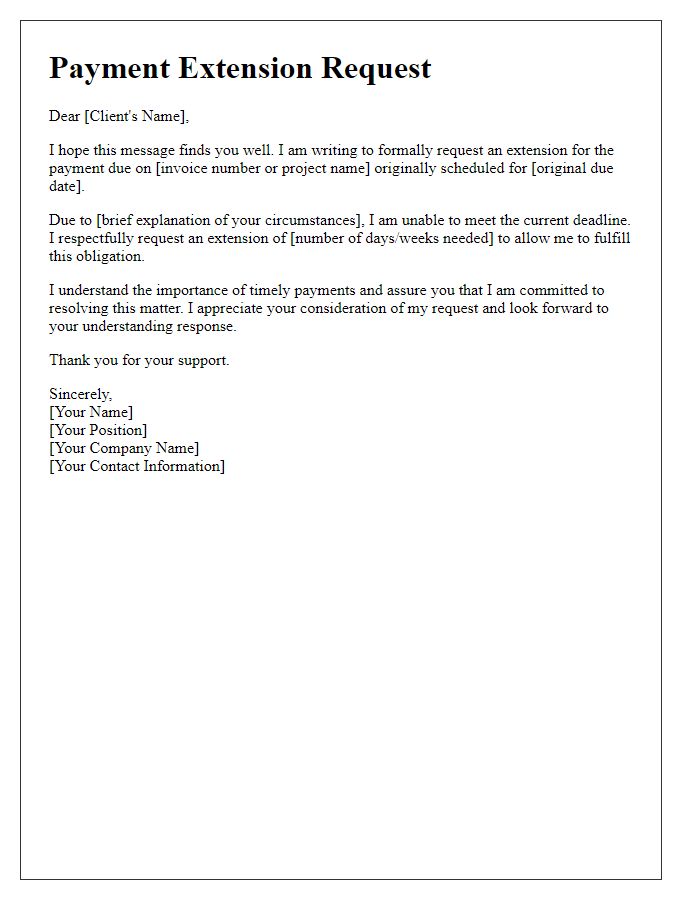

Are you facing a temporary financial challenge and need an extension on your payment due date? You're definitely not alone, and asking for a little extra time can often be a simple process. In this article, we'll explore the key elements of drafting a letter for payment extension approval that employers and service providers will empathize with. So, if you're ready to learn how to articulate your request effectively, keep reading!

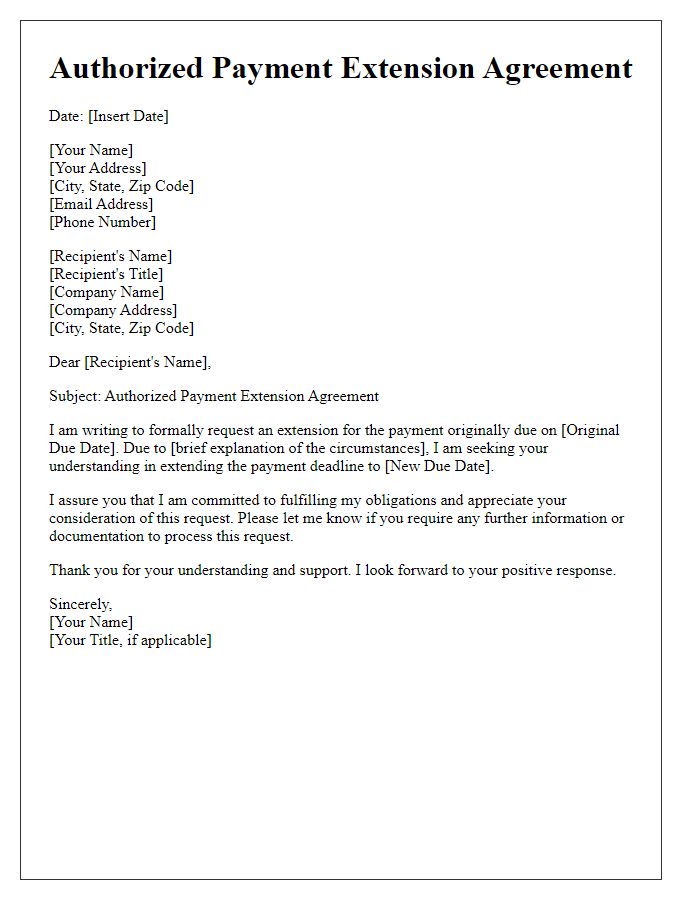

Company or Individual Information

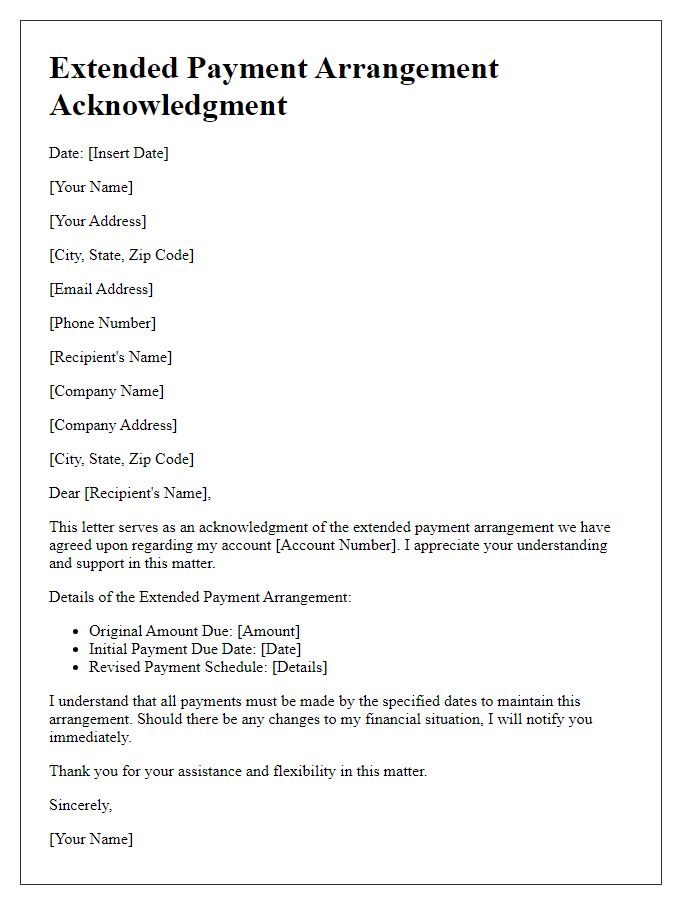

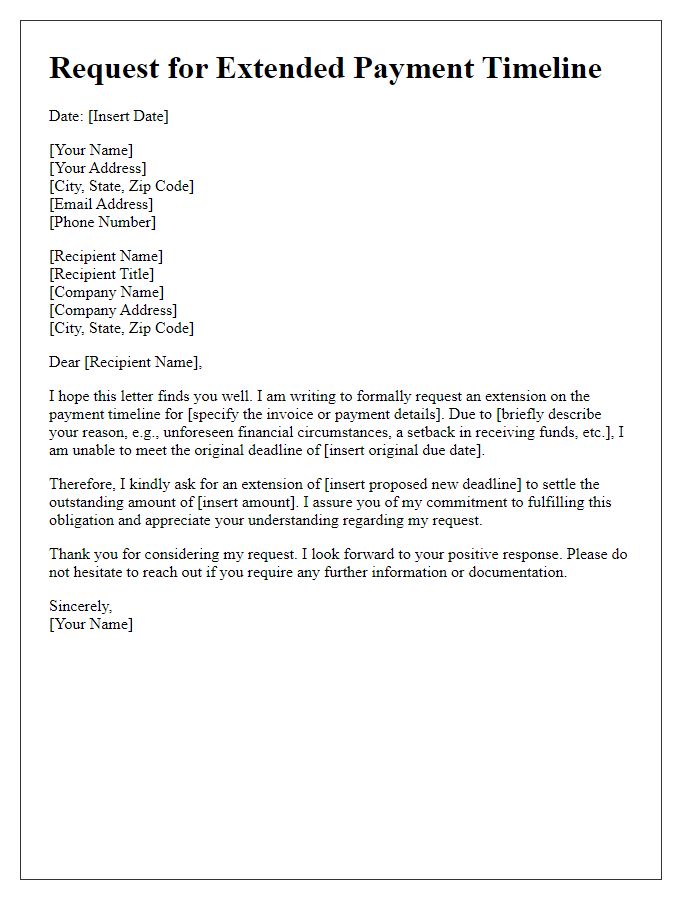

A payment extension request involves seeking additional time to fulfill financial obligations. Crucial details include the date of the original payment due, the amount owed, and specific reasons for the delay, such as unforeseen expenses or cash flow challenges. Clear contact information of the requesting party - whether a company like ABC Corporation in New York or an individual like John Doe residing in California - is necessary for effective communication. Reference to any previous agreements or extensions can strengthen the case. Indicating a proposed new payment date adds clarity. It's also beneficial to express willingness to discuss further and provide supporting documents if required.

Request Details and Context

A payment extension request typically involves a financial obligation where the payer, such as an individual or business, approaches a creditor for additional time to fulfill a payment. The request may stem from unforeseen circumstances, like unexpected medical bills or economic downturns, which result in cash flow issues. The creditor, possibly a bank or service provider, evaluates the request based on the payer's history, account status, and the specific terms of the contract. An approval process may include assessing the payer's income, expenses, and any previous extensions granted. Important details such as the amount owed, original due date, and the proposed new date for payment should be clearly articulated to facilitate the review process. A detailed and respectful tone enhances the likelihood of a favorable response. Providing supporting documentation, like income statements or invoices, reinforces the request's legitimacy, allowing the creditor to make an informed decision.

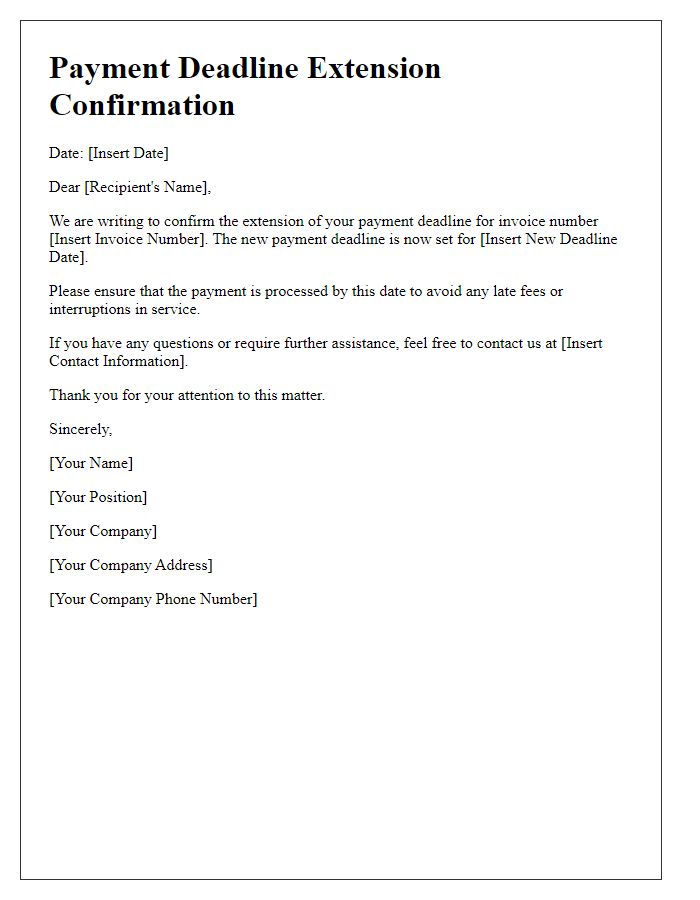

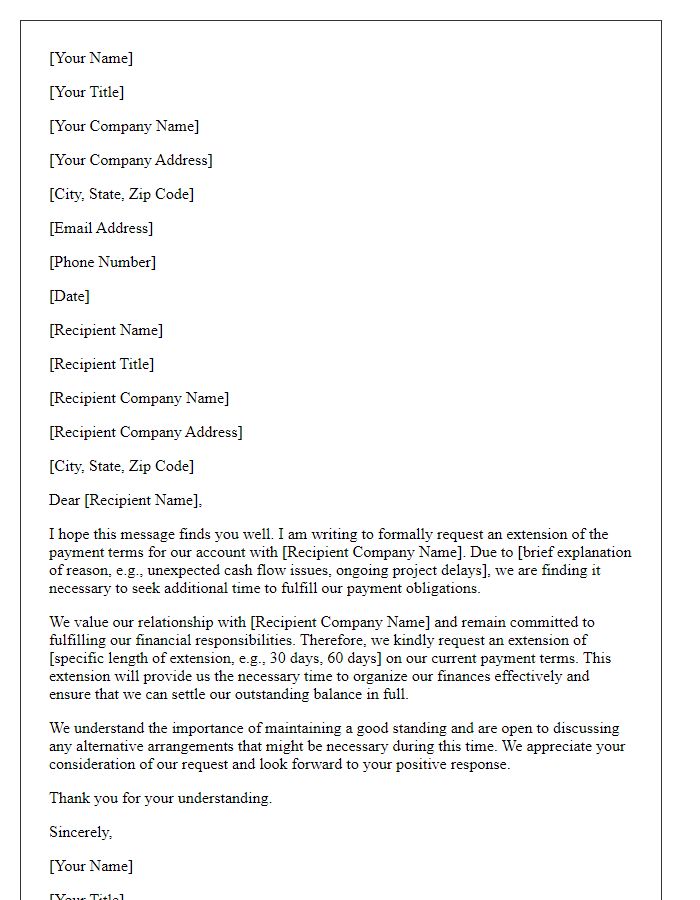

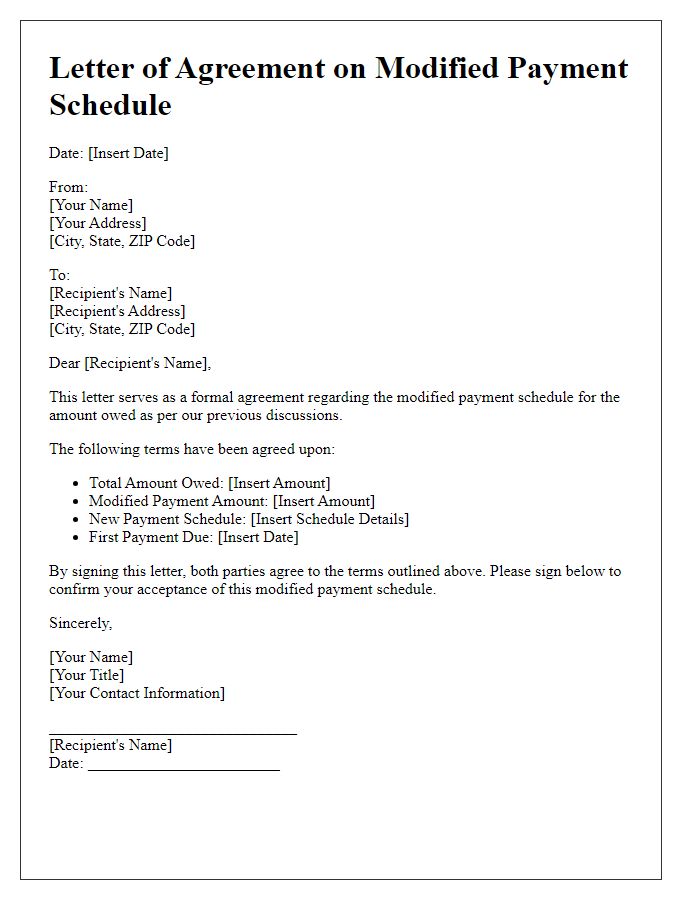

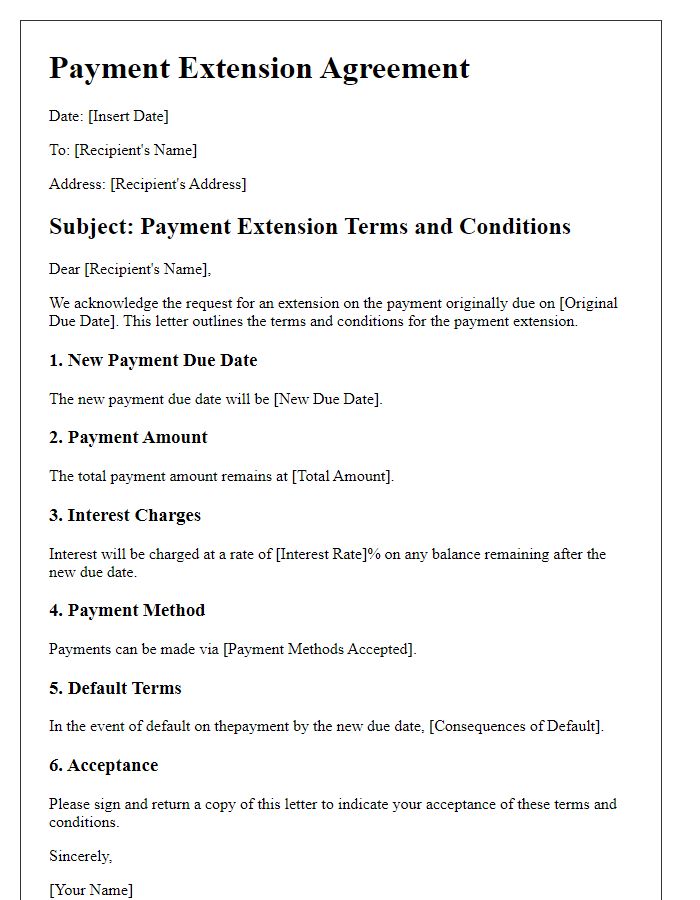

New Payment Terms and Conditions

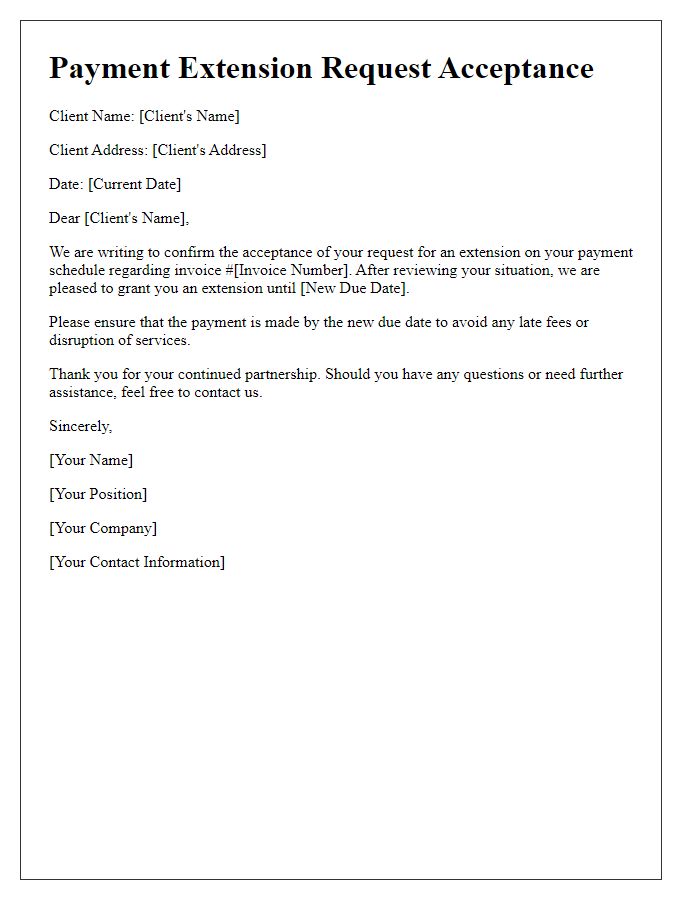

In financial negotiations, understanding the implications of extended payment terms is crucial for maintaining healthy cash flow. Newly negotiated payment terms can involve altered schedules, such as extending the payment duration from 30 days to 60 days, particularly during challenging economic circumstances. This adjustment, reflected in documents such as contracts or invoices, may lead to changes in interest rates or penalties related to late payments. Clear communication regarding these terms, typically finalized through written agreements, is essential. The location of the transaction, for instance, business activities taking place in New York City, may also influence legal considerations based on state regulations. Organizations often establish new payment conditions through formal proposals, outlining details such as monthly payment amounts or total outstanding balances to ensure mutual understanding between parties involved.

Consequences and Considerations

Payment extension requests can significantly impact personal finances and business operations. Customers seeking extensions, especially individuals facing economic challenges like rising inflation, may experience consequences such as late fees or adverse credit scoring, possibly dropping credit scores by 50 points based on current metrics. Businesses, like small retailers, could face cash flow disruptions, affecting inventory purchasing and operational expenses. Understanding the terms of extension agreements is crucial; for instance, extensions longer than 30 days may incur additional interest charges, averaging 10% across various lending institutions. Furthermore, maintaining open communication with creditors can facilitate better arrangements and prevent further financial strain.

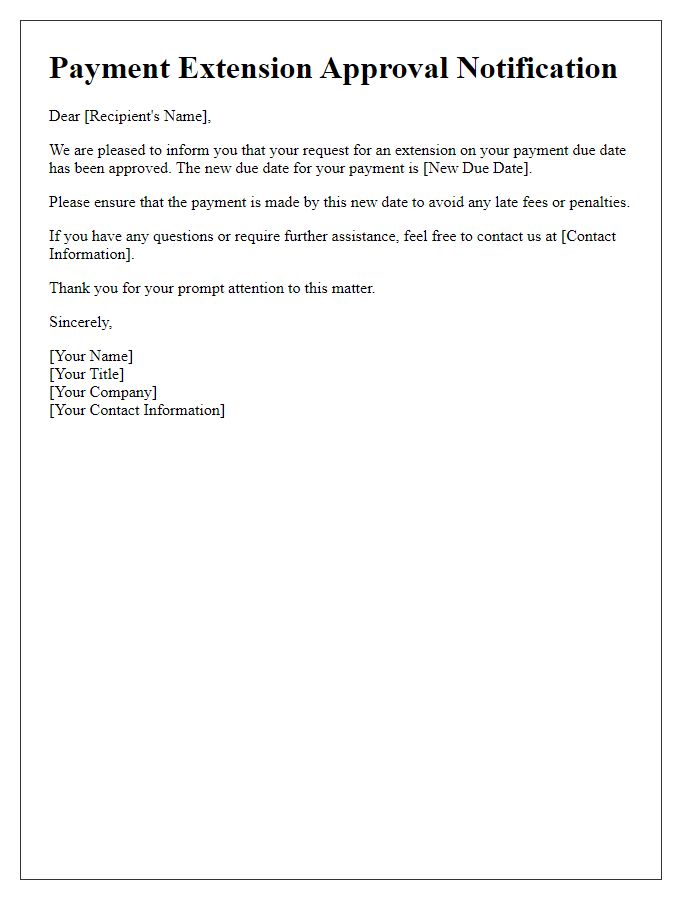

Assurance and Contact Information

Payment extension approval requests offer individuals and businesses an opportunity to manage their finances more effectively during challenging times. The assurance of support from financial institutions can alleviate stress and provide a pathway to stability. Contact information, such as a direct phone line (e.g., 1-800-555-0199) or an email address (e.g., support@financialinstitution.com), is crucial for timely communication, enabling clients to discuss their unique circumstances with representatives. Additionally, understanding the terms of the extension, including new payment deadlines or interest rates (such as a typical 0% increase), enhances clarity for all parties involved. Documentation requirements, including proof of income or financial hardship statements, will ensure a smoother approval process and a transparent approach to financial management.

Comments