Navigating the world of bank loan applications can be a bit daunting, but understanding the nuances can make the process smoother. Whether you're seeking clarification on the requirements or looking for tips on how to present your information effectively, we're here to help. By staying informed and prepared, you can increase your chances of securing the funding you need. So, let's dive into the details and unlock the secrets to a successful loan application!

Clear subject line

A bank loan application may require clarification for various reasons, such as incomplete documentation or insufficient credit history. When addressing this matter, it is essential to provide key details regarding the application, such as the application number (typically assigned by the bank) and the specific type of loan (personal, home, auto). Additionally, referencing the date of submission can help the bank locate the application in question, while explaining the needed clarifications (for instance, providing additional income verification or identification documents). This approach ensures a more streamlined communication process with the bank, facilitating a quick resolution and eventual approval of the loan.

Application reference number

When submitting a bank loan application, applicants often need to clarify specific details related to their Application Reference Number. This unique identifier, typically assigned upon initial submission, ensures efficient processing and tracking within the bank's system. Providing accurate information related to the Application Reference Number is crucial, as it allows bank representatives to quickly locate and review the applicant's loan details, such as personal identification, loan amount requested, purpose of the loan, and other pertinent financial information. Including this reference number in correspondence, especially if inquiring about the status, can significantly expedite the response process and enhance communication clarity.

Specific inquiry details

Bank loan applications are a critical process that potential borrowers undertake when seeking financial assistance from institutions such as commercial banks or credit unions. Key components include personal information, financial history, credit scores (typically ranging from 300 to 850 in the FICO scoring model), and the amount requested. Specific inquiries may arise regarding loan terms, interest rates, repayment schedules, and collateral requirements. Borrowers may also seek clarification on documentation like pay stubs, tax returns, and bank statements (covering at least three months) to ensure all necessary information is provided for accurate assessment. Understanding policies such as those under the Fair Lending Act can help applicants navigate the complexities of the loan application process.

Contact information

A bank loan application requires clear and comprehensive contact information to facilitate communication between the applicant and the financial institution. Essential details include the applicant's full name, verified residential address (including city and zip code), phone number (preferably a mobile number for immediate contact), and a professional email address. The loan officer may need additional information, such as alternative contact details or the names of individuals authorized to discuss the loan application on behalf of the applicant. Ensuring that this information is accurate and up-to-date is crucial for the successful processing and timely approval of the loan request.

Professional tone

A bank loan application requires clarity and precision for a successful review. An applicant may seek clarification on requirements, processes, and timelines, helping ensure all necessary documents are included, such as proof of income (W-2 forms), employment verification letters, and credit history reports. Applicants should reference specific loan types (e.g., personal loans, mortgage loans, or business loans) and the associated interest rates and repayment terms. Clarifying the submission format (digital or physical) and expected timelines for approval enhances understanding of the application journey. A professional tone conveys respect and seriousness regarding the financial engagement.

Letter Template For Bank Loan Application Clarification Samples

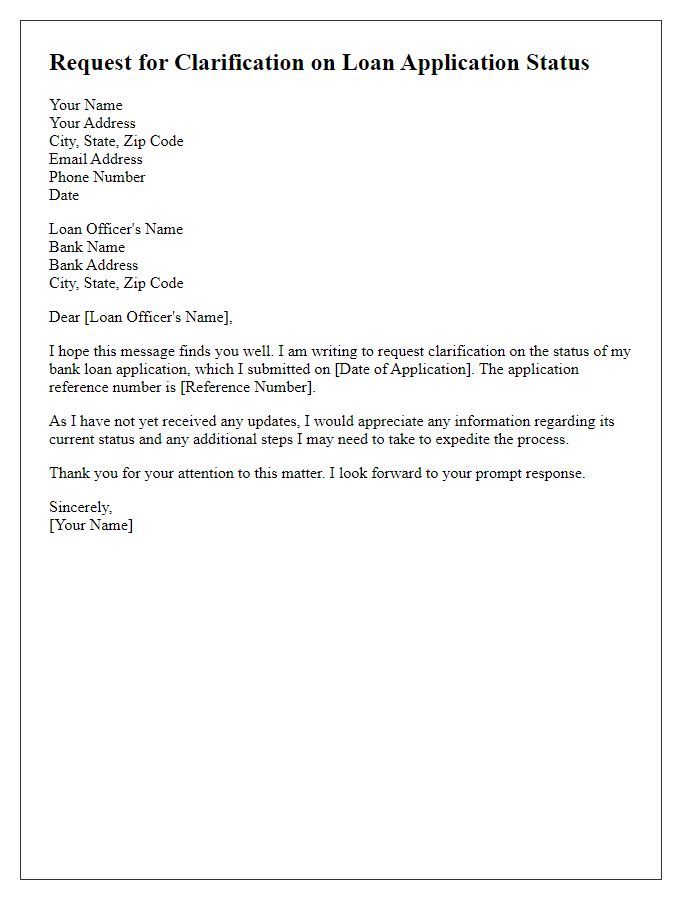

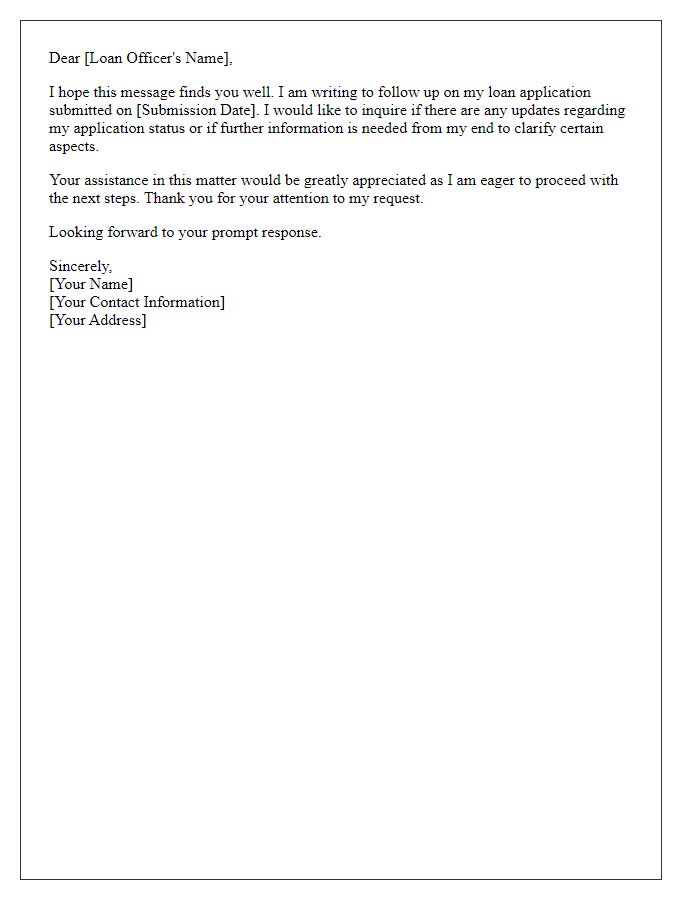

Letter template of request for clarification on bank loan application status

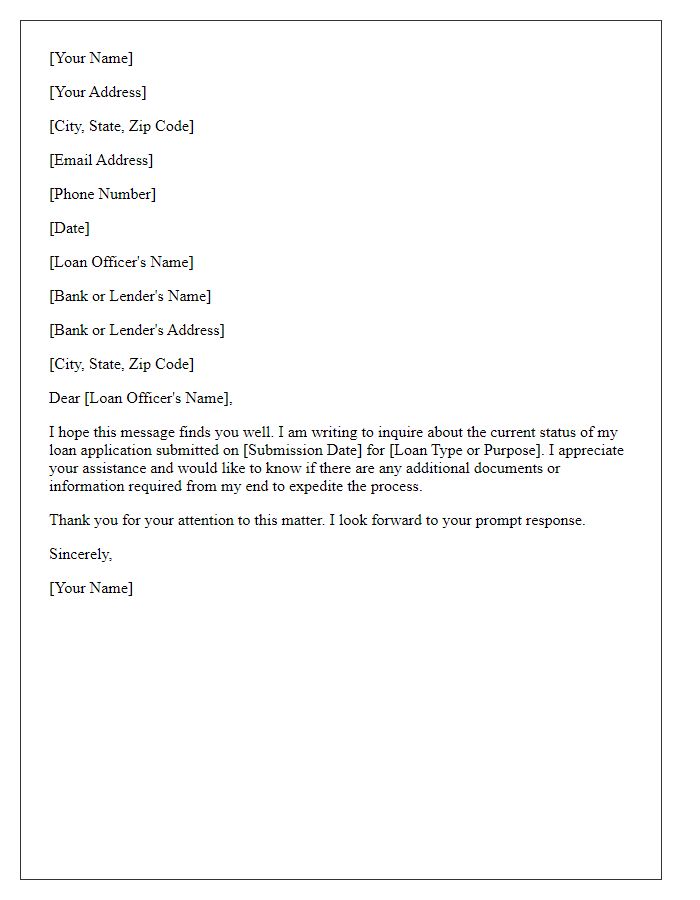

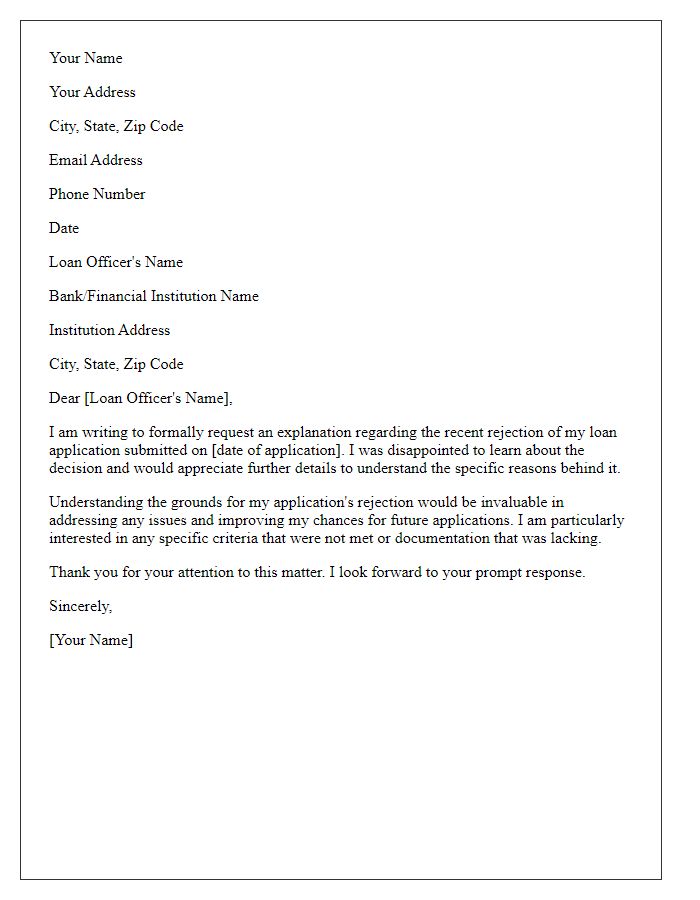

Letter template of inquiry for additional information regarding loan application

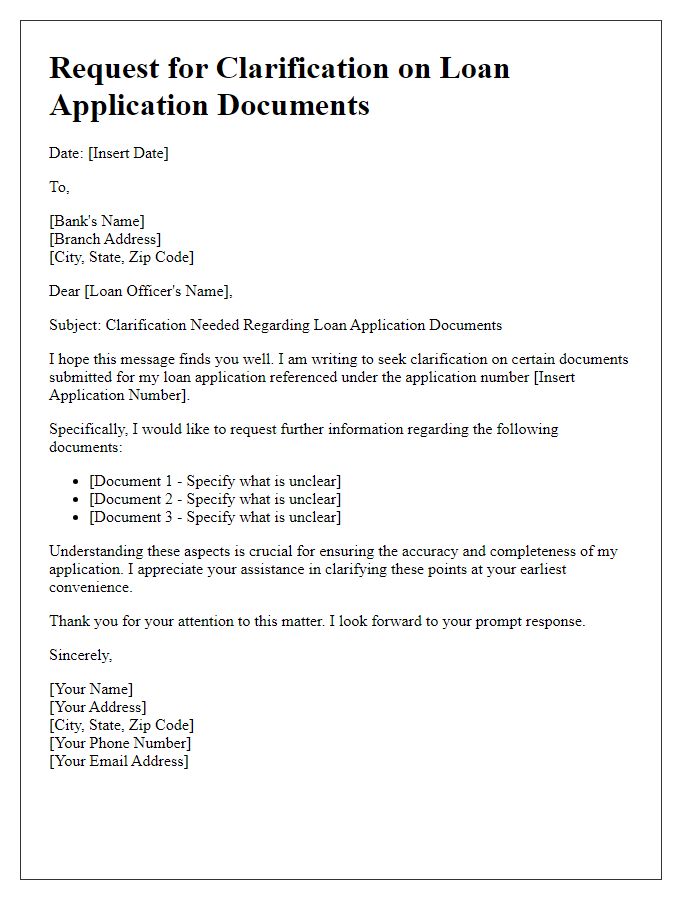

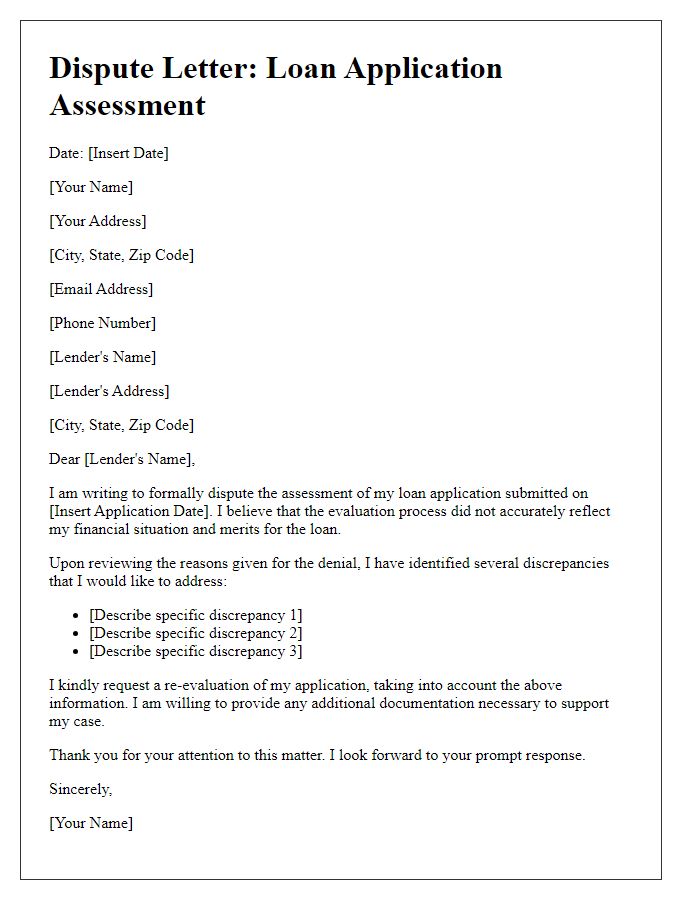

Letter template of clarification needed for bank loan application documents

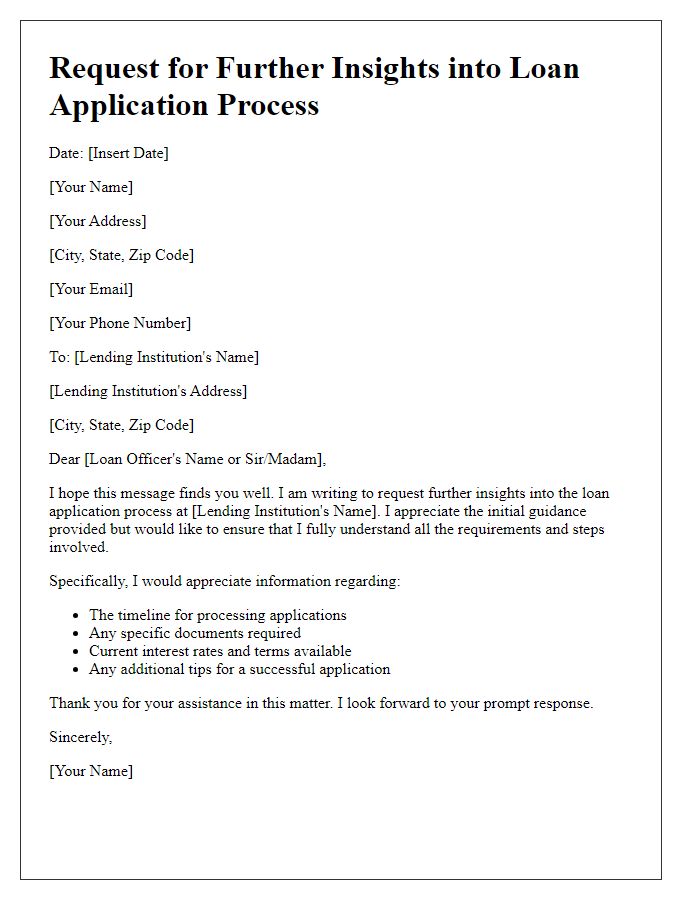

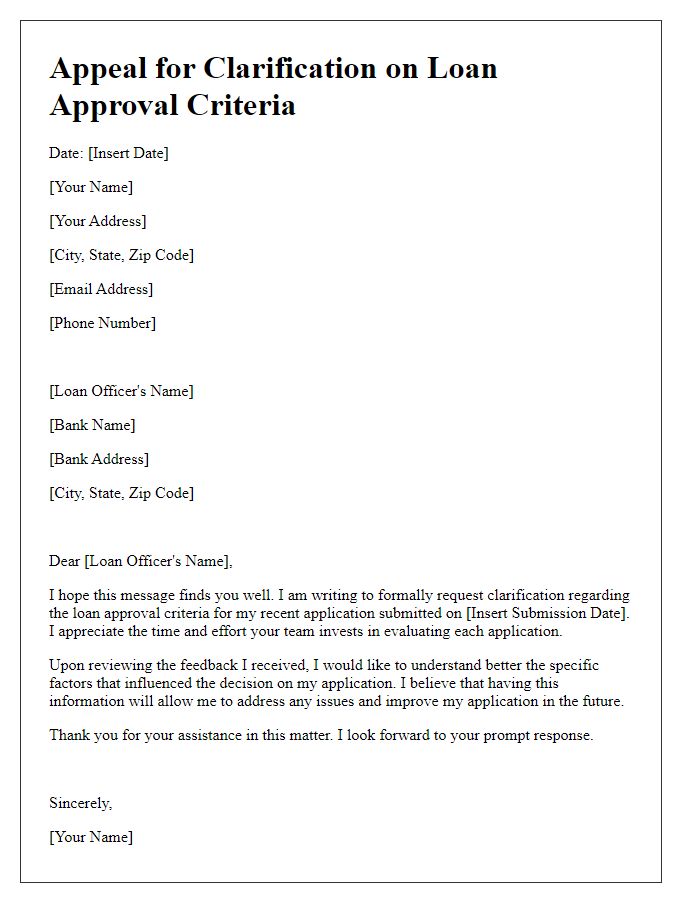

Letter template of request for further insights into loan application process

Comments