Are you looking for a reliable way to confirm account adjustments? Knowing how to communicate these details effectively can make a significant difference in maintaining transparency and trust with your clients or stakeholders. In this article, we'll explore a straightforward letter template designed to streamline the account adjustment confirmation process. So, let's dive in and discover how you can effortlessly manage your account communications!

Clear identification of account details

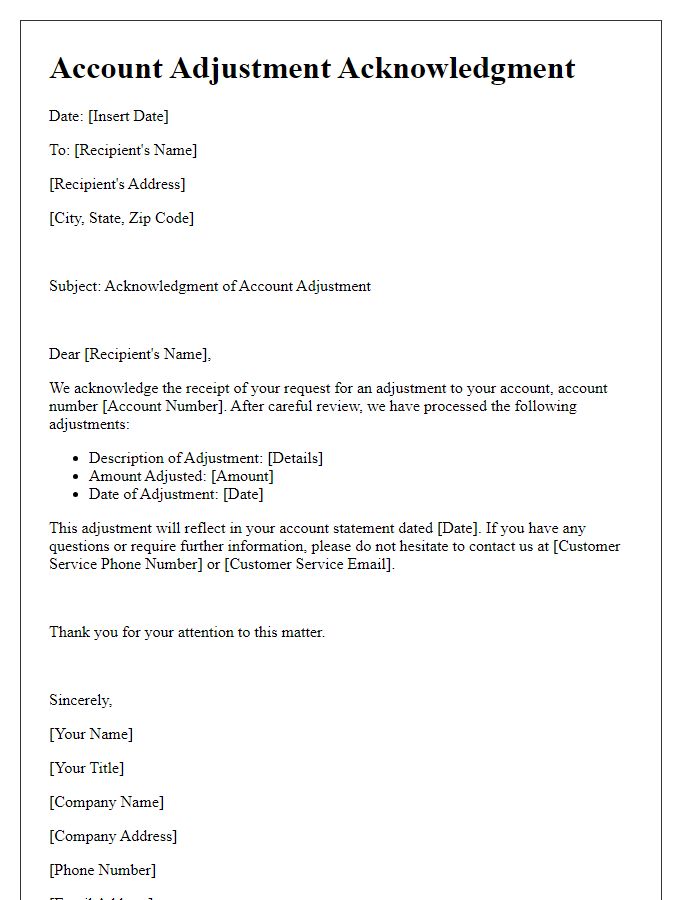

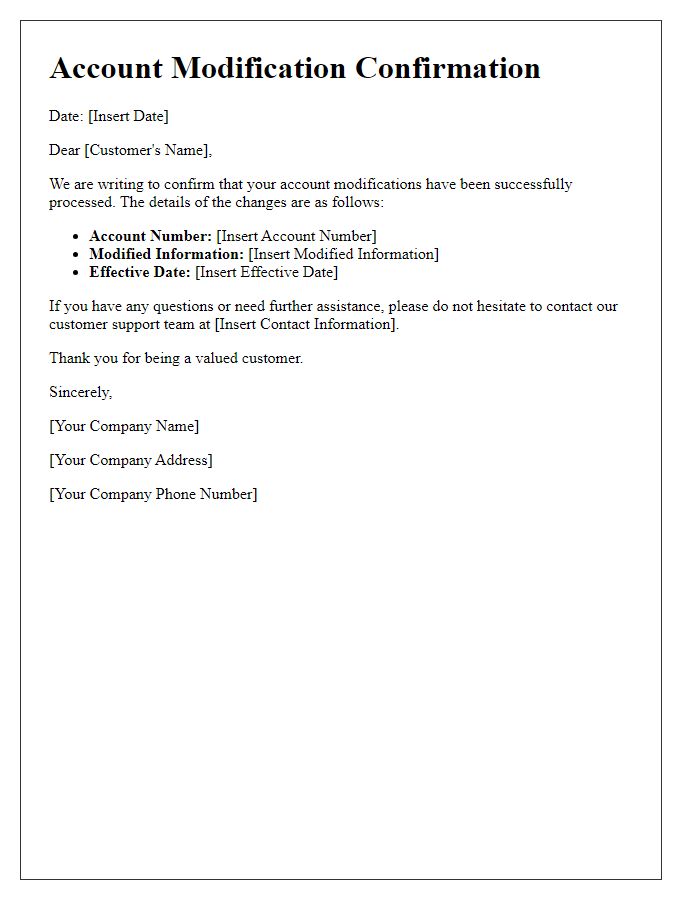

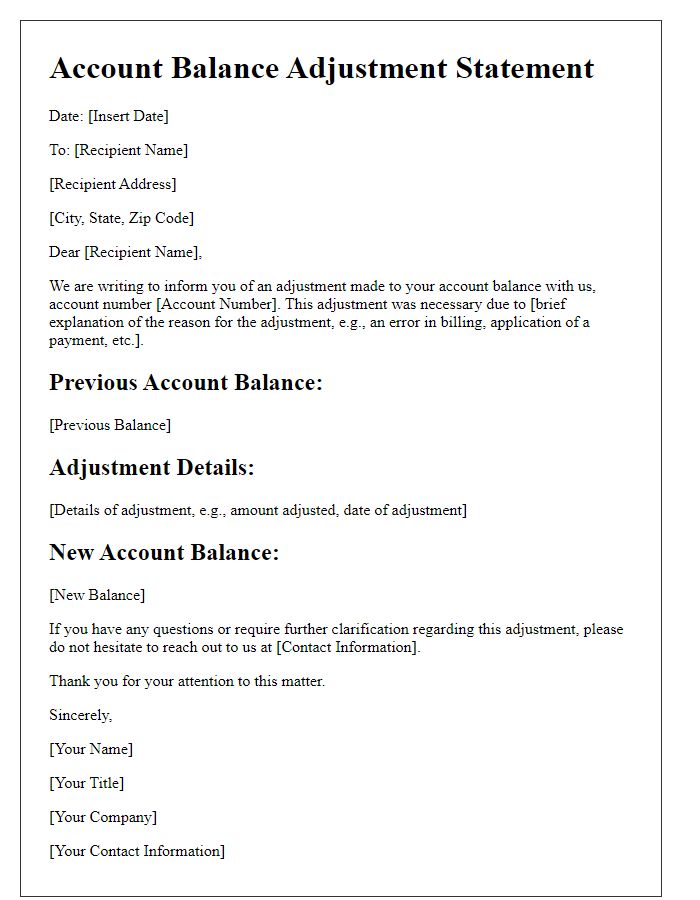

Account adjustment confirmations require precise identification of account details to ensure accuracy and clarity. Essential elements include the full account number (typically a series of 10 to 12 digits), the name of the account holder, and contact information such as an email address or phone number. Accurate balance adjustments must specify the previous balance, the amount of adjustment made (e.g., $50 increase), and the new balance. Dates of adjustment should be noted, providing context (e.g., effective from March 15, 2023). This information ensures seamless communication regarding account changes, minimizing potential errors and misunderstandings in financial management.

Precise explanation of adjustment reason

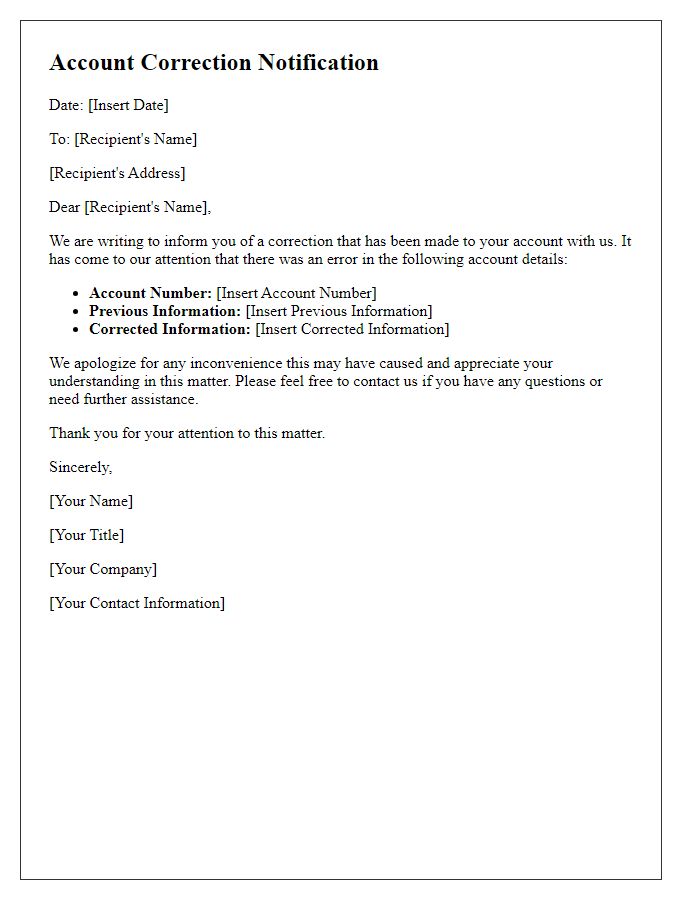

Account adjustments, such as billing discrepancies or balance modifications, often require precise explanations to ensure clarity. Adjustments may be due to multiple factors, including erroneous charges (potentially from automated billing systems) or customer service-related credits (issued after customer complaints or service failures). An example of an adjustment reason could involve incorrect subscription tiers, where a customer was charged $15 for a service plan that should have been $10. Such discrepancies can arise from system errors or human oversight. Clear identification of the affected accounts (for instance, account numbers or customer IDs) alongside detailed breakdowns of previous and adjusted amounts ensures transparency. Customers benefit from knowing resolution steps taken, underscoring commitment to service excellence and accuracy.

Detailed listing of adjusted figures

An account adjustment confirmation typically includes a detailed listing of adjusted figures to ensure accuracy and transparency in financial records. For instance, adjustments may include changes to the account balance, such as an increase of $500 in credits or a decrease of $300 in debits. Each adjustment should be broken down by category, such as payment corrections or transaction disputes, with the respective dates (e.g., April 5, 2023, and April 15, 2023) to provide a clear timeline of alterations. Additional notes may also reference specific invoices, such as Invoice #12345 and Invoice #67890, to establish traceability. Other relevant entities, such as previous account totals and the final adjusted balance, must be clearly stated, reinforcing clarity for both parties involved in the reconciliation process.

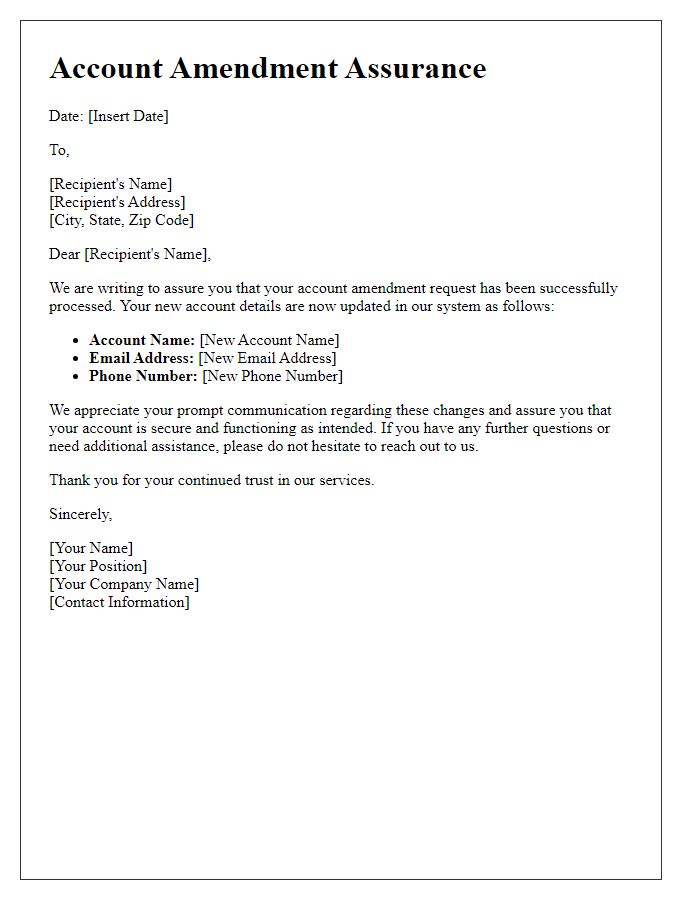

Assurance of updated account accuracy

An account adjustment confirmation ensures accurate records within financial institutions, such as banks or credit unions. This essential document verifies modifications made to account details, including transaction corrections or balance updates. Customers, for instance, may receive notifications confirming changes to their account status after discrepancies arise. Specific figures, like interest rates or service charges, can be detailed in this statement to enhance transparency. Such confirmations are critical for maintaining trust and ensuring compliance with regulations established by governing bodies like the Financial Industry Regulatory Authority (FINRA) in the United States.

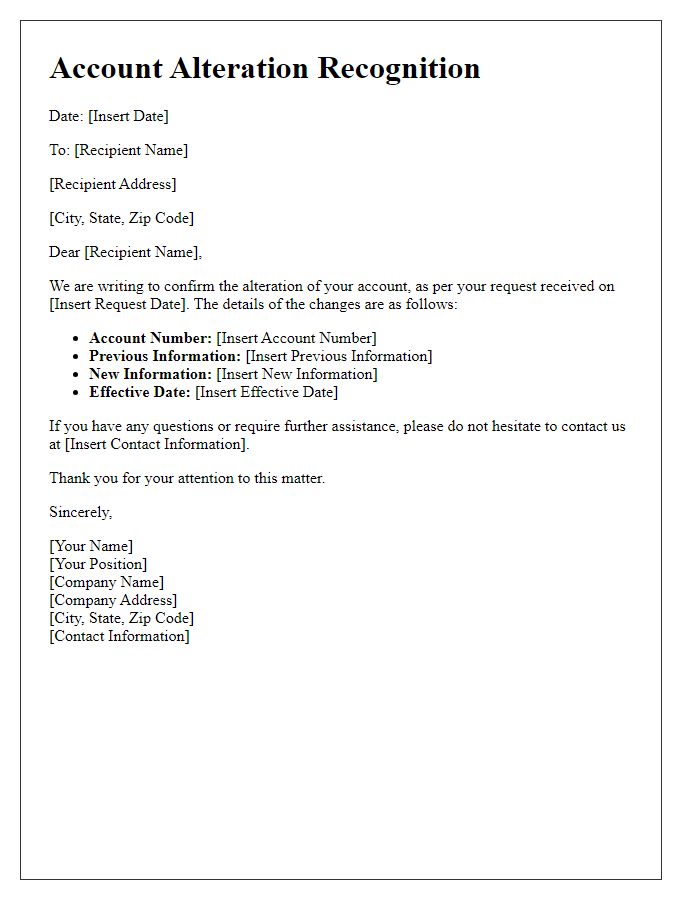

Contact information for further inquiries

For further inquiries regarding account adjustments, please contact our Customer Service Department at 1-800-555-0199 during business hours, Monday through Friday from 8 AM to 6 PM EST. Additionally, you can reach out via email at support@accountservices.com for any specific questions regarding your account details or adjustments. Our dedicated team will ensure a prompt response to all inquiries, typically within 24 hours on business days.

Comments