Are you looking to reopen a previously closed account? Whether you've changed your mind or need access to your funds again, the process can be straightforward with the right approach. In this article, we'll guide you through the essential steps and provide a handy letter template to help you communicate effectively with your bank. So, let's dive in and discover how to get your account back up and running!

Subject Line Optimization

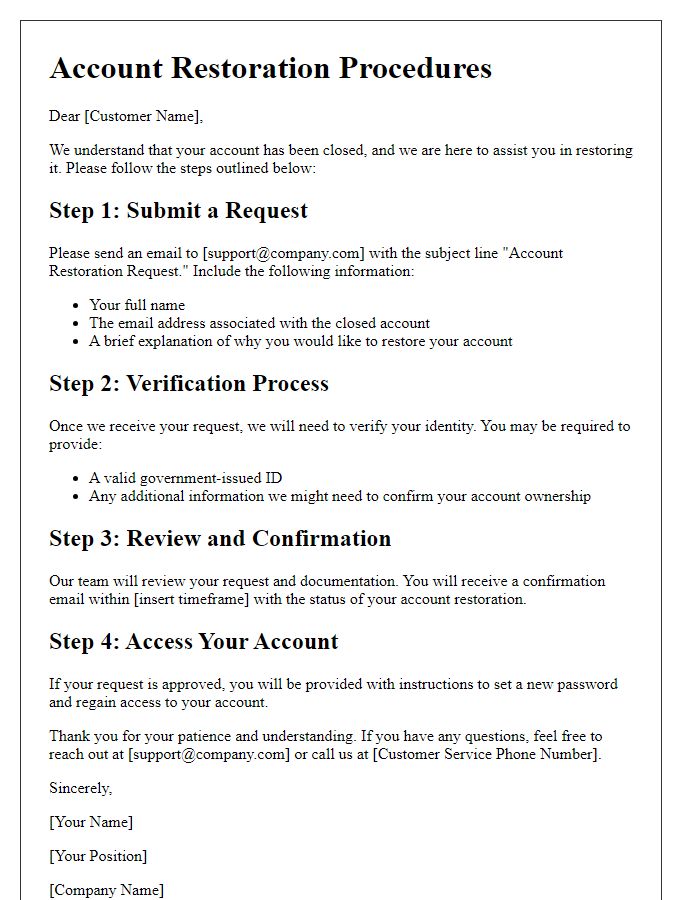

To reopen a closed account, it's essential to craft an engaging subject line that captures attention and prompts action. Effective subject lines should include key elements such as the account type (e.g., credit card, savings), the desired action (reopening), and a sense of urgency or importance. For example, "Request to Reactivate Closed Savings Account for Priority Review" indicates a specific request while highlighting the urgency for the recipient, leading to faster responses. Including account details, such as the account number (for internal reference), enhances clarity and eases the processing of the request. Always ensure that the subject line is concise yet informative to facilitate a smooth reopening process.

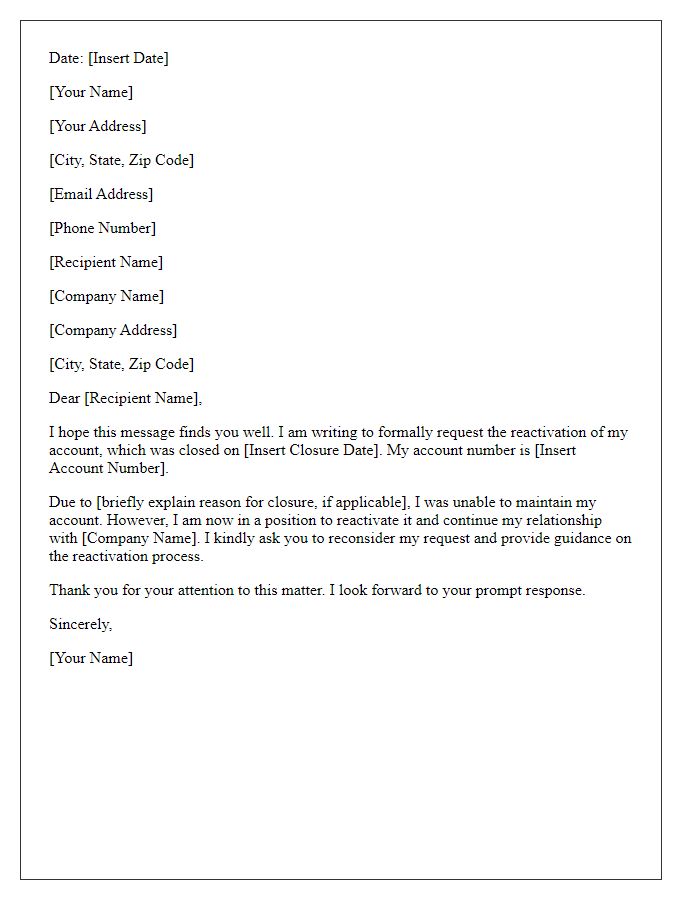

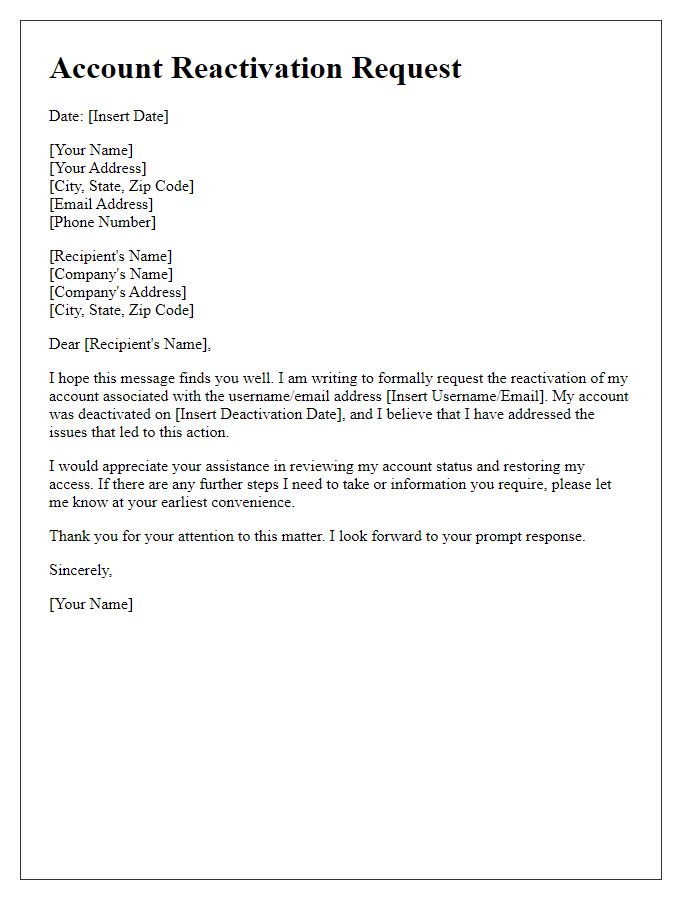

Personalization and Account Details

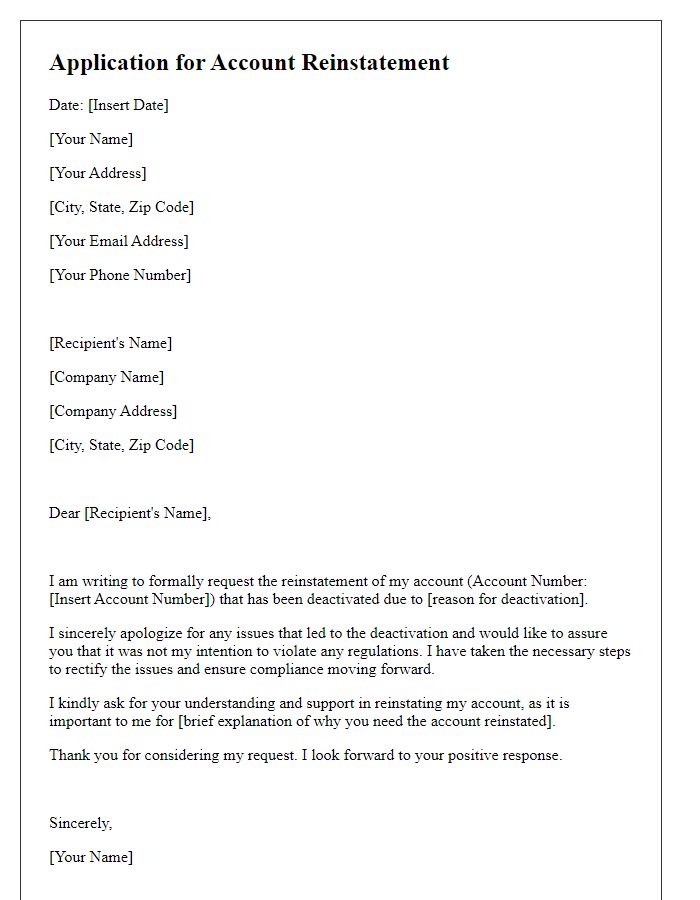

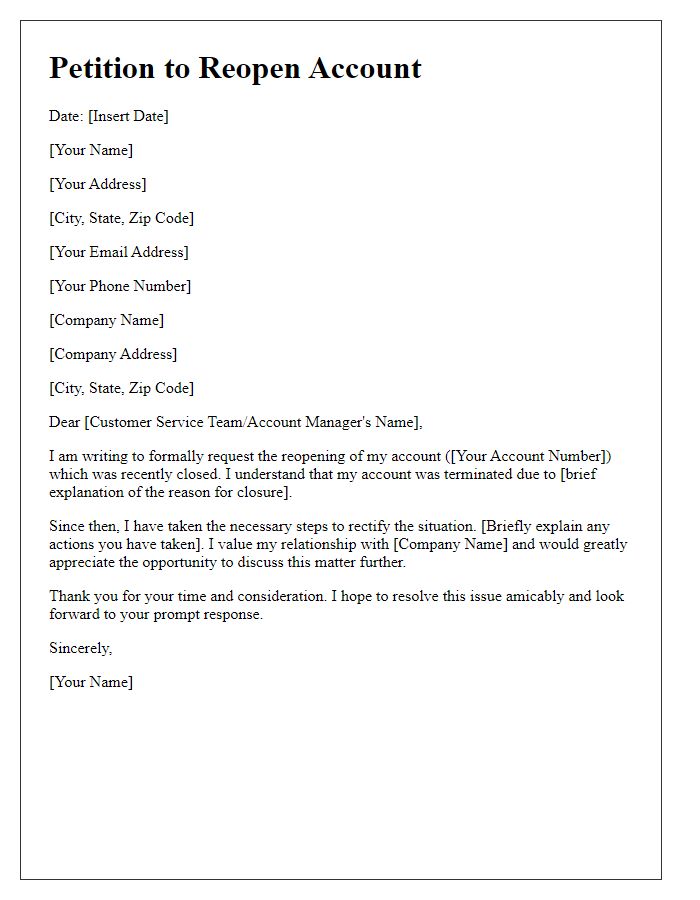

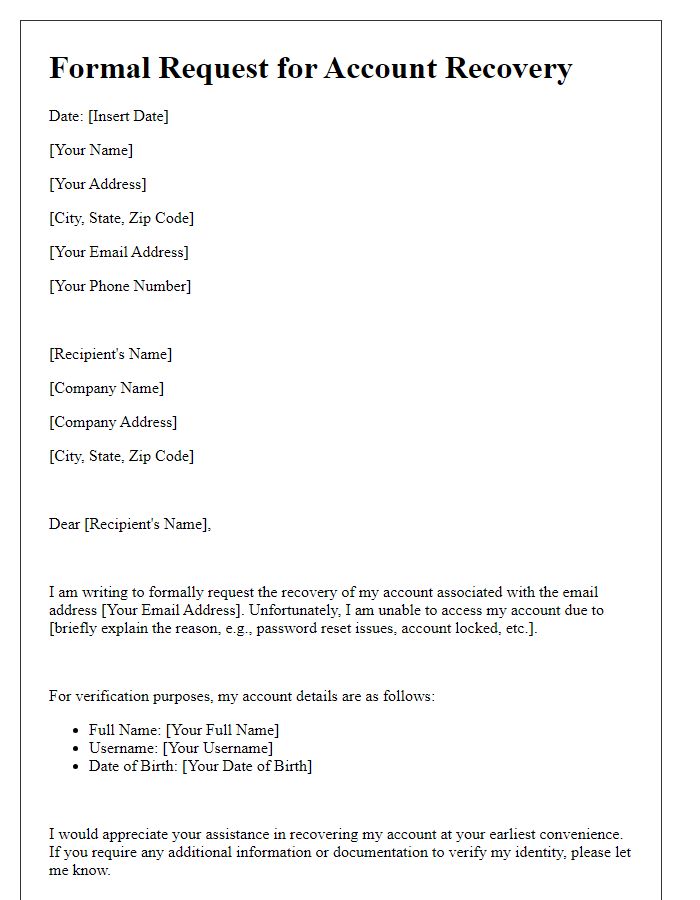

A process for reopening a closed bank account involves providing specific account details and personal information. Essential account information includes account number, type of account (savings or checking), and the closure date, which may span several months or years. Personal identification can include full name, date of birth, and address. Moreover, it's crucial to mention reasons for the closure, such as account inactivity or financial difficulties, which can illustrate the necessity for reopening. Customer service representatives often require additional verification steps, such as answering security questions or submitting identification documents, to ensure account security.

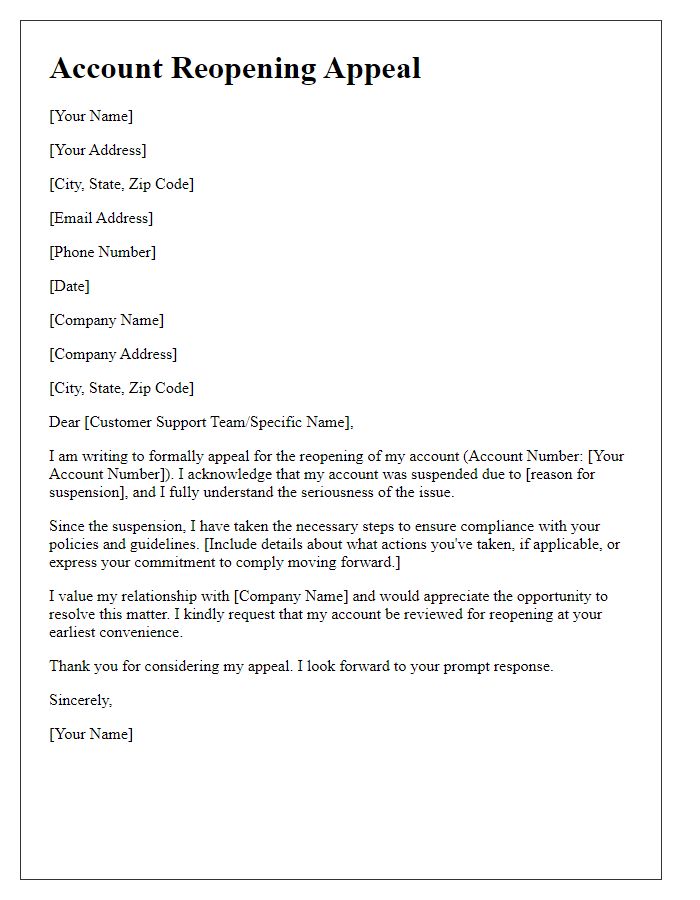

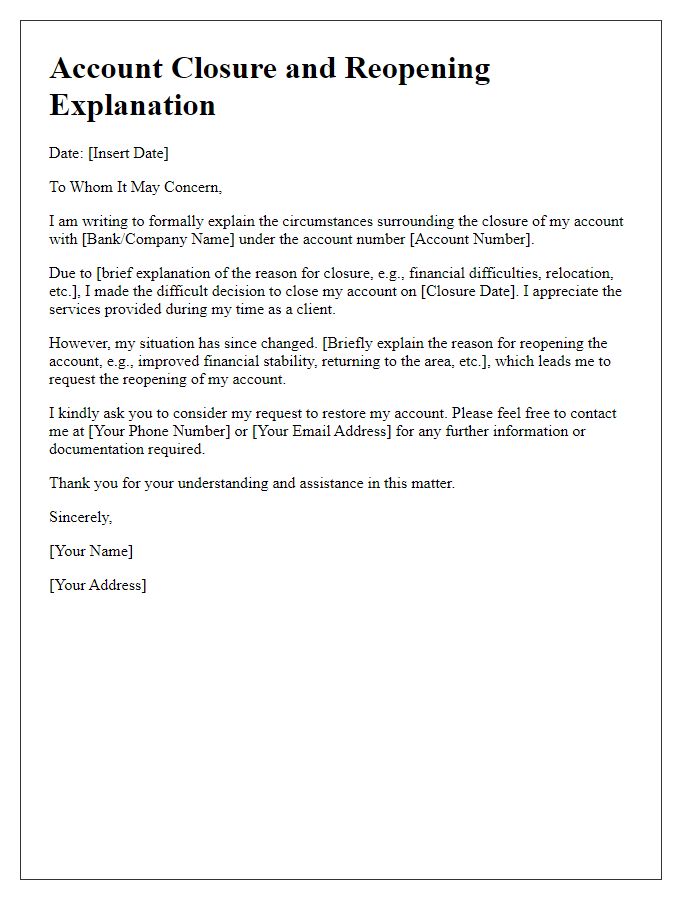

Compelling Reasons for Reopening

Reopening closed bank accounts can offer several benefits to customers seeking financial stability and convenience. Many individuals, such as students or newly employed professionals, may find themselves in transitional phases where access to funds becomes critical. Various banking institutions, like Bank of America or Chase, provide online banking features that facilitate easy access and management of personal finances. Additionally, the return of promotions, such as cash bonuses for opening new accounts, can incentivize customers to reactivate previously closed accounts. Customers may also have compelling reasons related to financial planning, such as saving for future goals like higher education or home purchase. Furthermore, exclusive offerings like high-interest savings accounts can enhance the appeal of reopening an account, helping individuals to achieve their savings objectives more effectively.

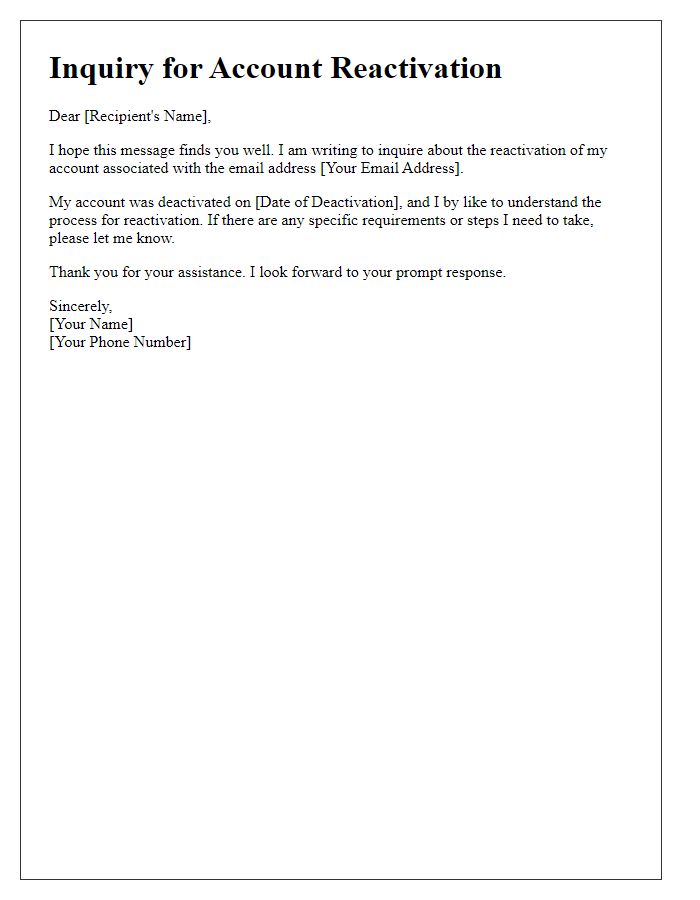

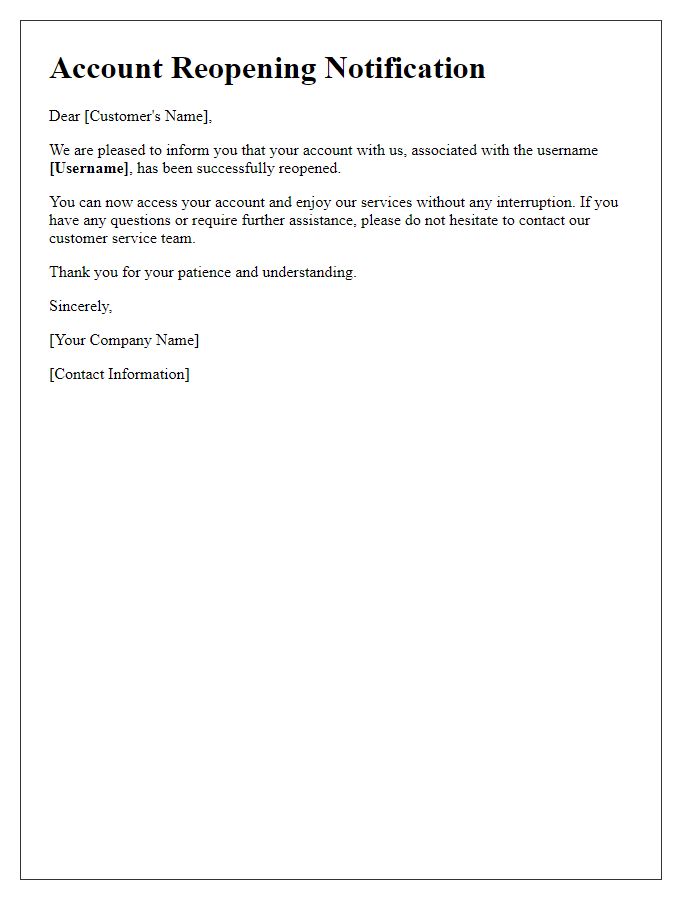

Clear Call to Action

Reopening a closed account, such as those from financial institutions or subscription services, can be crucial for users who wish to regain access to services. Users should clearly state their intent to reactivate the account, providing account details like account number or email associated with the account. Often, specific reasons for closure (like dissatisfaction, change of policies) can strengthen the request. Additionally, including a valid phone number or email can facilitate confirmation or further communication, easing the process of reactivation. It's vital to express a readiness to comply with any necessary steps or additional documentation required by the service provider.

Contact Information and Signature

To reopen a closed account, individuals must typically provide specific contact information, including a full name, address, email, and phone number. It is crucial to include the account number related to the closed account for easy reference. The request should be signed, preferably using a handwritten signature, to ensure authenticity and acknowledgment of the request. Documents supporting the identity, such as a government-issued ID, might also be beneficial for verification purposes. Depending on the institution's policies, individuals may need to indicate their reason for reopening the account to facilitate the process.

Comments