Are you feeling overwhelmed by your credit card spending? It's a common challenge many face, as the thrill of swiping can often lead to unplanned expenses. Fortunately, setting and enforcing a spending limit can be a game changer, helping you regain control of your finances. Join me as we explore practical tips and templates to effectively manage your credit card spending limits!

Personalization and accurate account details

Credit card spending limit enforcement is crucial for managing personal finances effectively. Many financial institutions utilize personalized account details to ensure compliance, adapting to individual spending behavior. For instance, a cardholder with a limit of $5,000 may receive notifications when nearing 80% utilization, which equates to $4,000 in spending. This proactive approach helps maintain a healthy credit score, avoiding potential penalties and restrictions. Additionally, implementing personalized alerts through SMS or email enhances user engagement, reinforcing budgetary discipline. As financial institutions evolve their strategies, maintaining accurate and updated account information is essential for effective spending limit management.

Clear statement of the spending limit

Credit card spending limits, such as those set by financial institutions like Visa or MasterCard, dictate the maximum amount a customer can charge to their credit account. For example, an individual with a credit limit of $5,000 should be aware that exceeding this amount could result in declined transactions. Each month, billing cycles reset the available credit, allowing consumers to manage their finances more effectively. Various account types may impose additional restrictions, such as daily withdrawal limits or transaction caps, further emphasizing the importance of understanding one's spending boundaries. Keeping track of spending can prevent fees associated with over-limit transactions and maintain a healthy credit score, which lenders review when considering future credit applications.

Explanation for the limit enforcement

A credit card spending limit is a regulatory measure implemented by financial institutions, such as major banks like JPMorgan Chase or Bank of America, to protect consumers from accumulating excessive debt. This limit often varies based on factors like credit score, income level, and repayment history, with typical thresholds ranging from $1,000 to $5,000 for standard cards. Enforcing spending limits can prevent financial distress, ensuring cardholders maintain manageable debt levels. In addition, this measure serves as a guardrail against unplanned purchases that might lead to difficulty in meeting monthly payments, which is particularly important during economic uncertainties. Regular monitoring of account activity is vital, as exceeding these limits can result in penalties or reduced credit scores, impacting future borrowing capabilities.

Contact information for further assistance

Setting a credit card spending limit can help consumers maintain financial control and prevent overspending. For individuals seeking assistance with understanding their account limitations, contacting customer service is essential. The typical customer service number appears on the back of the credit card, often available 24/7. Communication via authorized channels ensures security and privacy regarding account information. Additionally, many financial institutions provide online chat options through their official websites or mobile applications, facilitating immediate inquiries. Regular updates through email notifications regarding spending limits can also enhance awareness for cardholders. It's important to keep personal information secure when reaching out for help.

Professional and courteous tone

Credit card spending limits serve as a financial safeguard for consumers, helping prevent overspending and maintaining a healthy credit score (ranging from 300 to 850). Institutions often set limits based on various factors, such as income level, credit history, and market conditions, influencing an individual's borrowing capacity. During the enforcement process, it is essential to notify cardholders about their limits clearly, including specific amounts and recent changes, if applicable. Providing insights into potential consequences of exceeding limits, like fees (often $25 to $35), and the impact on credit utilization ratio (which ideally should stay below 30%) fosters responsible spending and encourages preventative measures for future transactions.

Letter Template For Credit Card Spending Limit Enforcement Samples

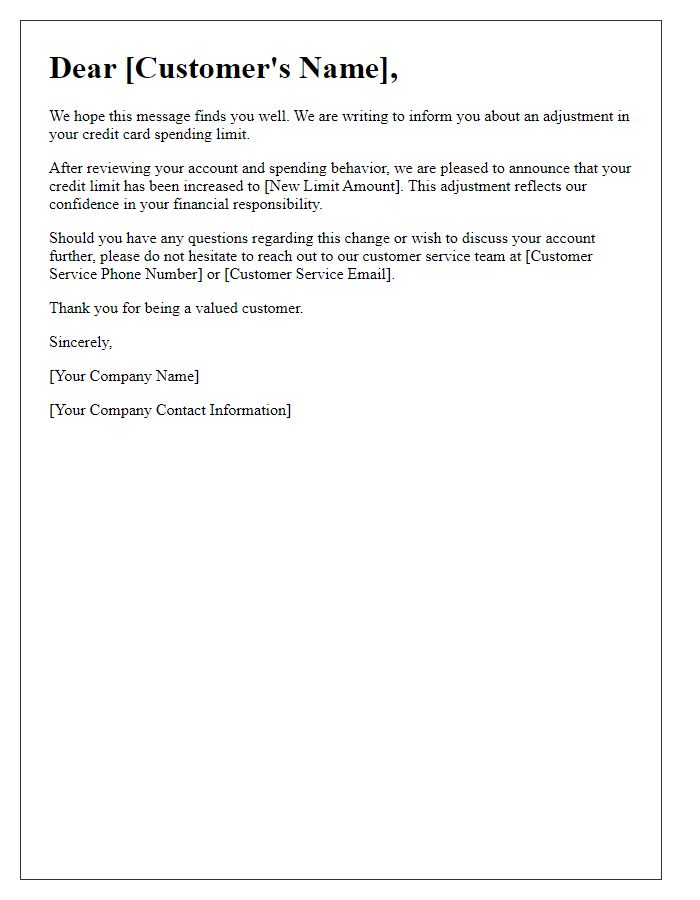

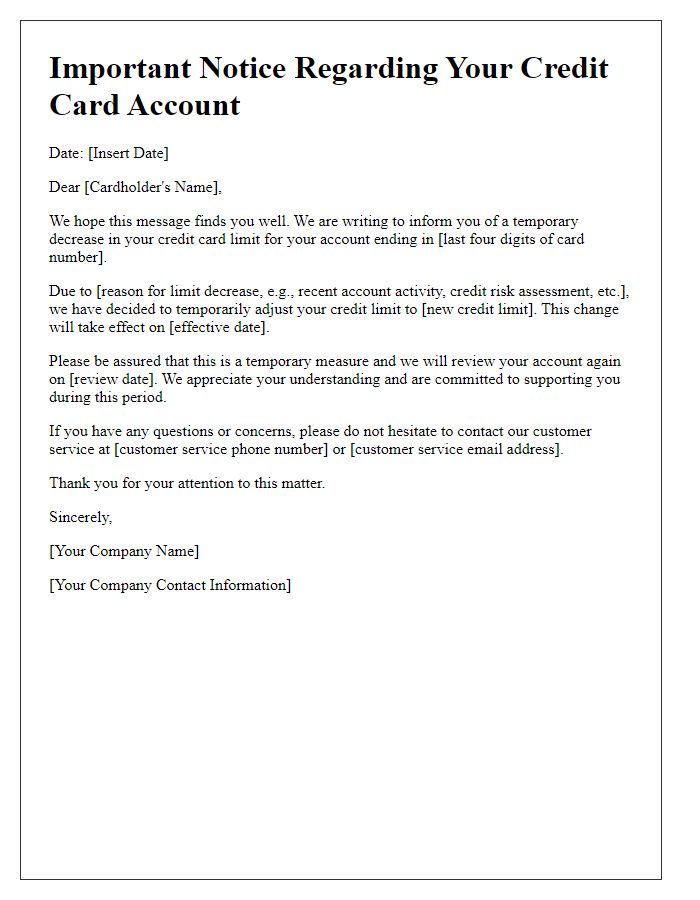

Letter template of adjustment in credit card spending limits for customers

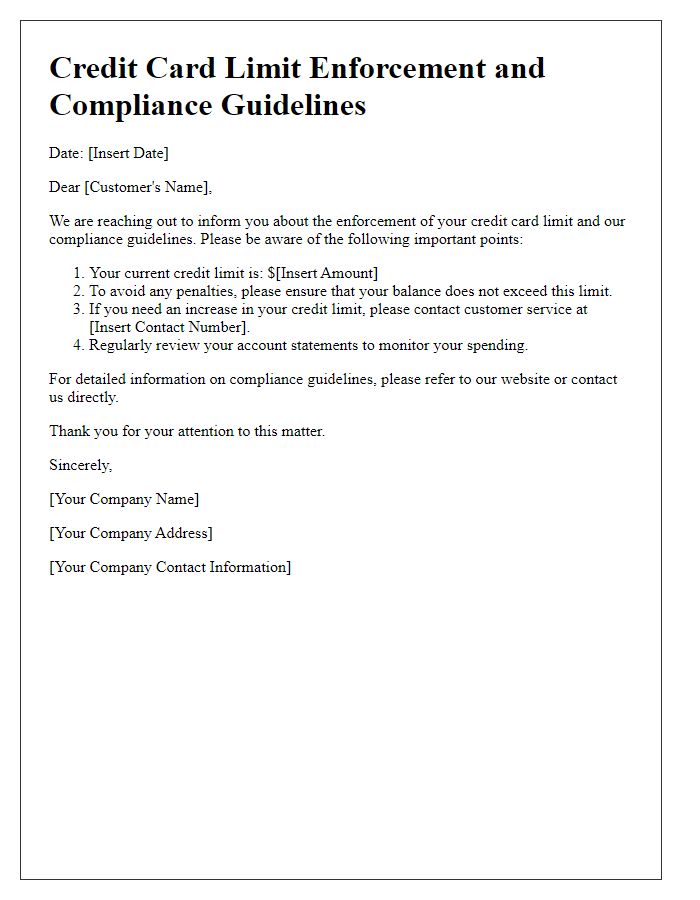

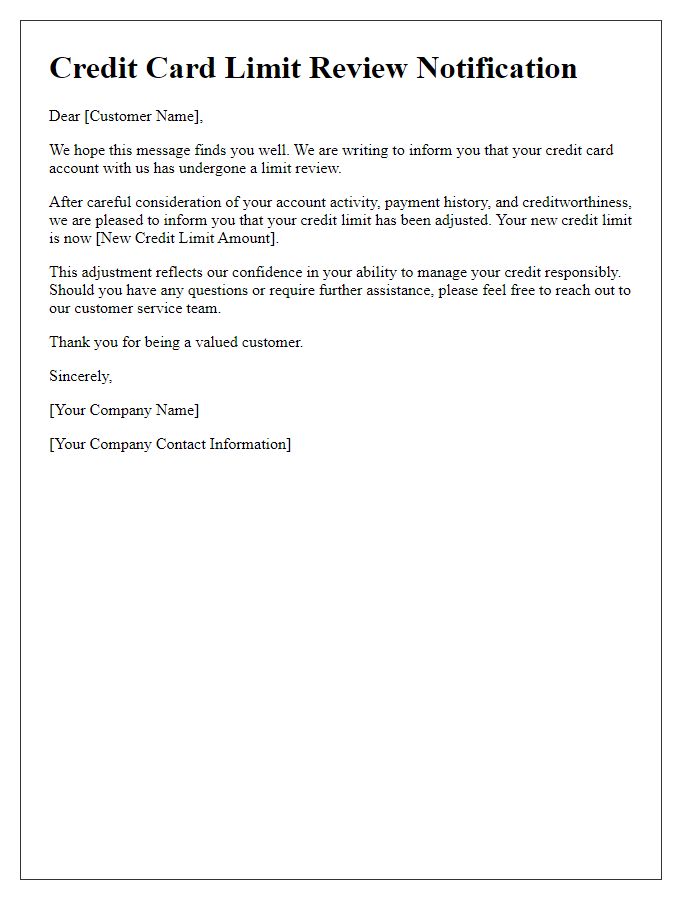

Letter template of credit card limit enforcement and compliance guidelines

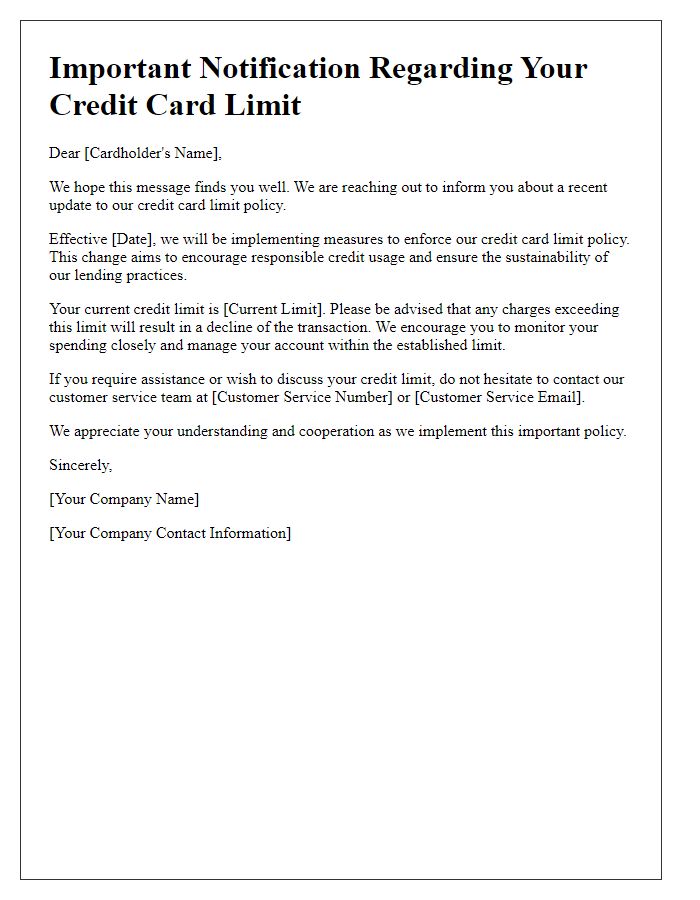

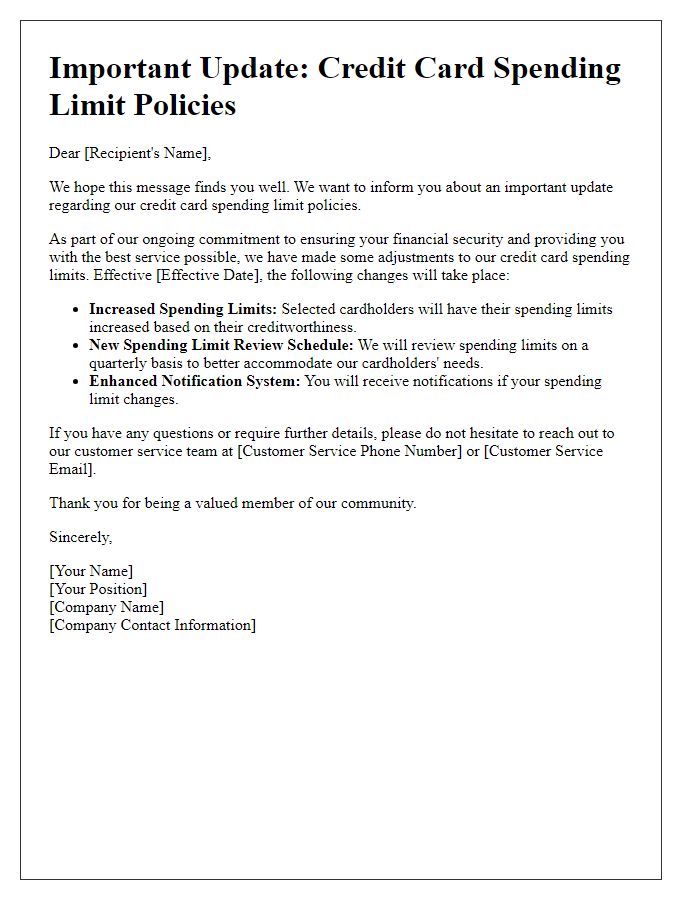

Letter template of formal credit card limit policy enforcement communication

Comments