Hey there! If you've found yourself in a situation where a payment didn't go through, you're not alone. Many people encounter this hiccup, and addressing it promptly can save you from added complications down the line. In this article, we'll guide you through drafting a clear and effective retry request letter, ensuring your next steps are as smooth as possible. So, grab a cup of coffee and let's dive in!

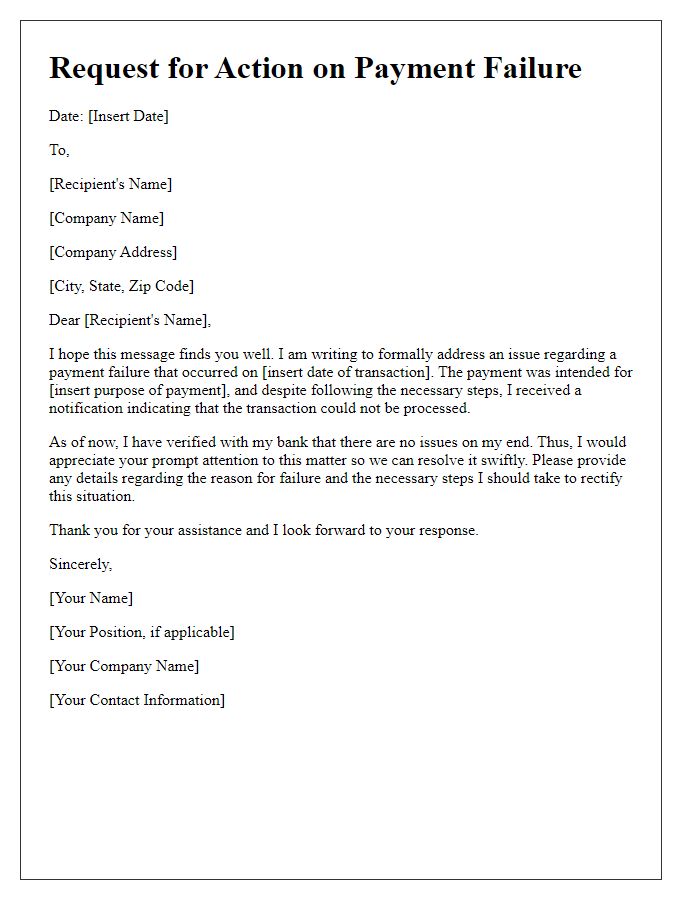

Polite and Professional Tone

In the realm of digital finance, failed payment transactions can pose significant challenges for businesses and consumers alike. Payment systems, such as credit card processors or digital wallets, often experience failures due to insufficient funds, expiration dates, or network issues. For example, Visa and Mastercard have specific error codes that indicate transaction declines, with error code 05 signaling denial due to suspected fraud. When such incidents occur, customers may receive notifications via email or app alerts, prompting them to update their payment information. Businesses can enhance customer experience by sending polite follow-up requests, urging clients to retry their payments while providing a seamless process to rectify the situation. Moreover, ensuring clear communication regarding the importance of maintaining up-to-date billing details can significantly reduce instances of future payment failures.

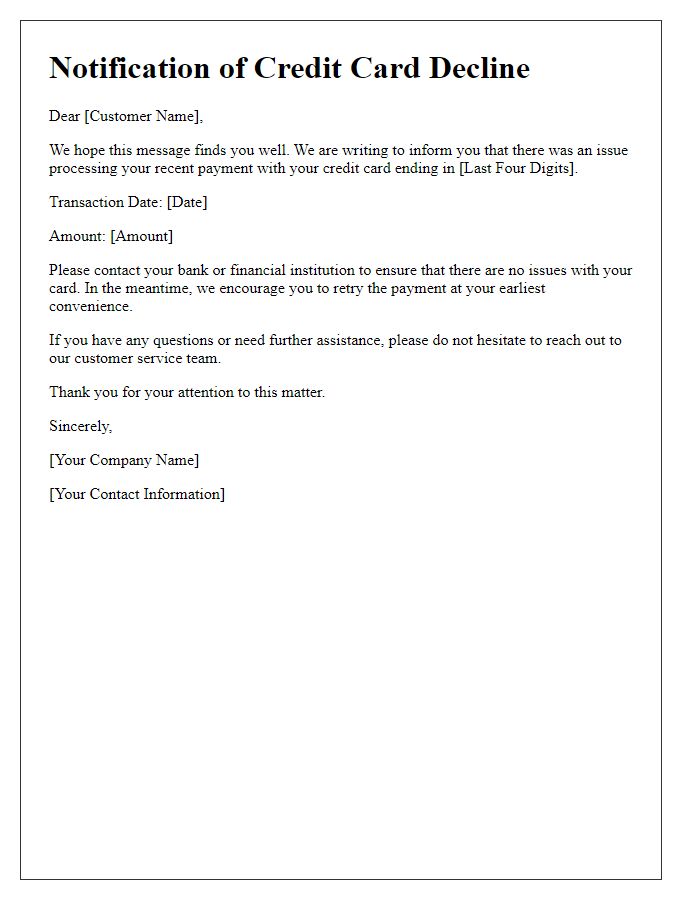

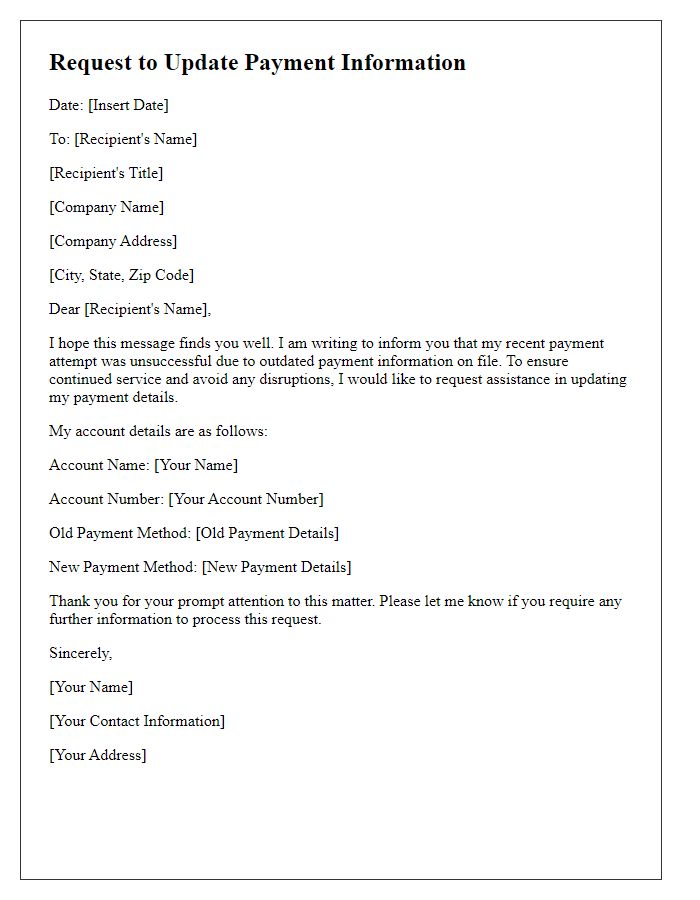

Clear Payment Details

When a payment fails, it can be crucial to provide clear payment details for further processing. This includes the transaction amount, payment method (like credit card, PayPal), and the specific date of the original attempt. For example, if the transaction amount was $49.99, initiated via a Visa credit card on October 15, 2023, it's important to indicate that this payment needs to be rerouted for processing. Additionally, confirming that the billing address is accurately entered can help avoid future failures. Providing a direct link to the payment portal can also facilitate a smoother retry process.

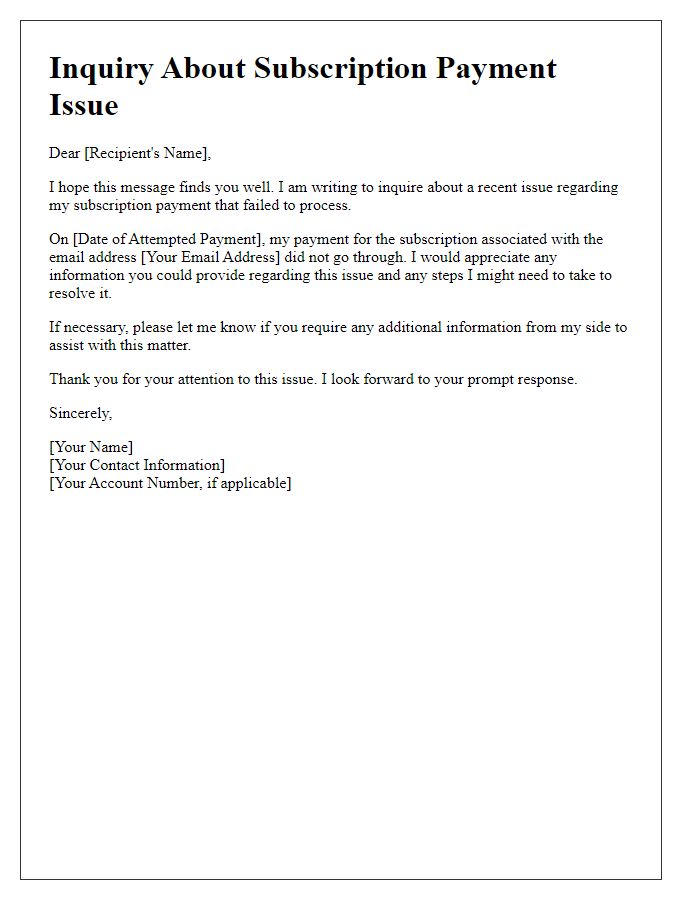

Request for Immediate Attention

Failed payment attempts can lead to disruptions in services or subscriptions, impacting user experience significantly. Issues like expired credit cards (often requiring updates every one to three years) or insufficient funds in bank accounts (which can vary widely depending on individual financial situations) may trigger these payment failures. In addition, merchant processing times, often taking anywhere from a few hours to several days, can cause delays in retrying the transaction. Immediate attention to this issue is crucial to maintain account access and ensure uninterrupted services from providers such as streaming platforms, cloud storage services, or subscription boxes, where timely payments are essential for continued delivery.

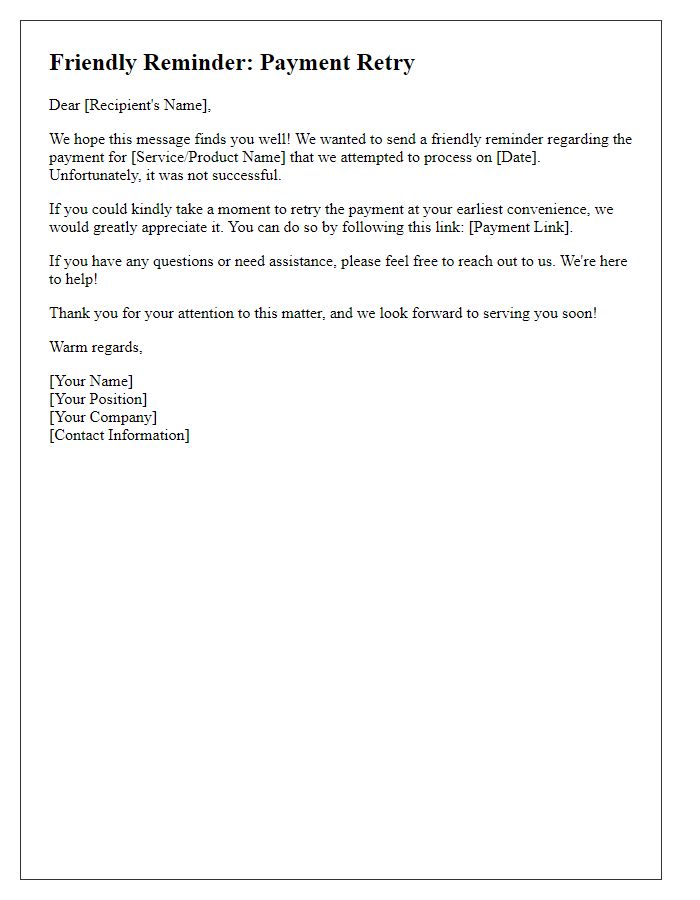

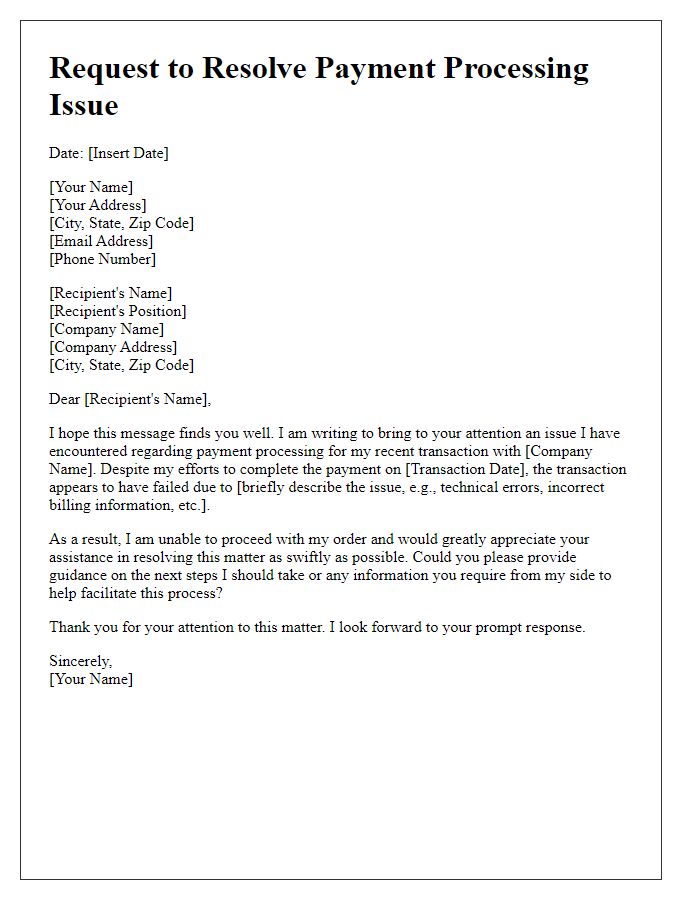

Instructions for Payment Retry

In cases of failed payment attempts for subscriptions, businesses often initiate a procedure to retry the payment. Payment gateways may retain the credit card or payment information securely, allowing for an automatic second attempt after a designated period, usually between 1 to 7 days. Businesses can send notifications to customers, detailing the need to update their payment methods in case of expiration or insufficient funds. It's important to communicate clearly regarding the specific date of the next attempt, typically indicated as a reminder through email or SMS. Providing a customer support contact can assist customers in resolving issues quickly.

Contact Information for Support

Failed payment notifications can create significant disruptions in service access. Commonly, payment processors such as PayPal and Stripe send alerts via email to users, indicating issues with credit card transactions or insufficient funds. In cases of recurring billing cycles, these interruptions could lead to cancellation of subscriptions or delayed access to premium features. Support teams typically encourage users to verify account details including card expiration dates and billing addresses to avoid payment failures. Contacting customer support often provides users with alternative solutions, including retrying the payment or updating payment methods securely through the company's website or dedicated support channels.

Comments