When it comes to crafting a compelling joint venture proposal, the right approach can make all the difference. Think of this letter as your opportunity to showcase how collaboration can pave the way for exciting new opportunities and mutual growth. By clearly outlining the benefits of the partnership and the shared vision for success, you can capture the interest of potential partners. Ready to explore the essentials of creating a standout joint venture proposal? Read on to uncover key insights and tips!

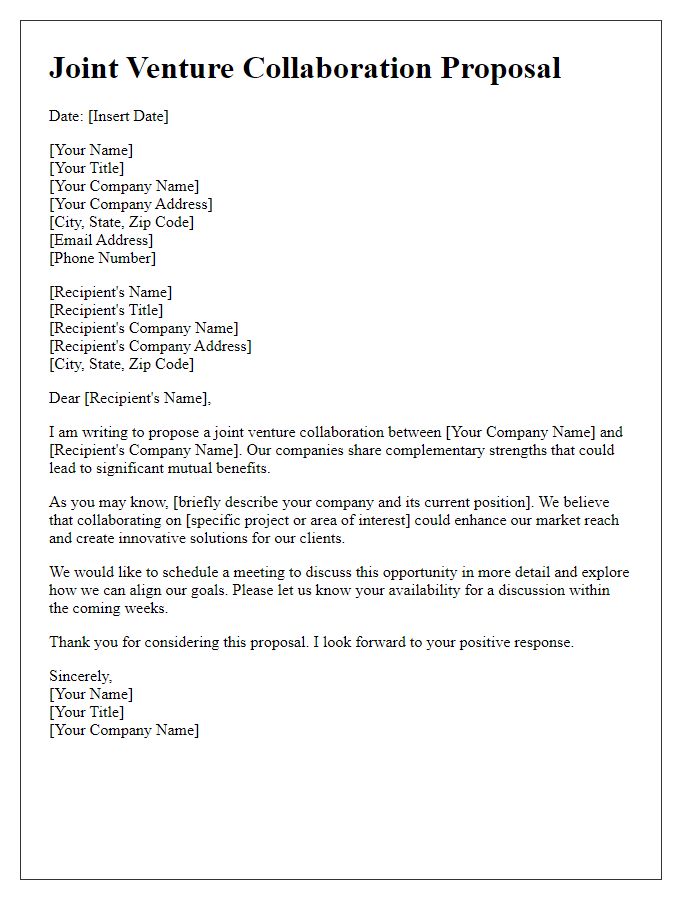

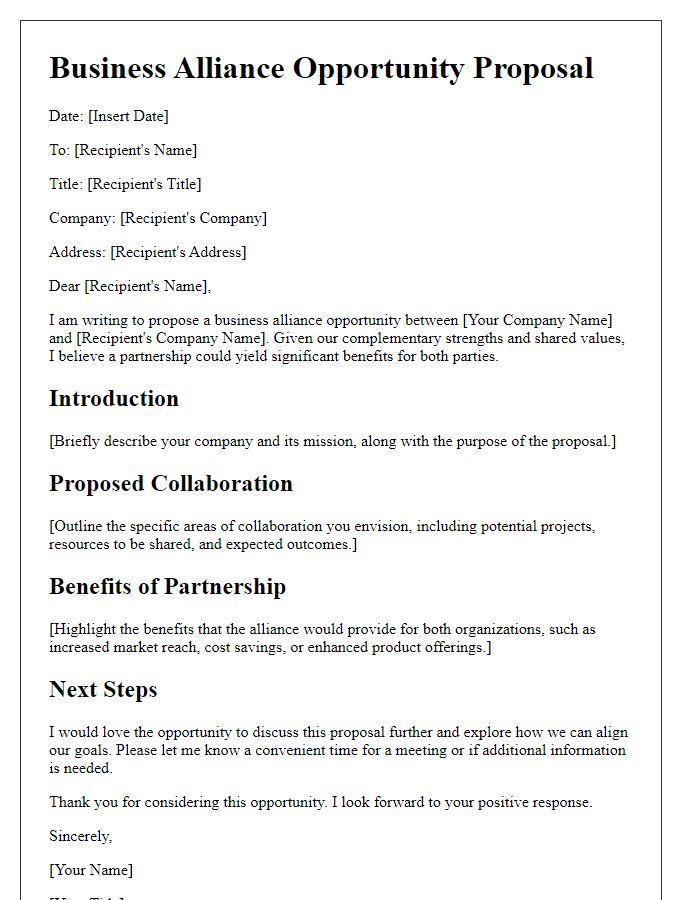

Introduction and Purpose

A joint venture proposal serves to outline a collaborative effort between two or more businesses aimed at achieving a specific objective, such as market expansion or product development. This agreement often highlights shared resources, expertise, and investments to leverage strengths of each entity involved. For instance, in the tech industry, a joint venture might enable a software company and a hardware manufacturer to combine their competencies, resulting in innovative products that cater to evolving consumer needs. The clear articulation of the partnership's purpose plays a crucial role, ensuring all stakeholders are aligned and focused on strategic outcomes that maximize profitability and market presence in competitive landscapes.

Objectives and Goals

A well-structured joint venture proposal outlines clear objectives and goals to align both parties on the partnership's vision and expectations. This includes maximizing market presence in specific sectors, increasing revenue streams by targeting a shared audience, and leveraging combined expertise to innovate products or services. Establishing measurable milestones, such as achieving a 20% increase in sales within the first year, can facilitate performance tracking and accountability. Additionally, defining roles and responsibilities aids in clarifying contributions from both entities, while risk management strategies promote sustainability and growth. Regular assessments ensure ongoing alignment with the defined goals, fostering a solid foundation for long-term collaboration.

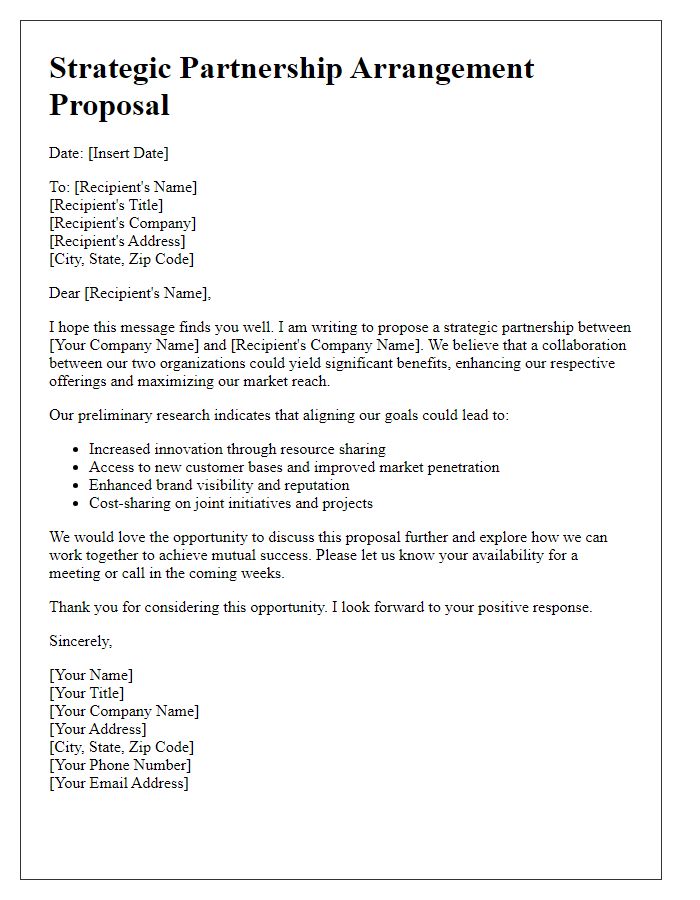

Synergies and Benefits

Joint venture proposals highlight synergies and benefits that can arise from collaborative efforts between two or more businesses. A well-conceived joint venture, like the collaboration between two innovative tech companies, can lead to optimized resource utilization, such as shared research and development (R&D) costs that can exceed millions of dollars. This partnership can leverage each other's intellectual property (IP) rights, resulting in improved product offerings and faster market entry, particularly in competitive industries like biotechnology and artificial intelligence. Shared marketing strategies can amplify brand visibility, potentially reaching millions of new customers within a matter of months. Access to each partner's distribution networks can enhance supply chain efficiency, reducing delivery times by up to 30%. Overall, such alliances can pave the way for significant revenue growth, exceeding several billion dollars over the contract's lifespan, while also fostering innovation that can reshape entire markets.

Roles and Responsibilities

A joint venture proposal outlines specific roles and responsibilities for each partner involved to ensure clarity and mutual understanding. In collaborative efforts, each entity may encompass distinct tasks such as financial investment, resource allocation, management oversight, or market strategy development. For example, the lead partner might handle stakeholder communication while the co-partner manages product development and quality assurance. Additionally, operational duties, marketing initiatives, and distribution channels must be clearly delineated, indicating which partner oversees logistics versus customer engagement. Setting performance metrics helps gauge success, while scheduled reviews foster accountability, aligning efforts toward achieving shared objectives in the venture.

Legal and Financial Terms

A joint venture agreement outlines essential legal and financial terms to ensure a clear understanding between partnering entities. The agreement should detail ownership percentages, specifying the distribution of profits and losses (often based on initial investment ratios). It is crucial to establish governance structures, including decision-making procedures, appointment of board members, and voting rights. Liability limitations must be defined to protect partners from unforeseen risks associated with joint business operations. Additionally, financial contributions, including capital investments and operating budgets, should be clearly articulated alongside timelines for funding. Specifics on revenue sharing models, tax implications, and exit strategies are critical to prevent disputes. Intellectual property rights and confidentiality clauses should safeguard proprietary information developed during the joint venture. Finally, dispute resolution mechanisms, such as arbitration or mediation, must be included to handle potential conflicts efficiently.

Comments