Are you looking to notify someone about an account transfer? Writing a clear and concise letter is essential to ensure that all parties are well-informed. In this article, we will guide you through a practical template that makes the process simple and straightforward. So, if you're ready to dive into effective communication strategies, let's get started!

Subject Line Precision

Precision in the subject line for an account transfer notification ensures immediate recognition and clarity of the message's intent. Relevant details include specifics like "Account Transfer Confirmation" or "Action Needed: Account Transfer Procedure." Inclusion of the transferring account number or associated names can reduce ambiguity, while using keywords such as "urgent" or "important" emphasizes importance. Timeliness in the subject also plays a critical role; adding a date, like "Effective October 25, 2023," informs the recipient of the transfer's immediate relevance. This targeted approach aids efficient communication and enhances organizational professionalism.

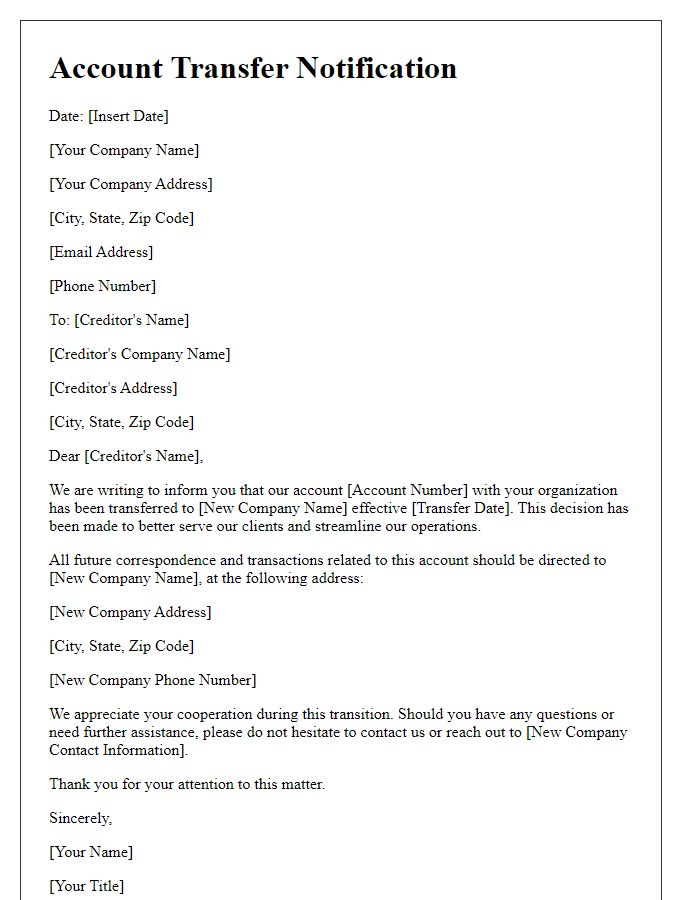

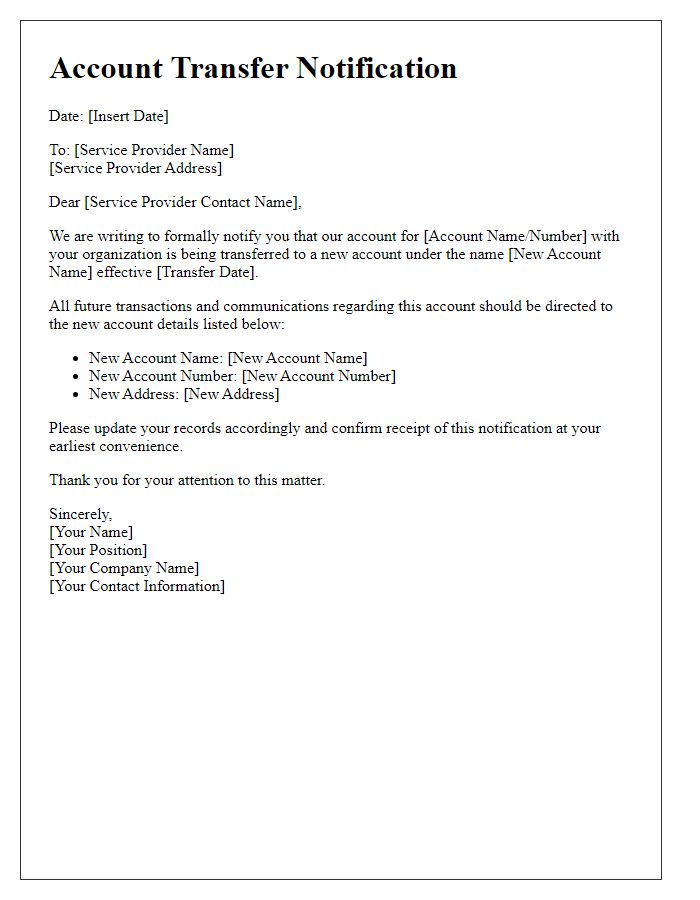

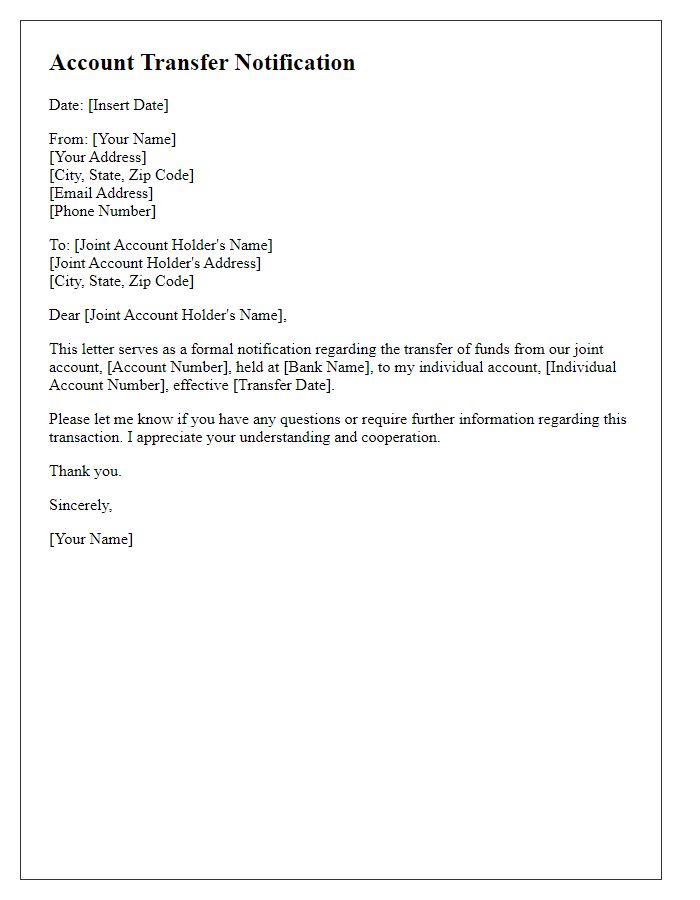

Sender and Recipient Information

The process of account transfer involves various important details to ensure a smooth transition. Sender information typically includes the full name, address, and account number associated with the existing account. Recipient information should encompass the full name, address, and intended account number at the new financial institution, highlighting the targeted bank or credit union where the funds will be moved. It's essential to notify both the current institution and the new institution regarding this transfer to avoid any interruptions in account access. Important dates, such as the desired transfer date and any deadlines for completing the process, should also be clearly indicated to ensure that both parties are aligned regarding timelines and procedures.

Clear Purpose Statement

Transferring accounts can ensure continuity of services and access for clients. Account transfer processes often involve critical elements such as validation of identity and verification of ownership to prevent unauthorized access. Necessary documentation (including proof of identity and previous account details) is typically required to facilitate smooth transitions. Specific institutions, such as banks or online platforms, may have distinct protocols in place, which can vary widely depending on regulatory requirements. Clear communication throughout this process is essential to mitigate any potential confusion or disruption in services. Addressing concerns promptly can enhance client trust and ensure satisfaction.

Transfer Details and Effective Date

Account transfers involve the relocation of financial assets or account ownership between institutions, such as banks like JPMorgan Chase, Bank of America, or credit unions. The transfer process typically requires the submission of documentation authorizing the movement of funds or assets, which may include forms like the Account Transfer Request (ATR) and identification verification. Effective dates play a critical role, as they indicate when assets will officially be moved, often set to align with banking business days, usually Monday through Friday, excluding federal holidays like Independence Day or Thanksgiving. Clients should anticipate potential delays during high-volume periods, such as the end of the fiscal year or promotional offer events, that may influence processing times significantly. Understanding these details ensures clients can manage their accounts effectively, avoiding unexpected lapses in access to funds or essential services during the transitional period.

Contact and Support Information

The notification of account transfer requires clear and concise information to ensure a smooth transition. Key elements include the specified date of transfer, detailed instructions for accessing the new account, and a list of benefits associated with the transfer, such as enhanced security features or improved customer service. Support contact details should be prominently displayed, including a dedicated helpline number (for instance, 1-800-555-0199) and an email address (like support@example.com) for assistance during the transition. Effective communication helps mitigate confusion and sets clear expectations regarding any changes to account management or services, fostering trust and enhancing customer satisfaction throughout the process.

Letter Template For Notifying Account Transfer Samples

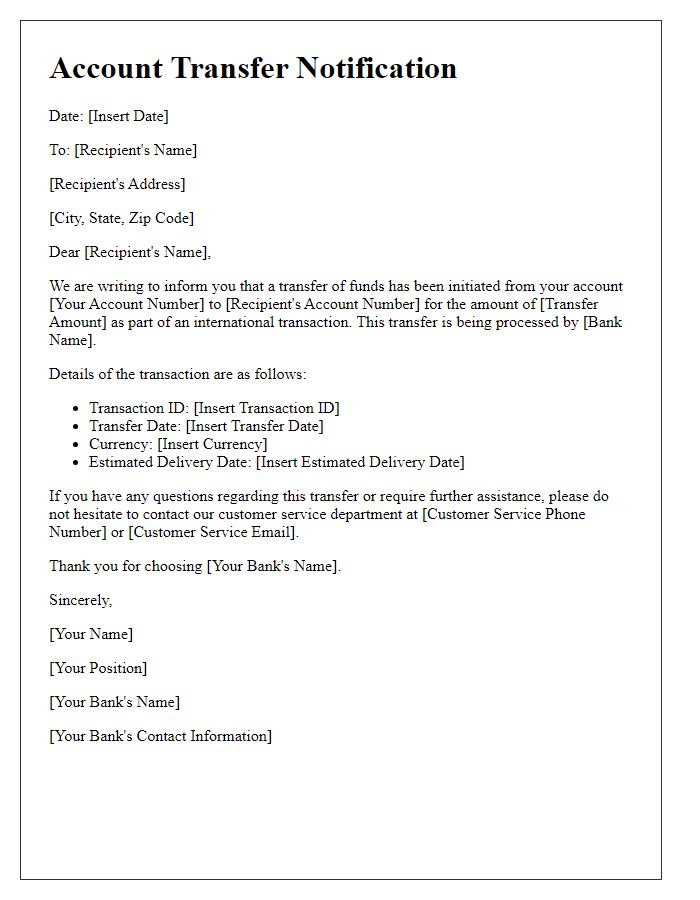

Letter template of account transfer notification for international transactions

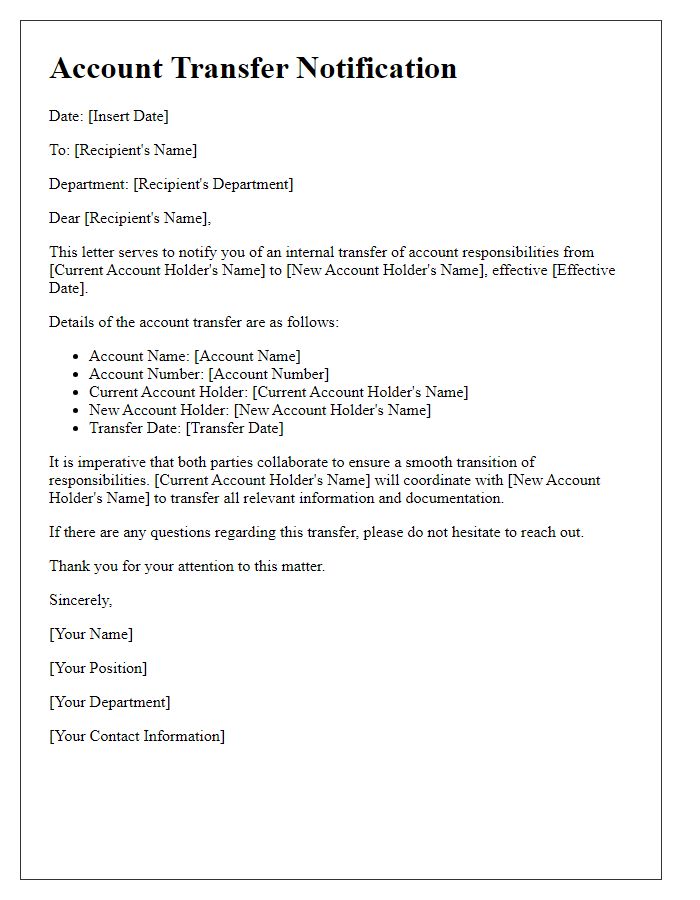

Letter template of account transfer notification for internal departmental transfers

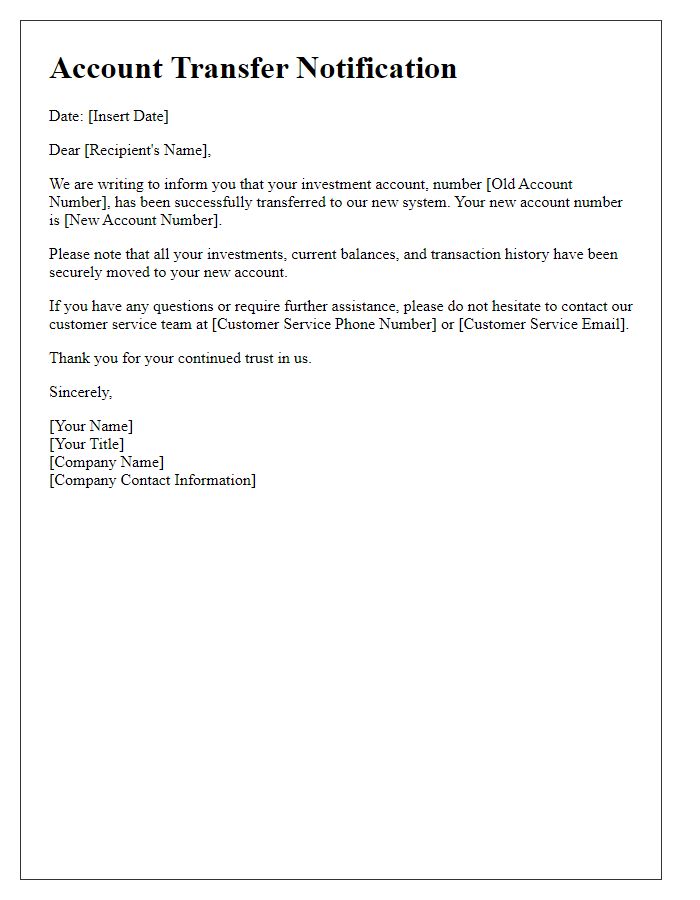

Letter template of account transfer notification for investment accounts

Letter template of account transfer notification for retirement accounts

Comments