Are you feeling overwhelmed by the process of debt recovery? It can be a daunting task to manage outstanding payments, but with the right tools and knowledge, you can take action. In this article, we will explore how to effectively draft a letter to authorize a debt recovery agent, ensuring that you communicate your intentions clearly and legally. So, if you're ready to regain control over your finances, keep reading to discover the essential steps involved!

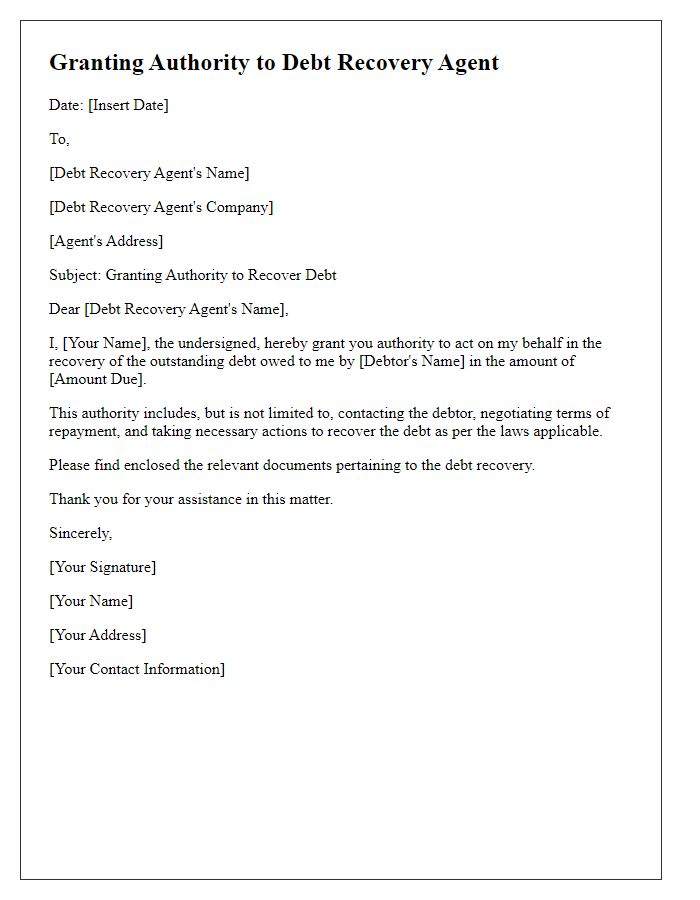

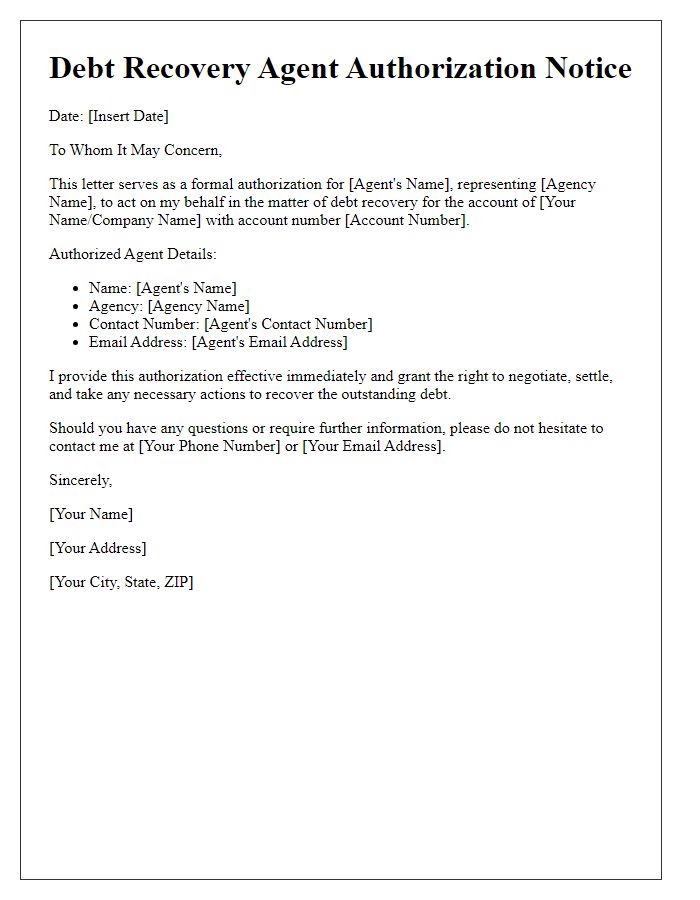

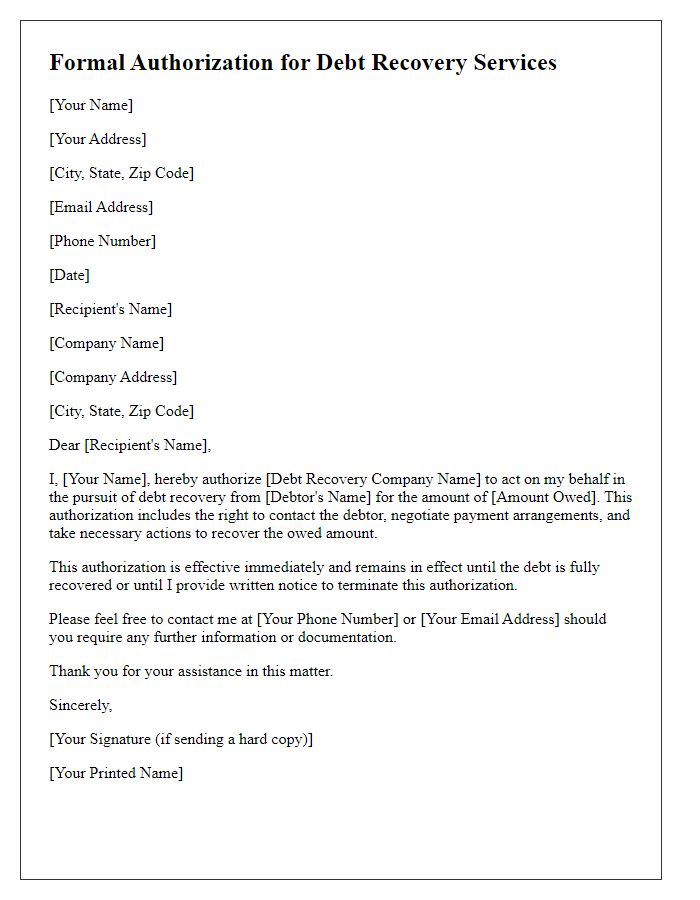

Agent Identification

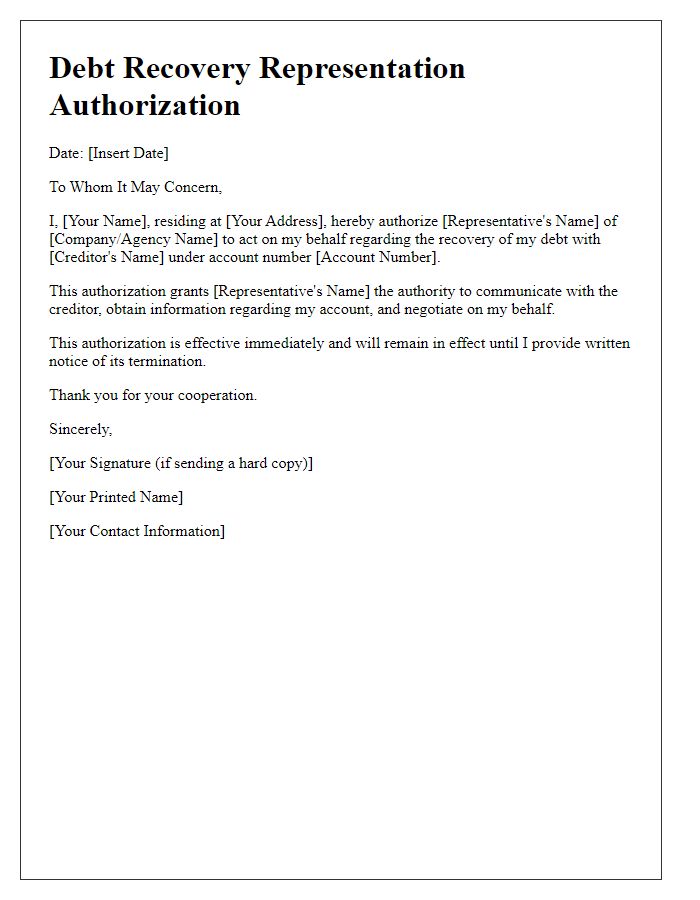

A debt recovery agent authorization form should include essential identification details to ensure proper representation. The agent's full name, including any professional designations, should be clearly stated, accompanied by a valid identification number, such as a driver's license or national ID. This document should also list the agency's name, like XYZ Debt Recovery Agency, with its business license number for verification. Contact details, including a phone number and email address, should be provided for direct communication. Additionally, the debtor's information, including full name and account number, must be included to establish the context of the authorization. A signature line for the debtor's consent and date of authorization completion adds validity to the document.

Debtor Information

In the realm of debt recovery, essential debtor information includes full name, address, contact number, outstanding amount, and original creditor details. The debtor's name represents the individual or entity in financial default. Address provides location context, critical for communication or legal proceedings. Contact number offers a direct line for negotiation or collection efforts. Outstanding amount quantifies the financial obligation, while original creditor details outline the entity initially owed. Accurate documentation of these elements ensures efficient recovery processes and legal compliance, often governed by regulations specific to regions such as the Fair Debt Collection Practices Act in the United States.

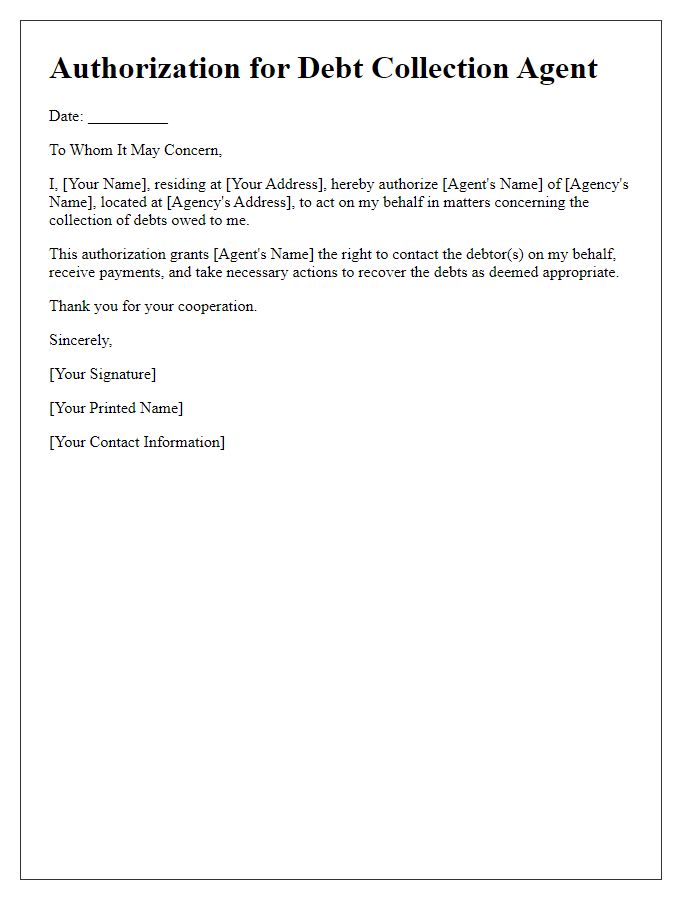

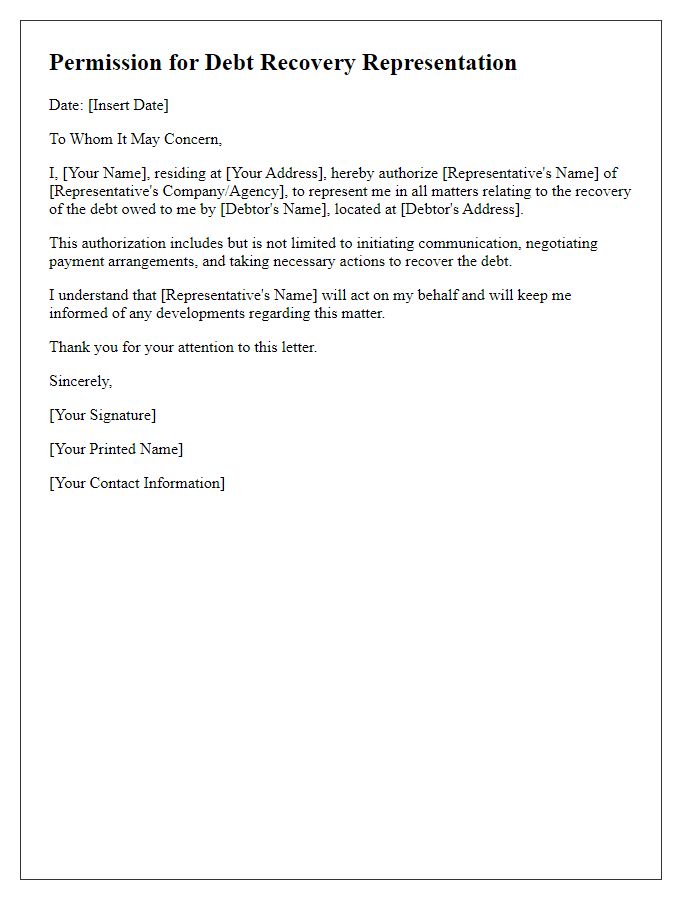

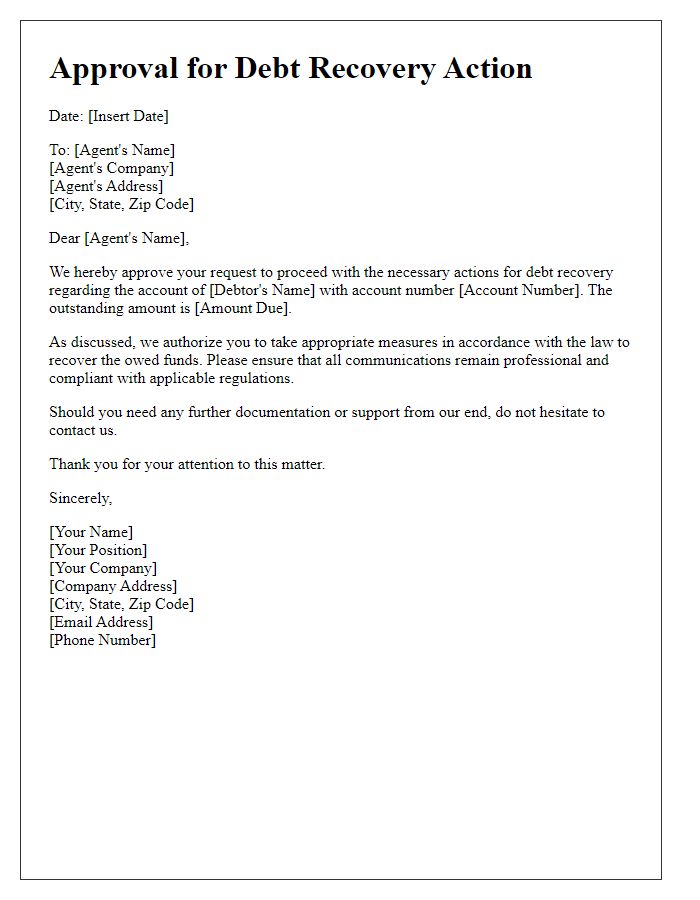

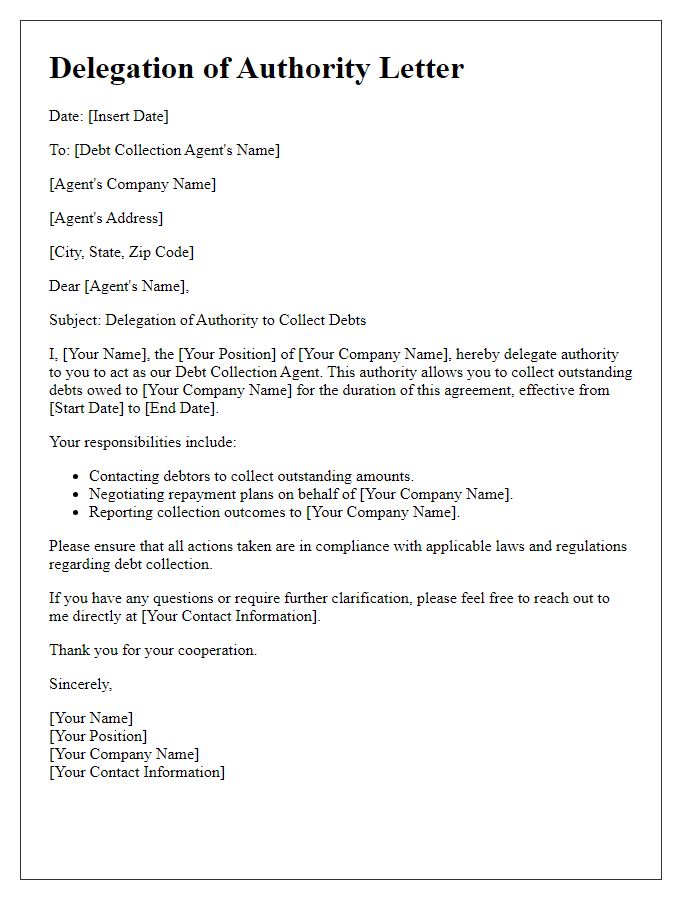

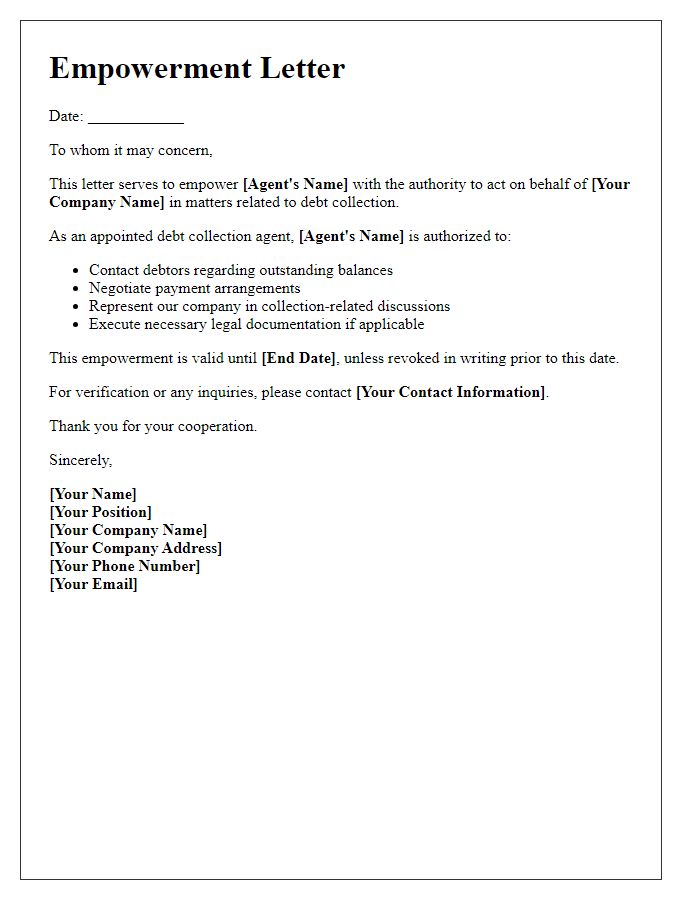

Scope of Authorization

A debt recovery agent authorization grants a specific individual or agency the legal power to act on behalf of a creditor in the recovery of outstanding debts. This authorization typically includes the authority to communicate and negotiate with debtors, initiate collection efforts, and potentially engage legal proceedings as necessary, depending on the terms outlined. The scope of this authorization may encompass various types of debts, such as personal loans, credit card debts, and business invoices, and it is often time-bound or subject to specific limitations. Organizations such as financial institutions or service providers may seek to formalize this agreement to ensure compliance with relevant regulations and protect the interests of all parties involved in the collection process.

Duration of Authorization

Authorization letters for debt recovery agents typically outline the duration for which the agent is granted permission to act on behalf of the creditor. This duration can vary based on different agreements or circumstances. For instance, a common duration could be set to six months starting from the date of authorization, allowing the debt recovery agent to pursue recovery efforts actively during this time frame. Extensions may be negotiated subsequently, depending on the progress of the recovery process. It is crucial to clearly specify any renewal terms or conditions that may apply, ensuring both parties understand the timeline and any potential limits placed on the authority granted. Note: Duration terms should comply with relevant legal regulations or industry standards in the specific jurisdiction.

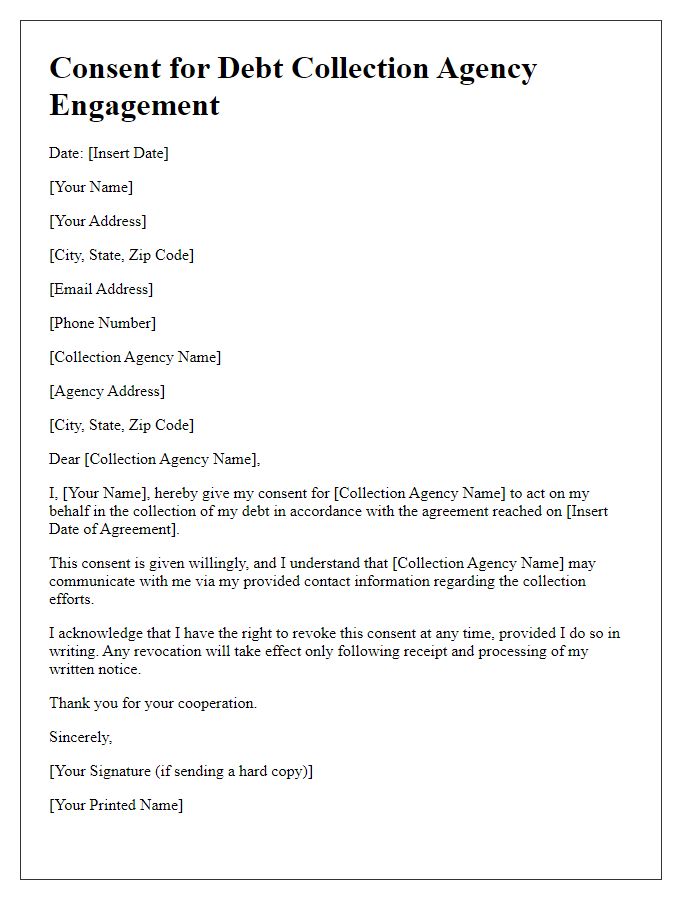

Confidentiality Clause

A confidentiality clause within a debt recovery agent authorization ensures the protection of sensitive information exchanged during recovery processes. This clause typically mandates that the agent, acting on behalf of the creditor (the original lender), is prohibited from disclosing any debtor information, including financial details, personal identification numbers, or account balances, to unauthorized third parties. Violations of this confidentiality clause can lead to legal repercussions, potentially involving fines or sanctions, as it disrupts the trust fundamental to the creditor-debtor relationship. Furthermore, adherence to data protection laws, such as the GDPR (General Data Protection Regulation) in the European Union, reinforces the importance of this confidentiality and imposes strict obligations on data handling and processing.

Comments