Are you feeling overwhelmed by unpaid debts and unsure of how to address the issue? Sending a debt collection notification can be a crucial step in regaining control over your finances while maintaining professionalism. With the right template, you can communicate effectively with your debtors, outlining the necessary information and encouraging timely payment. If you're looking for an easy-to-follow guide to crafting the perfect debt collection letter, keep reading!

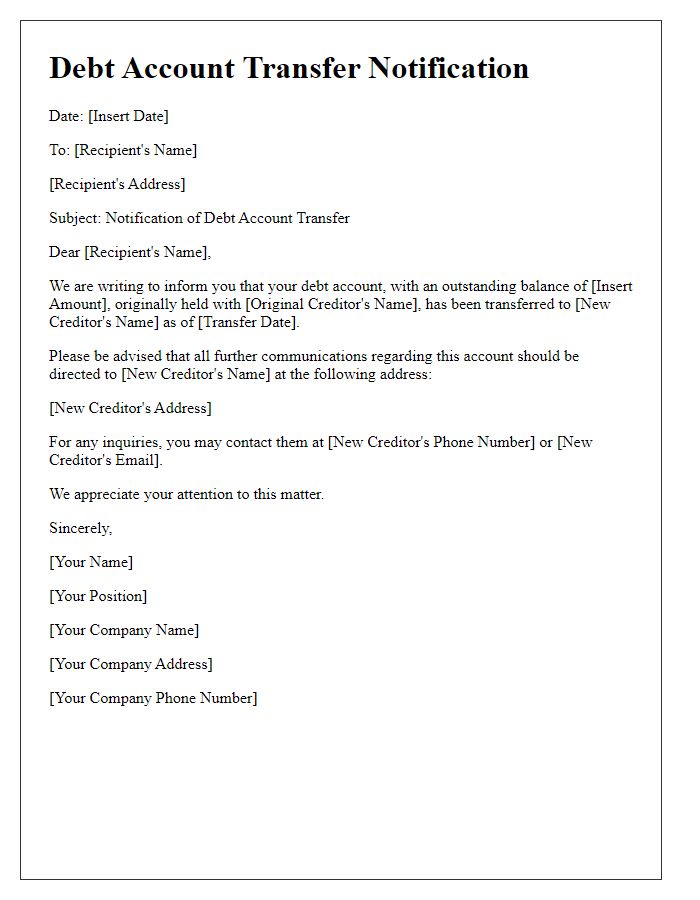

Clear identification of debtor and creditor

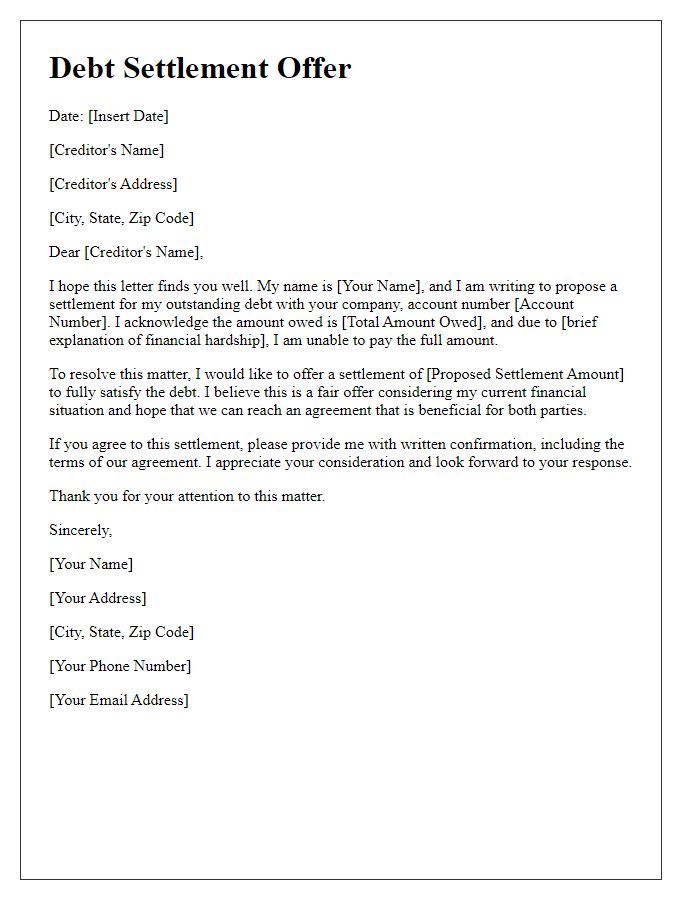

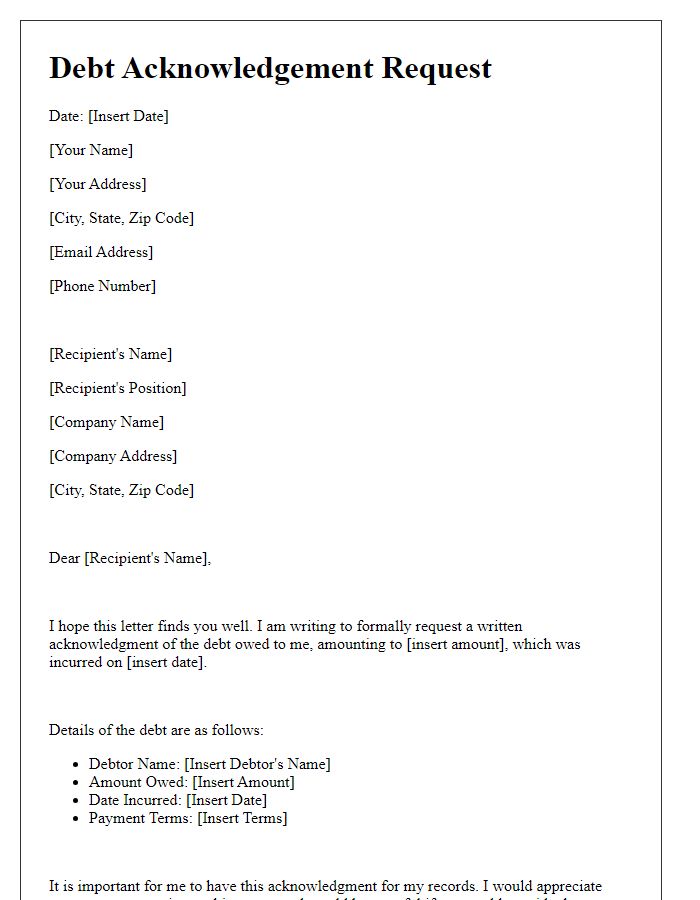

A debt collection notification is an important document that clearly identifies both the debtor (the individual or entity who owes money) and the creditor (the individual or entity to whom the money is owed). This notification typically includes essential information such as the debtor's full name, address, and account number. The creditor's details, including the business name, address, and contact information, must also be present. Additionally, it specifies the amount owed, relevant due dates, and potential consequences of non-payment. If applicable, the notification may reference previous communication about the debt, thereby highlighting the urgency of the situation and the need for prompt resolution.

Specific debt details and due amount

Urgent debt collection notifications often highlight specific debt details, such as the original creditor's name, the account number linked to the debt (e.g., 123456789), and the total due amount (for instance, $1,250.00). These notices underscore the importance of timely payments, often referencing the original transaction date (e.g., April 15, 2023) to establish the timeline of the debt. Furthermore, they may indicate any fees accrued due to late payments, emphasizing the repercussions of non-payment, which could include credit score impacts or potential legal action. Collectors often provide a prompt for clients to contact their office within a set timeframe (e.g., 30 days) to resolve the matter amicably.

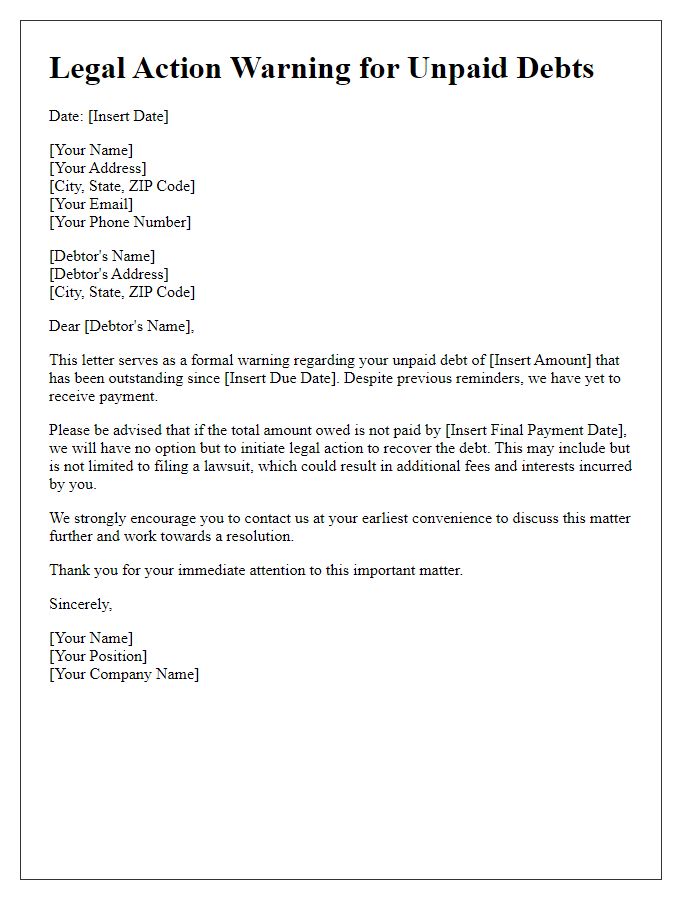

Consequences of non-payment

Failure to address outstanding debts can result in significant consequences that affect both personal and business financial health. Unpaid balances may lead to increased interest rates, with late fees potentially adding up to 25% more to the original sum owed. Credit scores can suffer dramatically, declining by as much as 100 points, which impacts future loan eligibility and mortgage rates. Furthermore, legal actions may ensue, with collection agencies becoming involved, and potentially leading to court judgments that could result in wage garnishments or asset seizures, creating additional stress and financial strain. In extreme cases, prolonged non-payment can lead to bankruptcy proceedings, erasing financial records and making future borrowing nearly impossible for a minimum of seven years.

Payment options and deadlines

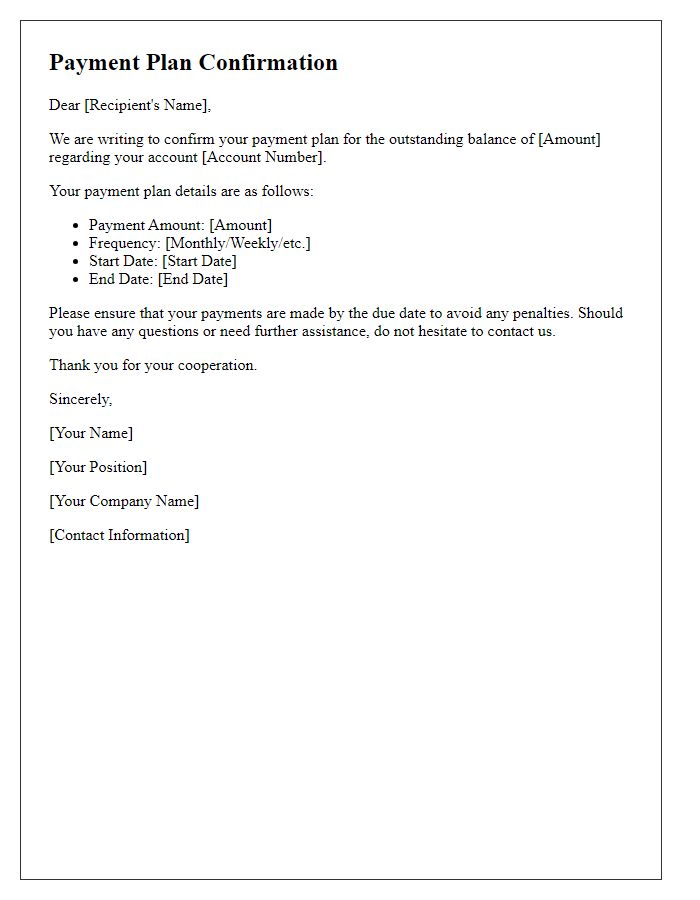

Timely communication regarding outstanding debts is crucial for effective debt collection. In a debt collection notification, include essential details such as the total debt amount (e.g., $1,500), payment options (e.g., online payment, bank transfer), and the stipulated deadline for payment (e.g., 30 days from the date of the notice). Highlight potential consequences of non-payment, which can include late fees (typically around 1.5%), credit score impacts, or legal actions. Specify how the debtor can contact the collection agency, providing a phone number or email for clarifications or payment arrangements, and emphasizing the importance of addressing the issue promptly to avoid escalation.

Professional and respectful tone

The current economic climate (characterized by rising inflation rates and increasing cost of living) often leads to financial challenges for individuals and businesses alike, making debt management critical. Timely follow-ups are essential for maintaining healthy relationships between creditors and debtors, with collections often relying on clear and respectful communication. Legal frameworks, such as the Fair Debt Collection Practices Act (FDCPA) in the United States, outline specific guidelines for how creditors can approach debtors, emphasizing the importance of professionalism and respect. Engaging tone conferences with clients about outstanding balances can foster understanding, as well as provide opportunities for discussing repayment plans or settlement options. By prioritizing empathy and clarity in communication, debt collection processes can remain constructive, preserving business relationships while addressing owed amounts.

Comments