Are you curious about how your investment portfolio is performing? A regular review is essential to ensure that your assets align with your financial goals and market trends. In this article, we'll guide you through the key elements to consider during your investment portfolio review, empowering you to make informed decisions. Join us as we delve deeper into strategies that could enhance your portfolio's performance!

Portfolio Performance Analysis

The investment portfolio review encompasses a comprehensive analysis of financial assets, including stocks, bonds, and mutual funds, assessing overall performance against benchmarks. The report details key metrics such as annualized returns (measured over three, five, and ten years), volatility indicators (standard deviation), and risk-adjusted performance metrics like the Sharpe ratio. Sector allocations provide insight into diversification strategies, revealing exposure to industries such as technology, healthcare, and consumer goods. Geographic distribution highlights investments in various markets, including emerging economies in Asia and established economies in Europe. Active versus passive management strategies illustrate the approach taken to optimize returns, alongside management fees that impact net performance. Additionally, the review includes tax considerations, emphasizing capital gains tax implications and strategies to minimize tax liabilities, ultimately guiding investors on informed decision-making for potential rebalancing or allocation adjustments.

Risk Assessment and Management

Investment portfolio reviews are critical for assessing risk exposure and ensuring alignment with financial objectives. Risk assessment involves evaluating asset allocation, market trends, and individual investment performance, focusing on stocks, bonds, and alternative assets. Key financial metrics such as beta (a measure of volatility), standard deviation (measure of risk), and Value-at-Risk (VaR) can provide insights into potential losses during market downturns. Management strategies must include diversification across sectors like technology, healthcare, and renewable energy, as well as geographic distribution, to mitigate risk. Regular evaluations and adjustments based on economic indicators and personal financial changes, such as income variations or life events like retirement, are essential for maintaining a balanced and resilient investment strategy.

Asset Allocation and Diversification

An effective investment portfolio review focuses on Asset Allocation (distribution of investments across various asset categories) and Diversification (spreading investments within those categories). A balanced asset allocation typically includes stocks, bonds, and alternative investments, depending on risk tolerance and financial goals. For instance, a moderate portfolio may consist of 60% equities and 40% fixed-income securities, aimed at generating growth and stability. Diversification within the stock segment involves varying sectors such as technology, healthcare, and consumer goods to minimize risk. For example, investing in the S&P 500 index offers exposure to 500 leading companies, while international stocks can enhance growth potential in global markets. Regular reviews every quarter allow for adjustments based on market performance and personal circumstances, ensuring alignment with overall investment objectives.

Economic and Market Conditions

Economic indicators reflect trends impacting financial stability. Interest rates, set by central banks like the Federal Reserve, influence borrowing costs and consumer spending. Inflation rates, measured by the Consumer Price Index (CPI), affect purchasing power, with recent US inflation hovering around 6.2%. Market volatility, influenced by geopolitical events and corporate earnings reports, can lead to fluctuations in stock indices such as the S&P 500 or NASDAQ. Global supply chain disruptions, originating from events like the COVID-19 pandemic, continue to challenge production and distribution sectors. Additionally, employment rates, tracked via the Bureau of Labor Statistics, provide insights into economic recovery phases critical for portfolio adjustments.

Future Investment Strategy and Goals

Investment portfolio reviews are crucial for aligning future strategies with individual financial goals. A comprehensive assessment includes analyzing current asset allocations, evaluating performance metrics, and identifying growth opportunities in emerging markets or sectors. Investors may focus on diversification across equities, bonds, real estate, and alternative investments to mitigate risks and enhance returns. Setting specific goals, such as reaching a target retirement fund of $1 million by age 65, can guide strategic adjustments, including increasing contributions or reallocating assets based on market trends and economic forecasts. Regular updates (quarterly or annually) ensure responsiveness to economic changes, allowing investors to stay aligned with their objectives.

Letter Template For Investment Portfolio Review Samples

Letter template of investment portfolio assessment for high-net-worth individuals.

Letter template of investment portfolio evaluation for retirement planning.

Letter template of investment portfolio inspection for tax optimization.

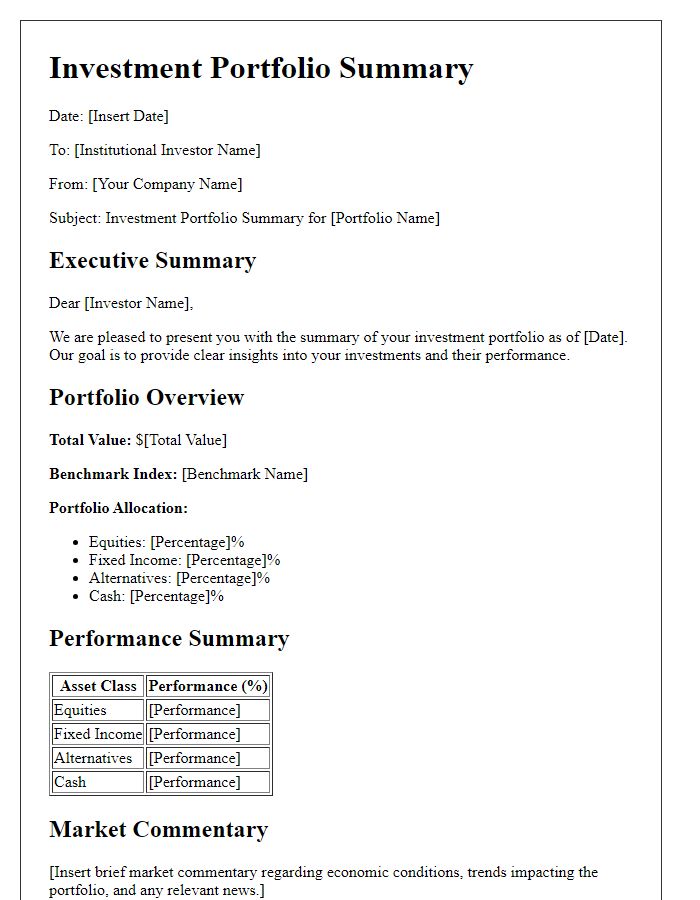

Letter template of investment portfolio summary for institutional investors.

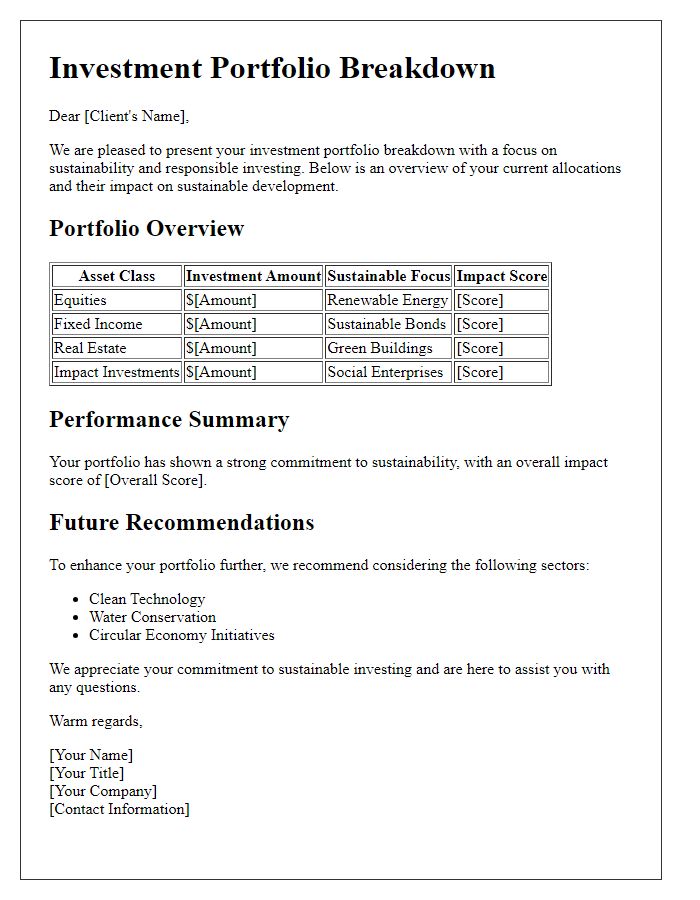

Letter template of investment portfolio breakdown for sustainability-focused clients.

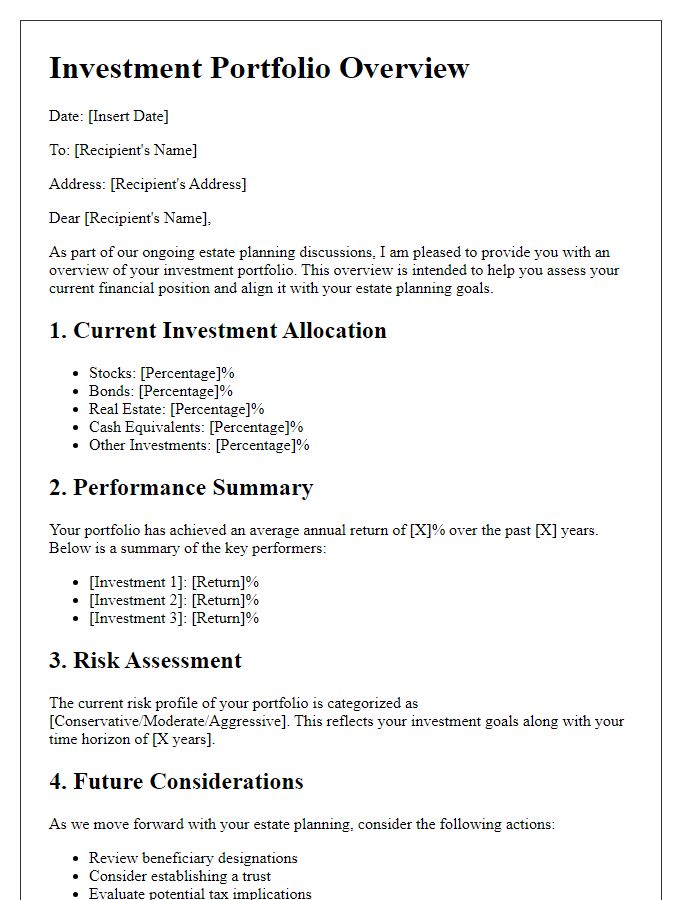

Letter template of investment portfolio overview for estate planning purposes.

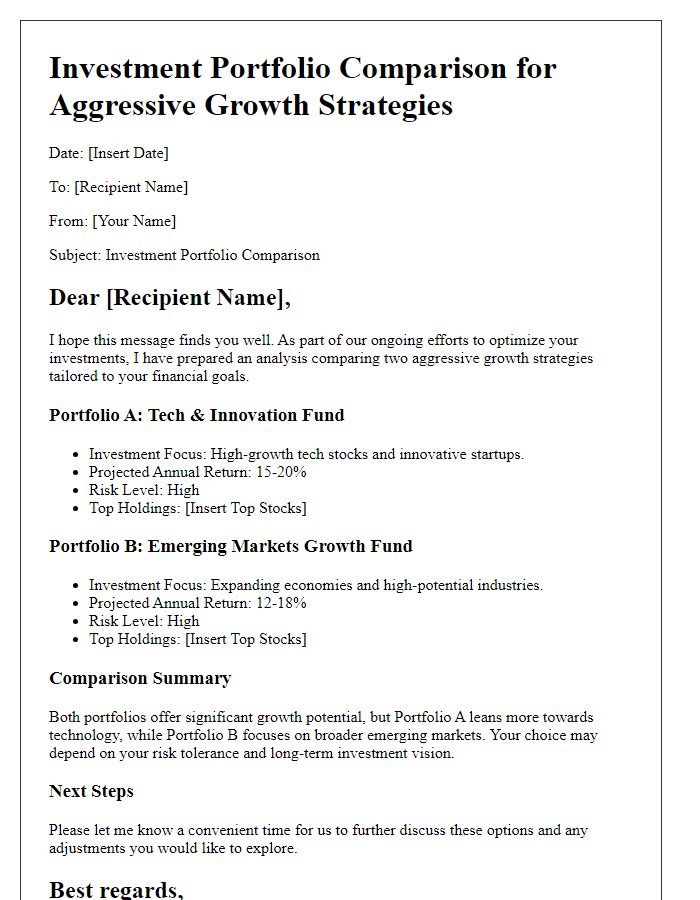

Letter template of investment portfolio comparison for aggressive growth strategies.

Letter template of investment portfolio update for socially responsible investing.

Comments