Are you tired of missing payment deadlines and the hassle of manual transactions? Setting up automatic payments can simplify your financial life, ensuring bills are paid on time without the stress of remembering due dates. In this article, we'll explore the benefits of automatic payment setups and how they can streamline your budgeting process. So, stick around to discover how you can make your life easier with this handy tool!

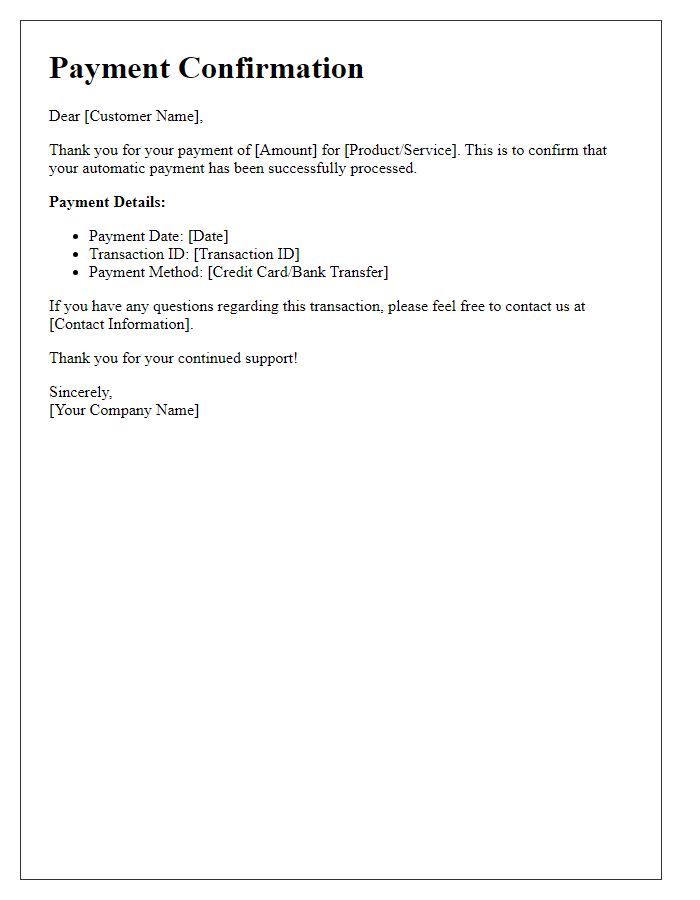

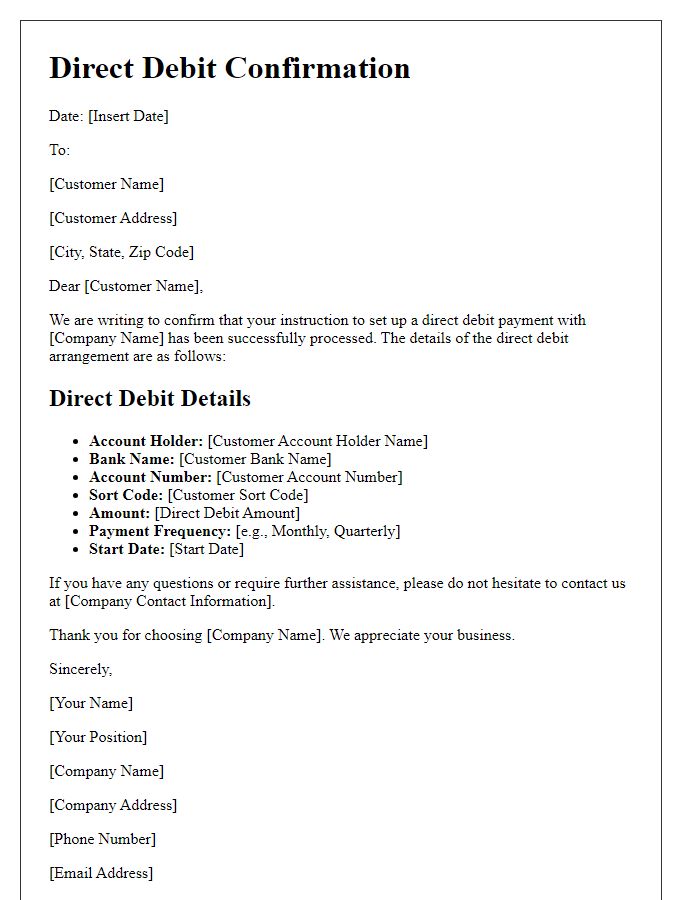

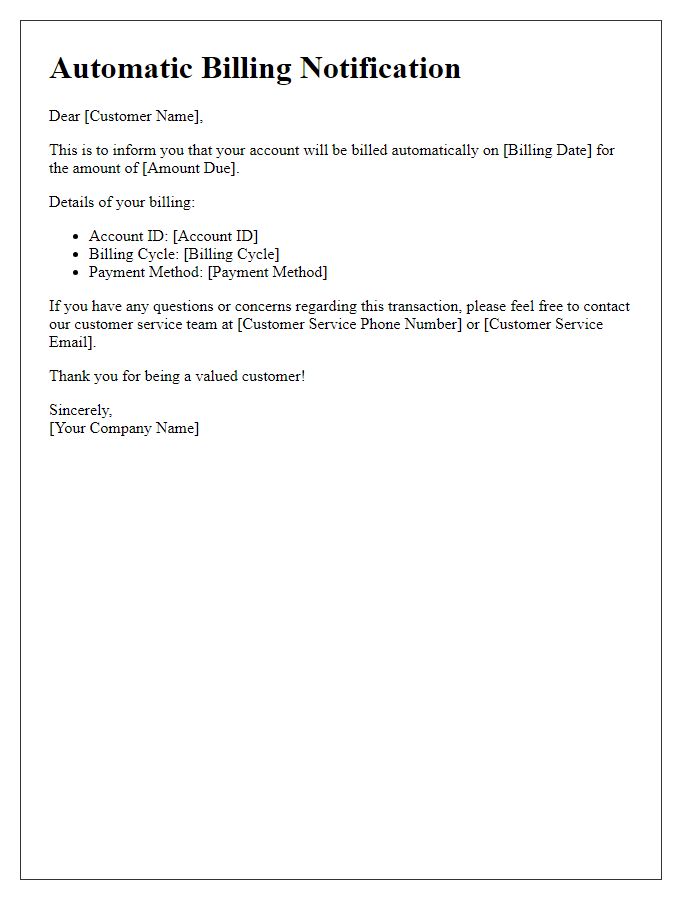

Customer Information Details

Automatic payment setups provide a convenient way for customers to manage their bills efficiently. This service allows recurring charges, like utility bills or subscription services, to be deducted automatically from bank accounts on a specified date each month, reducing the risk of late payment fees. Customers usually need to provide personal information such as name, address, and account numbers, which can vary by provider. Setting up these payments may involve a verification process, including an authentication email or text message from the service provider, ensuring the security of sensitive data. Effective communication with customers about this process can enhance satisfaction and prevent potential issues related to payment failures.

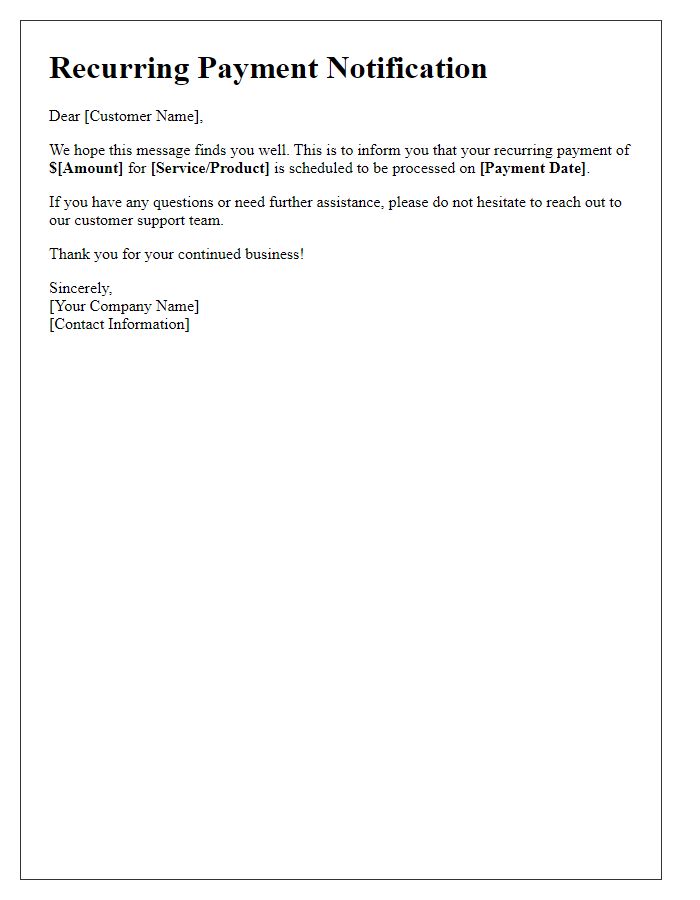

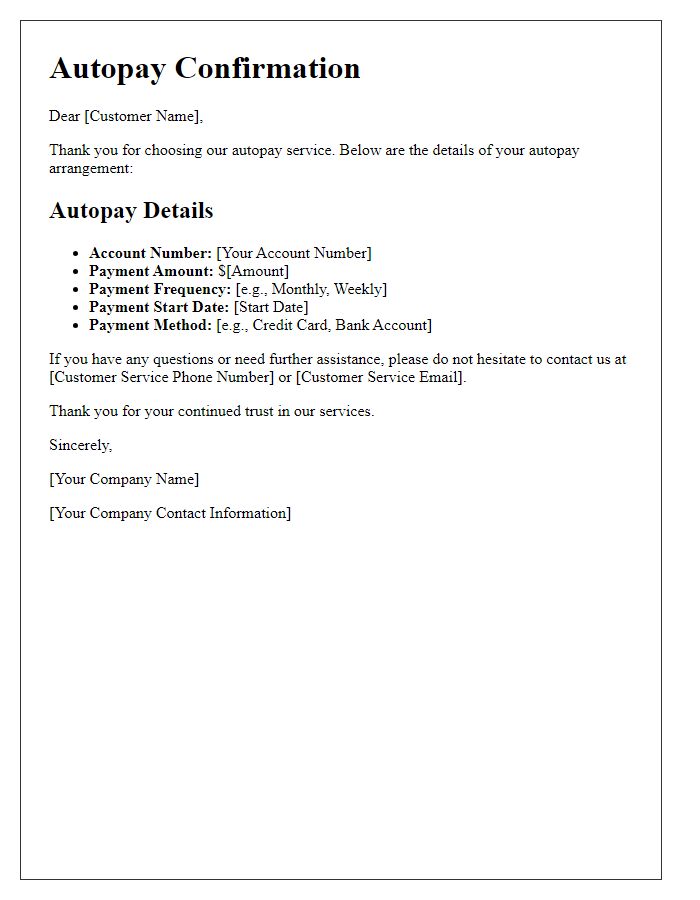

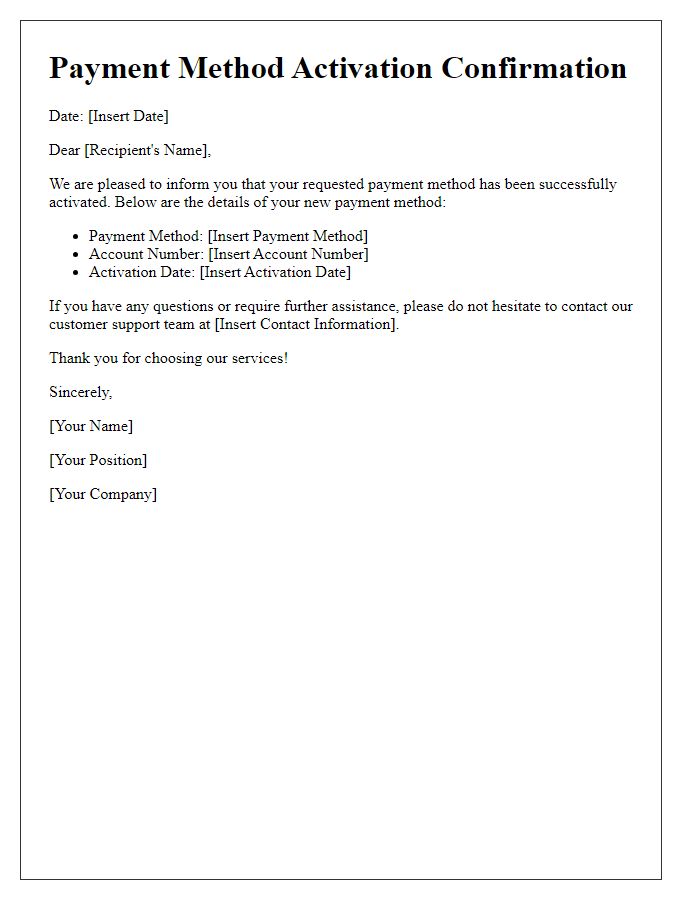

Payment Method and Frequency

Establishing automatic payments for services can streamline financial management significantly. Setting up automatic payments allows users to effortlessly manage recurring charges for services such as monthly utilities, insurance premiums, and subscription services. Payment methods typically include credit cards, debit cards, and bank transfers, with options for selecting frequencies like weekly, bi-weekly, monthly, or quarterly. Users must ensure that their financial institutions, such as Chase Bank or Wells Fargo, support automatic payments. Maintaining sufficient balance in accounts is crucial to avoid declined transactions, which could incur late fees or service disruptions. Clear communication from service providers, including confirmation emails, enhances user confidence in the automated setup process.

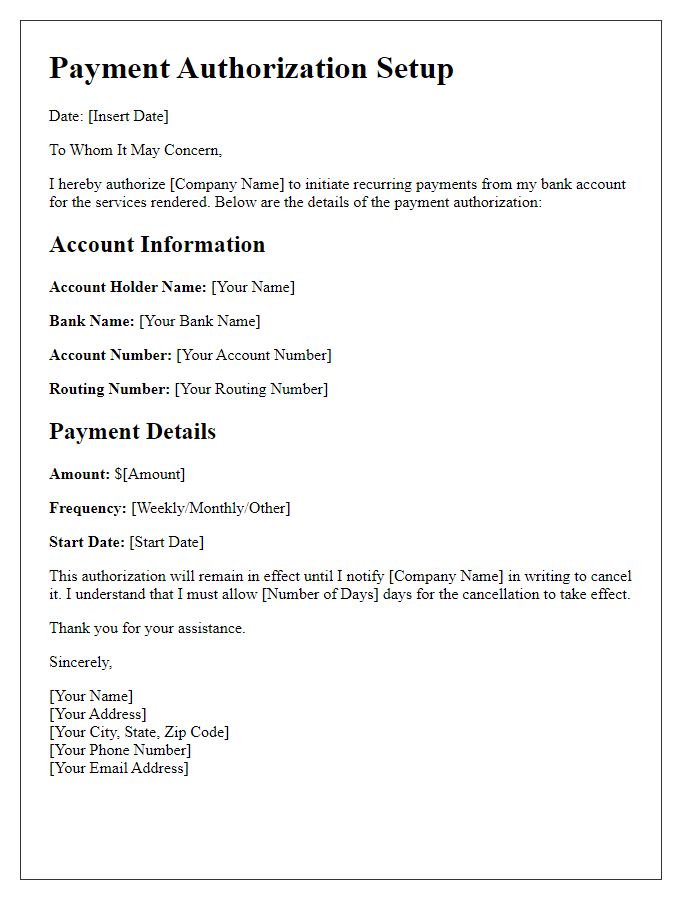

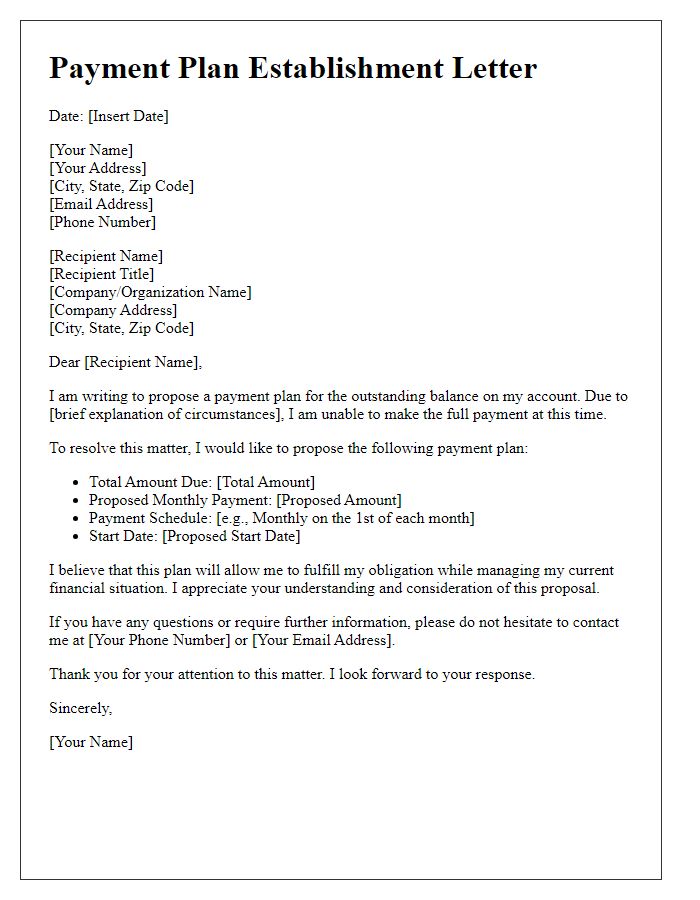

Authorization Consent Statement

Automatic payment setups for recurring transactions offer convenience and reliability for managing financial obligations, such as monthly utility bills or subscription services. A proper Authorization Consent Statement typically includes key elements, like the amount due, payment schedule, and billing entity. Customers must acknowledge that they permit the company (which could range from local service providers to international subscription platforms) to withdraw funds directly from their designated accounts, often tied to names like checking or savings accounts. Additionally, the statement should outline the process for changes or cancellations, emphasizing any required notice periods, which commonly range from 5 to 30 days, ensuring transparency and consumer rights protection.

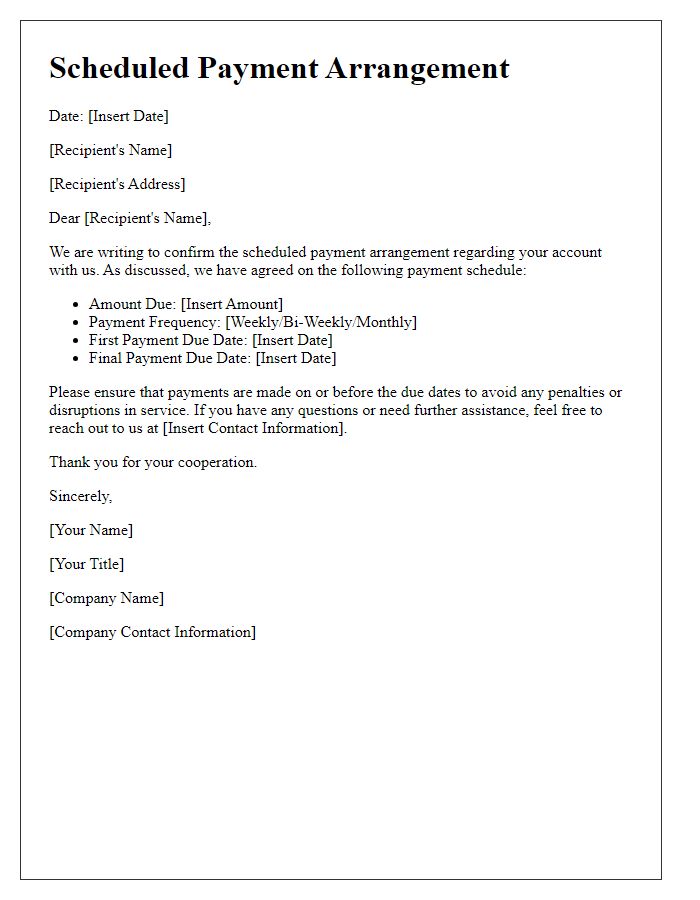

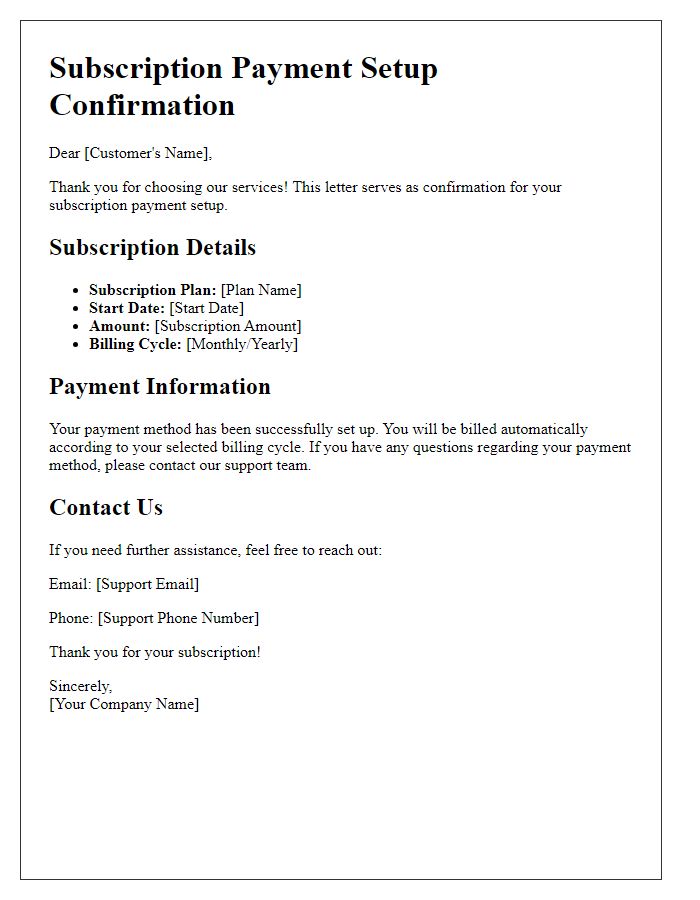

Contact Information for Queries

Automatic payment setups enable seamless transactions for services or products, ensuring consistent billing without manual intervention. Providing clear contact information for queries enhances customer support, allowing users to address concerns efficiently. Common platforms for automatic payments include credit cards or direct bank transfers, typically involving recurring charges on specific dates each month. Companies should include details such as a dedicated customer service number (for example, +1-800-555-0199) and an email address (like support@example.com) to facilitate prompt communication. Having such information readily available aids in building trust and reliability in the service.

Security and Data Privacy Assurance

Automatic payment setups provide convenience for managing recurring expenses, such as utility bills or subscription services. Customers often face concerns regarding security and data privacy, especially when sensitive financial information is involved. Industry standards, like Payment Card Industry Data Security Standard (PCI DSS), ensure robust protection of credit card details and personal data during transactions. Regular encryption methods, such as Advanced Encryption Standard (AES), safeguard information transfer to minimize the risk of data breaches. Additionally, secure payment gateways, like PayPal and Stripe, offer features such as fraud detection to further enhance transactional safety. Customers can feel reassured knowing that reputable services prioritize the integrity and confidentiality of their financial information in compliance with regulations like the General Data Protection Regulation (GDPR).

Comments