Hey there! If you're in a situation where you've co-signed a loan or lease, it's essential to understand the responsibilities that come with it. Co-signing isn't just a formalityâit means you're equally accountable for the debt, and any missed payments can impact both your credit scores. So, whether you're navigating this path for a friend, family member, or even a business relationship, it's crucial to keep the lines of communication open and informed. Want to know more about handling co-signer obligations? Keep reading!

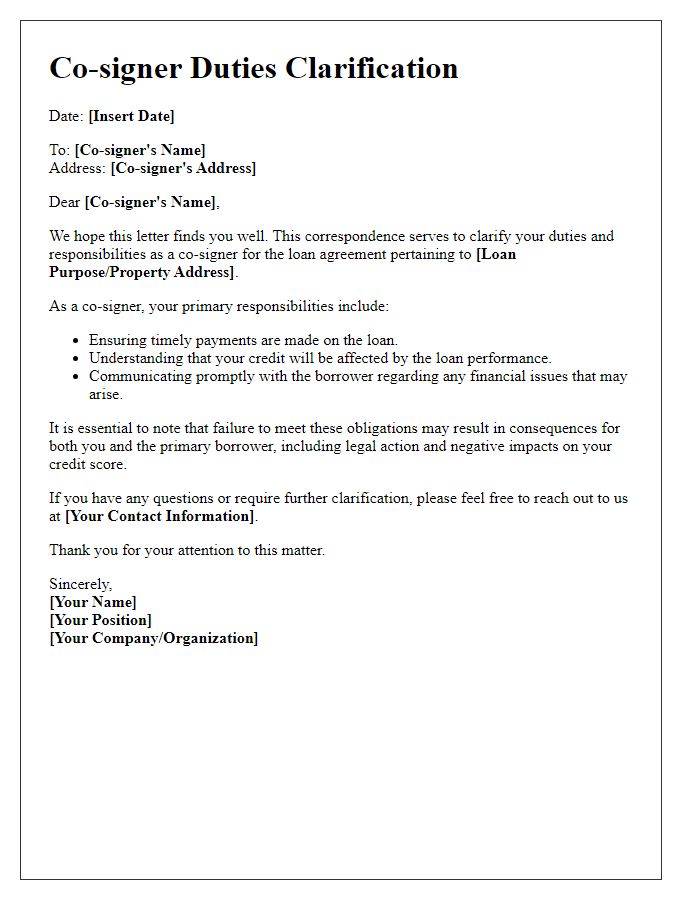

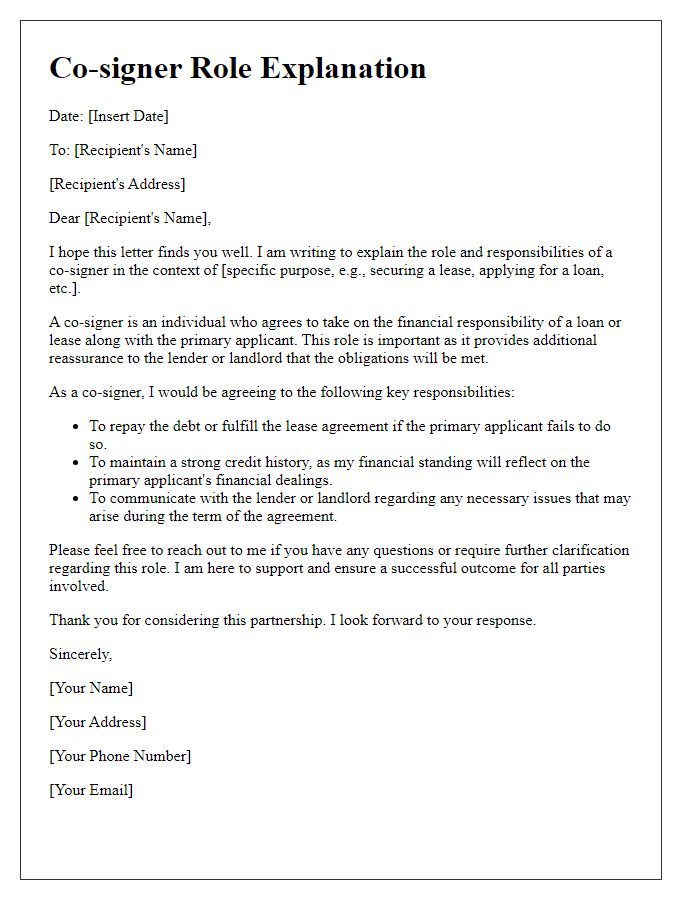

Co-signer obligation details

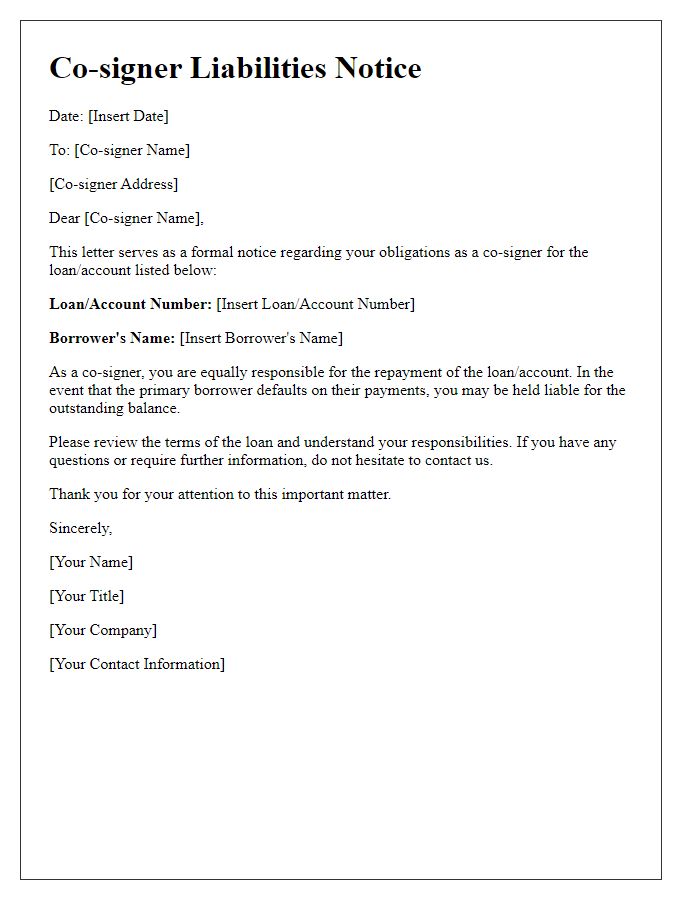

A co-signer's obligation involves assuming responsibility for a loan or lease, typically in rental agreements or personal loans. In instances where the primary borrower defaults, the co-signer, often a family member or friend, becomes liable for the full amount owed, which can range from hundreds to thousands of dollars depending on the agreement. This obligation may also negatively impact the co-signer's credit score if payments are missed, potentially leading to a decrease in creditworthiness. Additionally, co-signers have a legal duty to ensure timely payments to avoid financial repercussions, including legal action from lenders or landlords in states such as California or New York, known for strict lending regulations. Understanding these responsibilities is crucial when considering the implications of co-signing an agreement.

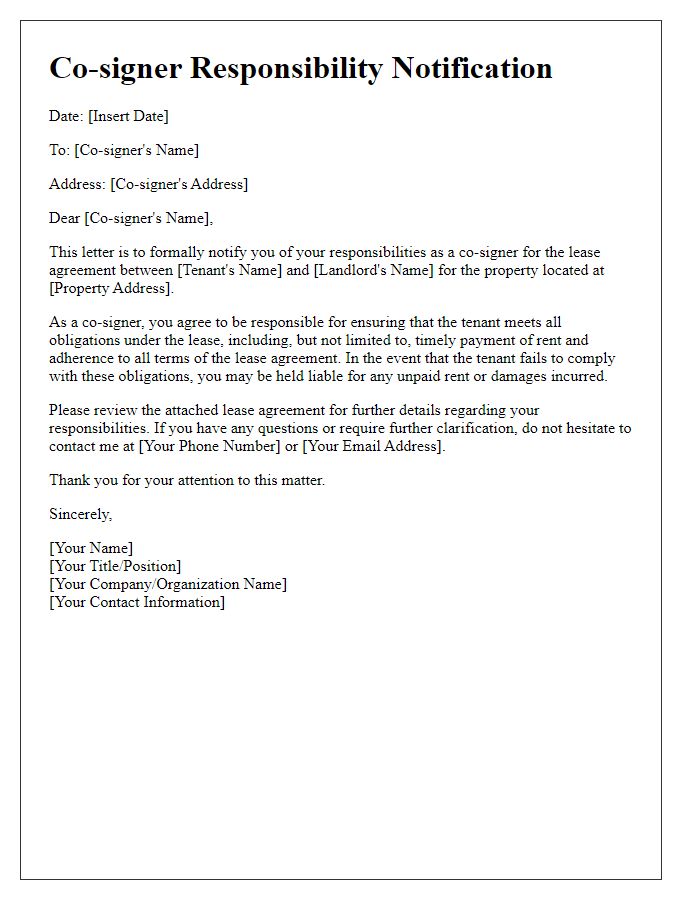

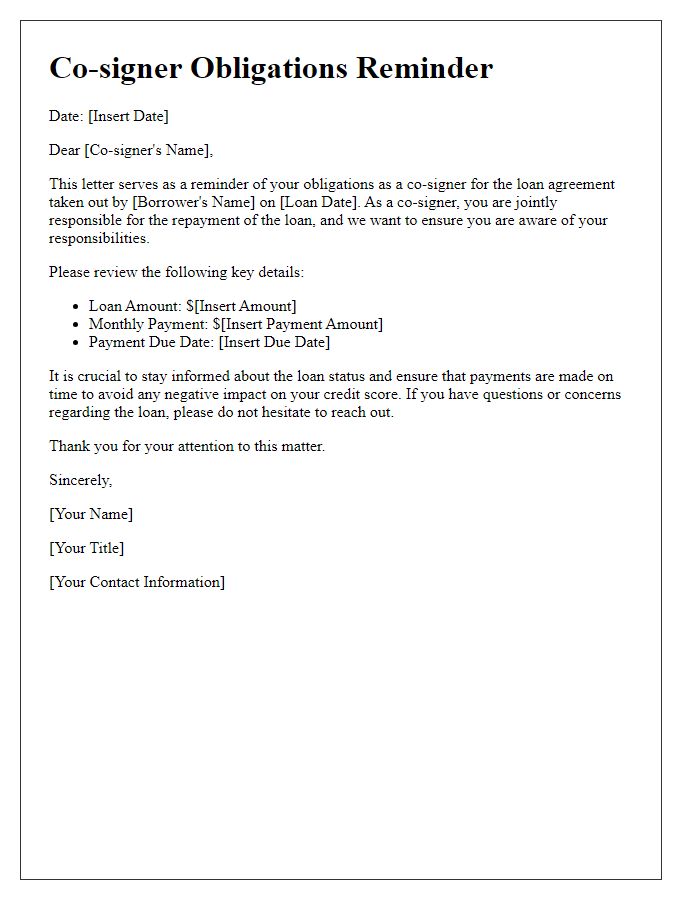

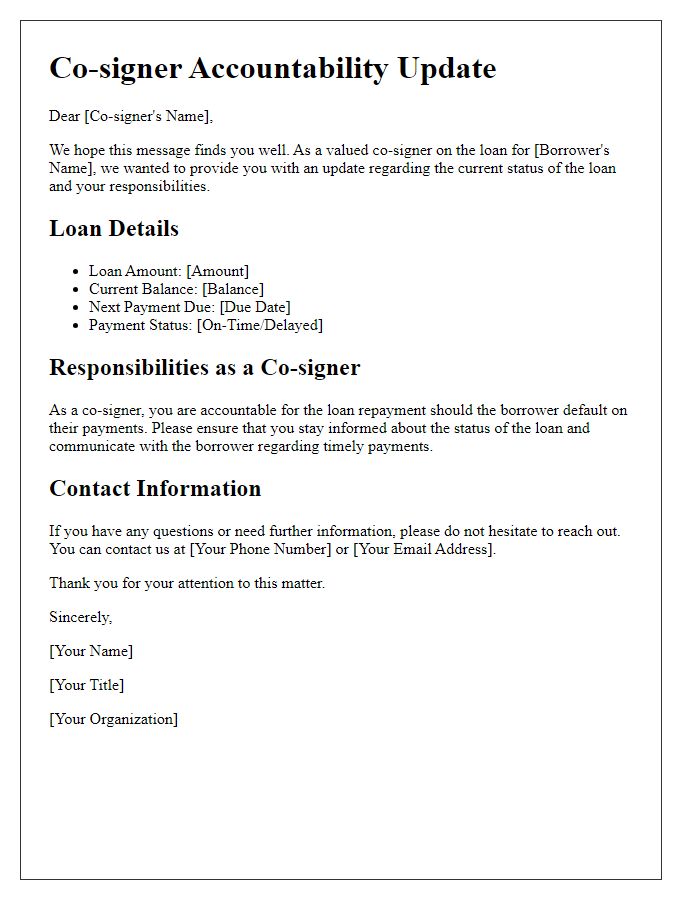

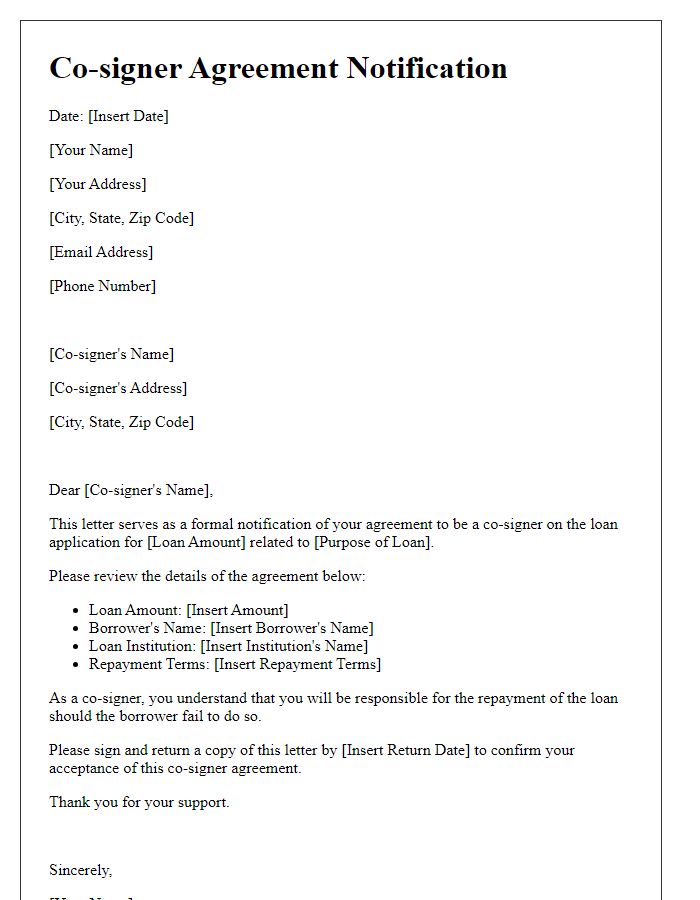

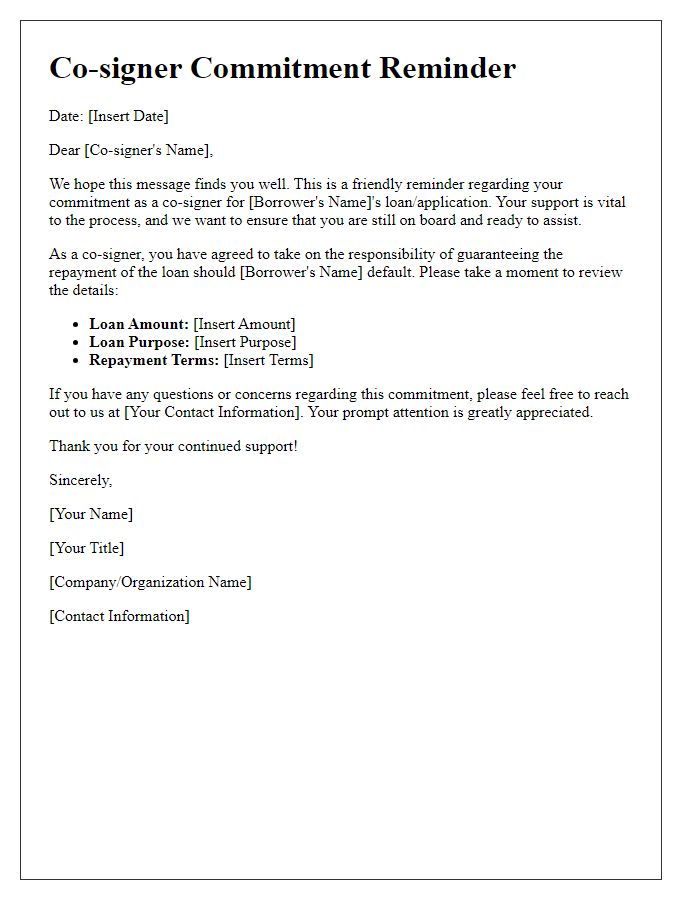

Loan agreement summary

The co-signer's responsibilities in a loan agreement typically include guaranteeing repayment, ensuring timely payments, and managing credit implications. In the context of a personal loan value of $20,000, co-signers must understand that their credit may be impacted by missed payments. For a loan duration of 5 years, consistent monthly payments of approximately $400 must be made. Should the primary borrower default, the co-signer becomes liable for the remaining balance, potentially affecting credit scores by 100 points or more. The lender, usually a bank or financial institution like Wells Fargo, reserves the right to pursue collection actions, including legal proceedings, against the co-signer. It is crucial for co-signers to monitor the loan status regularly to mitigate risks and maintain financial health.

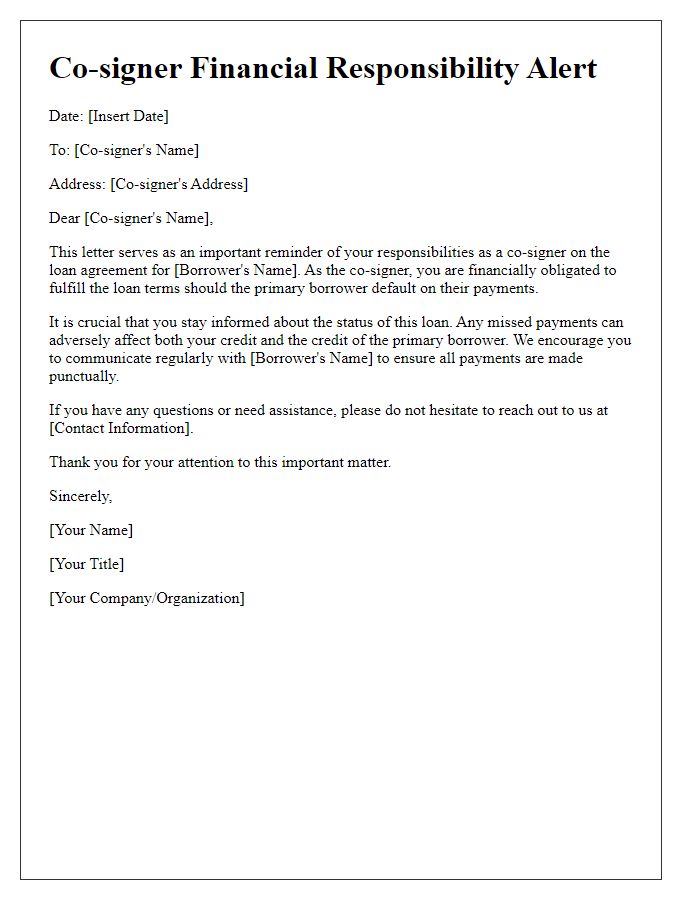

Consequences of missed payments

When a borrower defaults on a loan, co-signers face significant financial consequences. Missed payments can lead to credit score deterioration, impacting future loan eligibility and interest rates. Co-signers are equally responsible for repayment obligations, often resulting in debt collections and potential legal action if the primary borrower fails to meet their financial commitments. Communication with the lender becomes crucial, as missed payments may prompt them to pursue the co-signer for any outstanding balances or fees. Understanding these risks is essential to maintaining financial health and safeguarding personal credit.

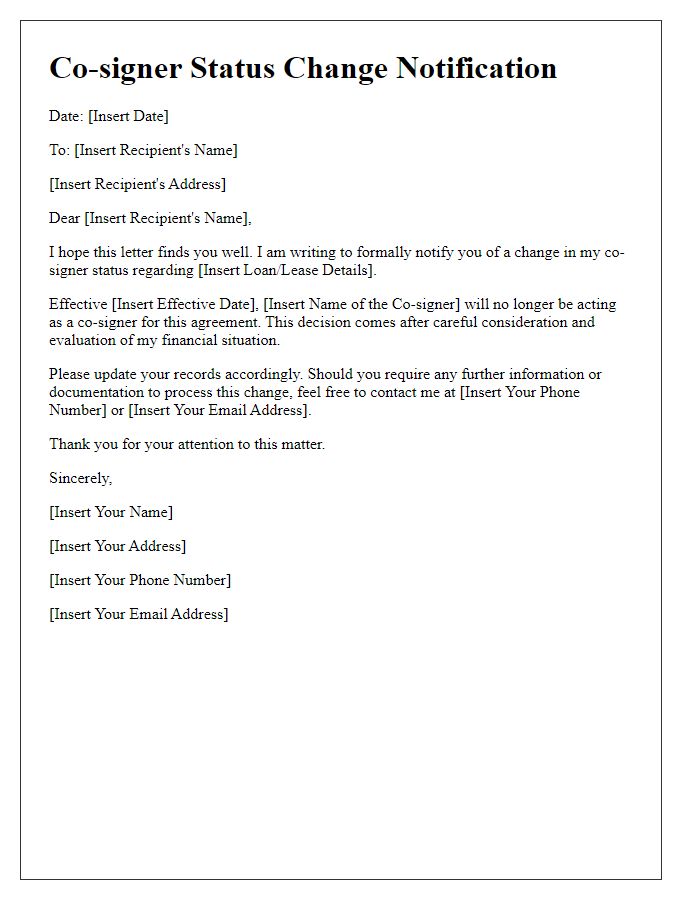

Contact information for queries

A co-signer (responsible party agreeing to pay the borrower's debt) on a loan agreement must be informed of their obligations. These obligations arise if the primary borrower defaults (fails to make payments as scheduled), typically outlined in official documentation such as loan contracts. Communication regarding these responsibilities should include contact information (phone number, email address) where queries can be directed. This ensures clarity about legal and financial repercussions, which may involve collection efforts or credit score impacts. Regular updates or reminders about account status could help prevent misunderstandings, promoting responsible financial behavior among all parties involved.

Deadline for acknowledgment

A co-signer's responsibility impacts the financial agreement significantly, especially in agreements involving loans or leases. The deadline for acknowledgment typically pertains to the date by which the co-signer must confirm understanding of their obligations, often set at 30 days from the initial communication. Legal documents in the jurisdiction, such as the Fair Credit Reporting Act, can outline these responsibilities clearly. Non-acknowledgment can lead to severe consequences, including potential damage to credit scores or default on the financial obligation. Clear communication about these responsibilities is crucial in ensuring co-signers understand their role in the agreement.

Comments