Have you ever found yourself in a situation where you needed to notify someone about a failed payment? It can be a delicate matter, balancing professionalism with empathy while ensuring your message is clear. In this article, we'll explore a thoughtful letter template that addresses the issue, helping you communicate effectively and maintain good relationships. Keep reading to discover the best way to craft your failed payment notice!

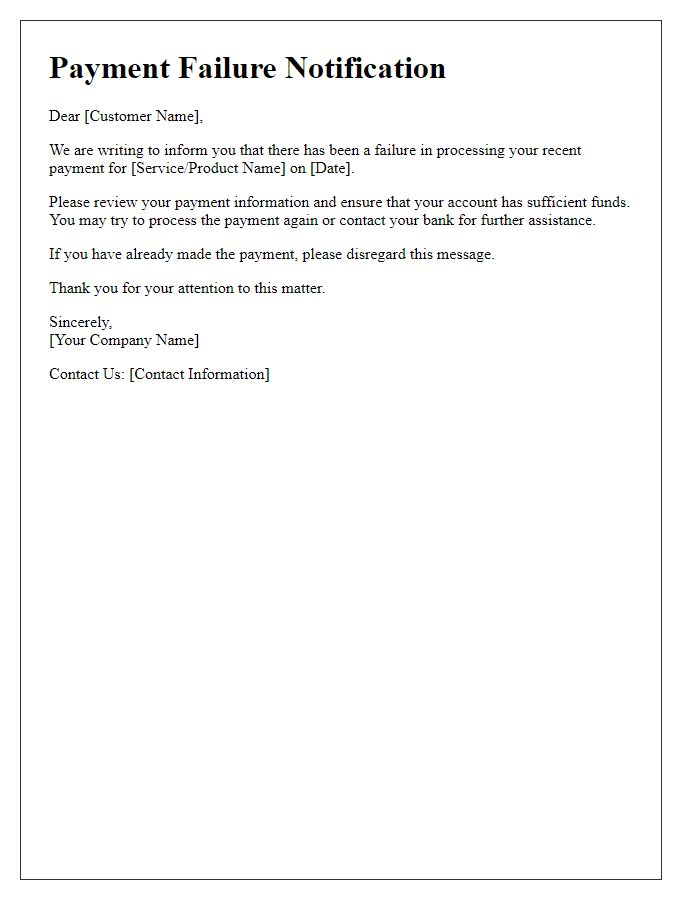

Clear Subject Line

Failed payment notifications inform clients about unsuccessful transactions. An immediate reminder of payment methods, such as credit card, PayPal, or bank transfer, is essential. The notice should include the transaction date, reference number, and applicable amount ($50, for example). A prompt to update billing information or retry payment methods should be clear, underscoring urgency. Moreover, detail on actions following non-payment, such as service suspension or late fees, provides necessary context. Customer support contact details encourage resolution, ensuring a smooth follow-up process.

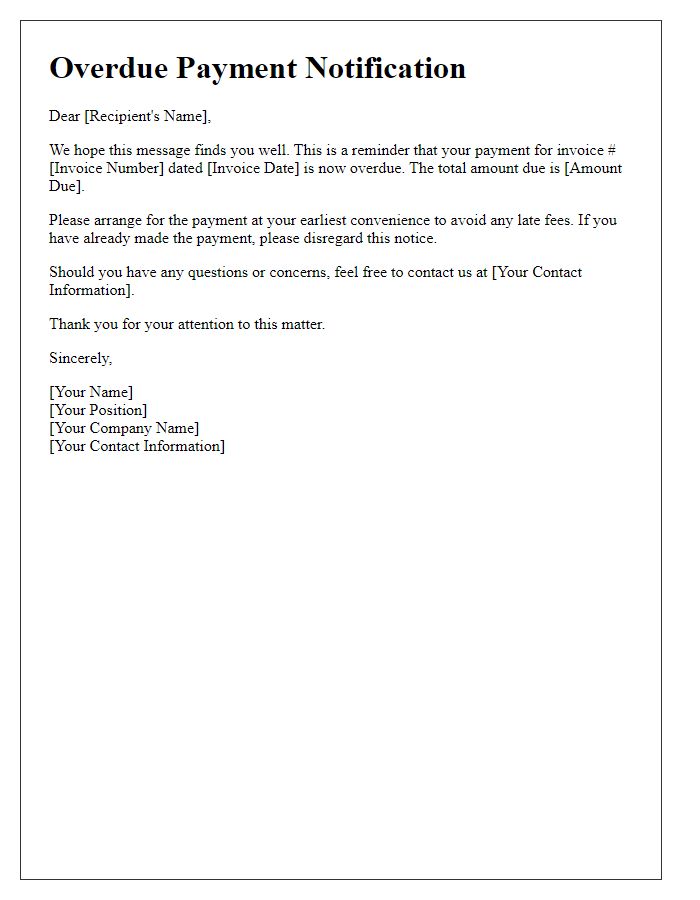

Polite and Professional Tone

Regrettably, we notify you of an unsuccessful payment attempt regarding your account associated with our services at [Company Name], specifically for the invoice number [Invoice Number], dated [Invoice Date]. The payment due amount is [Amount Due]. This issue may arise from insufficient funds, expired payment methods, or bank restrictions. To resolve this matter swiftly, please verify your payment information or contact your financial institution. Your prompt attention is appreciated to avoid any disruption in your services. Thank you for your understanding.

Detailed Payment Information

In a payment processing system, failed transactions can lead to considerable inconvenience for both merchants and consumers. A common issue involves credit card payments, where failures may occur due to insufficient funds, expired card dates, or incorrect billing addresses. For instance, a transaction attempt on a Visa card with an expiration date of September 2021 may result in rejection, requiring consumers to update their payment information. Additionally, failed payments can impact subscription services, such as streaming platforms like Netflix, resulting in service interruptions. Merchants should provide clear communications, including detailed payment information such as the transaction date, the amount due, and specific reasons for failure to ensure customers understand next steps and reattempt their payments.

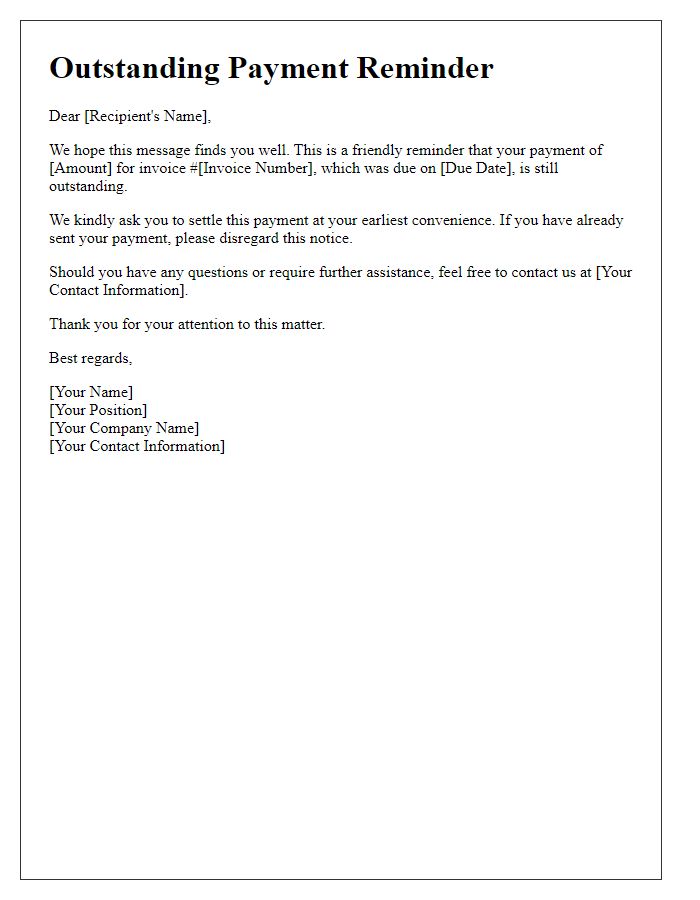

Consequences of Non-Payment

Invoices left unpaid beyond the due date (often stipulated in payment terms like Net 30 or Net 60) can lead to significant financial repercussions, including late fees that typically rise by 1.5% per month on the outstanding balance. Additionally, businesses may escalate collection efforts, which could involve third-party collection agencies. Unpaid bills may also result in notifications to credit bureaus, impacting the recipient's credit score, potentially ranging from 300 to 850. This financial blemish can hinder future borrowing capabilities, affecting major purchases like homes or vehicles. Furthermore, in extreme cases, continued non-payment might lead to legal action, resulting in court costs and additional legal fees, further exacerbating the original debt.

Contact Information for Assistance

Customers experiencing payment issues, particularly those involving online transactions or credit card processing, should promptly reach out to customer service for assistance. Common payment methods include Visa and MasterCard, while payment processors like PayPal or Square may also be involved. Customers should reference their account number or order number, typically found in purchase confirmation emails, to expedite resolution. Assistance is usually available through multiple channels, including phone support, which may operate within specific hours (like 9 AM to 5 PM Eastern Time). Additionally, many companies provide online chat options or email support, ensuring customers can seek help at their convenience. Always check for specific guidelines or FAQs on the company's website to find the most efficient way to resolve payment concerns.

Comments