Are you feeling uneasy about reaching out regarding a past due account? You're not aloneâmany people find this topic daunting. However, addressing payment delays with clarity and kindness can foster positive communication and understanding. Let's dive into how you can craft an effective letter that not only conveys the importance of settling the account but also strengthens your relationship with the recipient; read on to discover practical tips and a helpful template!

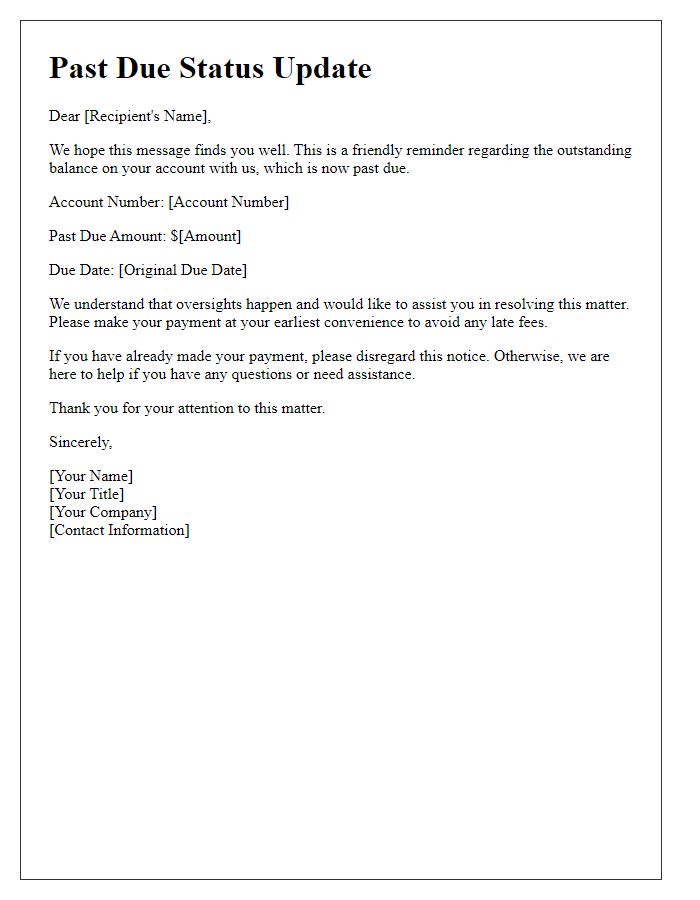

Account details and outstanding balance

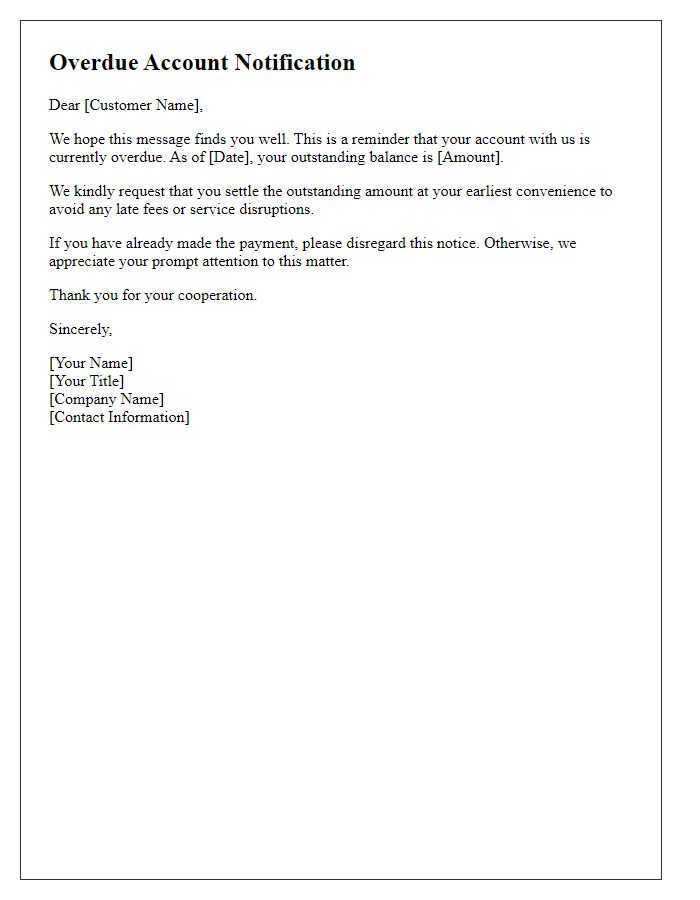

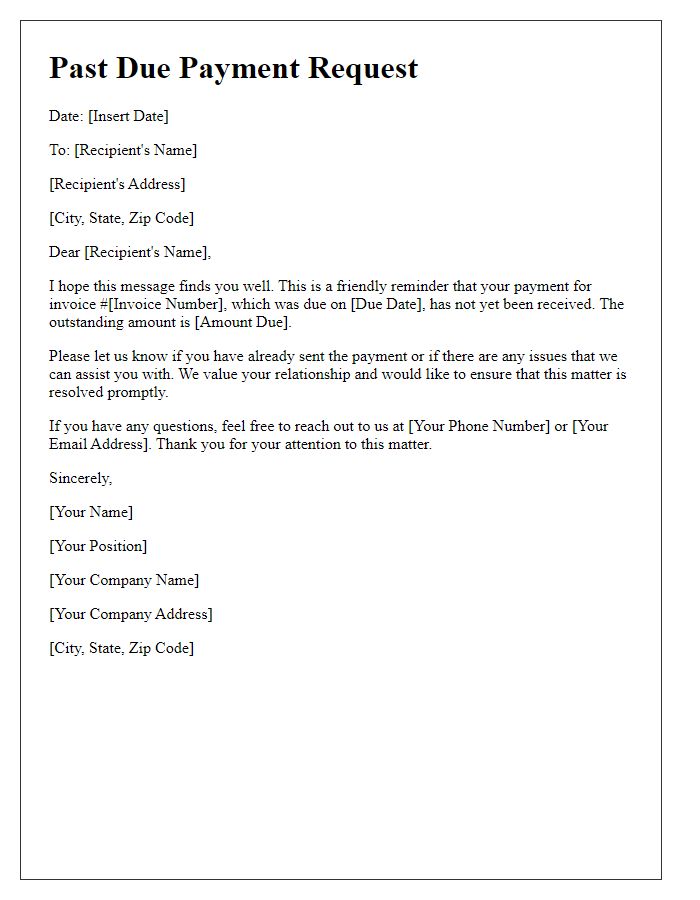

A past due account update typically includes essential account information, such as the account number, customer name, and the outstanding balance owed. For instance, an account numbered 123456789 belongs to John Doe, reflecting a past due balance of $500. This amount may include late fees incurred as of October 2023, and the update emphasizes the importance of clearing this balance to maintain a good credit standing. Regular reminders about the payment deadlines can help facilitate timely payments and reiterate the potential consequences, such as additional fees or negative impacts on credit scores, which may arise from prolonged non-payment.

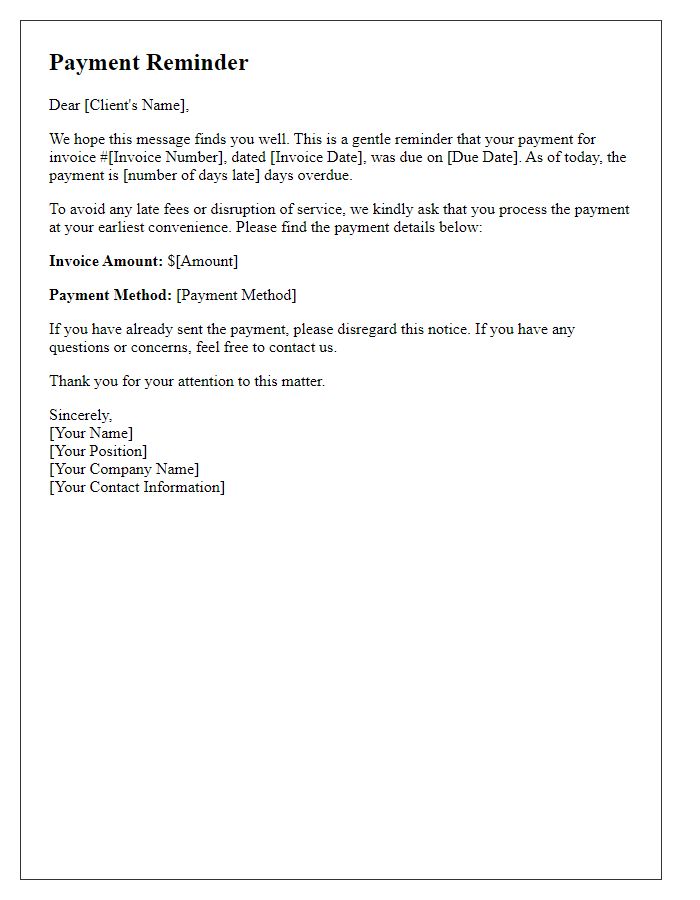

Friendly reminder and urgency

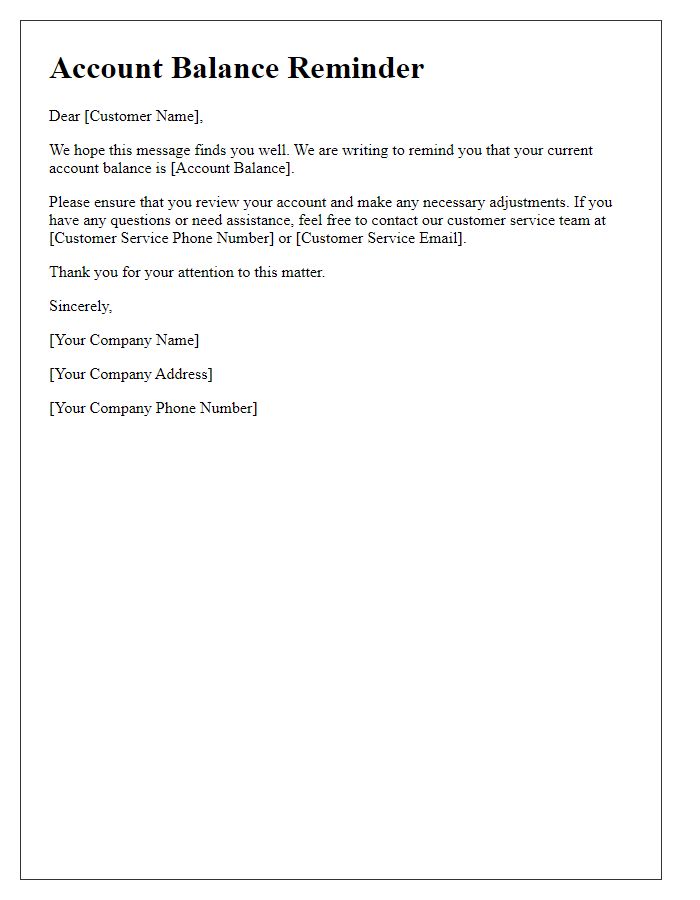

Businesses often face challenges managing overdue accounts, impacting cash flow and financial planning. For instance, a company may have invoices older than 30 days, resulting in a significant number of outstanding payments, potentially reaching thousands of dollars. Prompt communication with clients ensures they remain aware of their financial obligations. Sending a friendly reminder can improve recovery rates, especially when combined with an urgency element, highlighting the importance of timely payment. Clear language specifying the total amount due, due date, and payment methods can facilitate quicker responses from clients, ultimately strengthening relationships and ensuring fiscal stability.

Payment options and methods

Past due accounts often result from missed deadlines, leading to potential financial strain. Businesses typically offer various payment options, including credit card transactions, bank transfers, and payment plans to ease the burden on customers. For instance, online payment portals enable customers to settle their balances quickly, while phone payments through customer service representatives provide assistance for those who may have questions. Late fees, which can reach 5% per month, may apply if dues remain unpaid, potentially impacting credit scores. Clear communication about payment methods ensures that all parties understand their responsibilities and available solutions to avoid further complications.

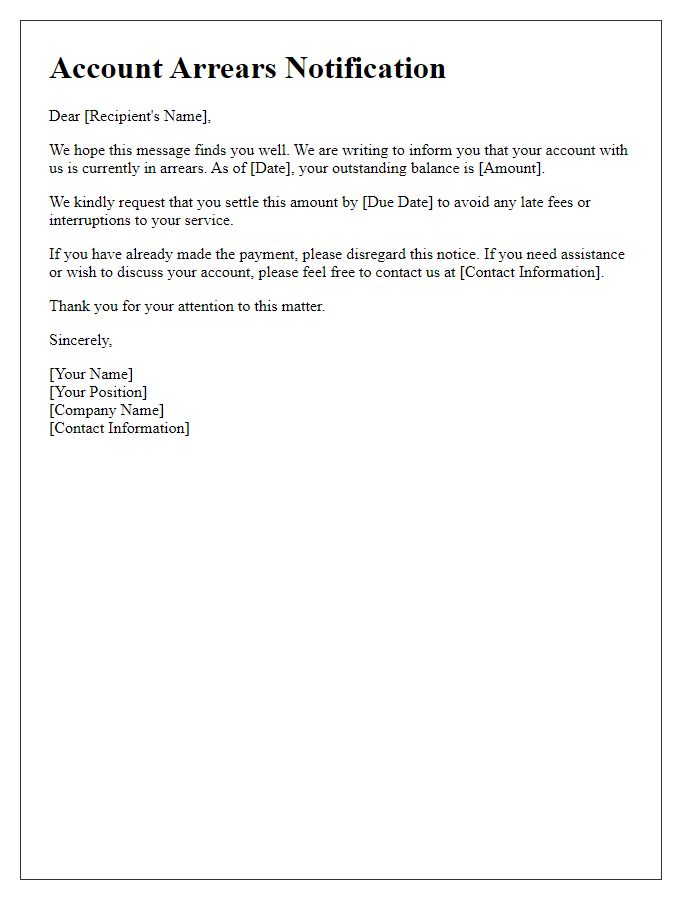

Contact information for assistance

A past due account update may involve a notification sent to customers regarding outstanding balances, emphasizing the importance of timely payments. Contact information plays a crucial role in facilitating support for customers facing discrepancies or needing clarification. Typically, customers should be provided with clear instructions, with a dedicated phone number (for example, customer service line at 1-800-555-0199) available during business hours, such as 9 AM to 5 PM Eastern Standard Time. An email address (support@companyname.com) may also be included for written inquiries. Additionally, a physical address for correspondence may be provided, allowing customers to send payment or communicate regarding the account status directly to the financial department in a specific region, such as New York, NY, ensuring prompt attention to their concerns.

Consequences of non-payment

Unresolved past due accounts can lead to significant repercussions for consumers, particularly in financial institutions like banks or credit unions. Late payments can result in late fees, typically ranging from $25 to $50 depending on the lender's policy. Additionally, credit scores may suffer severe impact, decreasing by 100 points or more due to payment delinquencies, which can hinder future borrowing capacity. In extreme cases, prolonged non-payment can trigger collections actions from agencies, initiating legal processes that may include obtaining judgments or garnishing wages. Moreover, repeated failures to settle debts can lead to asset repossession, depending on the nature of the account, thus emphasizing the importance of timely financial obligations.

Comments