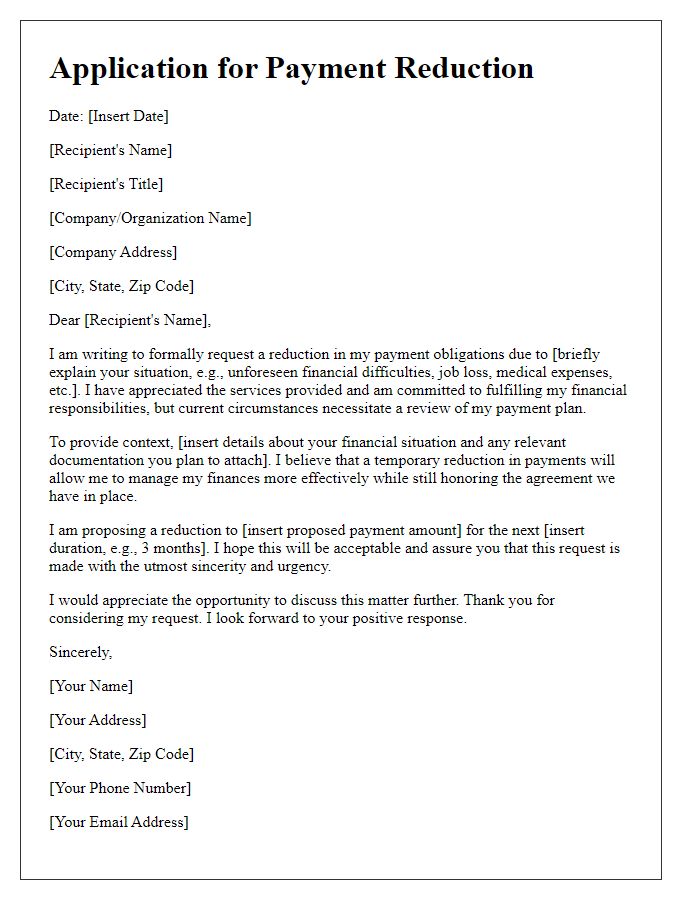

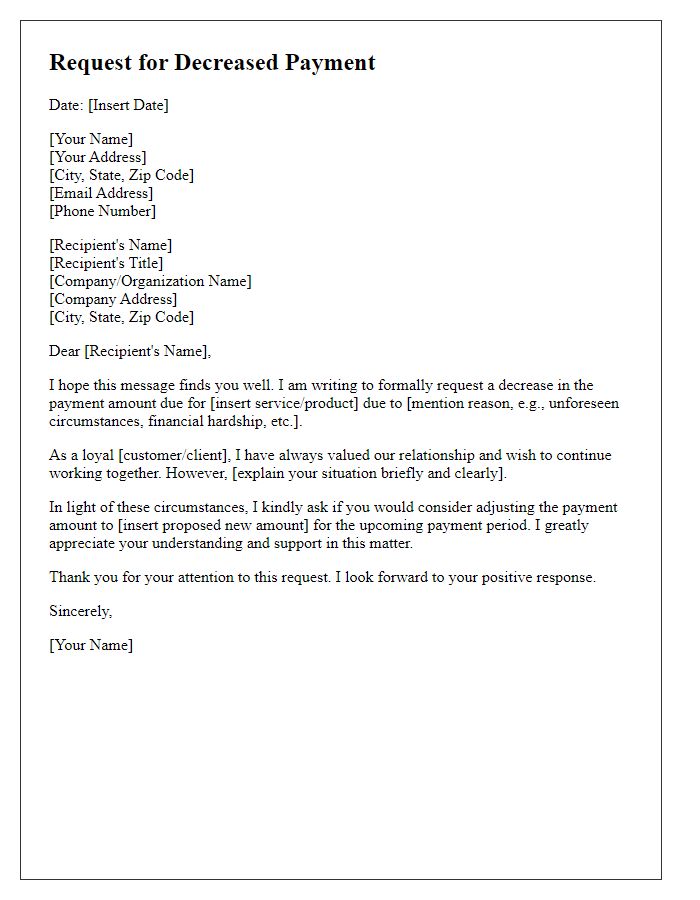

If you're seeking to craft a compelling letter for a reduced payment offer, you're in the right place! This kind of letter not only conveys your request but also establishes a respectful tone that promotes understanding. It's important to clearly explain your circumstances and the reasons behind your request, as transparency can foster goodwill. So, if you're ready to learn how to navigate this sensitive topic with ease, keep reading for a helpful template!

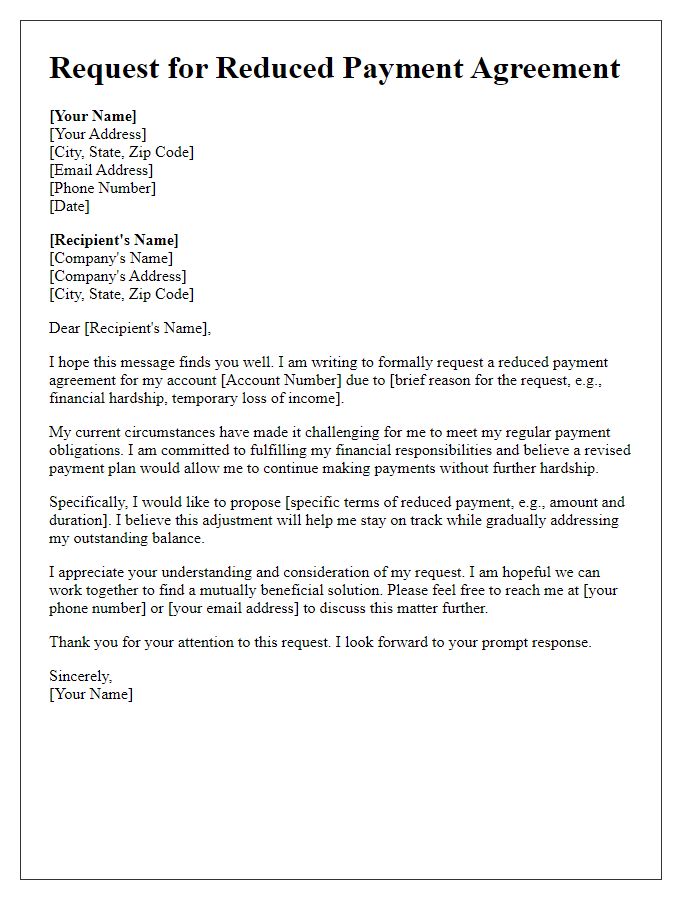

Financial Hardship Explanation

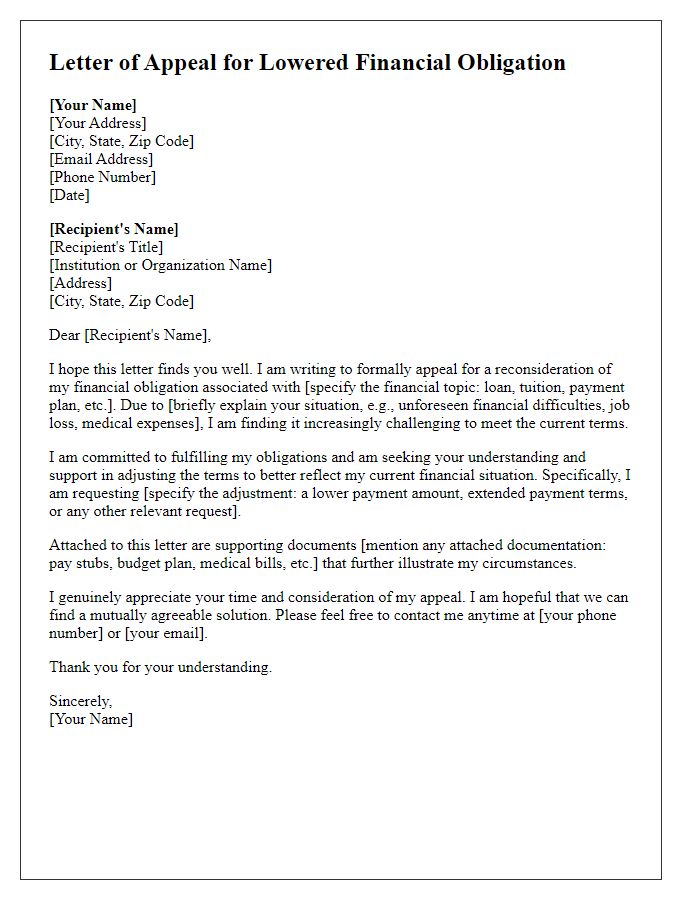

An offer for reduced payment due to financial hardship involves careful consideration of personal circumstances affecting one's ability to pay. Individuals may experience job loss, such as being laid off from employment at a major company like XYZ Corp, or unexpected medical expenses resulting from a critical illness like cancer requiring extensive treatment. Other factors, including the rising cost of living, may further strain finances, leading to difficulties in maintaining regular payment schedules. It is essential to clearly outline the specific circumstances, provide documentation to validate the claim (like medical bills or termination letters), and propose a realistic adjusted payment plan that aligns with current financial capabilities. This structured approach ensures that the request is both respectful and transparent, facilitating understanding from the creditor.

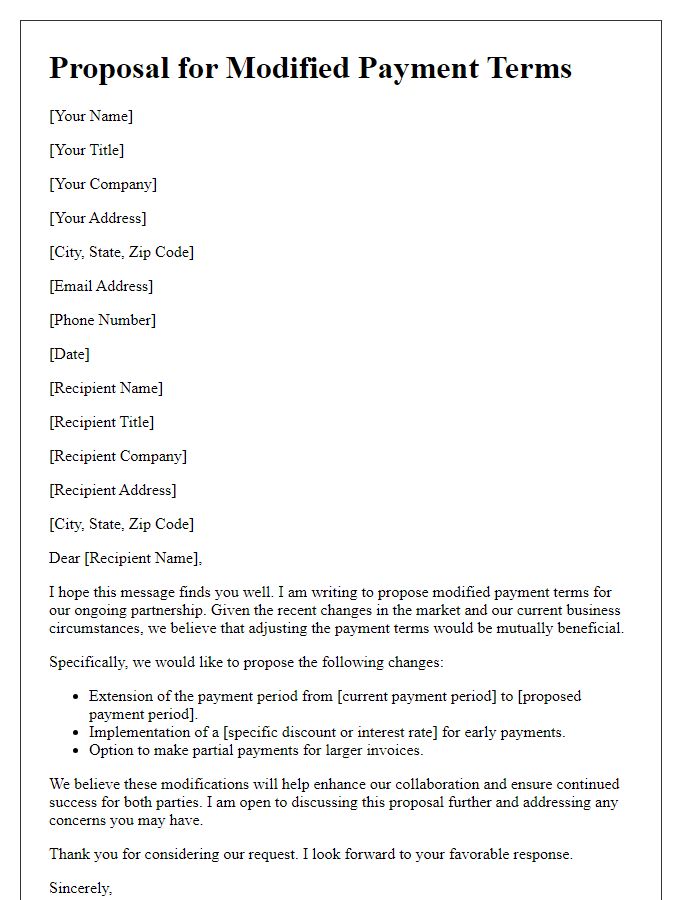

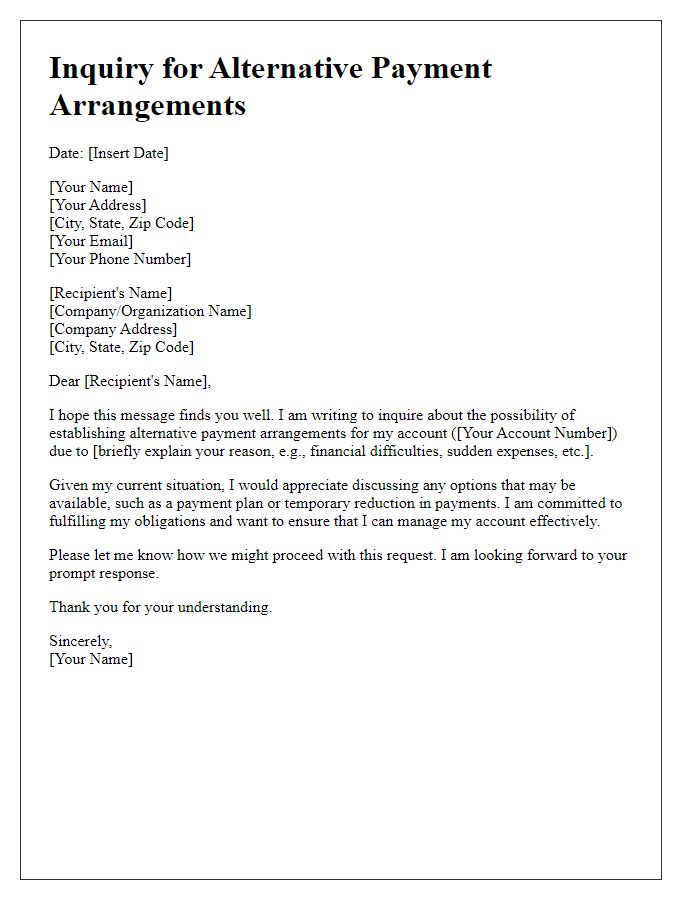

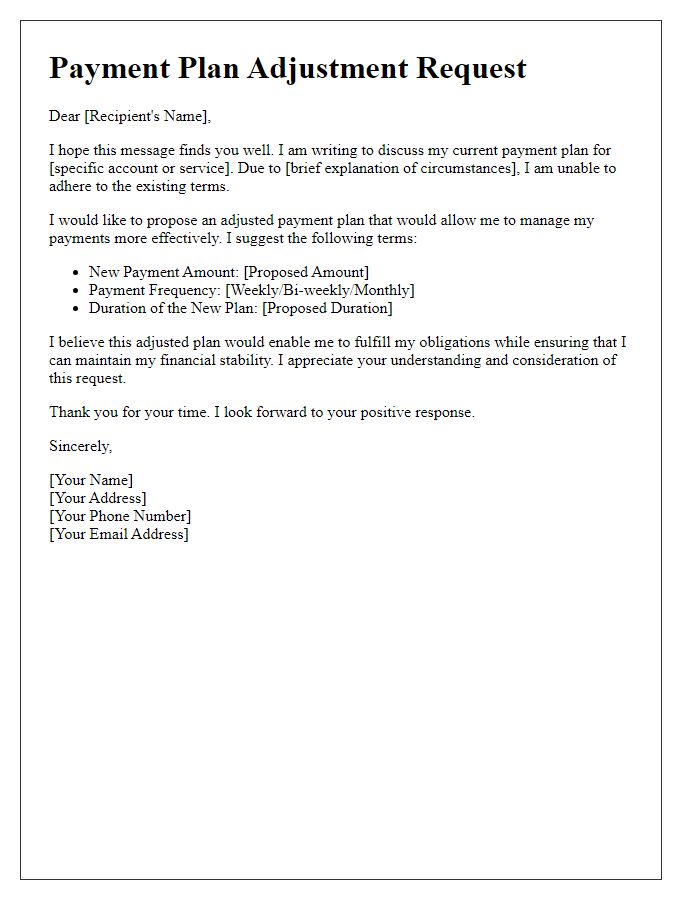

Proposed Payment Plan Details

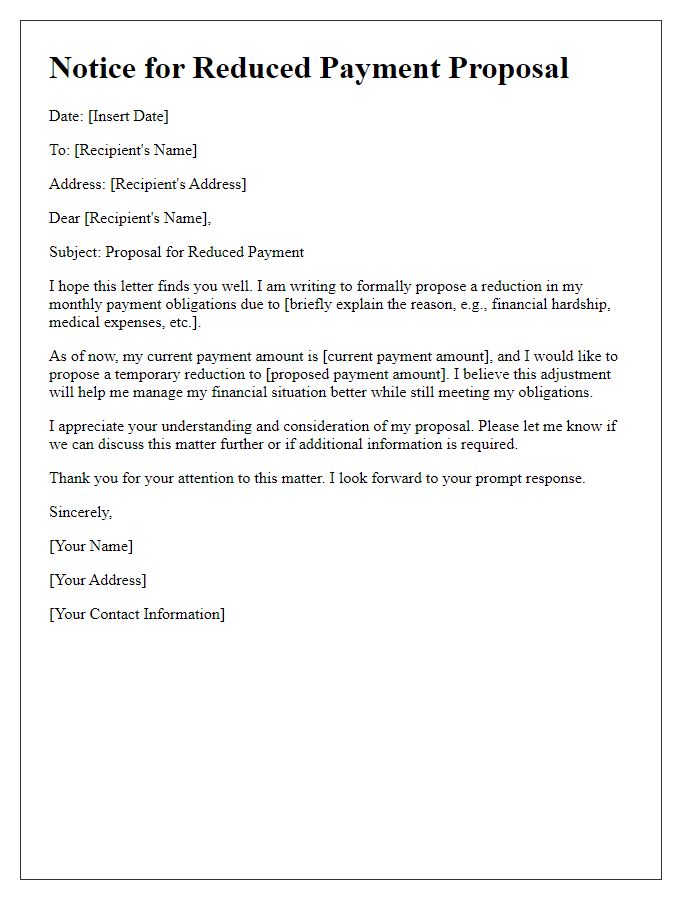

Proposed payment plans are essential financial strategies for managing debts or obligations. A structured payment plan often outlines key components, such as payment amounts, frequency, and duration. For instance, a typical plan may suggest a monthly payment of $200 over a period of 12 months, culminating in a total payment of $2,400. Specific financial agreements, such as those outlined by the Fair Debt Collection Practices Act, provide guidelines for setting up feasible payment schedules while protecting consumer rights. Stakeholders, including creditors and debtors, must communicate clearly to ensure a mutual understanding of the terms, as well as any possible implications for credit scores. Effective payment plans can alleviate financial stress and create a pathway toward financial stability.

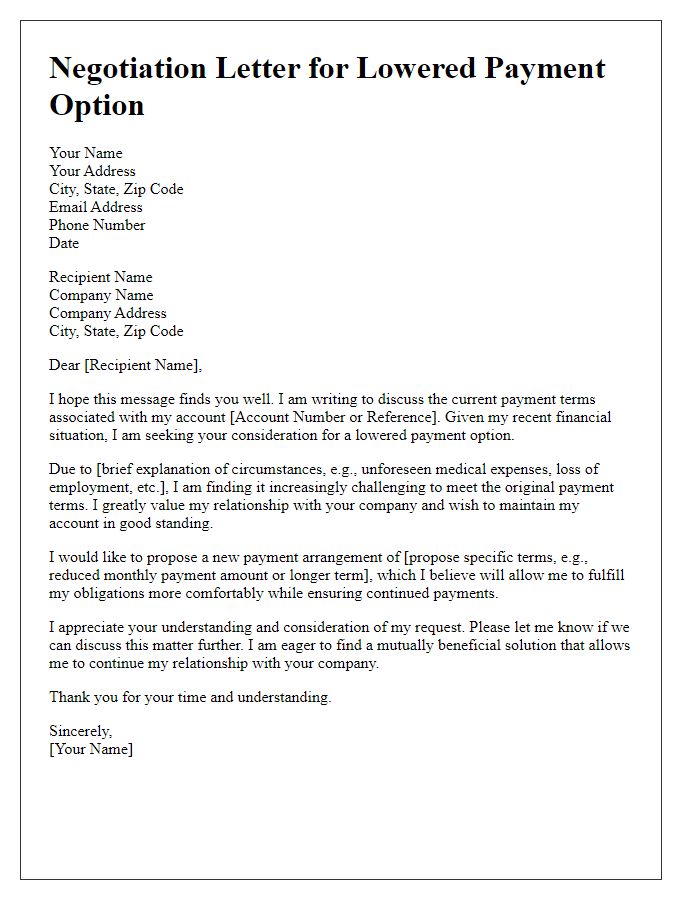

Justification for Offer

A reduced payment offer may stem from financial hardships experienced during economic downturns, such as the 2020 global pandemic that significantly affected many small businesses and individual incomes. Specific circumstances, like unexpected medical expenses or job loss in high-unemployment areas (up to 14.8% in April 2020 in the U.S.), can necessitate adjustments in payment plans. Additionally, comparisons to industry standards reveal a common practice among creditors to negotiate lower payments for clients facing genuine difficulties, particularly in places with high living costs, such as San Francisco or New York City. Demonstrating commitment to honor debts while seeking temporary relief showcases responsible financial behavior, fostering goodwill between debtors and creditors during challenging times.

Payment Method and Schedule

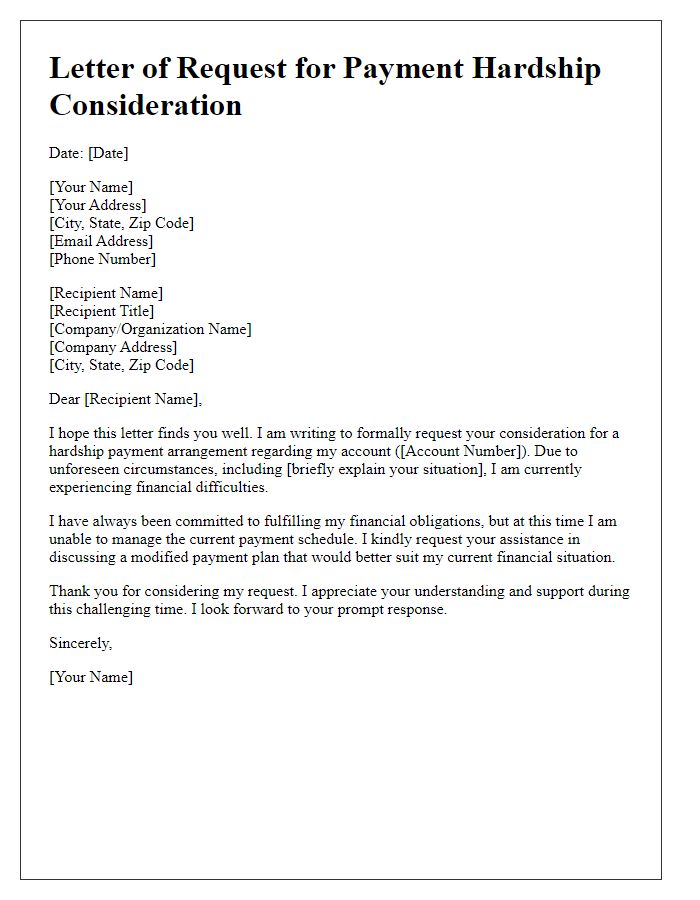

A reduced payment offer often involves monthly installments, typically initiated by a formal request. The payment method can include options like bank transfers, checks, or online payment platforms such as PayPal. The schedule may outline a timeline, for instance, a 12-month plan where the reduced amount (e.g., $100 instead of the full $300) is paid on specific dates each month. Clear communication and agreed-upon terms are crucial, ensuring both parties understand the new arrangement and its implications.

Contact Information for Further Discussion

Reduced payment offers can provide relief during financial strain. Individuals facing hardship can benefit from negotiating adjusted terms with creditors. Communication through formal channels (email or phone) ensures clear documentation. Specifics, like account numbers and due dates, should be included for reference. Creditors, such as mortgage companies or credit card issuers, may be more receptive to offers during economic downturns. Personal stories detailing financial challenges (loss of job, medical expenses) can humanize the request. Providing alternative payment options with clear timelines may increase the likelihood of acceptance.

Comments