Are you tired of chasing down overdue payments? It's a common struggle many businesses face, and drafting the perfect reminder letter can make all the difference. With the right tone and approach, you can encourage prompt payment while maintaining a positive relationship with your clients. Dive into our article for valuable tips and a handy template to simplify your reminder process!

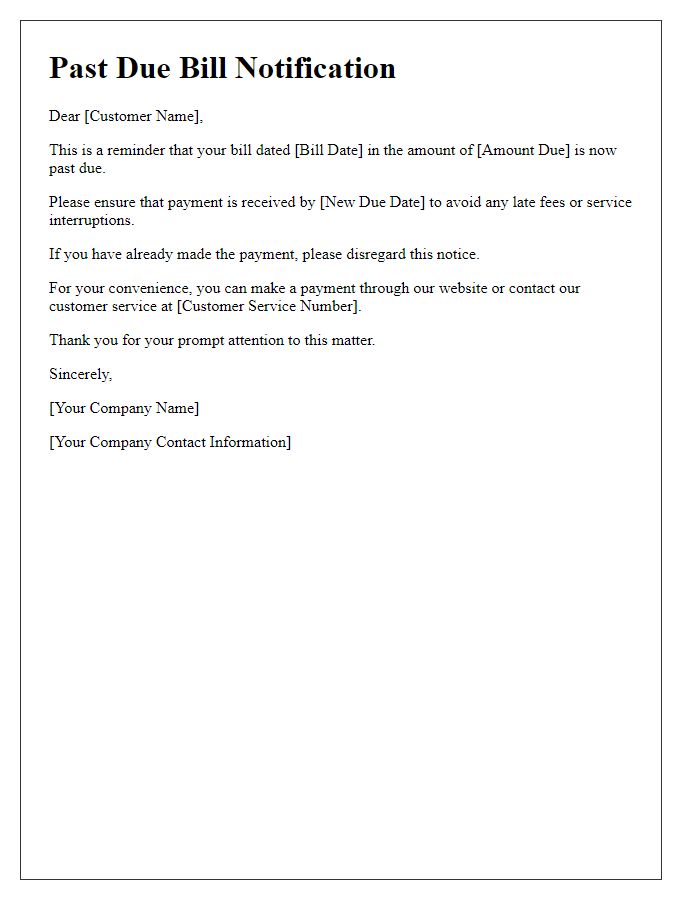

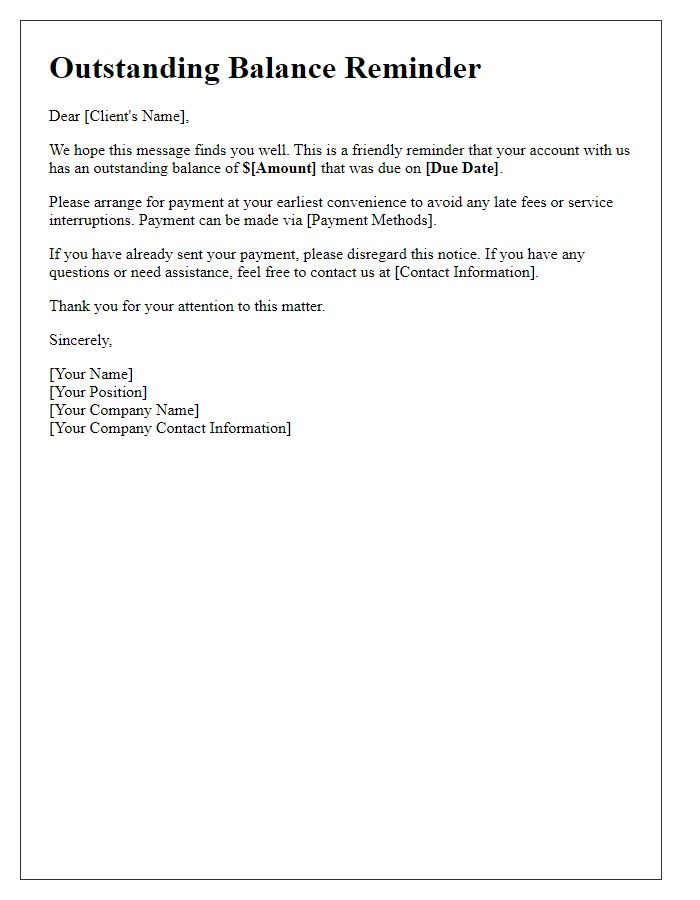

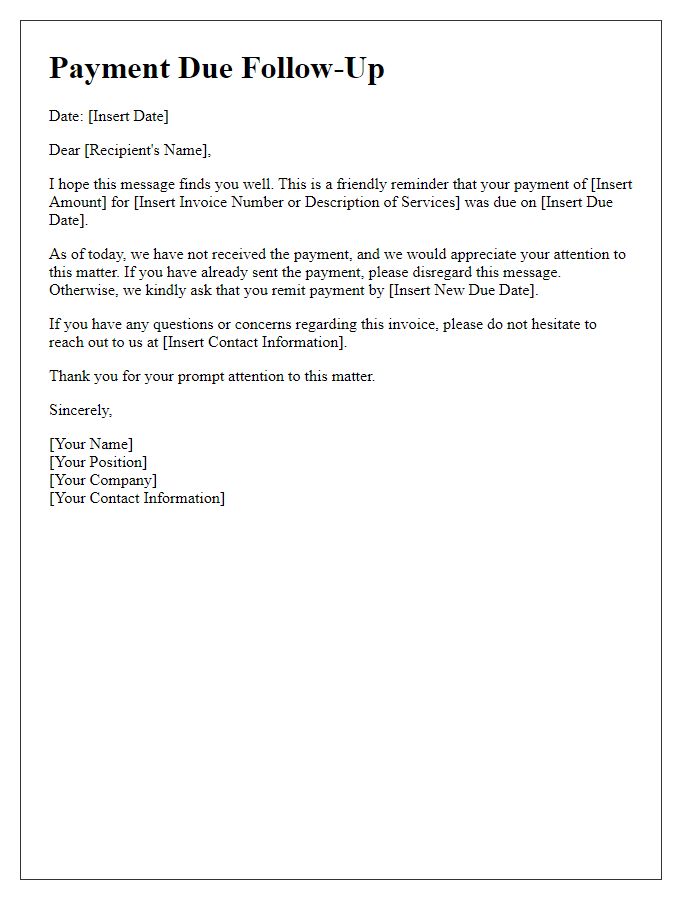

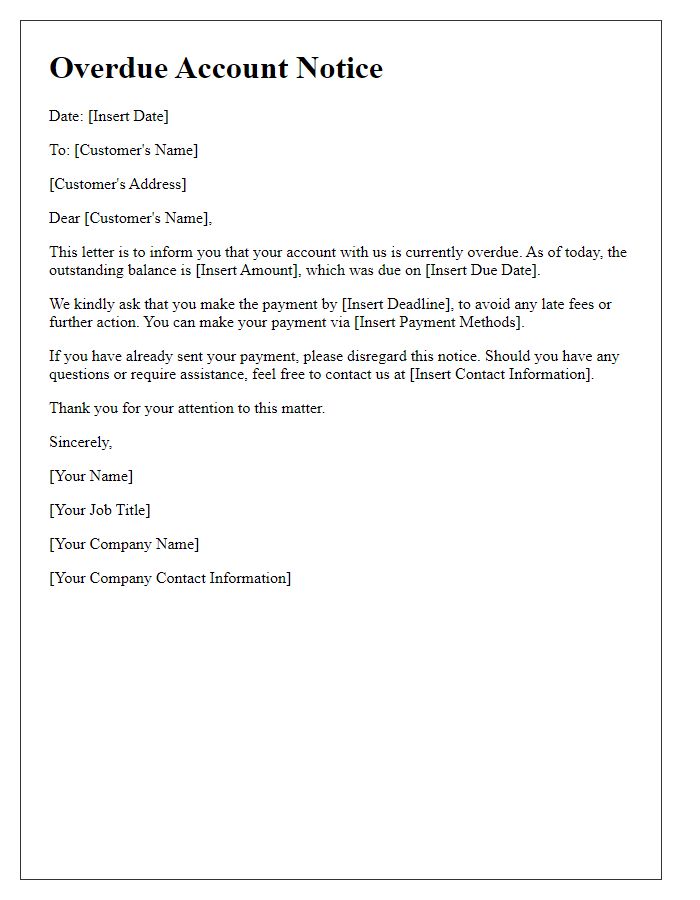

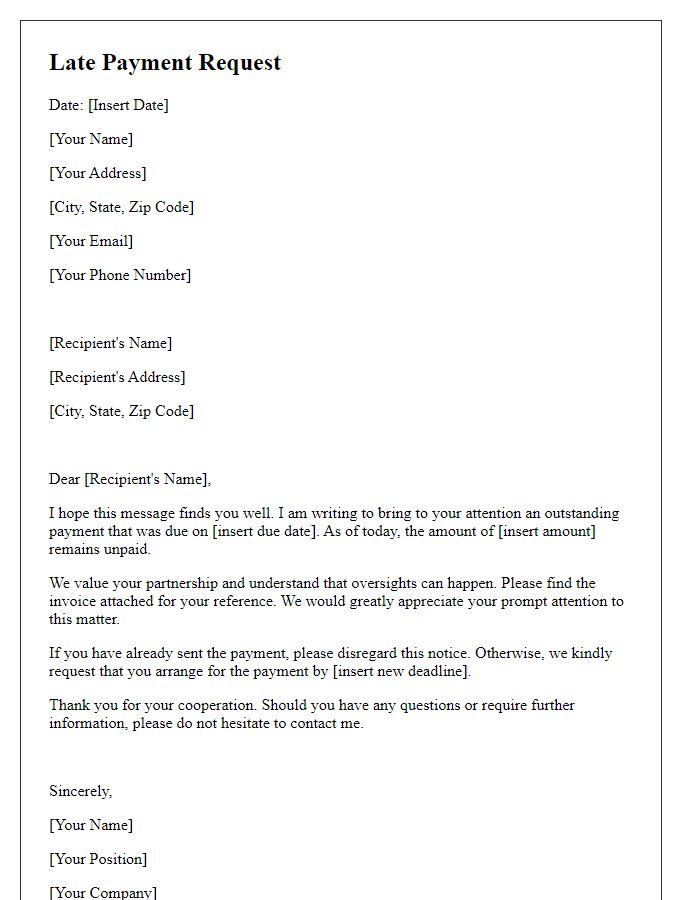

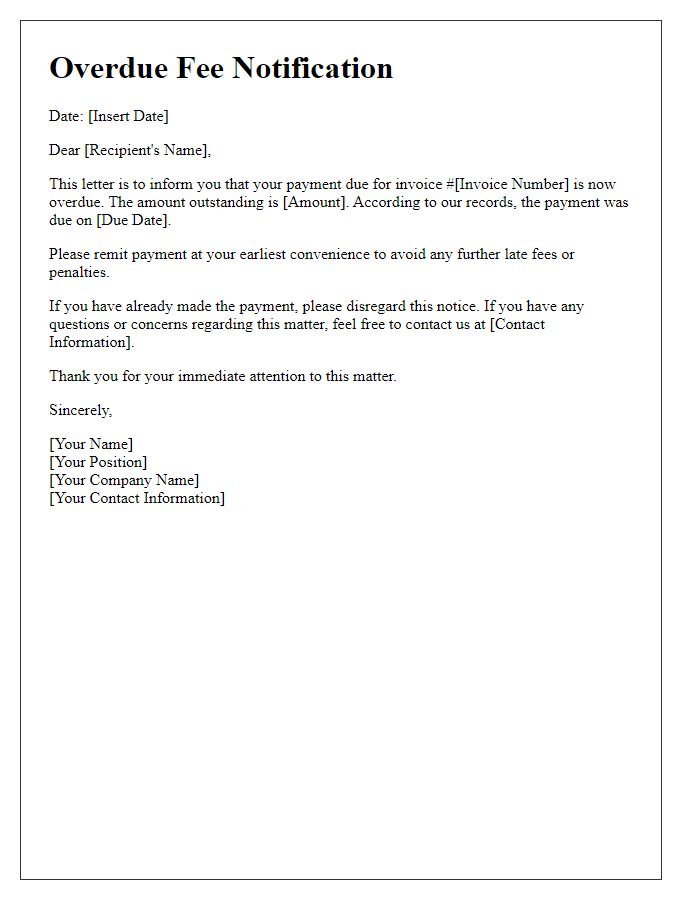

Professional tone

In the bustling world of finance, overdue payments can disrupt cash flow for businesses and professionals alike. Outstanding invoices not only impact liquidity but also strain professional relationships. According to recent studies, late payments account for 41% of small business failures, emphasizing the importance of timely transactions. In places like New York, where the financial market thrives, maintaining a consistent cash flow is crucial for sustaining operations. Clear communication regarding payment terms and reminders can significantly improve collection rates. Implementing regular follow-ups can help ensure that financial obligations are met, thereby fostering stronger partnerships and greater economic stability.

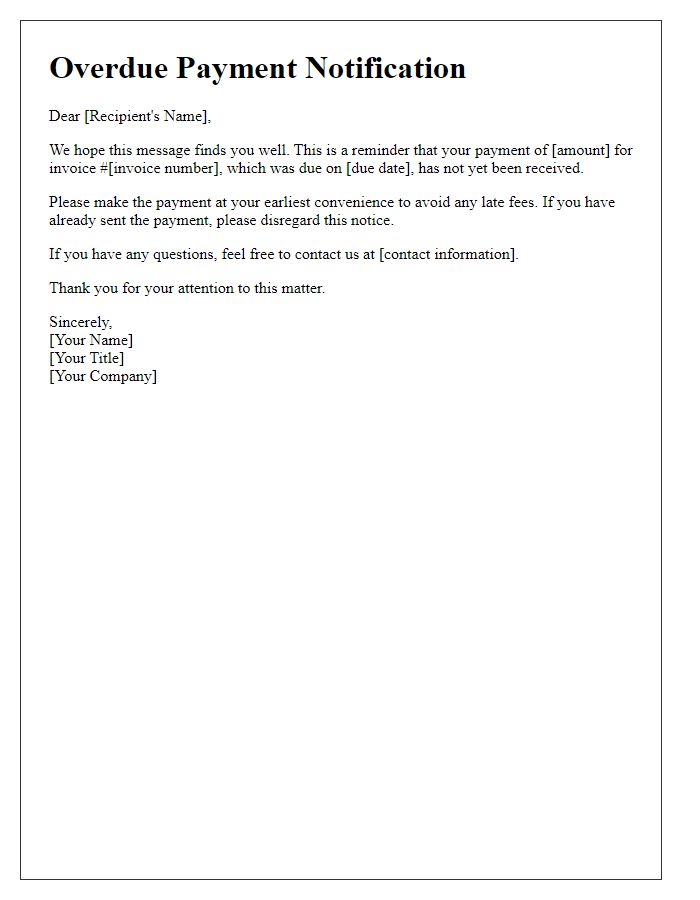

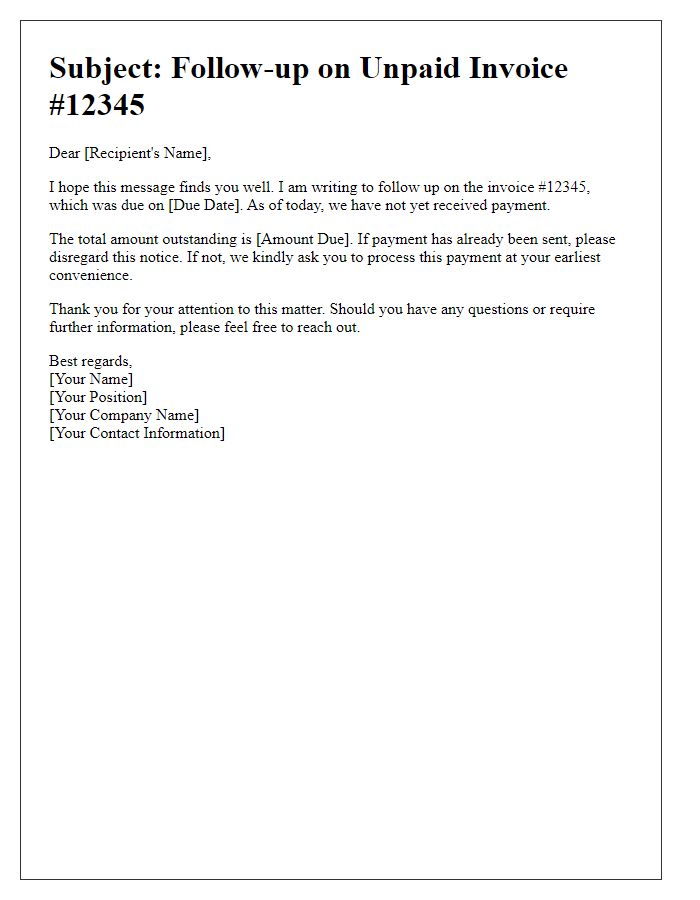

Concise and clear message

Overdue payments can negatively impact financial stability for businesses. A reminder for an overdue invoice, such as Invoice #12345, which was due on May 15, 2023, should clearly state the amount owed ($500) and any applicable late fees or interest charges. Clear contact information for inquiries, including a phone number and email address, should be provided to facilitate prompt communication. For efficient follow-up, the reminder should indicate preferred payment methods and deadlines for resolution, emphasizing the importance of timely payments to maintain business relationships.

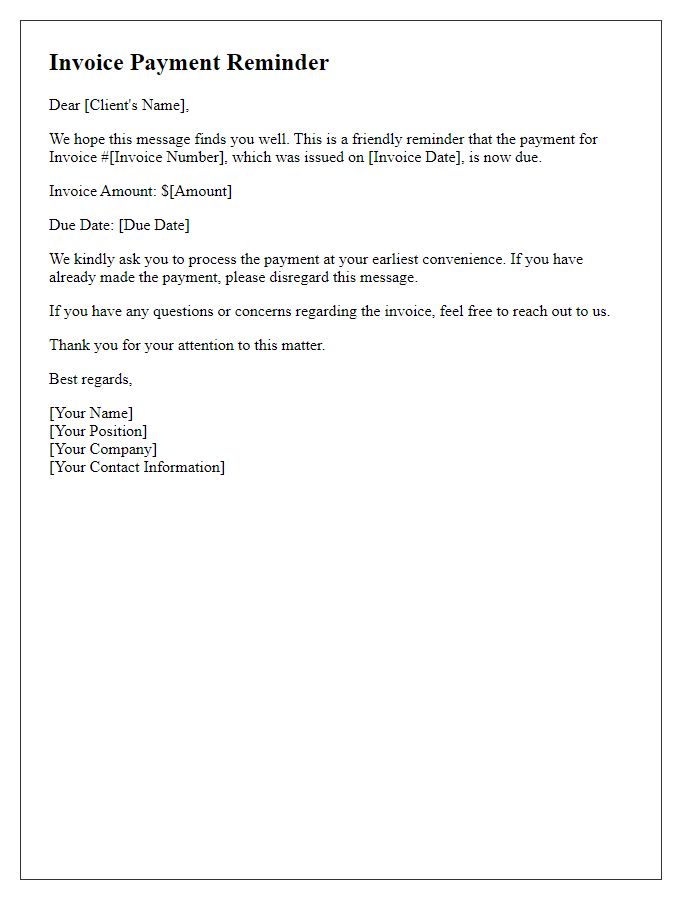

Include invoice details

Unpaid invoices can disrupt cash flow for small businesses. An overdue invoice, such as Invoice #12345 issued on January 15, 2023, for the amount of $500, may require a reminder. Payment terms typically state net 30 days, while this specific invoice is now 15 days overdue. Addressing the client (e.g., ABC Company) with the outstanding balance can help maintain a professional relationship. Including clear payment instructions, such as bank details for direct transfer or a link to an online payment portal, can streamline the process. Following up promptly may encourage resolution and ensure the business maintains its financial health.

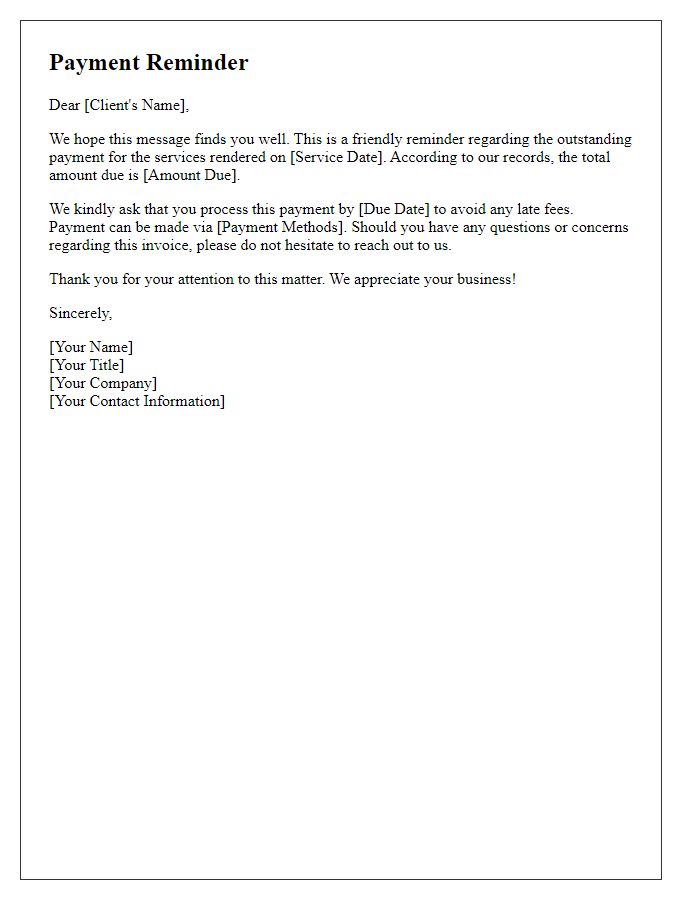

Specify payment methods

A reminder for overdue payments must clearly indicate the outstanding balance, payment due date, and accepted payment methods. Timely follow-up on invoices, typically 30 days past due, is essential. Payment methods can include bank transfers, credit card transactions, and online payment platforms such as PayPal or Stripe. Including specific details, such as bank account numbers or links for online payments, simplifies the process for recipients. Include contact information for questions or clarifications on the overdue amounts. Encouraging prompt payment ensures maintaining healthy cash flow for businesses.

Provide contact information

Overdue invoices can indicate an account imbalance for businesses, affecting cash flow. For example, a company like ABC Corp might send reminders when a client has not settled a payment within 30 days of the invoice date. Payment reminders typically include essential contact information, such as a phone number (e.g., +1-800-123-4567) and an email address (e.g., billing@abccorp.com), allowing clients to easily communicate for clarifications. Timely follow-ups are crucial for maintaining good relations and ensuring financial stability. Methods such as follow-up emails or phone calls can efficiently address overdue payments while providing a clear path for resolution.

Comments