Are you feeling the pinch from rising interest rates on your loans? You're not alone! Many borrowers are seeking ways to lessen their financial burden, and one effective approach might be to request a reduction in your interest rate. In this article, we'll guide you on how to craft a compelling letter for your interest rate reduction request that can help you get the relief you needâread on to find out more!

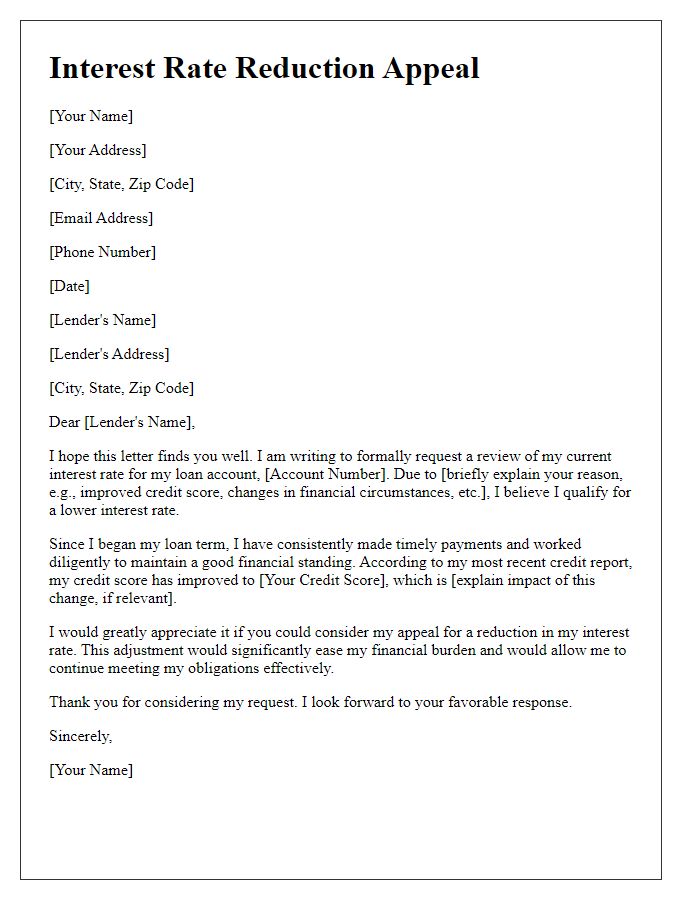

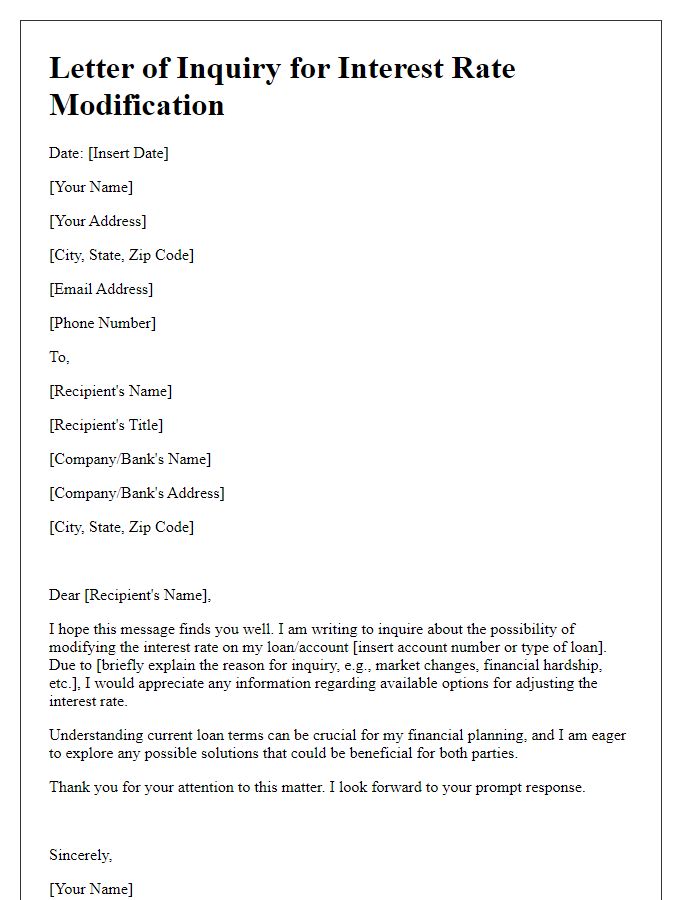

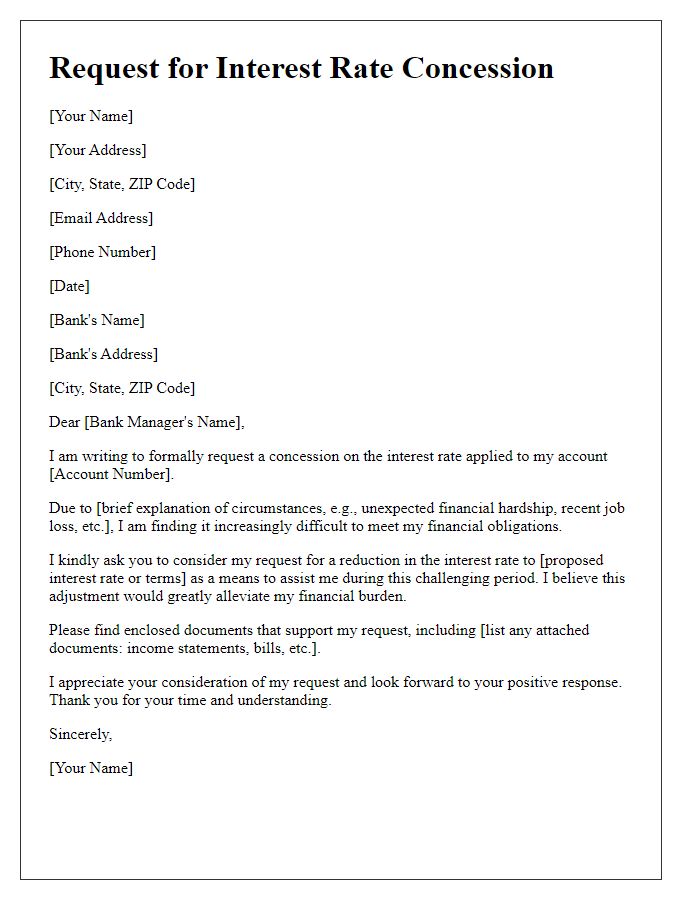

Polite and professional tone

Interest rate reduction requests can significantly impact financial obligations. Homeowners seeking to lower mortgage interest rates often approach lenders. Current economic conditions, such as low inflation (around 2.5% in recent years) and adjustable-rate mortgages (ARMs) reaching historical lows, prompt many borrowers to consider renegotiating terms. A polite and professional letter should include the account number, details about the current interest rate (e.g., 4.5%), and any pertinent circumstances affecting financial stability. Clearly articulating the request helps build a strong case for reducing rates, potentially leading to decreased monthly payments and improved cash flow.

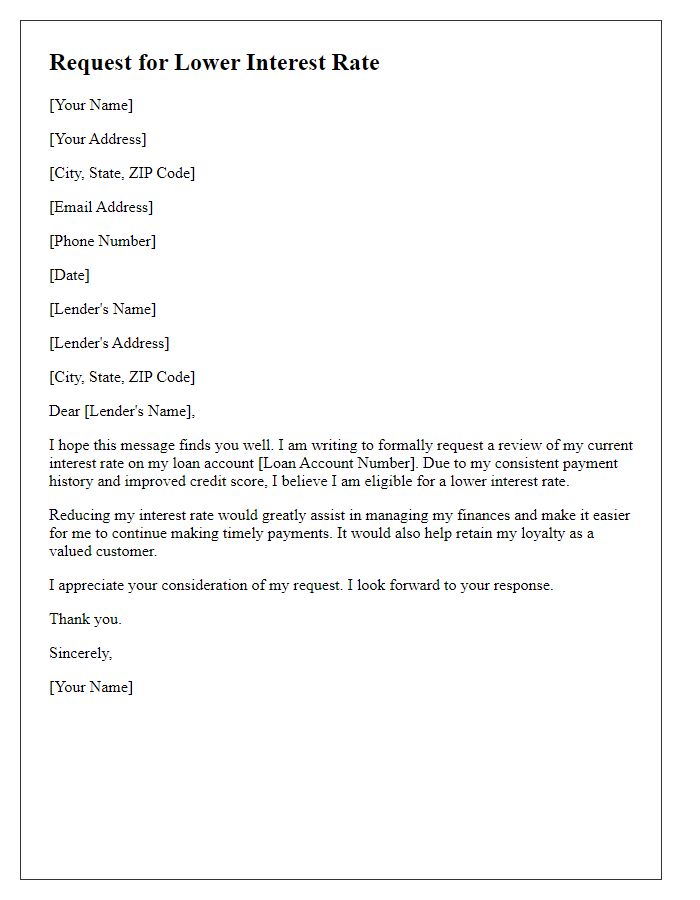

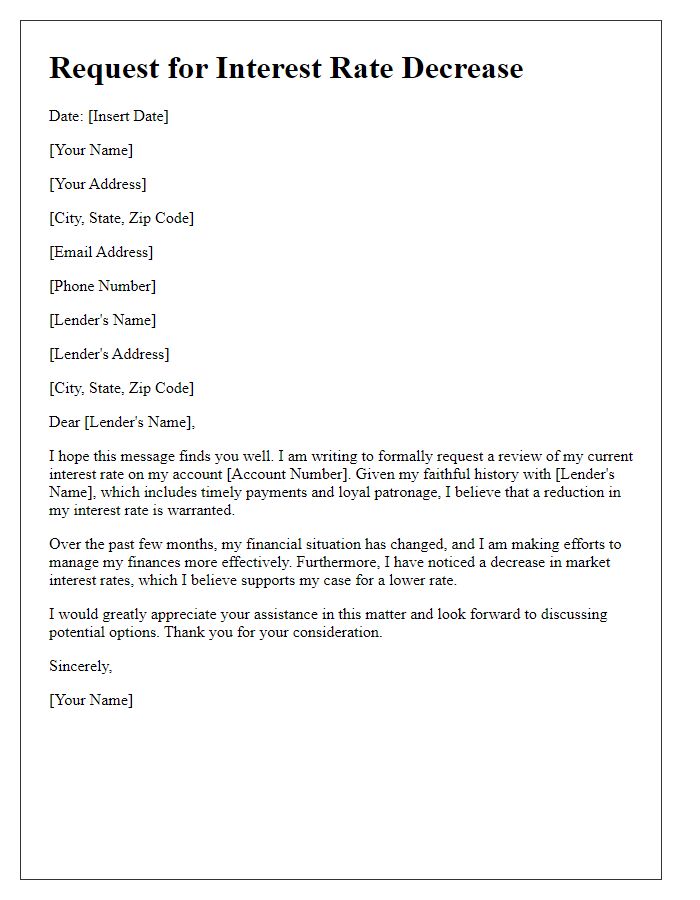

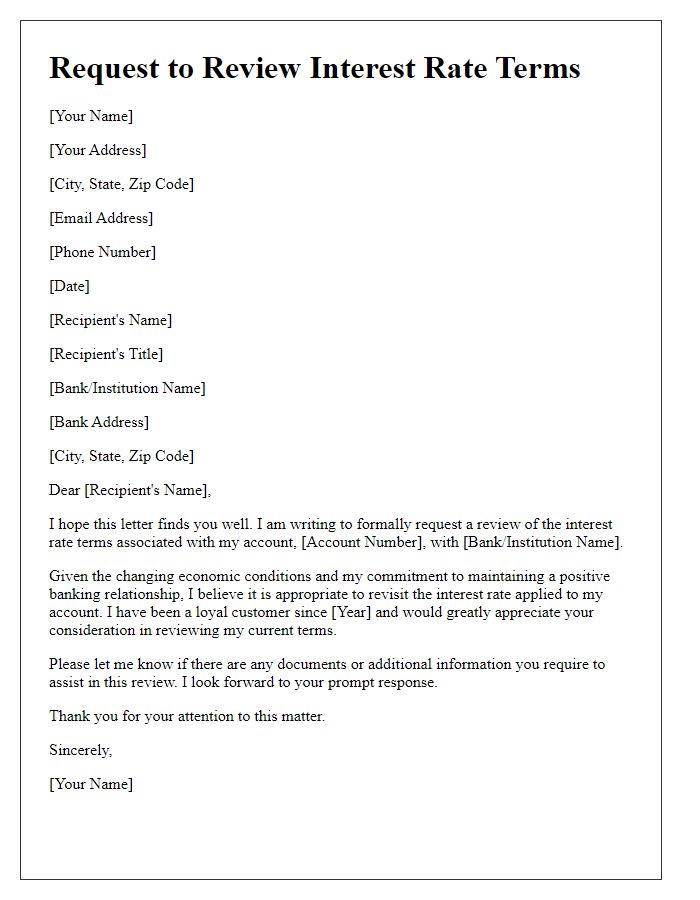

Specific loan account details

Requesting a reduction in interest rates can significantly impact monthly payments and overall loan affordability. For instance, consider a mortgage account under servicer XYZ, specifically account number 123456789, where the current interest rate stands at 4.5%. A reduction to 3.5% could lower monthly payments from approximately $1,200 to about $1,000, based on a 30-year term with a principal amount of $250,000. Such a change not only eases financial burden but also enhances the borrower's capability to allocate funds toward other essential expenses. Furthermore, market trends indicate potential for lower rates, making a strong case for reconsideration by the lender. Documenting this request with specific loan details strengthens the argument for a favorable review.

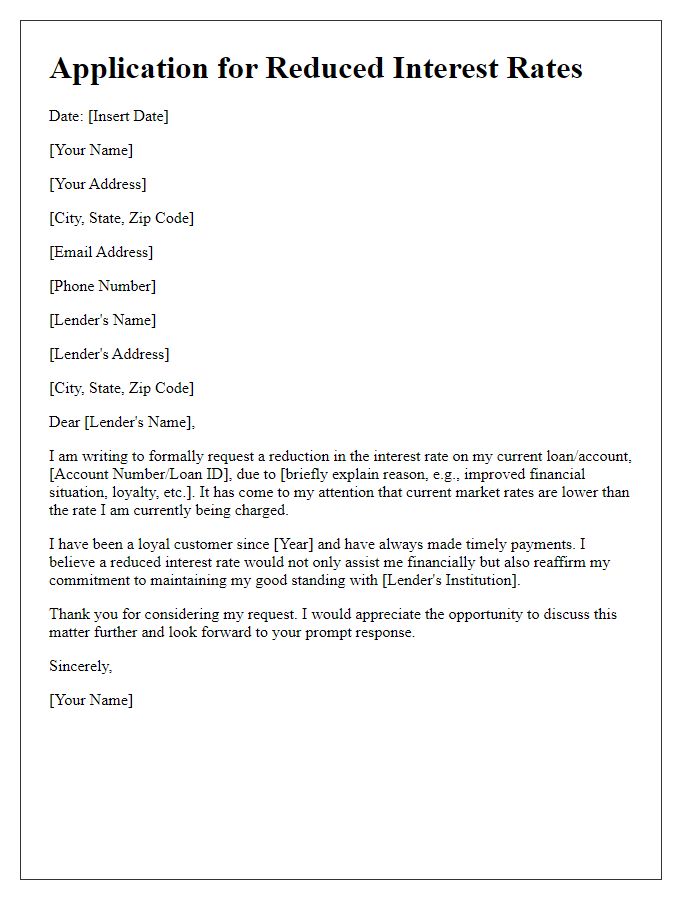

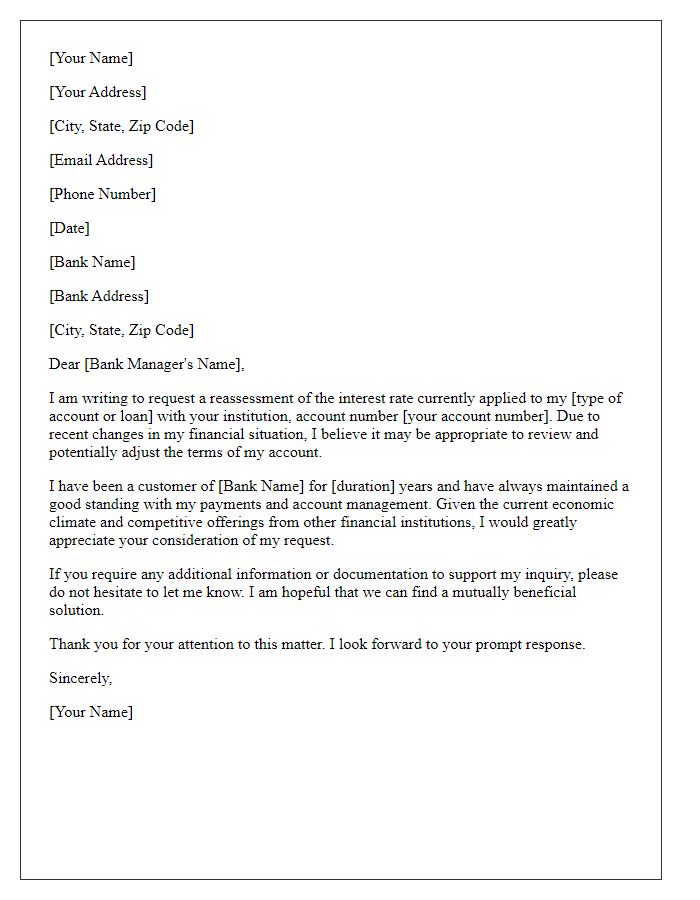

Clear request for rate reduction

Business loan interest rates can significantly impact financial stability for small enterprises, especially in the current economic climate. A reduction in the interest rate, such as a decrease from 5% to 3%, can lead to substantial savings in monthly payments, potentially reducing the total repayment amount over the loan's duration. Many small businesses, especially in sectors like retail and hospitality, are seeking financial relief amid challenges like supply chain disruptions and fluctuating consumer demand. The request for a lower interest rate should be directed to financial institutions such as community banks or credit unions, which often prioritize client relationships and may be more amenable to negotiations.

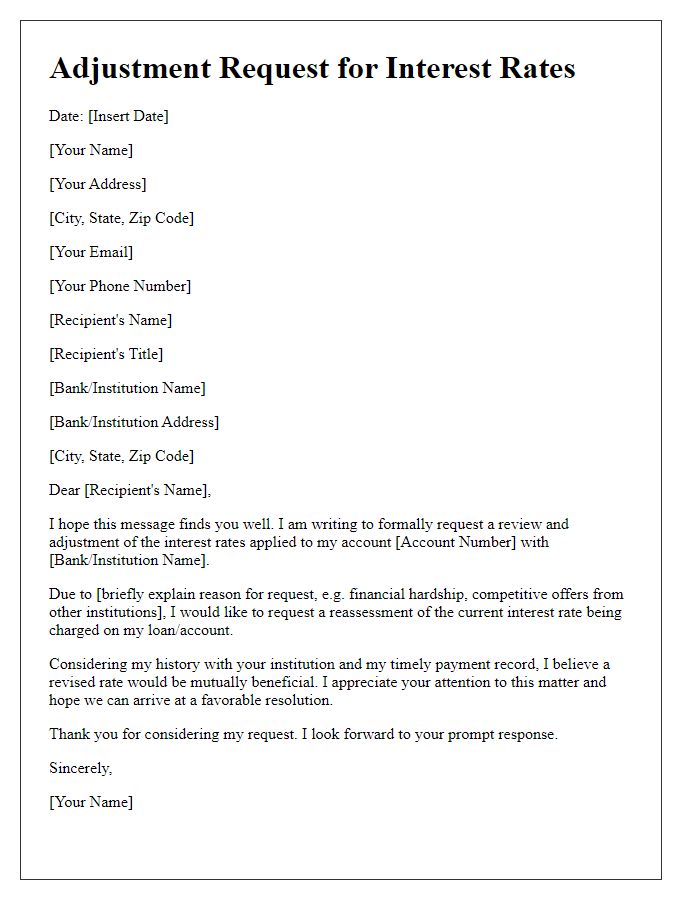

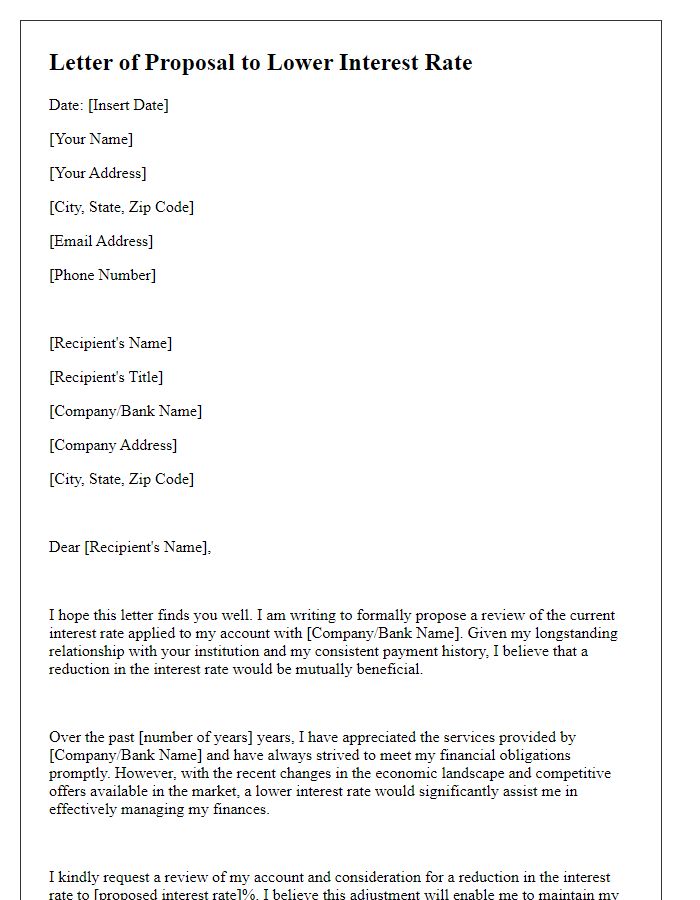

Justification for request (financial stability, improved credit score)

Reducing interest rates can significantly enhance financial stability for individuals seeking to manage debt effectively. With the recent improvement in credit scores, often exceeding 700, borrowers demonstrate a reliable repayment history, mitigating risks for lenders. Current economic conditions, like the Federal Reserve's recent rate adjustments, create opportunities for lower borrowing costs. A smaller interest rate can lower monthly payments, easing budget constraints and enabling individuals to allocate funds to savings or emergency funds. Furthermore, reduced interest can accelerate repayment timelines, fostering financial growth and security in an unpredictable economic landscape.

Contact information for follow-up

Interest rate reductions on loans, such as mortgages or personal loans, significantly impact financial planning. Borrowers often seek to lower their interest rates to reduce monthly payments and total loan costs. Financial institutions consider factors like credit score, payment history, and current economic conditions. Applicants often submit formal requests, detailing their current interest rates and circumstances prompting the reduction request. Communication channels, such as email or phone numbers, are crucial for lenders to facilitate quick follow-ups or gather additional information. Effective negotiation strategies can enhance the likelihood of approval for reduced rates.

Comments