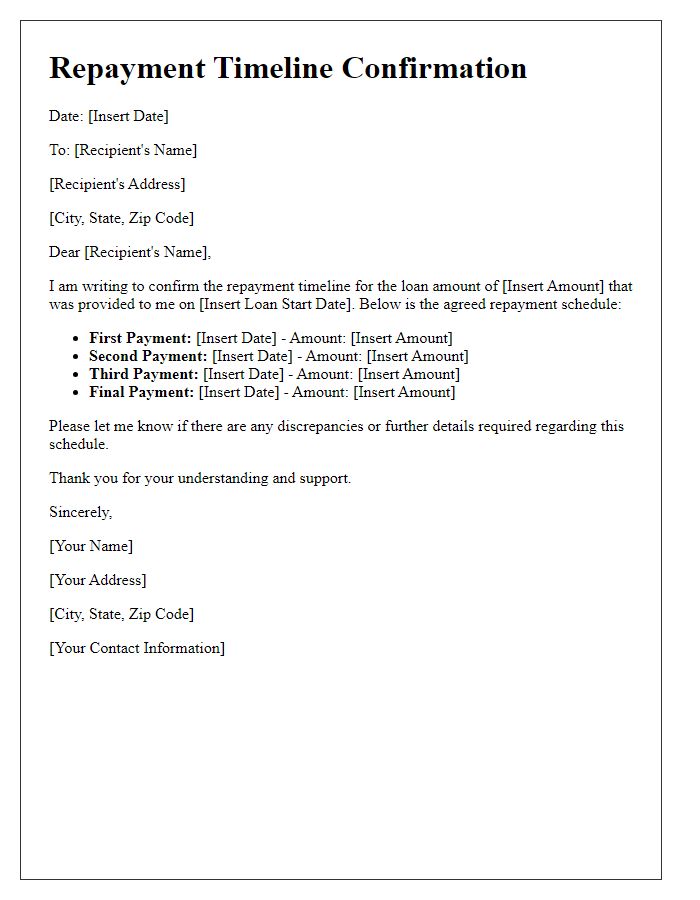

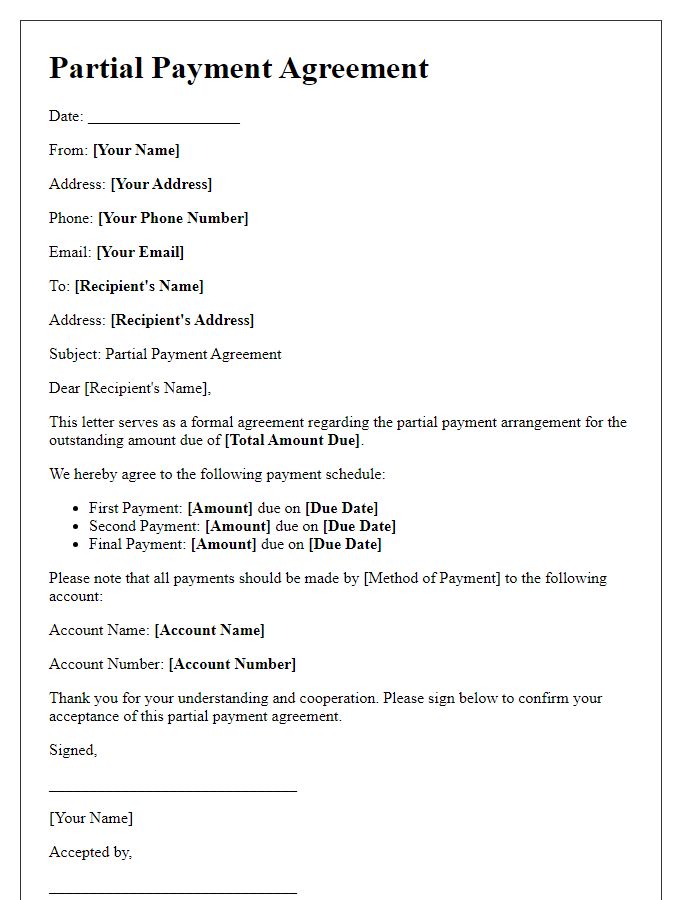

Payment plan and due dates

A structured debt repayment schedule is crucial for managing outstanding financial obligations effectively. This schedule outlines a clear payment plan with specific due dates for each installment. For example, if total debt amounts to $5,000, the repayment plan could span ten months, requiring monthly payments of $500. The due dates might start from January 1, 2024, continuing on the first day of each subsequent month until the debt is fully repaid by October 1, 2024. Incorporating interest rates into the schedule is essential; for instance, a 5% annual interest rate could influence the total repayment amount, thus necessitating adjustments to the monthly payments if applicable. Clear record-keeping and timely payments are vital for maintaining good credit standing throughout this repayment period.

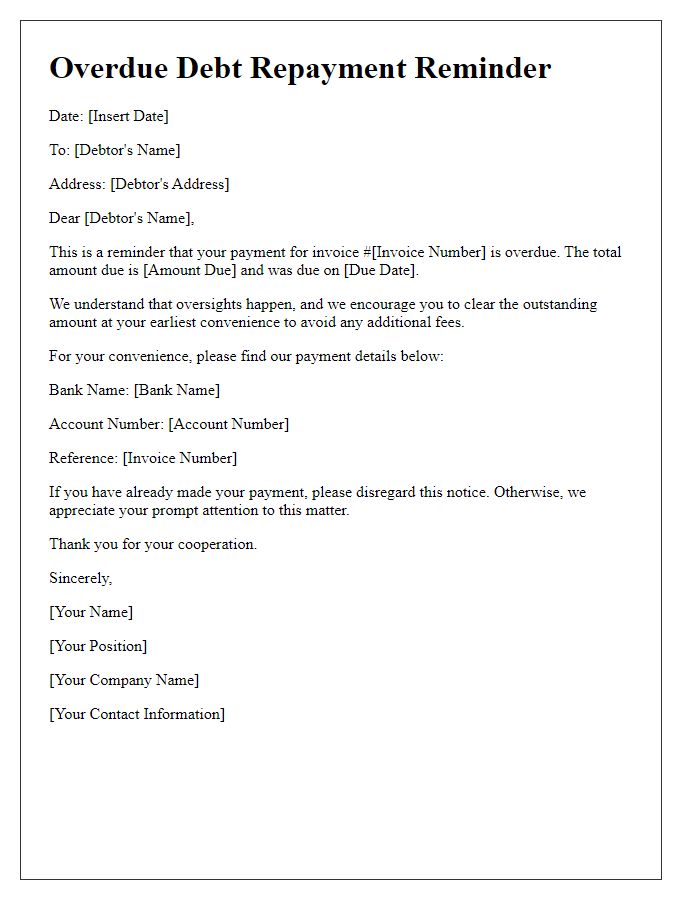

Consequences of non-payment

Failure to adhere to a debt repayment schedule can lead to significant consequences for the borrower. For instance, late payments may result in increased interest rates, escalating from an initial annual percentage rate of 5% to as high as 25% depending on the lender's policies. Such defaults can severely impact credit scores, with potential decreases reaching 180 points on the FICO scale, making it difficult to secure future loans or credit. Furthermore, lenders can initiate collection efforts, potentially involving third-party agencies and legal action, which may include garnishments of wages or liens placed on assets and properties. In extreme cases, prolonged non-payment may lead to bankruptcy filings, a lengthy process that could remain on credit reports for up to a decade, restricting access to financial opportunities. It is crucial for borrowers to understand these ramifications to avoid the pitfalls associated with inadequate debt management.

Contact information for queries

A debt repayment schedule is essential for managing outstanding debts effectively, highlighting critical details including amounts owed, due dates, and repayment methods. Often, creditors prefer to communicate through various means such as email, phone calls, or postal services to address any queries related to the payment terms. Providing comprehensive contact information, such as a dedicated customer service number (e.g., +1-800-555-0199), email address (support@debtcompany.com), and office address (123 Financial Way, Suite 456, New York, NY 10001) allows borrowers to seek clarification or assistance with their repayment plans. Ensuring support is easily accessible can help foster transparent communication and facilitate timely payments.

Comments