Are you looking for a simple way to confirm credit card authorization for your business transactions? A well-crafted letter template can streamline this process and ensure clear communication with your clients. In this article, we'll walk you through the essential components of a credit card authorization confirmation letter, making it easy for you to maintain professionalism and trust. Ready to safeguard your transactions? Let's dive in!

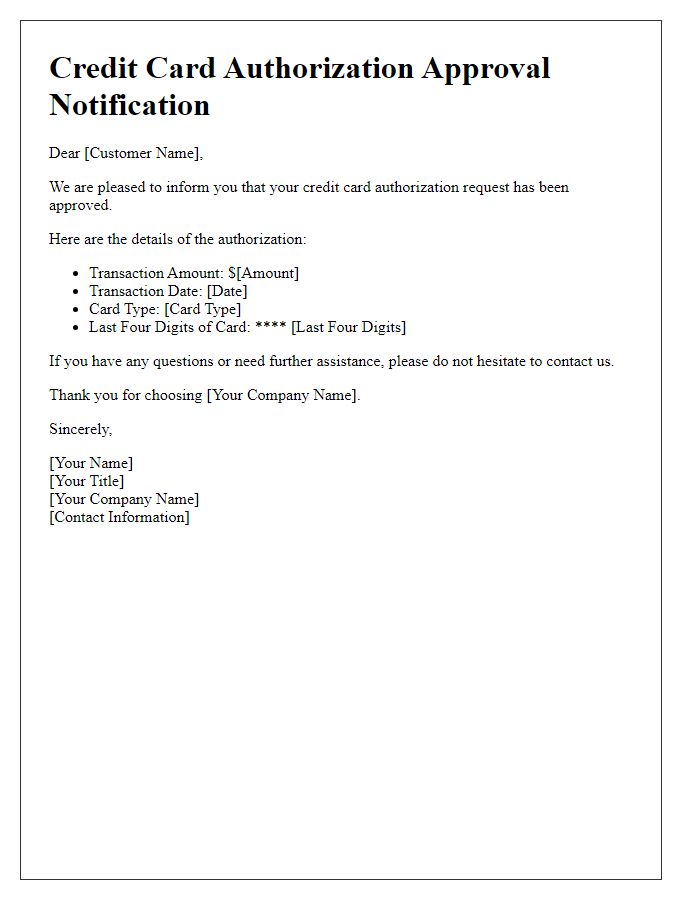

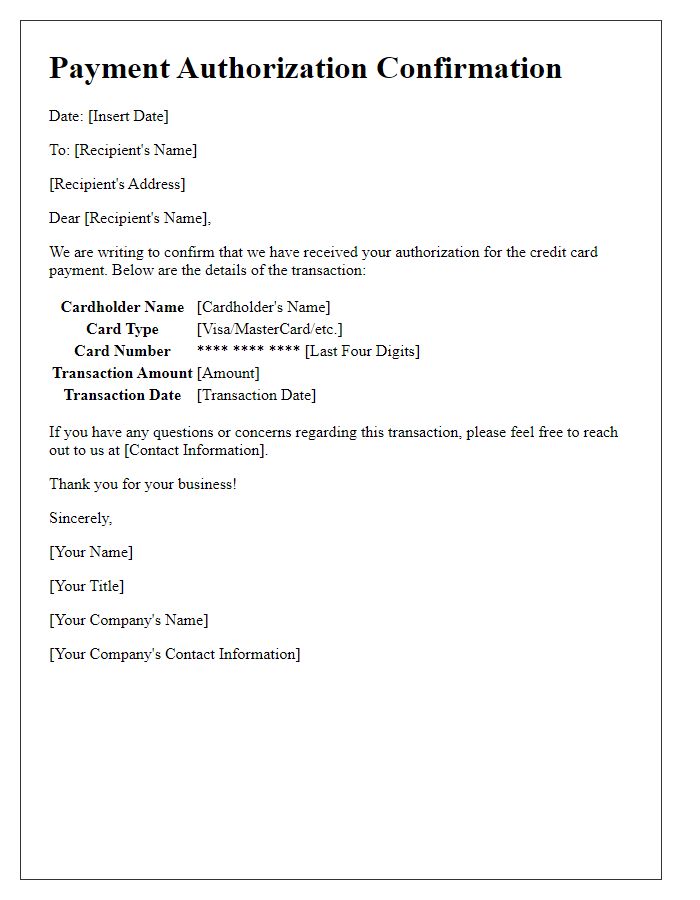

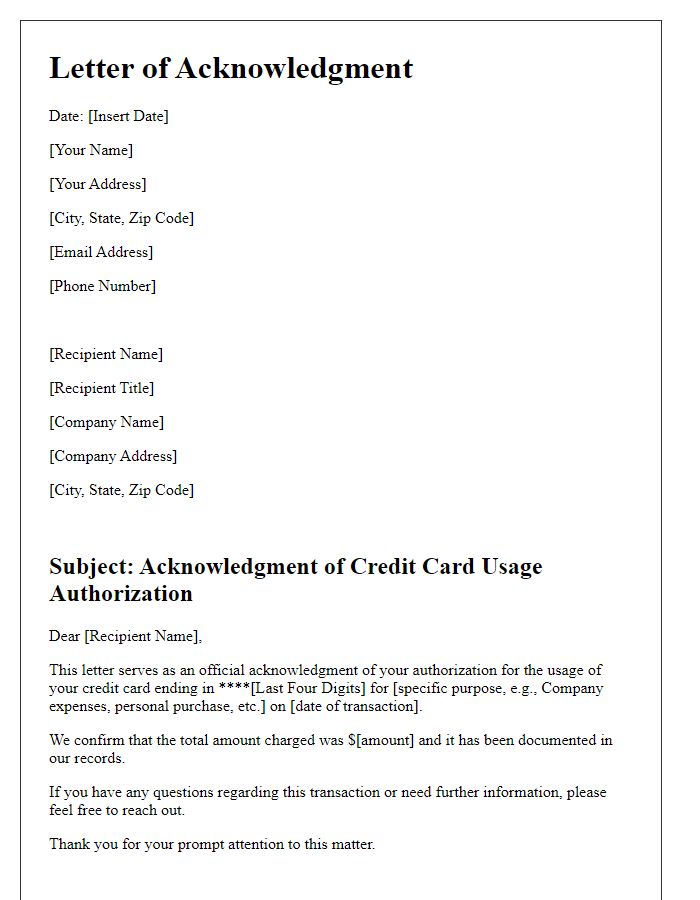

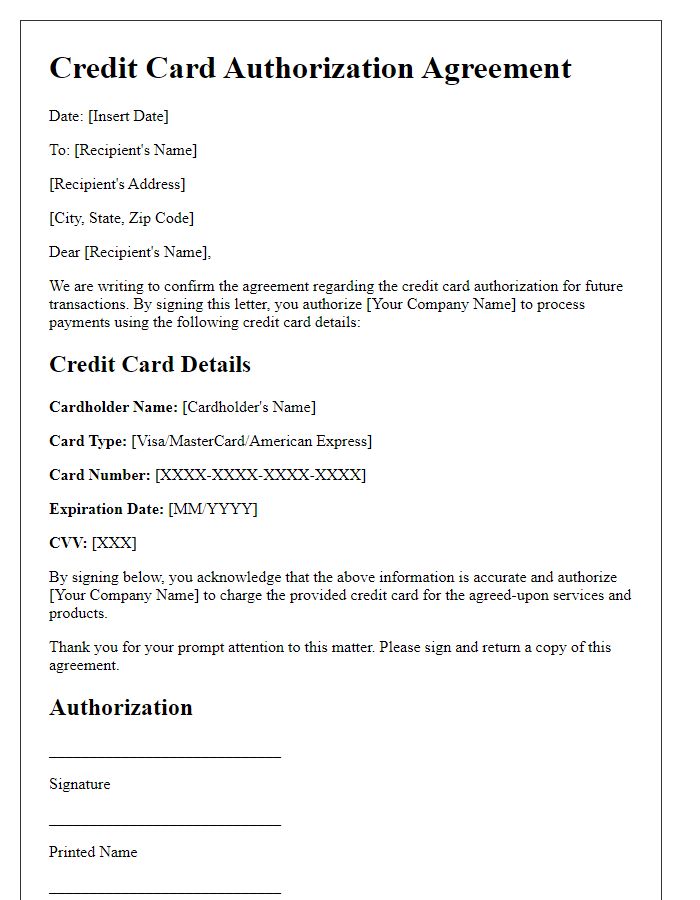

Cardholder Information

Credit card authorization confirmation involves verifying a cardholder's identity and ensuring transaction security. Key details include cardholder name linked to the account, card number with precise digits (typically the last four for security), expiration date indicating card validity, and billing address that matches bank records. Important to note is the transaction amount, which specifies the exact sum authorized for approval, along with the merchant's name where the transaction occurred for clarity. Additional security measures may include the CVV code, which is crucial for validating online purchases, and a timestamp indicating the date of the authorization request. This confirmation process is vital in preventing fraudulent activities and ensuring a seamless purchasing experience for cardholders.

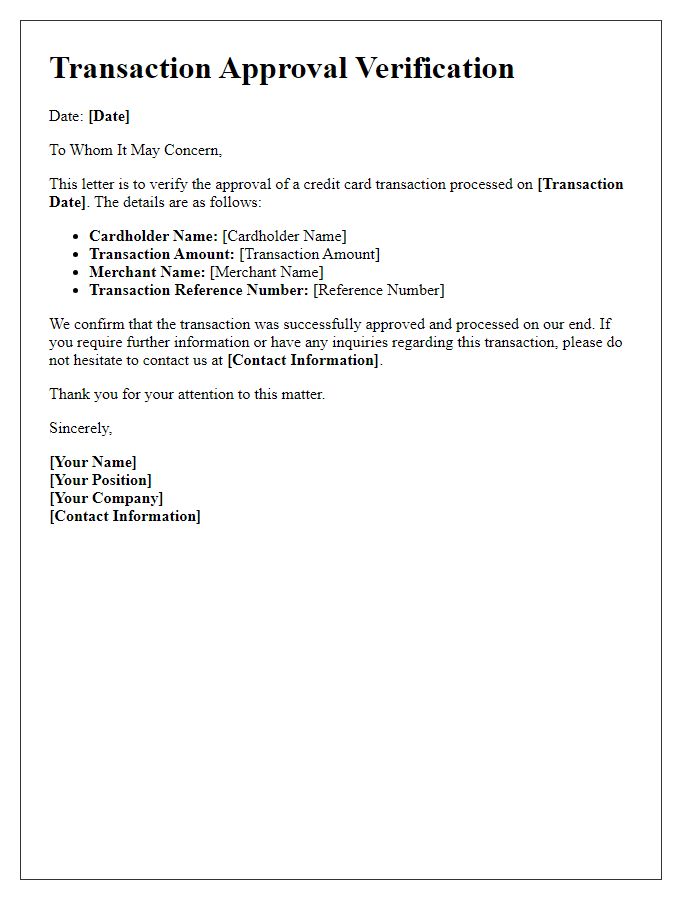

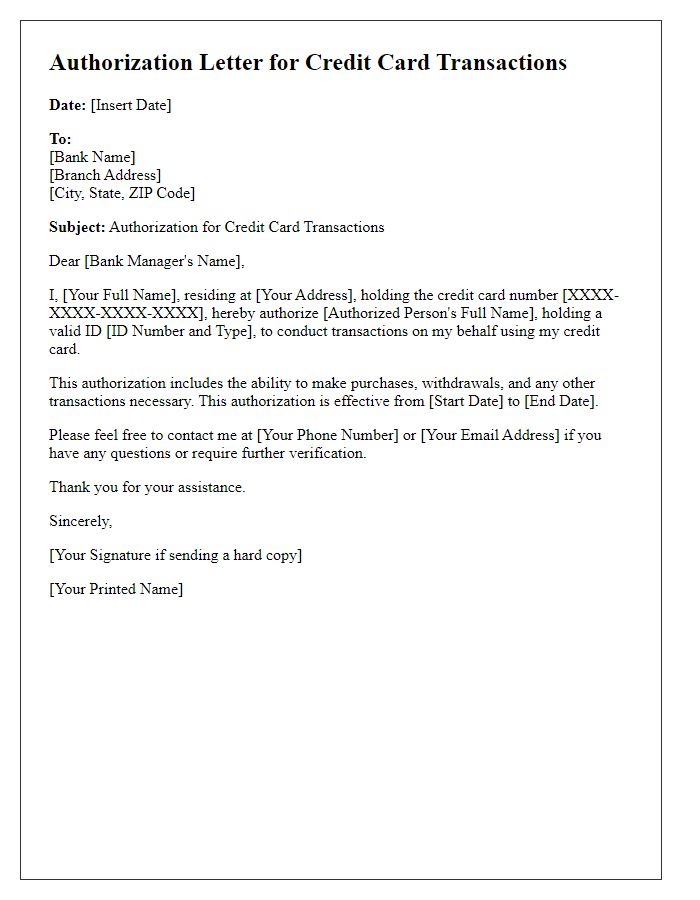

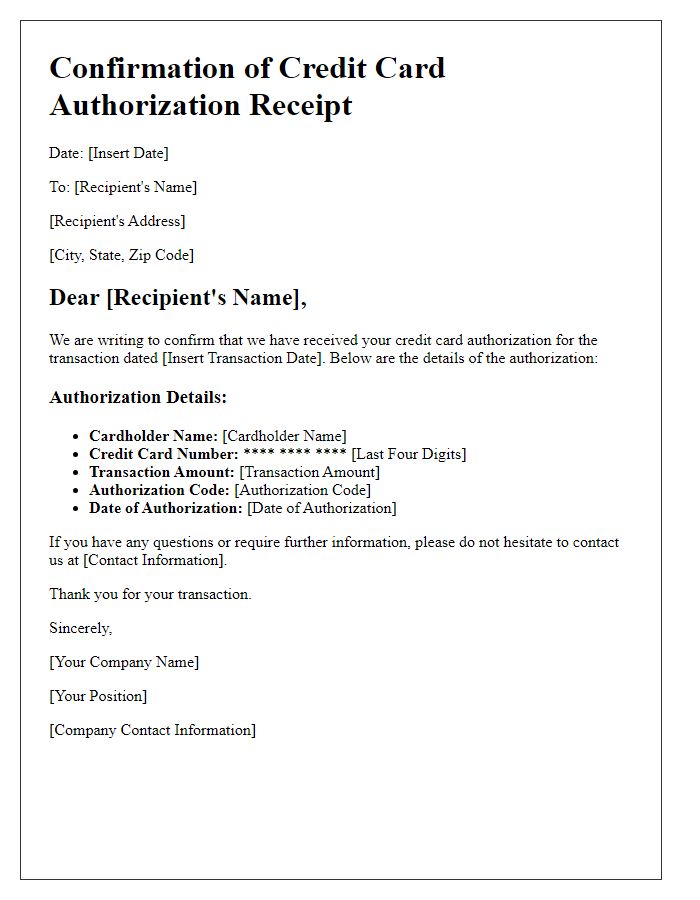

Authorization Details

Credit card authorization confirmation involves verifying the legitimacy of a transaction using sensitive financial information. Key components of this process include the authorization code, typically a six-digit number, the transaction amount, which may range from a few dollars to several thousand, and the cardholder's name, crucial for identity verification. This confirmation often occurs within financial institutions or retail environments in cities like New York, where high-volume transactions demand rigorous security measures. Additionally, the date and time of the transaction, which can impact fraud detection, are recorded, ensuring both parties maintain accurate financial records.

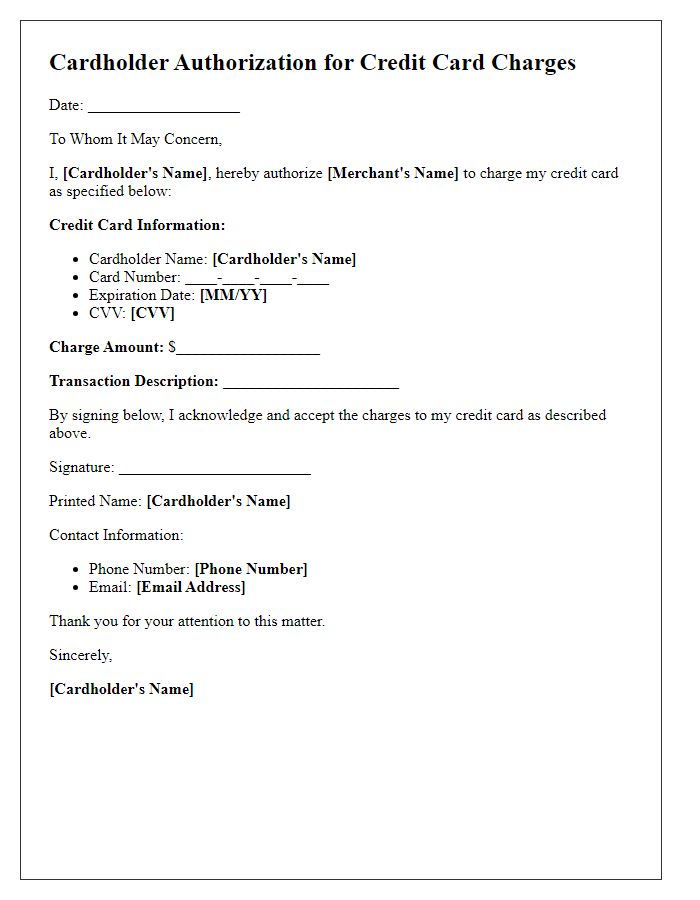

Compliance with Privacy Regulations

Credit card authorization confirmation serves as an essential process in financial transactions within retail establishments. Retailers must ensure that compliance with privacy regulations, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), is maintained when processing sensitive information like credit card details. The confirmation process involves verifying data against the issuing bank's system, usually conducted through secure payment gateways that utilize encryption methods. This practice not only protects user information but also helps in preventing fraudulent activities, which could lead to significant financial losses. Overall, robust measures must be established to ensure that customer data remains confidential and is handled in accordance with applicable privacy guidelines, particularly within the banking and finance sector.

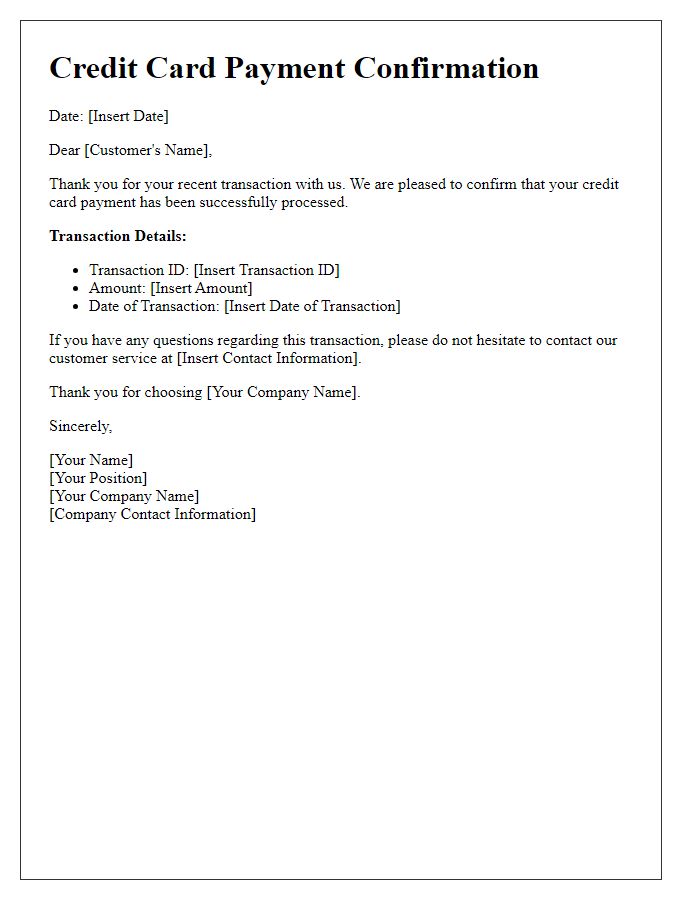

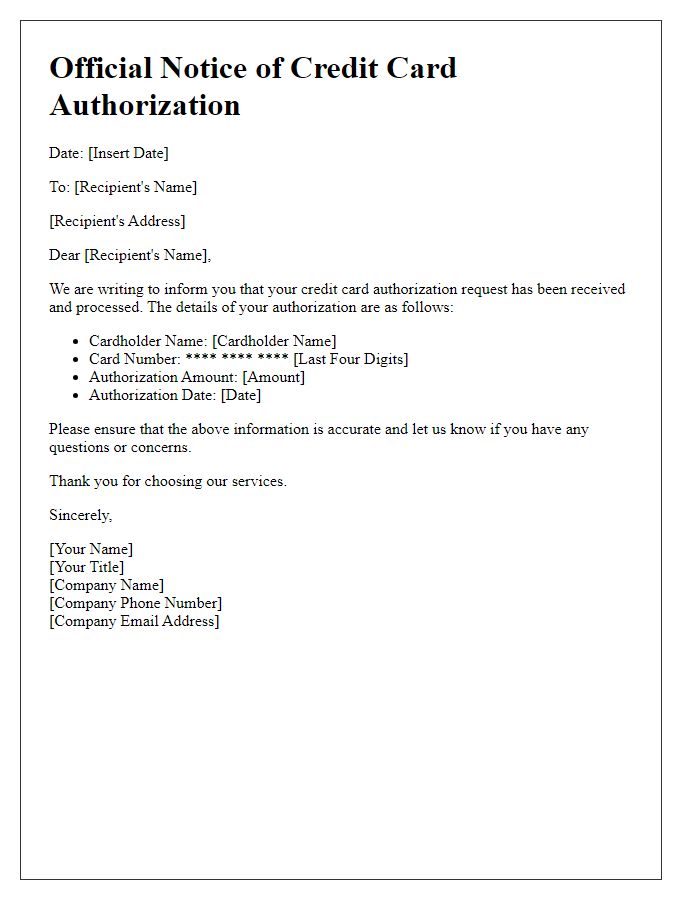

Contact Information for Queries

Credit card authorization confirmations are essential for secure transactions. Customers often require detailed contact information for any queries concerning their credit card authorization processes. Typically, businesses include a customer service phone number (often 1-800-XXX-XXXX for US customers) and an email address (for instance, support@company.com) for inquiries. Providing an online chat option on the company's website can enhance communication (convenient during peak hours). Clear instructions about response times (usually within 24-48 hours) should also be included, ensuring customers know what to expect. Additionally, mentioning office hours (for example, 8 AM to 8 PM EST) facilitates better planning for customers reaching out for assistance.

Security and Fraud Prevention Measures

Credit card authorization confirmation plays a crucial role in the security and fraud prevention measures employed by financial institutions. Financial transactions processed through platforms like Visa, Mastercard, and American Express often utilize encrypted channels to safeguard sensitive information. The authorization process involves verifying the cardholder's identity, ensuring the transaction amount does not exceed predefined limits, and monitoring for unusual patterns in spending behavior. The integration of advanced algorithms and machine learning technologies allows institutions to detect potential fraud in real-time, significantly reducing the risk of unauthorized transactions. Additionally, two-factor authentication methods can enhance the security of credit card usage, creating an extra layer of protection against identity theft.

Comments